Sell-side research readers like me can’t seem to go more than a few days without coming across a new primer on the artificial intelligence trend. The emerging theme and its corresponding ETFs are always being analyzed.

With a possible productivity boom on the horizon, I have a buy rating on the iShares Robotics and Artificial Intelligence Multisector ETF (NYSEARCA:IRBO).

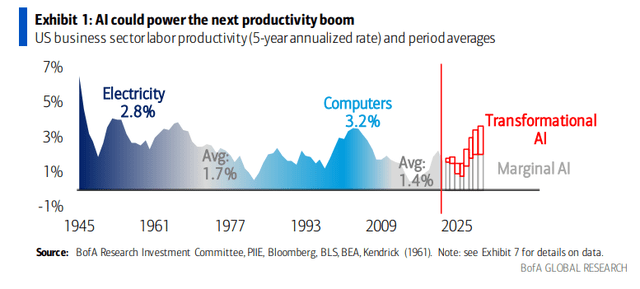

AI: A Transformation Technology?

BofA Global Research

According to the issuer, the ETF seeks to track the investment results of an index composed of developed and emerging market companies that could benefit from the long-term growth and innovation in robotics technologies and artificial intelligence. The fund offers exposure to companies at the forefront of robotics and artificial intelligence innovation and gives investors access to an equal-weighted index composed of global companies across the robotics and AI value chain.

IRBO features a moderate 0.47% annual expense ratio and total net assets under management total $443 million as of July 11, 2023. The portfolio’s trailing 12-month dividend yield of just 0.63% is very low considering stocks in the fund are growth-oriented. Tradeability is decent with 30-day average volume of 193,000 shares, per iShares while its 30-day median bid/ask spread is generally modest at just six basis points.

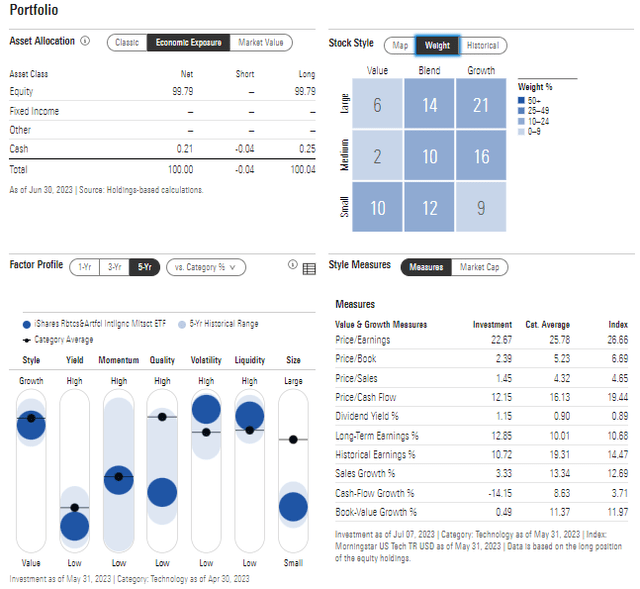

Digging into the portfolio, data from Morningstar show that IRBO’s holdings are mixed among value and growth, small and large cap in size. In net, there is a clear slant toward the growth style, and among the fund’s 113 positions, 41% sums to large cap while a significant 31% is considered small cap. On a valuation basis, IRBO trades near 23 times earnings, which is actually less than the earnings multiple on the Vanguard Small Cap Growth ETF (VBK) (26), so it is a bit pricey, but considering its long-run EPS growth rate of near 13%, the PEG is below 2.0.

IRBO: Diversification Across The Style & Market Cap Spectrums, Equal-Weight Product

Morningstar

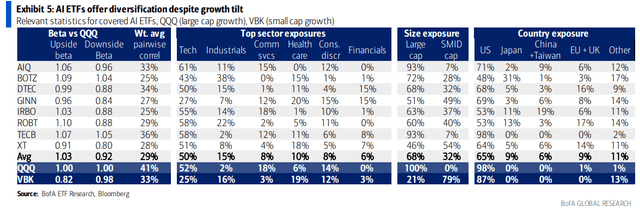

IRBO Compared To Competing ETFs

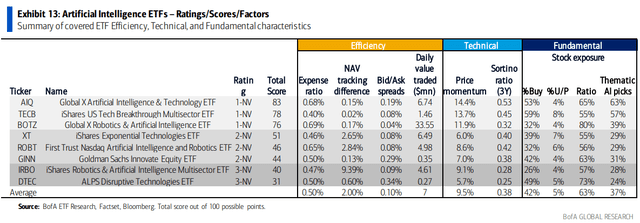

BofA Global Research

IRBO: Ranks Low In Score Per BofA’s Quant Analysis

BofA Global Research

In all, BofA’s latest AI ETF primer suggests that IRBO “has strong efficiency characteristics but performs poorly in fundamental and technical aspects.” The report further outlines that the fund “is relatively equally weighted and has strong exposure to ex-US companies and could be well suited for investors looking for highly diversified AI exposure.”

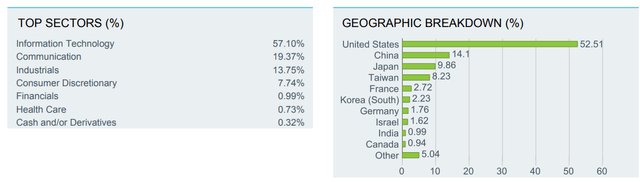

Bigger picture, investors should recognize that IRBO has high exposure to the Information Technology sector with some international diversification through its China, Japan, and Taiwan holdings.

IRBO: Heavy In Tech, Significant Ex-USA Exposure

iShares

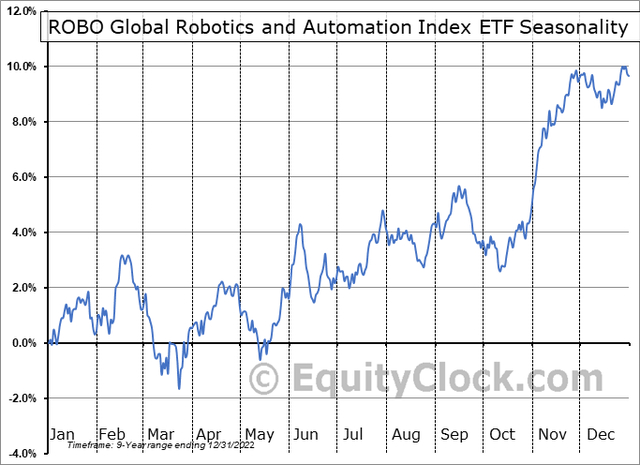

Seasonally, IRBO tends to trade sideways throughout much of Q3 before rallying into year-end beginning in mid-October. So, do not be surprised if some choppy price action takes place over the next three months, according to data from Equity Clock.

IRBO: Neutral Seasonality Through Mid-October

EquityClock

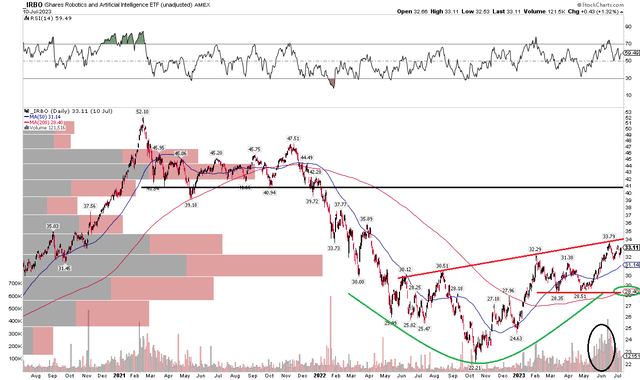

The Technical Take

With a moderate expense ratio, decent valuation, and a diversified equal-weight holding scheme, the technical situation shows improvement. Notice in the chart below that shares have put in a series of higher lows of their October 2022 bottom. Now up 50% from the nadir, the long-term 200-day moving average has inflected positive in its slope and there is a volume surge that came into this ETF over the past two months.

I see key support in the $28 to $29 range, so long here with a stop under that level can make sense. Spotting important resistance is tougher since there’s an uptrend line (I find those are less reliable than horizontal lines of support and resistance). Currently, modest selling pressure could come into play near $34. Longer-term, bulls should consider taking profits on an approach to the $39 to $41 range – that is the zone-lows from 2021. What’s encouraging is that there’s high volume by price in the $30 to $33 area, so pullbacks should be met with buyers. That feature also underscores placing a stop under the Q1 and Q2 double bottom.

Overall, the technical situation is constructive and has solid momentum.

IRBO: Bullish Rounded Bottom, Big Volume Last 2 Month, $28 Support

Stockcharts.com

The Bottom Line

I have a buy rating on IRBO. I prefer this product over similar funds for its liquidity, moderate cost, diversification, and constructive chart.

Read the full article here