Just over a year ago, I wrote on Jack in the Box (NASDAQ:JACK), noting that while the stock was becoming more reasonably valued, it was still hard to justify paying up for the stock at $75.00 given the difficult macro environment. Since then, we’ve seen JACK underperform the S&P 500 (SPY) by over 3000 basis points and it’s also significantly underperformed other quick-service brands like Restaurant Brands International (QSR) which made new all-time highs earlier this year. And while the company’s fiscal Q3 results were satisfactory with margin improvement and a strong opening in Salt Lake City under its new CRAVED image, the outlook for CYQ3-23 traffic is poor and CYQ4-23 hasn’t been much better. In this update, we’ll look at recent results, the outlook for fiscal Q4-23 and whether the stock is nearing a low-risk buy zone.

Jack in the Box Menu Offerings – Company Website

Recent Results

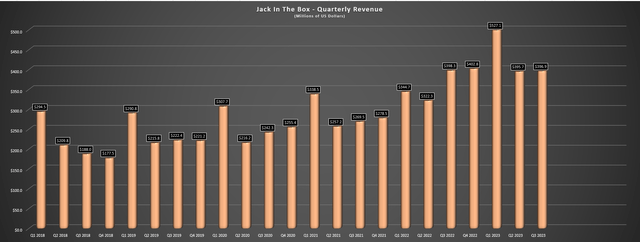

Jack in the Box released its fiscal Q3 results in mid-August, reporting quarterly revenue of $396.9 million that was down marginally year-over-year despite ~8% menu pricing across its system. The weaker sales figures were related to re-franchising of a portion of its Del Taco system with company restaurant sales down over 7% year-over-year, offset by an ~8% increase in franchise-related revenue. Meanwhile, although Jack in the Box saw decent same-store sales growth of 7.9%, this was offset by underwhelming same-store sales growth at Del Taco of 1.7%, especially considering the 8.1% pricing in the period. In addition, Del Taco reported a $5.4 impairment charge in Q3, with the company noting this was attributed to underperforming restaurants in Oklahoma and Atlanta.

Jack in the Box – Quarterly Revenue – Company Filings, Author’s Chart

Digging into the results a little closer, Jack in the Box saw 7.9% same-store sales growth (higher check and traffic at company-owned restaurants) and 8.0% system-wide sales growth, and noted that it saw a blowout opening for its new Salt Lake City restaurant with it representing a record-breaking opening for the company. This is certainly a positive development if other restaurants in this market can perform similarly, with 9 restaurants expected to be added in this market over the next five quarters. In addition, the company also shared that it continues to see improvements from a speed of service standpoint (12 second improvement), with its 4th consecutive quarter of lower wait times. Finally, the company’s collaboration with Snoop Dogg was a hit and helped boost its late-night day part, with the increase in operating hours/staffing progress were able to support the successful execution of this promotion.

Del Taco Presentation – Company Presentation

Unfortunately, the results weren’t nearly as strong at Del Taco, with the company limping out of the quarter with a disappointing 1.7% same-store sales figure (5.2% two-year stacked) despite pricing of 8.1%. Meanwhile, restaurant-level margins slipped to 17.4% with commodity, wage, and utility inflation, and as noted, the company recorded an impairment in the quarter related to the brand. Second, wage inflation remained elevated at 4.8%, with labor costs as a percentage of sales increasing to 34.0%. On a positive note, loyalty members were up ~200,000 to ~1.5 million, and the company has seen success in its re-franchising initiatives to create a more asset-light model, with 50 stores re-franchised (~8.5% of its system), with another 23 additional restaurants re-franchised at quarter-end, with ~66% of the total system now franchised (~54% previously).

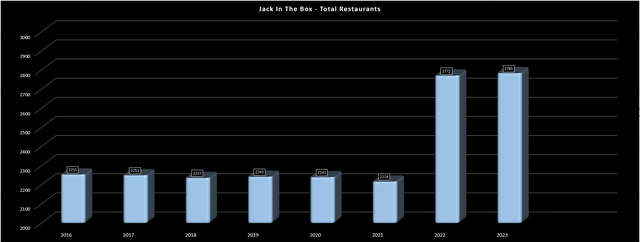

Jack in the Box Total Restaurants – Company Filings, Author’s Chart

Although these results were acceptable with decent performance at Jack in the Box offset by softer results at Del Taco, the company did note that it will have to lap significant price from last year (Q3 2022 pricing was ~9% to 11%) as it heads into fiscal Q4 (set to be reported in November), and this is occurring when industry-wide traffic is taking a beating. And on capital allocation and development, the company is seeing progress for franchisee interest for its flagship Jack in the Box concept, and Del Taco re-franchises have been guided up to 90-120 for FY2023. As for capital allocation, these proceeds will be re-directed to share repurchases, with the company planning to execute “at least” $80 million in share repurchases this year (up from $70 million previously).

Industry Wide Trends & Fiscal Q4 Outlook

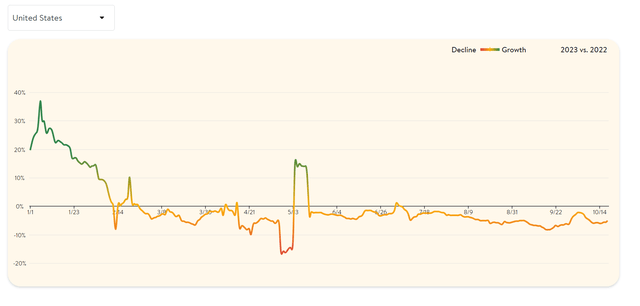

Although the better margin improvement at Jack in the Box was a positive, as was its Salt Lake City performance and its confidence around up to $55,000 in savings per restaurant related to equipment, simplification/optimization, and supply chain synergies, the top-line is an area of concern for the fiscal Q4 results and potentially fiscal Q1 as well. This is because industry-wide traffic has decelerated meaningfully since July, with August and September traffic down sharply industry-wide, and October traffic off to a slow start as well, at least according to Seated Diners from OpenTable. And more importantly for Jack in the Box, quick-service traffic also fell sharply in September logging its worst month year-to-date, suggesting that even trade-down beneficiaries like quick-service and fast-casual are seeing negative traffic, which was previously a sanctuary among a period of slowing casual dining sales.

Open Table – Seated Diners – OpenTable

The one silver lining for Jack in the Box is that its barbell menu could help to insulate it a little from this pullback. However, a more competitive environment due to increased promotional activity, more competition around late-night with Pizza Hut recently extending late-night hours to capture incremental sales in this day-part, and these brands fighting for fewer dollars as some consumers get squeezed by higher gas prices (in addition to already present headwinds from higher grocery, utility, and rent/mortgage costs), I think it’s tough to be optimistic about Jack in the Box beating its top-line or bottom-line estimates ($373 million sales, $1.15 in EPS) for fiscal Q4 2023, and I don’t see any reason to be overly optimistic about fiscal (CYQ4-23). And while this tougher setup might be worth ignoring if this was already priced into the stock, I don’t see this as the case currently. Let’s take a look at the valuation below:

Valuation

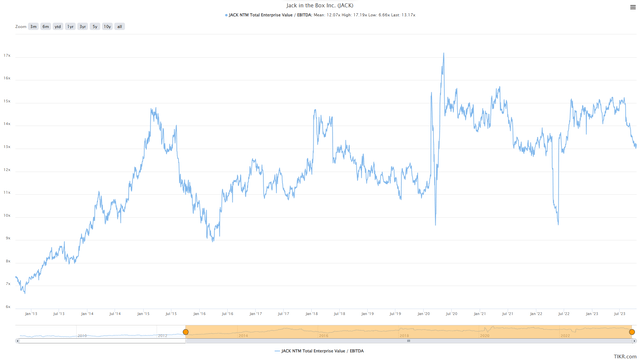

Based on ~20.5 million shares and a share price of $66.00, Jack in the Box trades at a market cap of ~$1.35 billion and an enterprise value of ~$4.45 billion. And while this is a significant departure from its peak market cap of ~$2.6 billion in 2021, the company still doesn’t look all that undervalued, trading at ~13x FY2024 EV/EBITDA estimates, slightly above its 10-year average EV/EBITDA multiple of ~12.2x. And while this valuation might be more than justified for a high-growth name in the restaurant space with over 95% of its system being franchised with iconic brands, it’s hard to argue that this is a steep undervaluation for a low-growth company with ~85% of its system franchised with two satisfactory brands.

Jack in the Box – Historical EV/EBITDA Multiple – TIKR.com

Using what I believe to be a fair multiple of 13.5x forward EV/EBITDA to account for the multiple compression we’ve seen across the market, I see a fair value for JACK of $74.00 per share, pointing to a 26% upside a total return basis (including dividends). However, I am looking for a minimum 30% discount to fair value for starting new positions in small-cap names to ensure a margin of safety, and ideally closer to 35% for names carrying higher levels of debt. Plus, as noted earlier, the company is in the less favorable position of having over 45% of its system in California (940+ restaurants), a state where we continue to see above-average wage rates that could continue to affect restaurant profitability.

After applying a 30% discount to its estimated fair value of $80.00, JACK’s ideal buy zone comes in at $52.00 or lower, suggesting the stock is still not in a low-risk buy zone despite its share price being nearly cut in half since its 2021 highs. This area would line up with a previous area of support for the stock from July 2022 in the $54.00 area, and a pullback to these levels would offer a better reward/risk from a technical standpoint. Obviously, I could be wrong, and it’s certainly possible the stock bottoms out here after what’s been a brutal correction. However, I prefer to buy at the right price or pass entirely, and with poor industry-wide traffic trends that suggest the potential for an underwhelming Q3/Q4 for most restaurants stocks and continued pressure on wages, I don’t see any reason to pay up for the stock above $66.00.

Summary

Jack in the Box’s acquisition of Del Taco may have been accretive given that it cost no shares to significantly increase its store count and annual revenue, but it increased the company’s exposure to California and could contribute to competition between the two brands due to the similarity in their markets. In addition, revenue has underperformed my expectations following the deal because of selling off company-owned stores, and FY2024 annual EPS is still expected to come in below FY2021 levels despite the growth from the Del Taco acquisition. Assuming the stock were trading below $54.00 and closer to 12x FY2024 EV/EBITDA, there might be more of an investment case here, where JACK would trade at a steeper discount to franchised peers. To summarize, while I think the valuation has become more reasonable after a ~50% correction, I don’t see any margin of safety yet.

Read the full article here