Thesis

iShares S&P 500 Growth ETF (NYSEARCA:IVW) is a passively managed ETF offering exposure to S&P 500 growth stocks. So far, it seems very efficient at tracking its benchmark and it has beaten the market in the last 10 years.

However, due to the fact that there are superior alternatives available, both in fees and past performance, I don’t think IVW is attractive enough. In this post, I will go into detail to demonstrate this thesis.

What does IVW do?

The iShares S&P 500 Growth ETF was issued by BlackRock, Inc. on May 22, 2000, and is managed by BlackRock Fund Advisors. It currently holds $31.92 billion in AUM.

Its goal is to replicate the performance of the S&P 500 Growth Index, which consists of stocks with growth characteristics within the S&P 500 index. The index uses the ratio of earnings change to price, revenue growth, and price momentum to select its constituents. IVW tracks the index using a representative sampling technique.

Naturally, this ETF may appeal to those who are looking for exposure to the market in bullish markets, in which growth stocks tend to outperform the overall market. Does it work though?

Performance

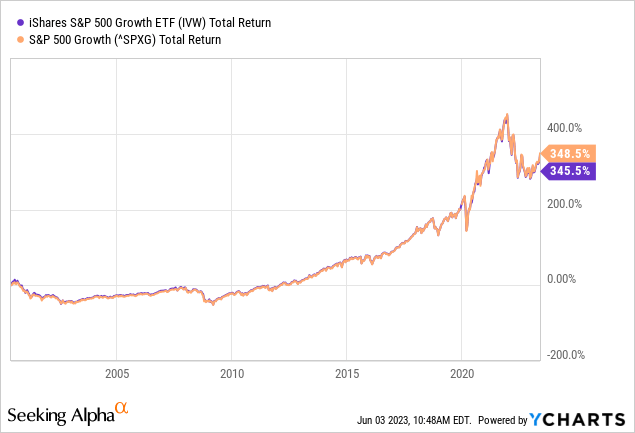

First, let’s look at how well IVW tracked the index over the years. Fortunately, a good thing we have here is a long track record. Since its inception, the ETF averaged a compound annual total return of 6.47%. During that period, the index increased by 6.65% per year. Not bad at all, considering the performance of more than two decades. Here is a chart that depicts even better how insignificant the tracking error is:

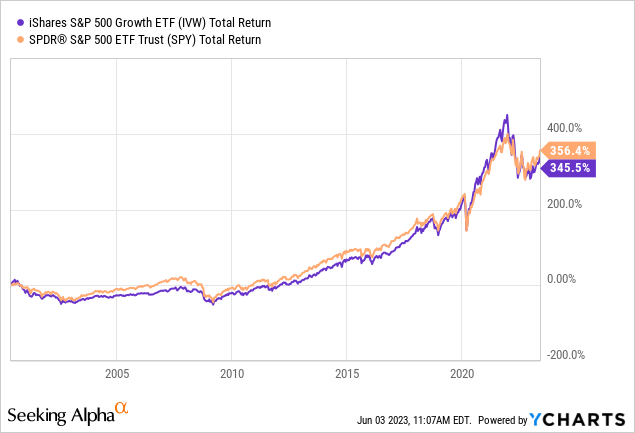

The ETF appears efficient at its job, but a more important question is what value its job can offer an investor. To answer this, I wanted to see how it performed against SPDR S&P 500 ETF Trust (SPY) since it was launched and the results were interesting:

As I expected, it couldn’t deliver better returns over such a long period. But by looking at specific time frames, we are able to gain more insight:

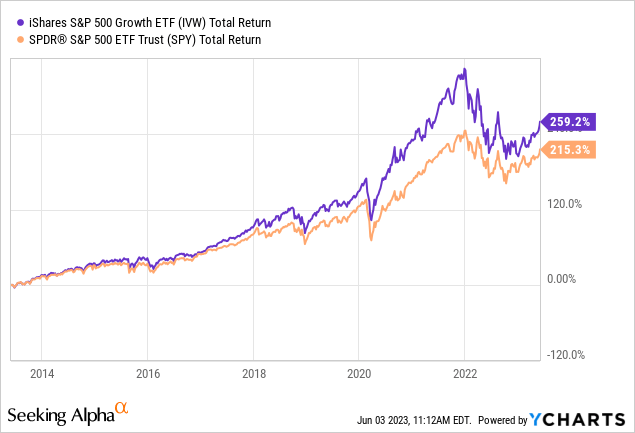

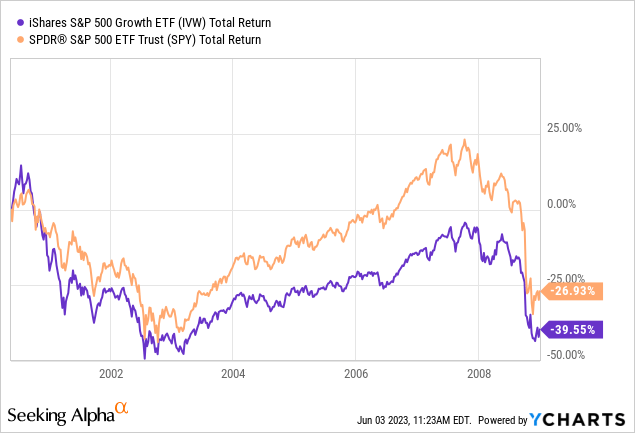

Turns out that in the last 10 years, it outperformed SPY by a significant margin. But that was mostly a bull market. What about its first few years of trading? Well, having experienced two crashes, we can say that from its inception date until the end of the year 2008, that was indeed a bad time to be invested in growth stocks; at least through IVW.

Evidently, this appears to be an efficient ETF and it so far has delivered what you’d expect from a fund designed to track the performance of large-cap growth stocks. It’s by no means appropriate for buy/hold investors though. And as you can expect from a growth fund, it has been a bit more volatile than SPY, eliminating another potential reason to hold it indefinitely.

| Ticker | Maximum Drawdown | Standard Deviation Annualized |

| IVW | -53.45% | 16.08% |

| SPY | -50.80% | 15.34% |

Source: portfoliovisualizer.com (Jun 2000 – May 2023)

However, let me note that there’s definitely a case to be made about using it as a way to control your allocation to growth stocks within a portfolio of specialized vehicles like this. Needs vary and I can see that someone would want to allocate more or less to growth depending on their risk appetite, instead of simply using a broad-market index fund.

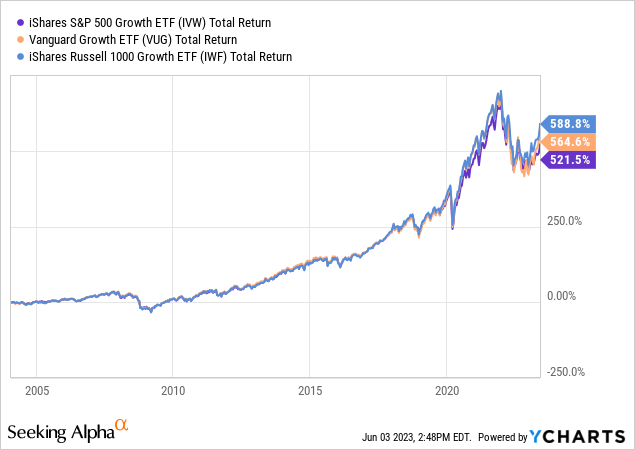

That almost sums it up. I also evaluate ETFs within the context of available options. I’d like to see if I can find a more attractive alternative. Of course, there’s no point examining the other ETFs that track the same index; their performance would be more or less similar. So, let’s see how other large-cap growth ETFs have done in the past:

Indeed, there are better-performing vehicles here. Since the Vanguard Growth ETF (VUG) was launched on 01/26/2004, it grew by a total of 564.6%, while IVW returned 521.5%. During the same period, the iShares Russell 1000 Growth ETF (IWF) outperformed both of them with a 588.8% gain.

By looking at the risk profile of each, it’s also clear that you wouldn’t have to take on more risk to enjoy such better returns:

| Ticker | Maximum Drawdown | Standard Deviation Annualized | Sharpe |

| IVW | -45.40% | 15.28% | 0.61 |

| VUG | -47.18% | 16.37% | 0.6 |

| IWF | -48.00% | 15.97% | 0.62 |

Source: portfoliovisualizer.com (Feb 2004 – May 2023)

Fees

Regarding fees now, IVW charges an expense ratio of 0.18%. To me, that seems a bit high for what it’s supposed to do. And with some other funds that charge much less for tracking the same index, I would say “unreasonably high”:

| Ticker | Expense Ratio | AUM | Inception Date |

| IVW | 0.18% | 30.56 B | 05/22/2000 |

| SPYG | 0.04% | 16.44 B | 09/25/2000 |

| VOOG | 0.10% | 7.20 B | 09/07/2010 |

Additionally, VUG, which as we saw has outperformed IVW, charges 0.04%. And IWF, which has outperformed both of them, charges 0.18%; the same as IVW. It may not be the best comparison as they track different indices, but in the context of a general demand for large-cap growth investing they appear a better value when you account for their superior returns.

Risks

- Market Risk: Naturally, IVW is an equity fund and is sensitive to changes in broad-market conditions like political developments, economic events, natural disasters, etc.

- Concentration Risk: The fund is designated as “diversified”, but it may overconcentrate in a particular security or sector if the underlying index does so too.

- Growth Securities Risk: Growth stocks can often come with higher valuations than non-growth ones and that could result in more volatility than if you held a diversified basket of value and growth stocks.

For a full list of the risks that come with investing in IVW, refer to the sponsor’s prospectus.

Verdict

In conclusion, the reason I do not consider IVW attractive is that there are simply better options out there. Even if I were to restrict myself by selecting an S&P 500 Growth fund, SPYG is more competitive by charging 0.04%; it is almost as old as IVW, by the way.

But because I don’t have any reason to do this, if I were currently interested in large-cap growth, I would prefer IWF which charges the same expense ratio as IVW but has delivered a lot better returns thus far.

However, I would like to know your opinion as well on the matter. Consider leaving a comment and letting me know. Thank you for reading.

Read the full article here