By David Brady

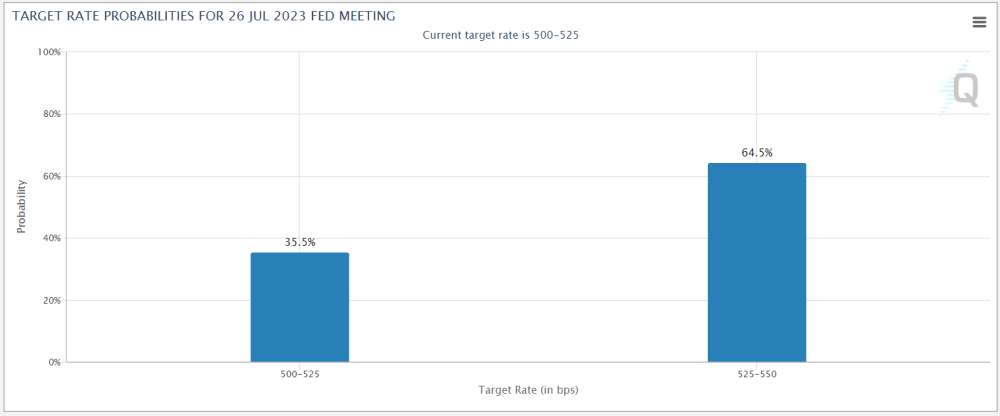

The Fed paused rate hikes on Wednesday but stated its intention to increase interest rates going forward, depending on the incoming data. Below are the current probabilities of another rate hike of 25 basis points in July and September. All-in-all, it was pretty much a non-event.

Now we have the ECB today, and by the time you read this, you will know the result. If we get a 25 bp hike and the forecast of another 25 bp at the next meeting, which are both priced in, then hit the snooze button again.

However, if the ECB forecasts more hikes, this would boost the euro and weaken the DXY. By contrast, if the ECB is more dovish than expected and mentions the word “pause” or that the next rate hike is data-dependent, the euro should head south and the DXY north.

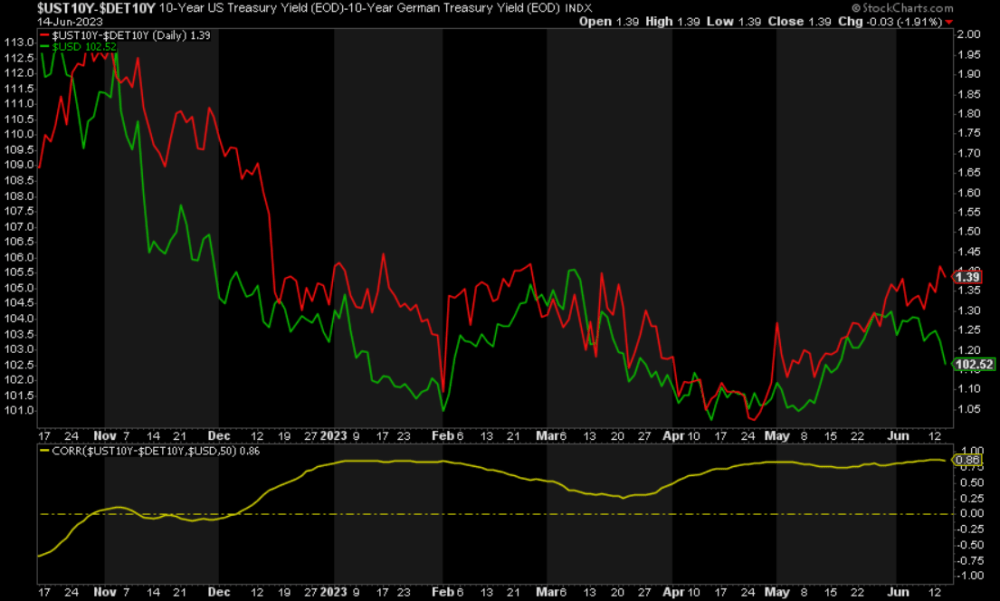

The inverse relationship between DXY and monetary metals means that whatever happens to the DXY, gold and silver tend to do the exact opposite.

The 10-Year yield spread between the U.S. and Germany has a high correlation (0.86) to the DXY. But in the short term, the DXY has fallen while the spread is rising. The risk is that the DXY plays catch-up to the spread.

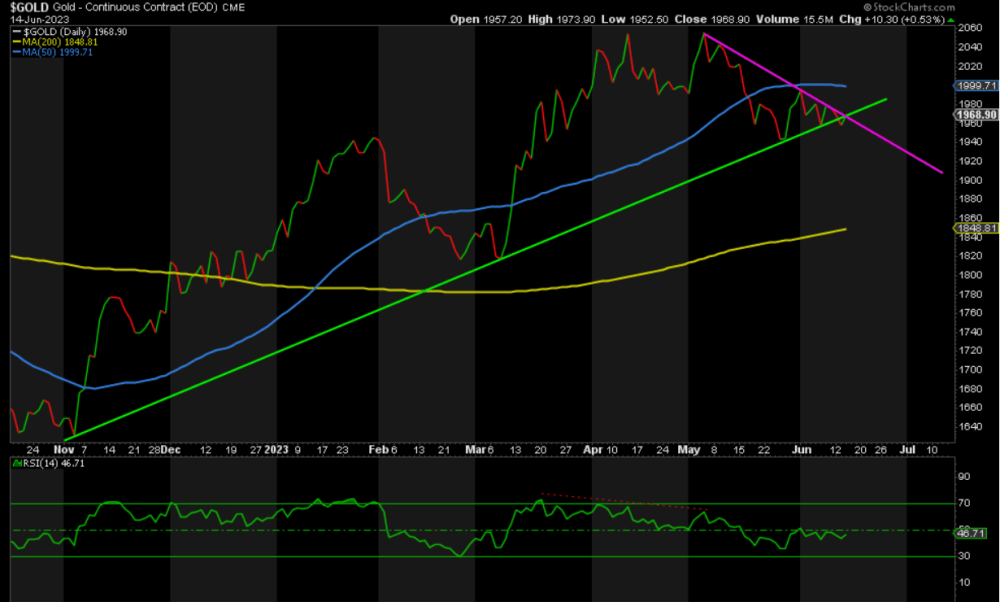

Gold

Gold broke trendline support (green) on Tuesday and backtested that support, now resistance, on Wednesday. This could go either way: It turns out to be a fake breakout to the downside, which is bullish, or we head lower from here.

The closing level that will decide gold’s fate one way or the other is 1969. I’m leaning to the upside in the DXY and the downside in gold, but I am happy to be wrong.

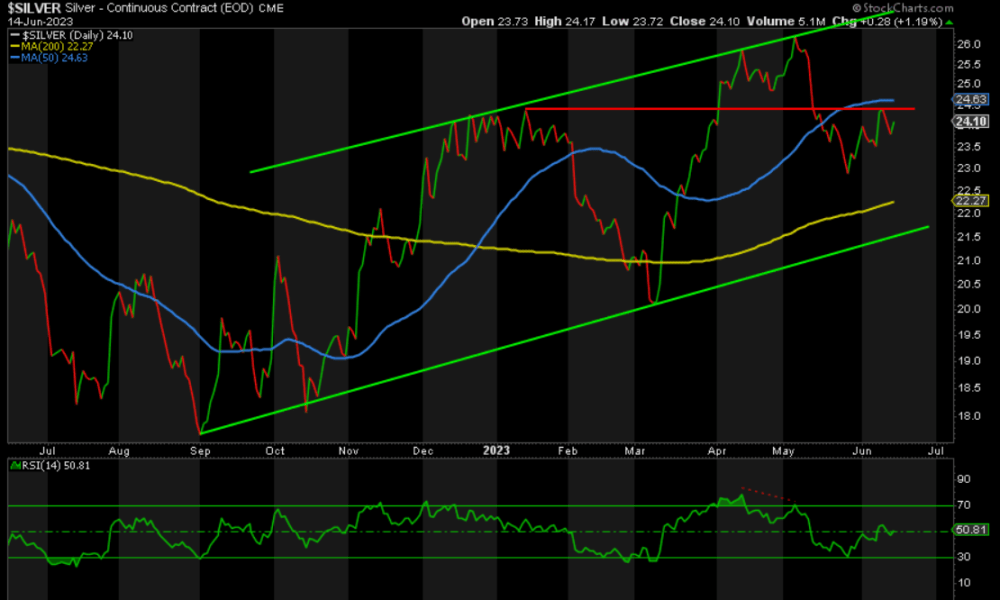

Silver

Until Silver closes above 24.41, the risk remains down.

The weekly chart also confirms that 24.41 is the level to break, as shown by the downtrend (purple) since the peak in Feb 2021. The fake breakout to the upside is bearish. Support is converging at the 200-day moving average and the rising support trendline in green at ~22.

Conclusion

Unfortunately, the next direction for the metals remains a coin toss. The fact that all of the RSIs are around 50 – i.e., neutral – confirms this. It could be resolved tomorrow depending on the ECB meeting and the euro’s performance.

I’m still leaning to the downside based on the risk of a stronger dollar coinciding with the rising U.S.-EU yield spread. A close below 1955 in gold would do the trick also.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here