Sea Limited (NYSE:SE) is one of the leading tech conglomerates in Southeast Asia, which operates its digital entertainment, e-commerce, and digital financial service businesses.

The company continues to be an important player in transforming the global retail market, serving the diverse needs of tens of millions of customers. Sea’s Shopee is the largest e-commerce platform in Southeast Asia and has also continued to actively expand its presence in Brazil since its launch in 2019.

The company’s equally important business is SeaMoney, which, since 2014, has offered various digital financial services, including mobile wallet services, credit offerings, and payment processing services. These products are provided to customers through such financial services as ShopeePay, SeaInsure, and SeaBank, allowing the company to maintain a leading position in the market despite stricter competition.

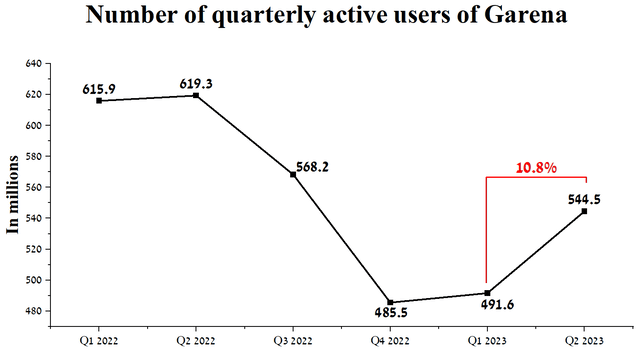

Sea’s third business is Garena, which is one of the largest developers of online games for mobile devices and PCs in genres such as multiplayer online battle arenas, MMORPGs, racing games, and more. Garena’s expanding portfolio of games is reflected in the growth of its number of quarterly active users from the second half of 2022.

Author’s elaboration, based on quarterly securities reports

Sea Limited’s slowing year-over-year revenue growth and the expected increase in expenses are raising concerns among financial market participants about its management’s ability to maintain an operating income increase in the coming quarters. So, at the earnings call, Yanjun Wang said the following regarding the growth of investments aimed at developing the company’s e-commerce platform.

Why we — in terms of take rates, as Tony probably already observed, we continue to see uptick in terms of advertisement and also so much spending on our platform, and therefore, the core marketplace revenue continues to grow as a result. But of course, there is some impact on the VAS revenue because of our ramp-up investment in logistics spending which affects due to GAAP accounting and netting off effects VAS GAAP revenue.

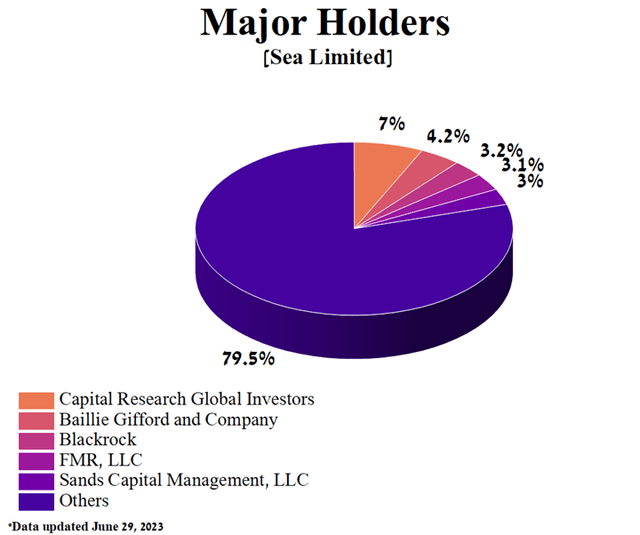

On the other hand, large institutional investors such as Capital Research Global Investors, Baillie Gifford, FMR, Sands Capital Management, and Blackrock collectively owned 20.48% of the company at the end of June 2023.

Author’s elaboration, based on Yahoo Finance

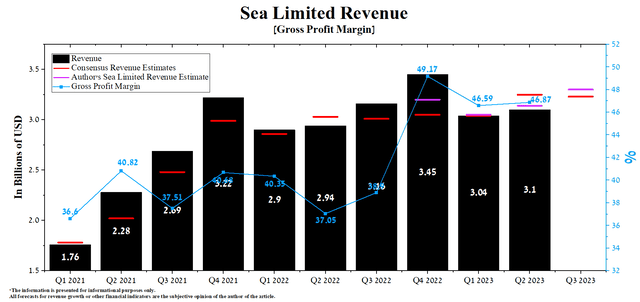

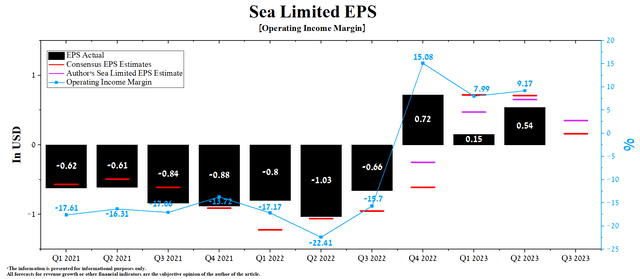

After the end of the acute stage of COVID-19, the company’s management continues to disappoint investors with its financial results. So, the second quarter of 2023 was no exception, showing extremely negative results, as Sea’s revenue and EPS failed to exceed analysts’ expectations.

Sea Limited is expected to publish its financial report for the third quarter of 2023 on November 16. According to Seeking Alpha, Sea’s revenue for the third quarter of 2023 is expected to be $3.09-$3.45 billion, up 7% year-over-year and in line with analysts’ expectations for the previous quarter. At the same time, per our model, the company’s total revenue will be within this range, amounting to $3.3 billion.

Sea’s year-over-year revenue growth will mainly be driven by increased demand for its credit products, growth in the number of quarterly paying users of Garena, and a surge in the number of Shopee users.

Author’s elaboration, based on Seeking Alpha

We expect the company’s operating profit margin to reach 8.5% in 2023. Furthermore, in 2024, this financial metric will increase to 9.4%, thanks to an increase in the number of new products and services of Sea, which will help attract new users in Brazil and Southeast Asia, reduce inflation, and growth in consumer spending around the world as central banks begin to cut interest rates.

According to Seeking Alpha, Sea Limited’s Q3 EPS is expected to range from -$0.3 to $0.71, down 77.5% from the Q2 2023 consensus estimate. Moreover, according to our model, Sea’s EPS will be in the median of this range and reach $0.35.

Moreover, the company’s Non-GAAP P/E [FWD] is 23.06x, which is 65.48% higher than the sector average, which is one of the factors indicating its overvaluation by Mr. Market even despite the growth of the company’s gross margin in the last years.

Author’s elaboration, based on Seeking Alpha

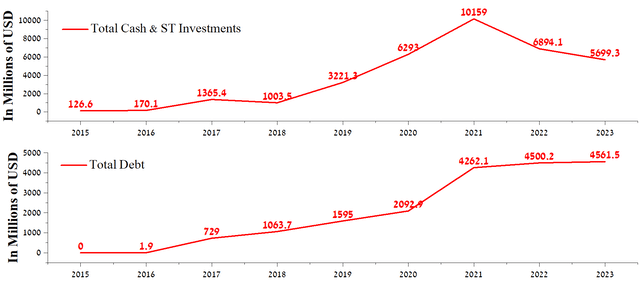

Although Sea does not repurchase its shares, one of its key advantages relative to companies in the communications sector is its relatively low debt. At the end of the second quarter of 2023, Sea’s total debt was about $4.56 billion, up slightly from 2021.

Author’s elaboration, based on Seeking Alpha

Moreover, given the company’s total cash and short-term investments of approximately $5.7 billion and its growing operating income margin yearly, we do not expect Sea Limited to have difficulty paying off the convertible notes maturing between 2024 and 2026.

Conclusion

Sea Limited is one of the leading tech conglomerates in Southeast Asia, which operates its digital entertainment, e-commerce, and digital financial service businesses.

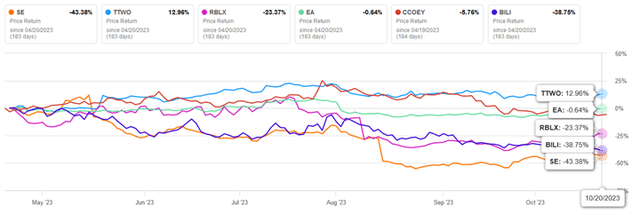

Sea’s slowing year-over-year revenue growth and the expected increase in expenses are raising concerns among financial market participants about its management’s ability to maintain an operating income increase in the coming quarters. As a result, the company’s share price has fallen by more than 43% over the past six months, underperforming key competitors such as Bilibili (BILI) and Take-Two Interactive Software (TTWO).

Author’s elaboration, based on Seeking Alpha

On the other hand, despite all the difficulties the company has faced in recent months due to increased competition in the global e-commerce market, its debt remains stable, which is extremely important in the current period of rising geopolitical tensions in the Middle East and the South China Sea.

We initiate our coverage of Sea Limited with a “hold” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here