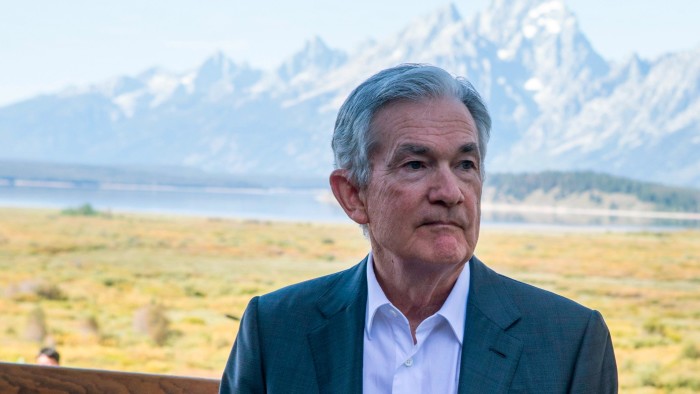

Jay Powell’s speech at the Federal Reserve’s August summit in Jackson Hole, Wyoming, is always a high-stakes moment. This year, the central bank’s chair takes the podium under fire — facing fierce attacks from Donald Trump and a growing insurgency within his own institution.

Trump has engaged in a months-long assault on Powell, calling him a “stubborn mule” and “numbskull” for refusing to cut borrowing costs this year over concerns that the president’s tariffs will inflame inflation.

Now, almost six months ahead of schedule, Trump has been gifted a chance to sow more discord within the Federal Open Market Committee by picking a loyalist to fill an empty seat on the Fed’s board.

Stephen Miran, the economist he has chosen to replace Adriana Kugler following her abrupt departure from the central bank’s policy-setting board, has endorsed Trump’s calls for interest rate cuts. He has also pushed for an overhaul in Fed governance that would hand presidents the power to dismiss the likes of Powell at will.

Analysts expect something like fireworks inside the ordinarily staid central bank.

“Miran is not somebody who’s going to be enveloped in and overwhelmed by the traditions inside the Fed,” said Steven Blitz, chief US economist at TS Lombard. “He will be the agent provocateur representing Trump at the FOMC. And proudly so. He’ll make no bones about it.”

It would make Powell’s job in Wyoming on Friday, when markets will pore over every word in his speech, more complicated than normal.

“We are in this uncomfortable equilibrium, where we don’t know where things go next,” said Gennadiy Goldberg, chief rates strategist at TD Securities. “The market wants a bit of confirmation from Powell on Friday as to whether he is open to cutting rates.”

Miran is not Powell’s only problem.

Christopher Waller and Michelle Bowman, two Fed governors who both made the Treasury’s 11-person longlist to succeed Powell in May, dissented and backed cuts at the central bank’s July vote.

Assuming Miran is confirmed by the Senate in time for the September 16-17 Fed meeting, that would leave Powell facing three dissenters from within his own seven-strong board.

A schism of that magnitude last occurred in 1988 — and would be seized upon by Trump and his supporters as evidence that the chair was losing his grip.

Mixed US economic data is adding to Powell’s dilemma as seeks to balance the Fed’s dual mandates of maximum employment and stable prices.

Trump’s sweeping duties on trading partners have yet to produce the sort of surge in inflation seen during Joe Biden’s time in the White House, but they have clouded the outlook enough to leave rate-setters wondering if they have much room to cut.

Investors leapt on a relatively benign consumer price index figure last week to fully price in at least a quarter-point cut in mid-September. But insiders view the Fed’s vote next month as a far closer call than markets.

While a gloomy jobs report for July has raised concerns about the health of the labour market, a hot producer price index figure brought worries that tariffs were about to hit US shoppers.

Torsten Sløk, chief economist at Apollo Global Management, said tariffs had created “a stagflationary impulse” that had complicated the Fed’s job “dramatically”.

Some Fed-watchers say Powell’s view would depend on whether he remains focused on the unemployment rate as the prime indicator of the health of the US labour market.

At 4.2 per cent, the rate remains low, suggesting the sharp slowdown in hiring this summer might be down to supply-side factors, such as a fall in immigration, which the central bank can do little to counteract.

Marc Giannoni, chief US economist at Barclays, said: “Powell warned [after the July meeting] that payrolls could be close to zero, he also said the unemployment rate may not move up much because of supply-side factors. If he repeats that, then that puts the expectations for rate cuts back closer to 50 per cent.”

Bets of a September cut have edged lower in recent days, to an 85 per cent chance as of Tuesday, on the back of the PPI report and Fed officials’ comments that have tempered expectations.

But doves argue that, at 4.25 per cent to 4.5 per cent, the Fed’s benchmark range remains in “restrictive” territory, limiting growth at a time when the US labour market might be on the turn and the economy showing signs of slowing. More bad data on jobs would raise the prospect of the likes of Waller backing a jumbo 0.5 percentage point cut — in line with calls from US Treasury secretary Scott Bessent for more aggressive action.

Trump’s demands, meanwhile, remain extreme: he wants borrowing costs slashed to just 1 per cent, claiming this would save the government hundreds of billions of dollars on debt repayments.

The big question for Miran is how he would keep pushing for such steep rate cuts while coming across as credible. He struggled in April to reassure investors during a market eruption after Trump launched his trade war, and previously wrote about the merits devaluing the dollar and a so-called Mar-a-Lago accord to realign the global economy.

“He’s there to try to see how far he can shift the Fed’s ‘Overton window’,” said Derek Tang, of LH Meyer, referring to the concept that describes the range of ideas considered acceptable in public discourse.

Miran, now chair of the Council of Economic Advisers, will not attend Jackson Hole, though his fellow council members Pierre Yared and Aaron Hedlund will be there.

Ed Glaeser, who taught Miran microeconomics in his first semester at Harvard, expected his former pupil to echo the president’s calls for rate cuts, but played down the degree to which he would be a disruptive force within the Fed.

“I suspect he would not be nominated if he did not believe that he should be cutting rates and he will certainly come into it with a pro rate-cutting view,” Glaeser said. “But he will listen to his colleagues and do his best to be a decent member of this group.”

Data visualisation by Carolina Vargas

Read the full article here