Recently there has been a lot of chatter around the economy falling into the recessionary territory. The talks have intensified especially since the FED started to hike interest rates at an unprecedented pace.

The interest rates have gone up massively causing notable concerns around the ability of non-financial corporates to service the existing debts and conduct refinancings. Also, there are serious threats in the consumer segment, where the cost inflation in combination with more expensive credit card debts have introduced headwinds for the overall consumer spending level, which, in turn, could render unfavorable knock-on effects on the corporate profitability.

The classical leading economic indicator purchasing managers’ index (PMI) indicates a clear risk of further pain in the economy.

YCharts

Both manufacturing and services PMI have exhibited negative trend since the beginning of 2022 when the FED decided to assume restrictive monetary policy. While the services PMI is close to the recessionary zone, the manufacturing PMI has already breached the 50 mark and as of now sends a major signal that from the manufacturing perspective we are certainly set to experience a decline in the business activity.

Moreover, considering what the FED communicated in its most recent press conference, the probability of facing incremental rate hikes has sharply risen.

The recalibrated view post-FED conference projects a year-end 2023 FED Funds rate in the 5.5% – 5.75% range, implying an additional 0.5% hike.

As a result of sharp increase in the front-end yields, the 10 – 2 year yield curve has become inverted. Historically, an inverted curve has been a precursor to a recessionary period.

Federal Reserve Bank of St. Louis

While the aforementioned aspects do not bode well for the economy and the prospects of equity markets, the market itself seems to ignore the increasing probability of stagnating business and consumer activity.

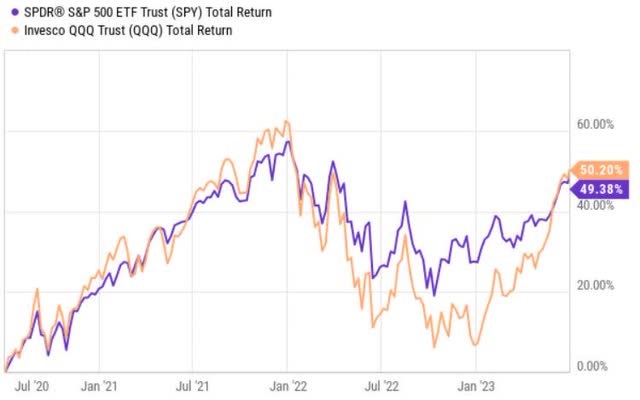

YCharts

Currently, we are seeing a strong convergence among the Nasdaq and S&P 500 towards the peak levels that were registered before the FED’s change in the policy stance.

In other words, despite the looming recession and significantly higher discount rates (which per definition should bring down the valuations), we are still seeing surging equity prices.

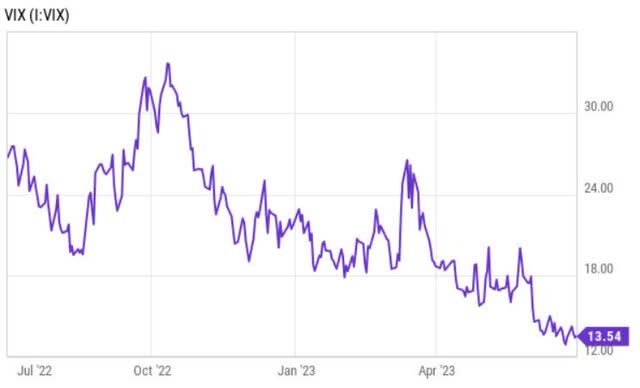

YCharts

Moreover, the VIX, which is a measure of market’s implied volatility, exhibits a strong normalization towards stable and less volatile territory.

The case for JEPQ

Based on the colliding data above, where the market has detached from the underlying fundamentals in the economy, financial market participants are finding themselves in a difficult situation.

On the one hand, it would not prudent to allocate massively in the equity space due to the recessionary risks in the economy, but on the other hand there is a risk of suffering an opportunity cost. Put differently, avoiding exposure to equity factors has proven to be a risky strategy, where such investors have clearly missed the chance to participate in market rallies. Furthermore, if we consider equity market a leading economic indicator, it would also make sense to invest in the equities.

In a nutshell, neither bull or bear scenario seems to be fully justified; and that is why the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) could come into play.

The objective of JEPQ is to deliver solid streams of current income without sacrificing too much of the capital appreciation potential. This is done by via an actively managed (long) portfolio of equity securities with exposure to the Nasdaq-100 Index in combination of short positions in the corresponding equity-linked notes (ELN).

In addition, JEPQ seeks a lower volatility level than the Nasdaq-100 Index, which goes hand in hand with the strategy to sell short ELNs (i.e., covered call strategy).

Since the inception of JEPQ, the fund’s registered beta has been 0.71x, which implies that there are more defensive characteristics embedded within the fund.

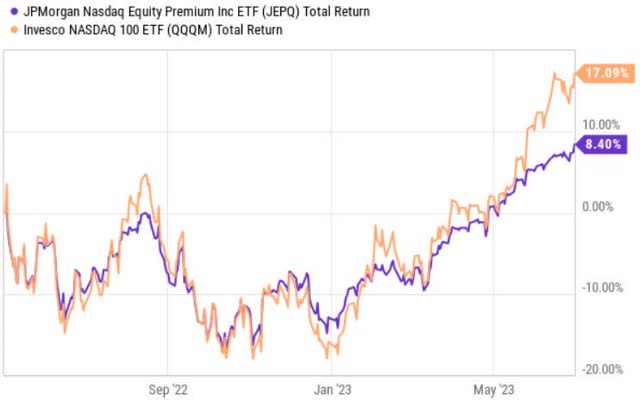

YCharts

At the same time, the benchmark index has outperformed JEPQ by ~9% on a total return basis.

The key reason behind the subpar performance of JEPQ is the notion of the covered call strategy. This strategy per definition introduces a cap on the return potential that can result in a relative underperformance if the underlying index (benchmark) has risen in a manner, which more than offsets the pocketed premium from shorting ELNs (including the pre-stipulated delta between the strike and price of the underlying / index at the inception of short sale). This has been the case where the benchmark has gained a lot, exceeding the combination of ELNs strike and premiums.

An additional factor that has imposed challenges for JEPQ is the decreasing volatility levels (see chart on VIX above) that also renders covered call strategies less profitable due to lower option premiums.

So we have to assume that JEPQ will not be able to deliver superior returns in the case of strongly increasing markets, but that the returns will come in a more balanced fashion.

Given the macro data above and the fact that the market is reaching its peak levels again, I am not that worried about fully participating in a potential price surge.

In my humble opinion, the characteristics of JEPQ should be appreciated from the following angels:

- The current yield of 11.5% provides an attractive opportunity for dividend seeking investors to capture relatively stable and predictable cash flows. There might be a slight decline in the yield level due to decreasing VIX, but if we annualize the recently delivered dividend (distributed during times when the VIX had already reached relatively low levels), the ex-ante yield still lands at juicy ~9.4% level.

- Investors, who are a bit cautious and skeptical about prospects of further rallies in the equity markets, have the luxury to still carry an exposure towards Nasdaq-100 (i.e., market) to mitigate the risk of opportunity cost and at the same time receive enhanced yields if the market goes sideways or even starts to decline.

The bottom line

JEPQ is a perfect instrument for investors, who seek attractive yields, but at the same time wish to participate in equity rallies. It also fits nicely with the investors, who are afraid of exiting market because of the potential opportunity cost, but who are also of the opinion that the odds are stacked against abnormal performance in the equity markets going forward.

Read the full article here