JFrog (NASDAQ:FROG) provides clients with a supply chain software solution. The company has achieved a high amount of organic growth, but as the company continues to generate significantly negative earnings, the stock still seems risky. Although the stock seems very expensive at a quick glance, I believe the valuation is very reasonable when taking a deeper look. As my theses are often based largely on valuation, I have a hold-rating with a DCF model indicating a correctly priced stock.

The Company

JFrog develops a platform that helps companies optimize their systems. The platform has multiple functions to address the need:

The JFrog Platform (jfrog.com)

The company emphasizes DevOps as an integral part of the offering. DevOps is a philosophy and set of tools that helps communication between software developers and IT teams through automation and assistance in collaboration.

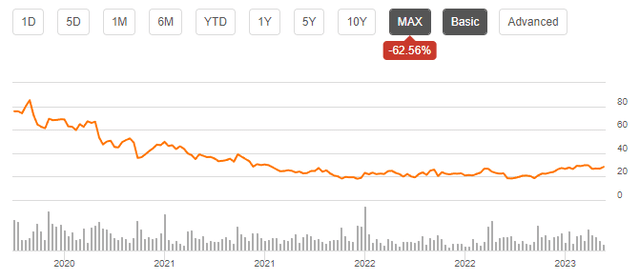

After going public in 2020, JFrog’s stock has seen a large decrease in price:

Stock Chart (Seeking Alpha)

The stock fall has turned into a rise in the recent past – JFrog’s current 1-year return is 44%.

Financials

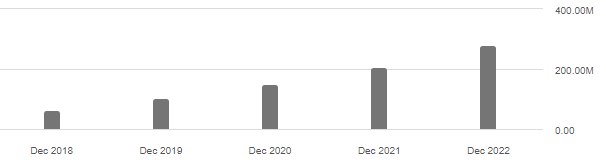

JFrog has achieved significant growth, as the platform developer’s compounded annual growth has been 44.9% from 2018 to 2022:

JFrog’s Revenues (Seeking Alpha)

For the current year, the company guides revenues between $343.5 million and $345.5 million, translating to a growth of 23%. This seems to be in line with what the company expects in the longer term – JFrog has a revenue guidance of $775 million to $825 million for 2027, with the middle point of $800 million representing a CAGR of 23.4% from 2022 to 2027.

The historical CAGR of 44.9% is very slightly boosted by an acquisition made by JFrog in Q3 of 2021 – the company bought out Vdoo for approximately $300 million to integrate its offering into JFrog’s own. Although the acquisition didn’t straight away significantly contribute to JFrog’s revenues, the acquisition expanded the offering creating more room for growth after integration – JFrog communicated in a special call after the acquisition that Vdoo’s revenues have been immaterial as the company’s go-to-market strategy was only ramping up.

JFrog has a huge amount of stock-based compensation, as technology companies often seem to have; with trailing numbers, the company’s SBC stands at $80.7 million, being over a quarter of the company’s revenues. The expense makes JFrog significantly unprofitable – the company has a trailing EBIT margin of -25.2%, meaning a negative EBIT of $79 million. As JFrog does have a very strong gross margin of 77.6%, the company should be able to scale into good profitability with further growth.

Currently JFrog doesn’t hold any interest-bearing debt – as the company’s earnings are quite weak for the time being, debt would pose a risk to the company. On the other hand, JFrog does have $46.7 million in cash and $423 million in short-term investments after Q2 – the company’s balance sheet seems to be very strong.

Valuation

The stock currently trades at a trailing EV/S ratio of 8.11 – as SaaS companies have a great business model for high margins and growth, such companies often have high ratios. The valuation can seem really expensive at first glance, as JFrog currently generates heavy losses. To get a further understanding of the valuation, I constructed a discounted cash flow model.

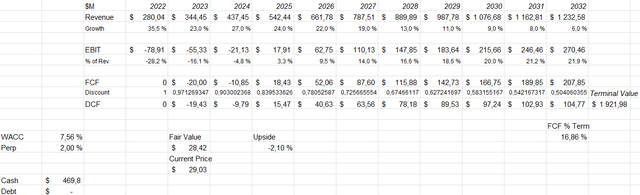

In the model, I expect the company’s financials to mostly follow the company’s guidance. For 2023, I expect a growth of 23.0% in line with the guidance – going forward from 2023, I see that the company could accelerate growth a bit as Vdoo is integrated well and starts to contribute more – for 2024 I expect a growth of 27%. The growth slows down in steps in the model, as I expect JFrog to hit revenues of $787.5 million in 2027, representing the lower side of the company’s guidance for the year. The growth further slows down into a perpetual growth rate of 2% in 2033 and forward.

Another significant factor to consider is the company’s future margins – in the model, I expect JFrog to scale into an EBIT margin of 21.9%. As a SaaS company, I believe this margin is very reasonable to expect as the company matures.

JFrog has a very strong cash flow conversion – from 2018, the company has had positive operating cash flow, and the company’s depreciation seems to be significantly higher than JFrog’s current needs for capital expenditures. The company has also had decreasing net working capital for every year from 2018, adding to the cash flows.

Although the cash flows seem to look good, the most significant factor to the positive cash flows is the large amount of stock-based compensation – I believe SBC is a very real cost as it causes dilution, so I see it as reasonable to count in SBC into cash flows in a DCF model. These assumptions along with a cost of capital of 7.56% craft the following DCF model with an estimated fair value of $28.42, around 2% below the stock’s current price:

DCF Model of JFrog (Author’s Calculation)

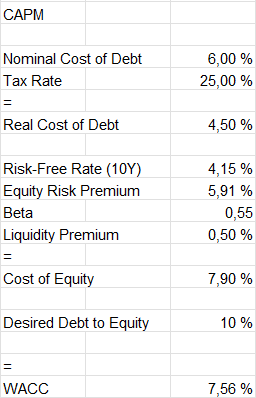

The used cost of capital is derived from a capital asset pricing model:

CAPM of JFrog (Author’s Calculation)

As JFrog currently has no debt, I conservatively expect the company to leverage debt in a very low amount as the company achieves positive earnings – I input a long-term debt-to-equity of 10% with an interest rate of 6%. The interest rate is well above the United States’ bond yields, leaving a margin of safety into the assumption.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.15% as the risk-free rate. The used equity risk premium of 5.91% is Professor Aswath Damodaran’s estimate made in July. As the company has mostly recurring, low-risk revenues and predictable expenses, JFrog has a very low beta of 0.55 according to Tikr. Finally, I add a small liquidity premium of 0.5% into the cost of equity, crafting a cost of equity of 7.90% and a WACC of 7.56%.

Takeaway

I believe the current price reflects JFrog’s long-term prospects correctly. With the Vdoo integration, the company should achieve good growth for the coming years. In my opinion the company’s future operating margin is the most significant factor in determining the stock’s value – currently investors have low visibility into the future margin, which could affect the stock price significantly.

With very low-risk recurring revenues and no interest-bearing debt, the company seems to be a mostly safe pick as JFrog nears profitability. As the DCF model points towards a correctly priced stock, I currently have a hold-rating.

Read the full article here