It’s been a bumpy start to the year for the VanEck Gold Juniors Index (GDXJ) in what’s typically the best month of the year from a seasonal standpoint, with an average return for the sector of ~2.6% in January over the past 30 years. This is evidenced by the index being down over 11% year-to-date, which is certainly disappointing for investors after gold put together a record eight straight weekly closes above the $2,000/oz level.

With some producers that have reported exceptional 2023 operational results, this is a case of the baby being thrown out with the bathwater. However, for Jaguar Mining Inc. (OTCQX:JAGGF), this was the third consecutive massive miss vs. annual guidance, and with stope ore from Faina still at least six months away, I would expect a mediocre H1 at best at its relatively low grade underground operations. In this update we’ll dig into Jaguar’s Q4 production results, its forward outlook, and whether the stock is offering enough margin of safety after several years of underperformance.

Jaguar Mining Operations – Company Website

Q4 & FY2023 Production

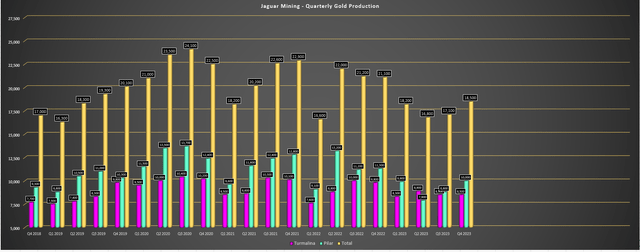

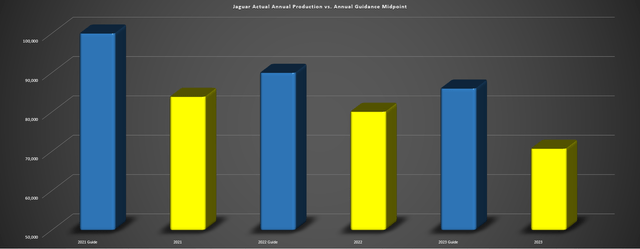

Jaguar Mining released its Q4 and FY2023 production results last week, reporting quarterly production of ~18,500 ounces, a 12% decline from the year-ago period. However, it’s important to note that the company was lapping easy comparisons with a production declining 8% in the year-ago quarter, and this was the company’s worst Q4 performance since Q4 2018. Hence, the improvement sequentially (+7% vs. Q3) was hardly worth writing home about. Besides, Jaguar missed its annual guidance for a third consecutive year following the mediocre Q4 results, producing a paltry ~70,700 ounces vs. ~81,000 ounces last year and FY2023 initial guidance midpoint of 86,000 ounces of gold, translating to an 18% miss. Worse, this was the third consecutive miss for the company vs. its initial guidance midpoint, and it wasn’t even close.

Jaguar Quarterly Gold Production by Mine – Company Filings, Author’s Chart

Jaguar Mining – Annual Production vs. Annual Guidance Midpoint – Company Filings, Author’s Chart

While guidance misses are understandable and often occur in an unpredictable sector like mining, none of these misses were small by any means, with an average miss over the past years of ~13,700 ounces. This is a massive threshold to miss by relative to the midpoint for a small-scale producer like Jaguar, with this track record (~14% average miss vs. midpoint) being even worse than Equinox Gold (EQX) which has also missed guidance for three years at a rate of closer to 8%. Not surprisingly, Jaguar has declined to provide guidance in 2024 and plans to issue guidance later this year when it has a better handle on the ramp-up of production at the Faina deposit, but it’s hard to put much trust in the team when guidance is issued given the level of misses relative to plans in past years.

So, what went wrong?

Digging into the production results a little closer, its smaller Turmalina Mine ended the year with annual production of just ~33,100 ounces (FY2022: ~36,200 ounces), affected by lower grades, recoveries and throughput. This was affected by lower mined grades and tonnes in Q2 with higher variability than planned. Unfortunately, Jaguar’s Pilar Mine didn’t fare any better, with production down over 15% year-over-year to ~37,600 ounces because of a difficult rainy season in Q1 and its primary orebodies seeing a change in geometry that didn’t conform well to its previous mining method. Fortunately, there was no required change to reserves and resources according to the company and Jaguar noted that modifications to its mining methods are yielding improved results with a step up in production in Q4 (albeit at much lower grades year-over-year).

Recent Developments

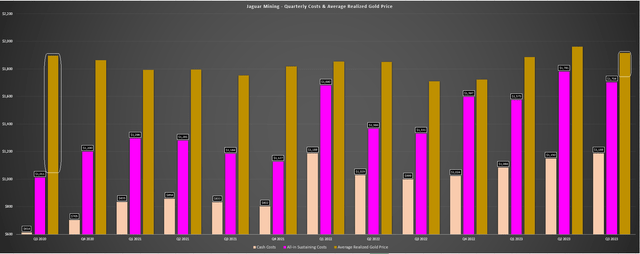

On a positive note, while grades fell considerably year-over-year to 3.09 grams per tonne of gold (FY2022: 3.44 grams per tonne of gold) and well below its reserve grade, the company plans to bring a new high-grade mining front online in H2-2024. This is the Faina deposit at its Turmalina Mine, with the below image showing that the company has advanced near the Faina orebody, which carries a higher average grade of 5.08 grams per tonne of gold and a decent size resource of ~1.43 million tonnes in the M&I category. And while Jaguar won’t see a meaningful contribution of stope ore from Faina until at least Q4, this should lift overall grades towards year-end and hopefully help the company bring down its costs which spiked above $1,700/oz in two of three quarters in 2023, with all-in costs averaging $1,951/oz year-to-date (first nine months of 2023).

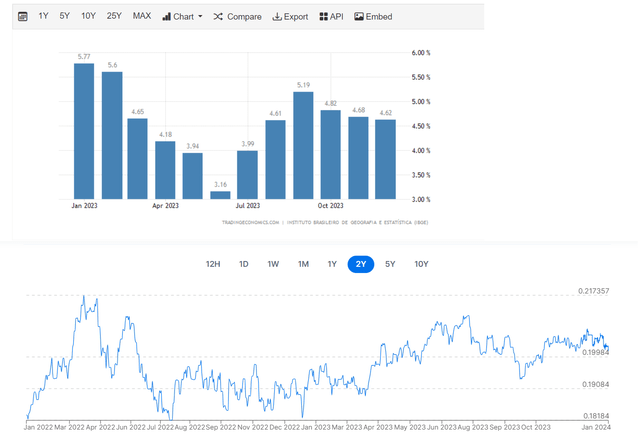

The other positive news is that the gold price continues to hold up well, averaging ~$2,030/oz quarter-to-date, which is an improvement from an average price of $1,916/oz in Q3 for Jaguar, suggesting a better year ahead from a margin standpoint if this strength persists. And for an extremely low margin producer like Jaguar with costs nearly 20% above the industry average, a small move in the gold price can have a big impact on margins. That being said, the Brazilian Real remains well off its 2022 lows, which is a minor headwind for the company and inflation rates have cooled from ~8% and ~9% in 2021/2022, but remain elevated at 4.6% in December. So, while I am confident that Jaguar should see better unit costs year-over-year in Q4 once Faina is online, I think sub $1,450/oz all-in sustaining costs may be a distant memory at current exchange rates with continued inflationary pressures.

Brazil Inflation Rate & BRL/USD Rate – XE.com, TradingEconomics.com

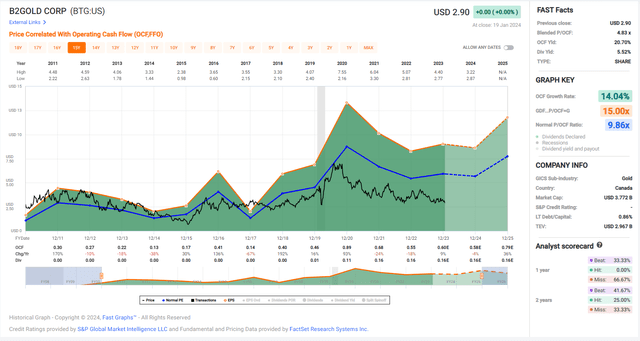

The last development worth noting may not be Jaguar specific, but it applies to the investment thesis for Jaguar Mining. This is the fact that many diversified mid-tier producers are sitting at their lowest valuations since March 2020 with low single-digit forward cash flow multiples and with many paying 2-5% dividend yields. And while Jaguar might have been a worthy speculative bet in mid November 2023 when the sector had rallied off its lows, this is not the case anymore with far more attractive opportunities elsewhere that carry lower risk at only slightly higher multiples. Hence, although Jaguar has not appreciated much in price vs. November 2023 levels, its relative valuation has deteriorated in my view. Let’s take a closer look at Jaguar’s valuation below.

Valuation

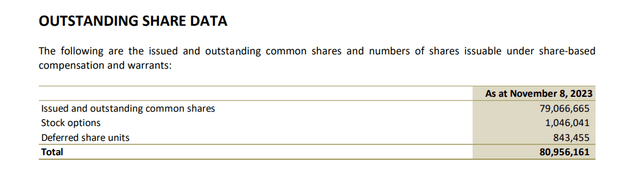

Based on ~81 million fully diluted shares and a share price of US$1.34, Jaguar trades at a market cap of ~$107 million. This makes Jaguar one of the lowest capitalization names in the producer space, behind other names like Fortitude Gold (OTCQB:FTCO) and Mandalay Resources (OTCQB:MNDJF). However, the lower capitalization relative to peers can be largely justified by the company’s rising cost profile and razor-thin margins, with year-to-date all-in sustaining costs above $1,650/oz (Q3 2023: $1,704/oz), leaving little left over for shareholders (hence the dividend cut). And while the company is confident that it can significantly grow production at lower costs, I’m less optimistic given the poor track record with three years in a row of massive misses relative to guidance and disappointing operational execution overall. Plus, in a market where some of the higher-quality names with industry-leading margins are on sale, I don’t see any reason to stoop to buying high-cost junior producers with poor track records of meeting their promises.

Jaguar Mining Fully Diluted Shares – Company Filings

Jaguar Mining AISC Margins – Company Filings, Author’s Chart

So, what’s a fair value for the stock?

Using a more conservative multiple of 3.5x FY2024 cash flow estimates to reflect sector-wide multiple compression and adding in net cash, I see a fair value for Jaguar Mining of ~$158 million [US$1.95 per share]. This points to a 45% upside from current levels, but I am looking for a minimum of a 45% discount to fair value for junior producers, and ideally closer to 50% for commodity price sensitive producers like Jaguar. If we apply the midpoint of this discount (47.5%) to Jaguar’s estimated fair value of US$1.90, this points to an ideal buy zone of US$1.03 or lower. So, while the stock may have corrected from its highs, I don’t see enough margin of safety yet, and don’t see any reason to invest in the stock when higher-margin and diversified names with Tier-1 jurisdiction assets are available at only slightly higher multiples like B2Gold (BTG) at ~3.6x FY2025 cash flow estimates with a ~5.5% dividend yield.

Summary

Jaguar Mining’s ~80% decline from its 2020 highs may entice some investors to jump into the stock, but there are few sectors where it’s more important to focus on quality than the gold sector, and high-cost single-jurisdiction producers carry the higher risk among their peer group. Fortunately, Jaguar is benefiting from a higher gold price to help offset its significant increase in costs, but I prefer low-risk and high-reward investments if I’m already dealing with commodity price uncertainty (external risk), and Jaguar is hardly low-risk with high-cost mines, all of its NAV in one jurisdiction and a track record of missing operational guidance. Hence, while the stock may work out for investors as a speculative bet, I would need a pullback to US$1.03 or lower to get interested from a swing-trading standpoint, and I think there are dozens of better names to invest in at current levels.

B2Gold Historical Cash Flow Multiple & Dividend Yield – FASTGraphs

Among medium-risk names, I see Argonaut Gold (OTCPK:ARNGF) as a more attractive bet, trading at ~2x FY2024 cash flow estimates in Tier-1 ranked jurisdictions (Ontario/Nevada). Among lower-risk and diversified names, I prefer B2Gold, which trades at its lowest multiple in years with an industry-leading dividend yield and barely 5x FY2025 free cash flow estimates.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here