Investment thesis

Our current investment thesis is:

- Jamieson has developed deep expertise in the industry, through product development and innovation. This has allowed the business to develop a highly regarded and trusted brand for high-quality products.

- Growth has been strong, with Management now focused on international expansion, through entry into China and investment in the US market. We believe this has the potential to unlock significant value in the coming decade.

- We see unexploited value in the business, such as through product expansion (leveraging its brand) and reduced discounting once further scale is reached (contributing to margin improvement).

- Jamieson is currently trading at a discount to its historical average and a recent large industry transaction, implying substantial value.

Company description

Jamieson Wellness (OTCPK:JWLLF) is a leading Canadian health and wellness company specializing in the manufacturing and distribution of high-quality vitamins, supplements, and natural health products.

With a rich heritage of over 100 years, Jamieson Wellness has established itself as a trusted brand, providing consumers with science-backed products to support their overall well-being. The company operates in both the domestic and international markets, catering to a diverse customer base seeking to enhance their health through natural and effective solutions.

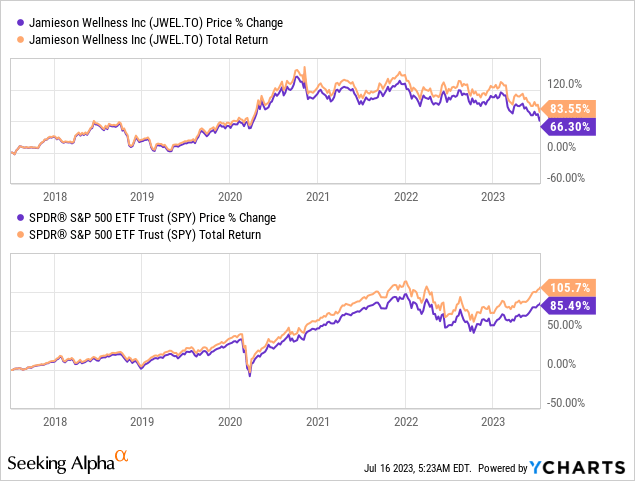

Share price

Jamieson’s share price has performed comparably to the market since it was listed, reflecting a continuation of its positive financial development and attractive fundamentals.

Financial analysis

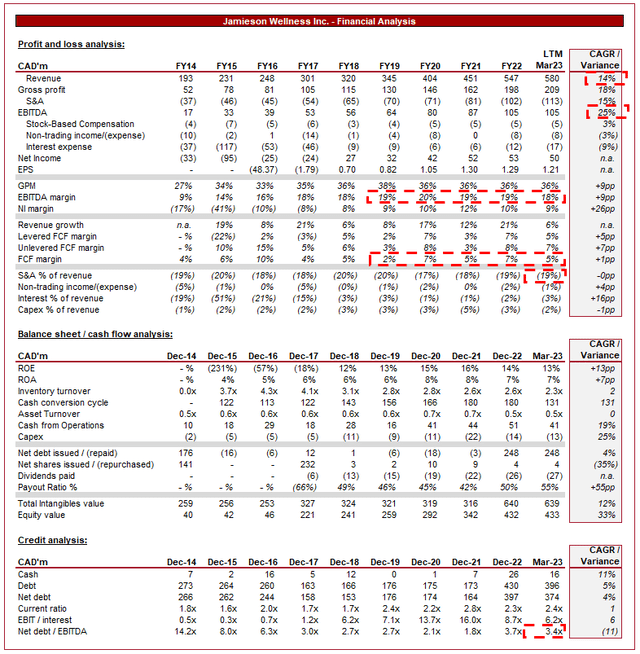

Jamieson Financials (Capital IQ)

Presented above is Jamieson’s financial performance for the last decade.

Revenue & Commercial Factors

Jamieson’s revenue has grown at an impressive CAGR of 14%, with only 3 fiscal years of growth below 10%. This suggests an impressive development during this period, with demand high for its products.

Business Model

The Jamieson business operates through two key segments.

Firstly, Consumer Health. This segment focuses on developing, manufacturing, and marketing branded vitamins, minerals, supplements, and other natural health products directly to consumers. This is the core competency of the business, with a deep history of innovation and natural products.

Brands (Jamieson)

Jamieson utilizes various distribution channels, including retail stores, online platforms, and pharmacies. This allows the business to expand its reach, and directly compete with peers for shelf space. Given the number of players in the industry, this is a critical requirement.

Secondly, Jamieson collaborates with strategic partners, including retailers and private-label clients, to develop and manufacture customized health and wellness products. Given the expertise of the business, it utilizes its production scale and deep expertise to further monetize the business. This segment helps expand the company’s reach while also diversifying its revenue streams and maximizing productivity. This does have some scope for cannibalization but Management is very selective with their relationship and uses this as a means of accelerating its strategic initiatives.

In conjunction with the first point above, Jamieson Brands International is responsible for the distribution and marketing of Jamieson-branded products in international markets, primarily in Asia, Europe, and the Americas. Through JBI, Jamieson Wellness leverages its brand reputation and product portfolio to tap into global opportunities. This is a key growth driver for the business in the coming years, as a strong presence in Canada means the potential is softening in this market.

The company’s competitive advantage revolves around its well-regarded brand and deep expertise in the industry. This allows the business to continually develop successful products, knowing customers will trust the product to be a leading offering.

Vitamin and Natural product Industry

Jamieson faces competition from various players in the health and wellness market, including Nature’s Bounty (OTCPK:NSRGY), GNC, Reckitt Benckiser (OTCPK:RBGPF), and Pfizer Nutrition (PFE). Further, there are also local and regional players, as well as an increasing number of private-label brands.

The vitamin industry has experienced strong growth in the last decade, as Increasing consumer awareness and a shift toward proactive health management drives the demand for health and wellness products.

In conjunction with this, Consumers are also seeking natural and organic alternatives, favoring products with clean ingredients, sustainability, and minimal environmental impact.

Jamieson also attributes growth to rising disposable income, age demographic, and greater access to information. Our view is that this trend should continue in the coming years as despite the growth, the market size remains small relative to personal products.

Jamieson

Management’s focus has turned to winning the US market and achieving growth in China. Consumers are seeking widely accessible products, natural ingredients, and a trusted brand. For this reason, the key to succeeding will be the development of its brands, reflecting the value proposition, and building trust. Given the capabilities developed thus far, we believe Jamieson is positioned well to succeed in their expansion.

Within China, in particular, Jamieson has made several shrewd decisions to successfully execute its strategy. The business has acquired distributor assets in the country, as well as invested heavily in marketing to develop its brand and build relationships. Further, the business has partnered with DCP Capital, a fund specializing in brand-building in China. The objective is to gain local knowledge and expertise. In exchange, DCP acquires 33.3% of the Chinese venture for $47m, as well as warrants. This is a rich price to pay but the Chinese market is estimated to be $30b+ in size, implying the returns could be significant.

The company’s focus is clearly on international growth but it is important to attribute the necessary focus to continually enhance its core market. The rise of e-commerce has transformed the retail landscape, offering convenience and accessibility for consumers to purchase health and wellness products online. The development of a strong direct-to-consumer e-commerce offering could be incredibly fruitful in the long term. This can only work if the company has a strong brand and so will begin with growing its share in the Canadian market. Beyond this, however, the business can transition to its International markets once further market share is gained. The financial results will be margin improvement and greater insight into customer purchases.

Further, the business also has scope for developing its product range, expanding into other all-natural products for example. Again, this can be “tested” in the Canadian market. We believe this can support a continuation of its current growth trajectory, leveraging its brand to capture market share.

Margins

Jamieson’s margins have gradually improved over the historical period, reaching an EBITDA-M of 18% in the LTM period.

This improvement is a reflection of scale economies, although the extent to which improvements have been made is small post-FY17. This is likely to ensure the business maintains its growth trajectory, pricing attractively.

In the most recent quarter, the business has seen a slight decline in margins, with inflationary pressures impacting both input costs and S&A.

Margin improvement is possible in the future but with investment in China and further US growth, it is likely that Jamieson will remain at its current level, with any gains reinvested.

Balance sheet & Cash Flows

Despite having fairly consistent cash flows, Jamison has utilized debt in order to grow the business. ND/EBITDA currently sits at 3.4x, a moderately elevated level in our view. We would like to see this decline in the coming years, especially as rates have been lifted. Interest payments represent 3% of revenue and coverage stands at 6.2x, compounding this assessment.

Valuation

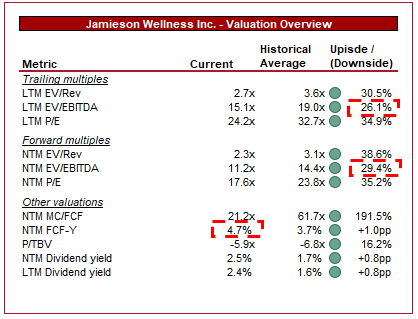

Valuation (Capital IQ)

Jamieson is currently trading at 15x LTM EBITDA and 11x NTM EBITDA. This is a discount to its historical average.

Our view is that a small premium relative to its historical average is warranted. The reason for this is that the business has achieved improved scale while maintaining margins, and has significant growth opportunities in the US and China.

M&A

Nestle acquired the core brands of The Bountiful Company for $5.75bn, the number one pure-play leader in the global nutrition and supplement category. Jamieson has the potential to reach the heights of this business, especially if it considers our suggestion of expanding its product range in conjunction with its international expansion. The company had an EBITDA-M of 18% at the time of the transaction, with Nestle’s transaction valuing the business at an implied EBITDA multiple of 17x.

Based on this, we believe Jamieson is incredibly well-positioned. Even if the transaction comp was heavily discounted, say 30% (We do not consider this appropriate), it would still be undervalued on an NTM basis. This provides downside protection and the potential for significant upside if a potential buyer makes a move. Jamieson does look great as part of the portfolio of a Consumer Goods business. This will likely be actioned based on how successful its entry into China is.

Key risks with our thesis

The risks to our current thesis are:

- FX. As a business expands its international presence, the business faces risks in converting its overseas income to CAD.

- Execution. With a strong strategic focus on international expansion, especially in China, the business faces high execution risk. Should this fail, the business will rapidly see growth decline as it is already the largest player in Canada, restricting the ability to generate incremental gains.

Final thoughts

Jamieson looks to be a quality business. The company has deep expertise and a strong brand in an industry that is growing well, with forecasting implying this trajectory will continue. Jamieson’s current strategic focus is on achieving growth in the two largest markets, presenting the opportunity to generate substantial returns if successful. We believe the necessary steps are being taken to improve the likelihood of this, namely brand development.

With the business trading at a discount to its historical average and the potential for a takeover, we believe the value proposition is attractive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here