Nvidia (NVDA) earnings are out of the way. The attention now shifts from Jensen Huang to Jay Powell. The Federal Reserve Chairman will deliver remarks from Jackson Hole Friday morning, and both stock and bond market participants will pay close attention to what the Fed Chief says about the state of the economy and future policy actions.

Following a stern and “painful” 8-minute message that sent markets plunging to an eventual October low last year, it is clear that this platform can provide an outlet for Powell to make remarks slightly different from what is heard at the usual FOMC press conferences. A particular topic and conversation-starter among economists is whether Jay will speak to a possible adjustment in the so-called “r-star,” or the neutral effective Fed Funds rate.

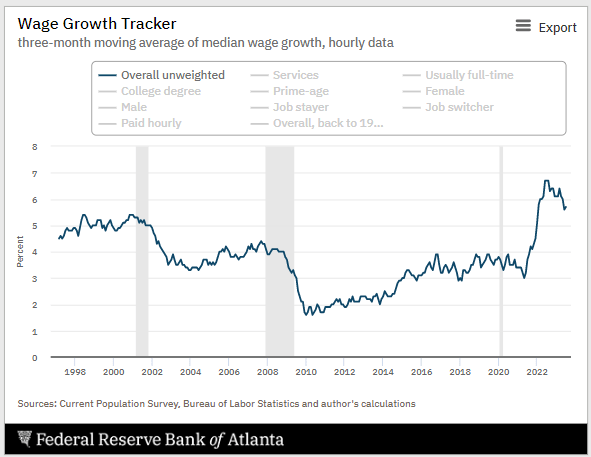

As it stands, the FOMC targets a 2% inflation level, but there are calls for a bump-up in that baseline rate given high wage growth today and a global shift away from negative interest rates and yield curve controls. What’s more, heavy Treasury bond issuance throws another wrench into the equation.

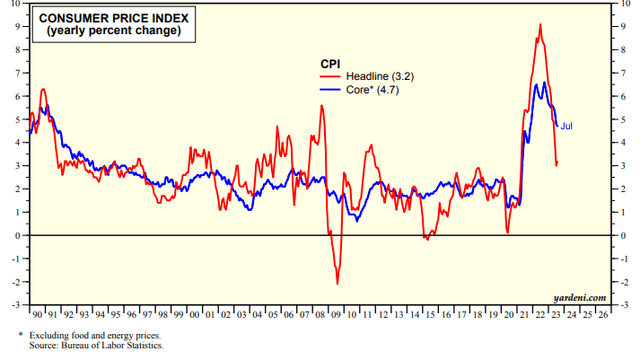

US CPI Cools Off

Yardeni Research

Powell might also take a mini victory lap given how quickly inflation has declined from four-decade highs above 9% on headline CPI in June last year to a few basis points under 3% year-on-year, evidenced by the June 2023 CPI report. But getting both CPI and PCE back to 2% is no small task. A labor market characterized by power among workers (see: UPS and a potential United Auto Workers deal in the weeks ahead) and an unemployment rate that remains near its lowest levels since the 1950s and ‘60s.

But with a 3% inflation rate today and a robust jobs situation, it is hard to argue with the reality that conditions are much better than was feared some 12 months ago as FOMC members gathered in Jackson Hole. Perhaps Powell’s 2021 message that dubiously emphasized the “transitory” nature of inflation has indeed played out, just a bit longer than expected.

Wage Growth Slowing, But Still Stellar

Federal Reserve Bank of Atlanta

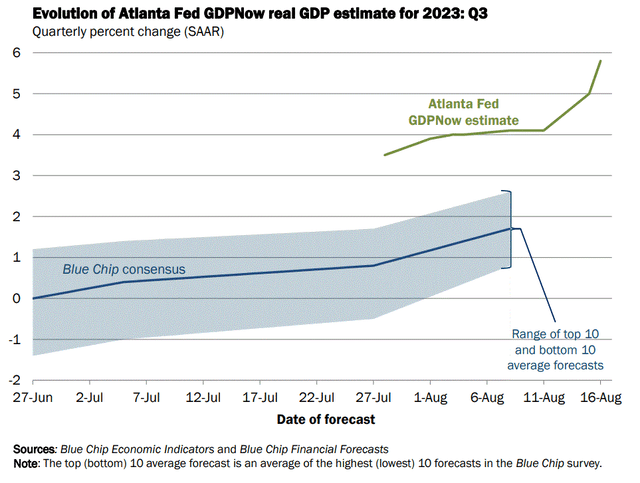

I see risks, though. Economic data has been strong lately, underscored by a red-hot July Retail Sales figure that helped send the Atlanta Fed’s GDP now soaring to near 6% modeled third-quarter annualized real GDP growth.

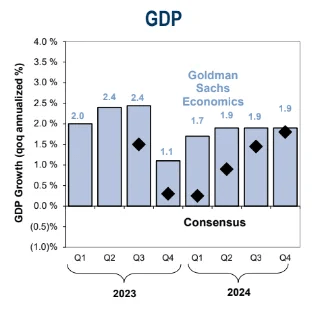

While that estimate should retreat over the coming weeks as more Q3 data comes in, it seems far-fetched to see a meaningful slowdown that would tailspin the economy into a recession. For the first time in this cycle, economists are no longer forecasting any quarters of economic contraction.

Very Strong Q3 US Real GDP Growth Modeled

Atlanta Federal Reserve

Consensus Forecast No Longer Sees A Recession

Goldman Sachs Investment Research

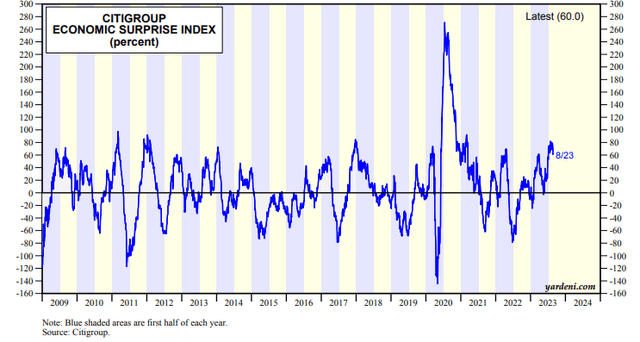

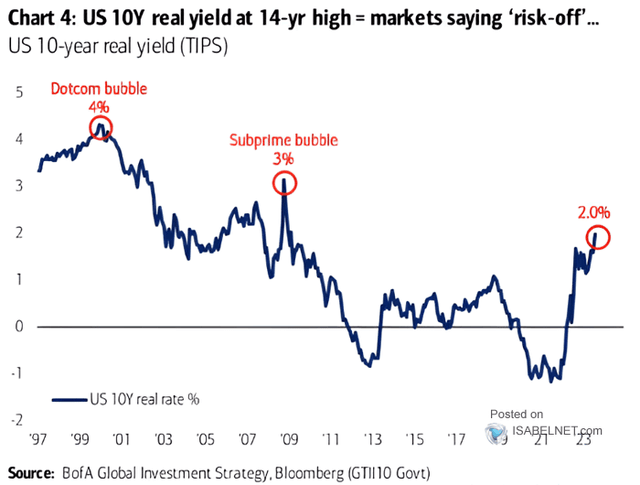

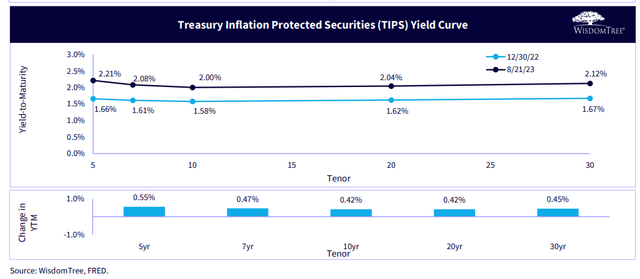

Moreover, the Citigroup Economic Surprise Index (CESI) remains strong, and that reality has recently sent bond yields soaring. Ever since the start of the Q2 earnings season, Treasury market selling has been intense. Real yields have climbed above 2% on many parts of the rate curve.

You can even lock in inflation-protected Treasury exposure above 2.1% on the 20-year bond. With the benchmark 10-year rate at its highest level since October 2007 and with money market yields north of 5%, TARA (there are reasonable alternatives) has arrived while TINA (there is no alternative) has been shown the door.

Citigroup Economic Surprise Index Near 30-Month Highs

Yardeni Research

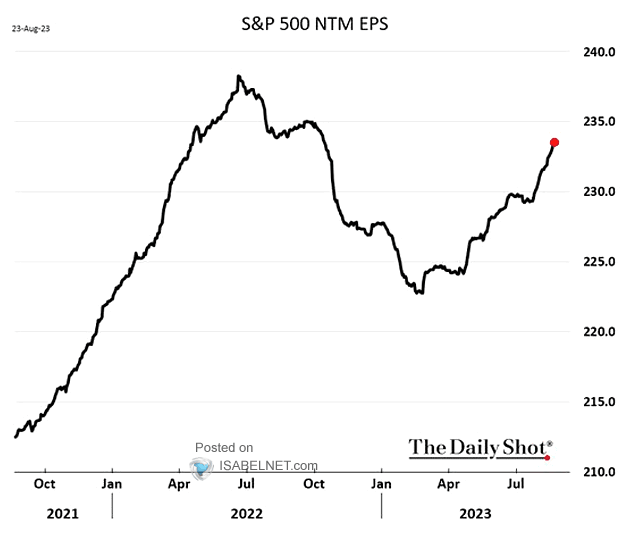

S&P 500 Earnings Estimates on the Rise Despite Higher Rates

The Daily Shot

10-Year Real Yield Back at 2% For the First Time Since the Late 2000s

BofA Global Research

TIPS Curve Shows Real Yields Above 2%

WisdomTree Funds

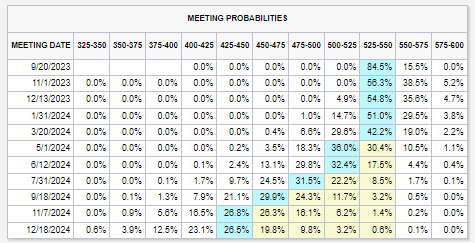

Overall, I do not expect any drama from Powell on Friday. At this juncture, he is not looking to ruffle any market feathers given the volatility he has stirred up in the last two years. I assert he will leave it to the committee meeting on September 20 to offer up meaningful updates on policy thinking. And the market believes there is a reasonable chance, 44%, of a final rate hike come November 1.

A curveball could come via a more divided Fed today compared to a year ago – there are more solid doves who assert the FOMC should back off on further hikes, given tighter financial conditions and a rise in bankruptcies, whereas a set of hawks have recently said more work is needed due to hot jobs growth and inflation that is still running above target.

Traders Remain Split Regarding Rate-Hike Prospects Later This Year

CME FedWatch

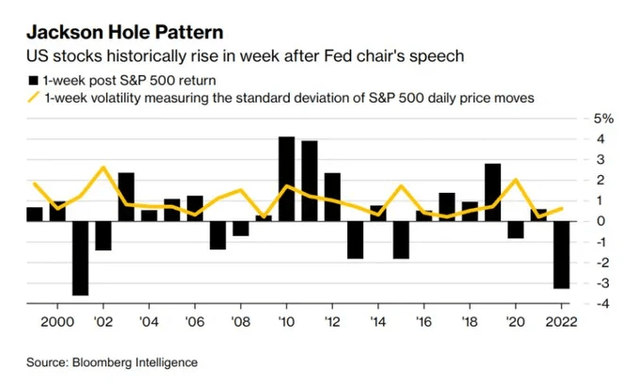

Stocks’ Performance Post-Jackson Hole Mixed

Bloomberg

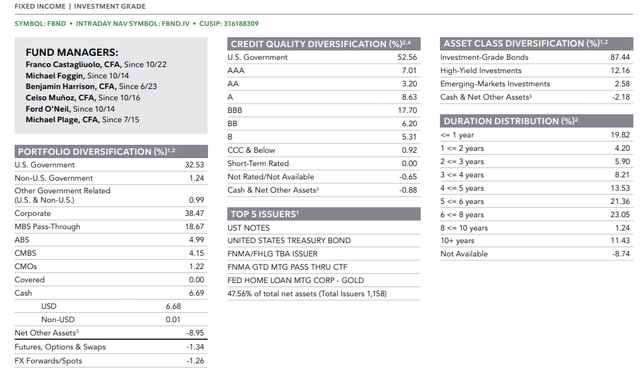

With that in mind, let’s assess the state of the total bond market via the Fidelity Total Bond ETF (NYSEARCA:FBND). According to the issuer, FBND, an actively managed fund, normally invests at least 80% of its assets in investment-grade debt securities of all types and repurchase agreements for those securities. The fund uses the Bloomberg US Universal Bond Index as a guide in allocating its assets across the investment-grade, high-yield, and emerging-market asset classes and in managing the fund’s overall interest rate risk. The ETF invests up to 20% of its assets in lower-quality debt securities and invests in domestic and foreign issuers and allocates assets across different asset classes, market sectors, and maturities.

FBND is a large ETF with more than $4.5 billion in assets under management and it has paid a dividend rate of 4.0% over the past 12 months; I would estimate that its current yield to maturity is just shy of 6% given the allocation. A 4-star rated Morningstar fund, it has a moderate expense ratio of 0.36% with a 3-month daily average volume of just 640,000 shares. Still, liquidity is strong with the fund as its 30-day median bid/ask spread is relatively low.

FBND differs from other aggregate bond funds in that it holds a modest amount of high-yield debt. Overall, the fund is 87% investment-grade and 12% high yield with small non-US exposure. More than half the portfolio is comprised of US Government securities while 38% of FBND is made up of corporate credit. Its effective duration is 6.0 years, per Morningstar.

FBND: Portfolio Characteristics, Credit Quality, And Duration Profile

Fidelity Investments

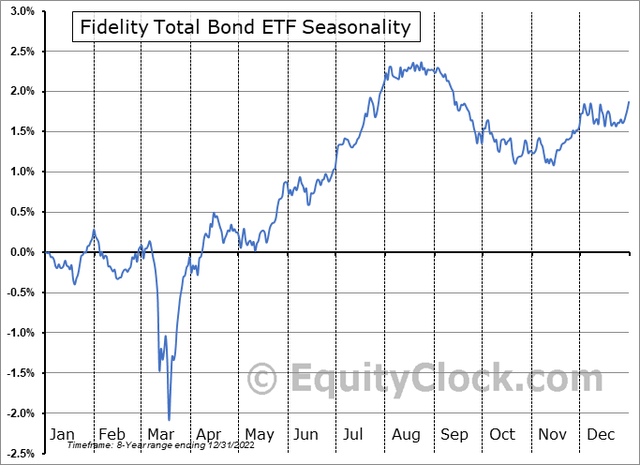

Seasonally, this total fixed-income market fund tends to peak in early September with an ultimate low in mid-November according to data from Equity Clock. Keep in mind that there is actually alpha in the aggregate bond market compared to the S&P 500 in September, too.

FBND Seasonality: Bearish Trends Through Mid-November

Equity Clock

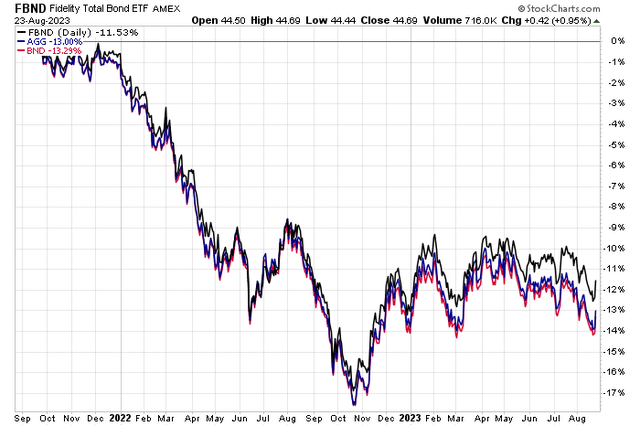

Over the last two years, FBND has performed comparably to broad US high-grade fixed-income index funds.

FBND: Very Close to Aggregate Bond Market Exposure

Stockcharts.com

The Bottom Line

With higher yields today and real rates near 2%, I assert that holding a broad bond fund like FBND is warranted. Still, I do not like FBND’s somewhat high annual expense ratio, though I do like how this active strategy includes high-yield bonds, unlike so many index funds.

I have a hold rating on the fund and would lean more towards being long something like iShares Core U.S. Aggregate Bond ETF (AGG), Vanguard Total Bond Market Index Fund ETF Shares (BND), Schwab U.S. Aggregate Bond ETF™ (SCHZ), SPDR® Portfolio Aggregate Bond ETF (SPAB).

Read the full article here