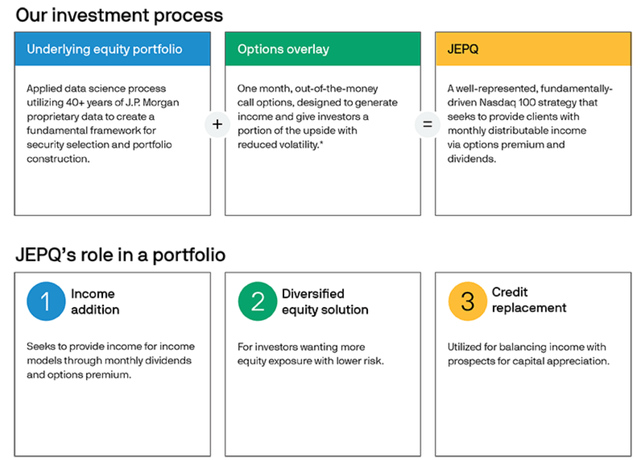

I have previously argued that JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) offers investors an attractive risk/ reward set-up, as I highlighted the funds’ strategy to generating income through overwriting options premium while preserving the opportunity of value appreciation through investments in high quality growth stocks.

In other words, JEPQ invests in U.S. large-cap blue chip growth stocks and aims to generate recurring income by selling call options on its holdings. Accordingly, the fund’s performance is closely correlated to the performance of the NASDAQ 100-Index (NDX) for capital appreciation, as well as the VIX index for monthly premium income. As communicated through the ETF’s prospectus:

The investment objective of the Fund is to seek current income while maintaining prospects for capital appreciation. The Fund seeks to achieve this objective by (1) creating an actively managed portfolio of equity securities comprised significantly of those included in the Fund’s primary benchmark, the Nasdaq-100 Index® (the Benchmark), and (2) through equity-linked notes (ELNs), selling call options with exposure to the Benchmark.

JEPQ Prospectus

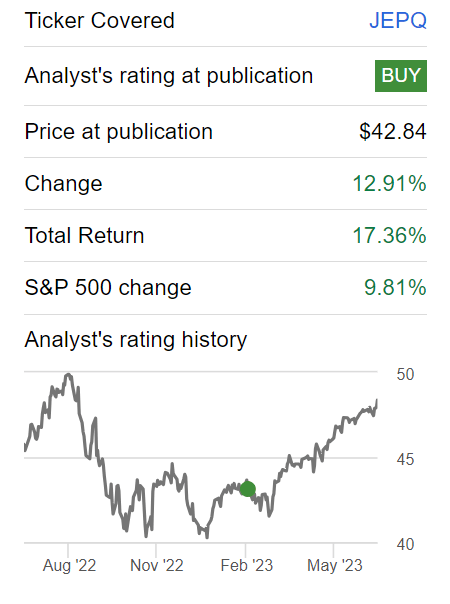

In February, when I first presented the bullish thesis for JEPQ, the call-overwrite strategy on growth stocks made perfect sense – because implied volatility was trading rich and growth stocks were trading cheap. And upside on both return components appeared very likely.

Seeking Alpha

Accordingly, since my initial buy recommendation, JEPQ returned to investors approximately ~17.5% (~13% in form of capital appreciation and ~4.5% in form of dividend distribution), as compared to a total gain of ~10%” for the S&P 500 (SPX).

However, today I am reluctant to reiterate a “Buy” recommendation on JEPQ because the bullish signals that prompted an attractive risk/ reward set-up in mid-Q1 2023 have mean reverted, if not stretched to an unfavourable extreme.

Firstly: The VIX, which was trading around ~20 in February, has dropped to 14 as of late June, a level that is at the very bottom of the 52 week trading range of 13 – 35. And with a low VIX (reflecting low implied volatility), the option premium that investors get from selling option is respectively meager. For context, if an investor sells an option with a ~14% implied volatility, and the subsequently realized volatility on the underlying over the relevant time period is greater 14%, the trade is value dilutive.

Seeking Alpha

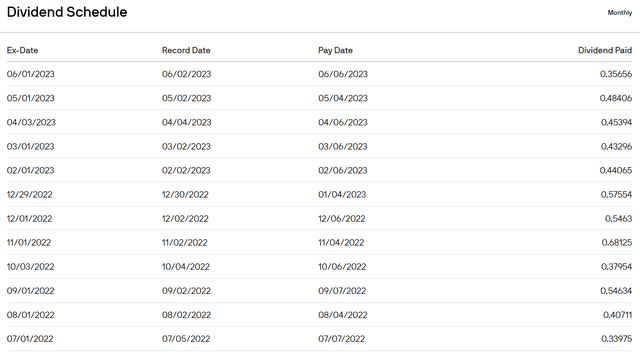

In line with lower volatility premia, JEPQ’s dividends dropped by about 37% over a six month period, from $0.58/ December 2022 to $0.37/ June 2023.

JEPQ Prospectus

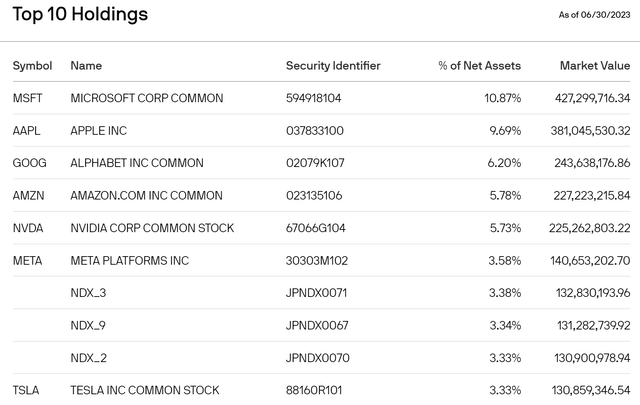

Secondly: Investors should consider that JEPQ invests in securities that approximately match the Nasdaq 100 benchmark. With that frame of reference, the fund’s largest single stock holdings as of late June 30th are all AI-leveraged technology stocks that have enjoyed a breathtaking YTD performance: Microsoft (MSFT) and Apple (AAPL) are both up by approximately ~50% YTD, Meta Platforms (META) has gained ~130% and NVIDIA (NVDA) has more than tripled. In fact, in 2023 so far the Nasdaq 100 has delivered the best 1H since 1983, likely setting up for another mean reversion trade — this time at the expense of JEPQ holders.

JEPQ Prospectus

Conclusion

I have previously assigned a “Buy” recommendation to JPMorgan’s Nasdaq Equity Premium Income ETF, as I thought the fund’s strategy offered investors an attractive risk/reward setup by investing in large-cap blue chip growth stocks and generating income through selling call options. Since the initial “Buy” recommendation, JEPQ has returned approximately 17.5% to investors.

However, I am very hesitant to reiterate a “Buy” recommendation today, as the favorable market conditions that prompted a strong JEPQ performance have mean-reverted: The VIX index has dropped significantly, resulting in lower option premiums; and JEPQ’s largest stock holdings, which are all AI-leveraged technology stocks, have rallied to levels that might not be sustainable.

Overall, I continue to believe that JPMorgan’s equity premium funds such as JEPQ are enormously attractive investment vehicles for retail investors. But the strategy of selling option premium on growth stocks might currently not enjoy the most favorable market conditions. Downgrade to “Hold”.

Read the full article here