Freight bellwether, J.B. Hunt (NASDAQ:JBHT), reported a more than 30% decline in operating income and turned in overall Q3FY23 results that came in below expectations.

In a prior update on the stock following the Q2FY23 print, I viewed shares as fairly valued on account of persistent weakness in volume. In addition, the stock had advanced a healthy 12% prior to the release. Since that update, shares have indeed remained little changed.

Current period results continue to reflect a freight environment that has seen retailers continue to trim inventory levels following significant builds in prior periods. In addition, recent results provide a clearer image of the impact of falling freight rates on JBHT’s results of operations. Despite the more challenging operating environment, shares continue to trade near the upper end of their 52-week range. This warrants a hold at current levels, in my view.

JBHT Q3 Earnings Recap

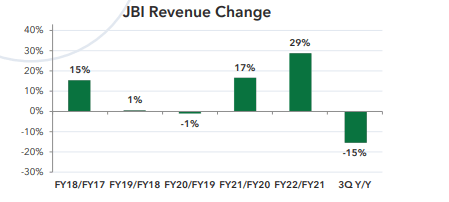

Total operating revenue declined 18% in the third fiscal quarter, missing estimates by +$40M. Driving the decrease was across-the-board weakness in all reportable segments. Their largest unit, Intermodal (“JBI”), reported a total decline in revenues of 15%. But it was Integrated Capacity Solutions (“ICS”) that contributed to the most significant drag, with a total YOY revenue decline of 48%, led by a 38% decrease in segment volume.

Q3FY23 JBHT Earnings Presentation – Summary Of Intermodal Revenue Performance

Low volume contributed to declines elsewhere as well. Final Mile Services (“FMS”), for example, saw a 20% decrease in stops during the quarter.

In one positive, volumes increased 1% and 6% in JBHT’s JBI and Truckload (“JBT”) segment. But more than fully offsetting the volume strength in JBI was a 16% decrease in gross revenue per load.

Dedicated Contract Services (“DCS”) provided a buffer against the revenue declines incurred in other segments, albeit on a negative basis itself. During the quarter, total revenues declined by 4%. There was also 370 fewer revenue producing trucks at quarter end than in the same period last year. Sequentially, however, the count was up by 31. And customer retention also held at a healthy 94%.

At the bottom line, total operating income was down 33%, led by a 41% decline in JBI. This was due to a combination of wage pressures and maintenance-related expenses on equipment. Other segments didn’t fare much better. JBT was down 48% on higher expenses, including insurance and costs related to ongoing technology enhancements. DCS and ICS came in on the flatter end, while FMS benefitted from favorable revenue quality, resulting in a 33% increase in operating income.

Overall, JBHT reported total diluted EPS of $1.80/share, a few cents under consensus estimates.

Market Reaction To JBHT Q3 Results

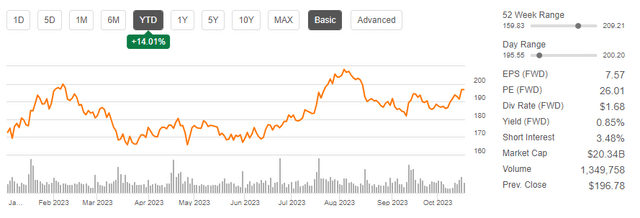

In extended trading following their release on Tuesday, shares dipped over 3.5%. Markets were perhaps disappointed in the double miss on both revenues and earnings. The over 30% sink in profits also signaled caution to wary investors who have largely remained bullish on the stock through 2023.

Leading up to the release, shares were trading at the upper end of their 52-week range. The stock was also up 14% YTD and little changed over the past month. This compares favorably to the broader S&P (SPY), at least when measured on a one-month timespan, where the S&P has lost 1.5%.

Seeking Alpha – YTD Share Price Performance Of JBHT

Outlook For JBHT Stock

JBHT is currently wrestling with declining margins in an unfavorable freight rate environment. In Q2, for example, quarterly operating margins were 8.6%. In Q3 they were 7.6%.

In addition, the pace of inventory destocking has indeed moderated, but it still appears to be a relevant trend, with many retailers continuing to pare inventory levels ahead of what would normally be a busy holiday season. This could potentially have a further impact on JBHT in Q4 and into the first fiscal quarter of the new year.

And while truckload rates, reported by Cass Information Systems, did increase from August to September, it did so only slightly, at 0.5%. YOY, rates are still down over 20%, a prime headwind that contributed to JBHT’s weaker-than-expected results.

Is JBHT Stock A Buy, Sell, Or Hold?

Though results may have missed expectations, there were a few positive takeaways. For one, the DCS segment continues to prove resilient in a challenging operating environment.

And in their largest segment, Intermodal, the business showed some signs of a turnaround in total volume. This turnaround came as the JBHT management team pointed to a moderation in the inventory destocking trend.

Intermodal President, Darren Field, noted on the conference call that volumes went from being down 1% in July to up 4% in September. The month also saw its largest volume week in company history.

Despite the optimistic takes, JBHT is still very much in a freight recession, as evidenced by the current freight rate environment, which is pressuring revenues at the same time that wages and other costs continue to accelerate.

JBHT President, Shelley Simpson, emphasized during the call that pricing is but a lagging indicator compared to volume, which is seen as a leading. This is true. It’s also a good spin following a quarter that produced a 30% decline in profit.

With shares near the top end of their 52-week range at a forward multiple of 26x, I don’t believe JBHT presents enough of a value proposition for investors seeking market-beating returns. This is especially true in the face of declining operating margins as a result of lower freight rates and higher operating costs. To pivot to a more bullish stance, I would need to see a more pronounced uptrend in the Intermodal business. Until then, I would continue to view shares best left on hold.

Read the full article here