Summary

Following my coverage of Joby Aviation (NYSE:JOBY), I recommended a buy rating due to the business’s continuous success in executing against its commercial timeline targets (i.e., compliance on track). This post is to provide an update on my thoughts on the business and stock. I reiterate my buy rating for JOBY as compliance and commercialization plans remain on track. Importantly, there is now more visibility into the JOBY revenue generation timeline, giving me more confidence that JOBY is able to achieve its FY26 targets on time.

Investment thesis

With the first aircraft fresh off the assembly line, I have every reason to believe that JOBY is poised for success in the type certification process, which will soon move into a more extensive flight testing campaign. There is much less of a chance of failure now that JOBY has submitted all of its certification plans to the FAA and nearly two-thirds have been accepted. The field trials with the USAF, in my opinion, will yield even more information.

In terms of commercialization timeline, it was music to all investors’ ears when JOBY announced it delivered its first aircraft to Edwards Air Force Base on 25 September 2023. The significance of this early delivery cannot be overstated; the original deadline for the first shipment was set for 2024. Management now anticipates delivering a second aircraft to Edwards in early 2024, which is a significant earlier date than previously anticipated. For context, this shipment is being made as part of JOBY’s AFWERX Agility Prime contract with the United States Air Force, which is worth $131 million. The combined value of Joby’s current and past contracts with the Department of Defense is $163 million. Up to nine planes will be supplied to the US Air Force and other government agencies through the Agility Prime contract. Joby and U.S. Air Force personnel will work together to demonstrate a variety of logistical missions, such as cargo and passenger transportation, using aircraft operated from within the base. Benefiting the entire air taxi industry, NASA will use the planes in conjunction with the U.S. Air Force to study how these planes might integrate into national airspace.

This is a great achievement, and it should put to rest any remaining doubts that some investors may have had about JOBY’s ability to deliver on its promises. More importantly, this information also provides a benchmark against which investors can evaluate JOBY’s future revenue generation potential and timing (i.e., investors can assume with greater certainty that more aircraft will be delivered beginning in FY24).

The earnings call also included a bright spot when management discussed several FAA proposals. Management is anticipating an early pull-forward of previous expectations for widespread eVTOL deployment as a result of the Innovate28 implementation plan. The impact on the profit and loss statement today is nil, but I view this as a very encouraging sign that the underlying discussions with prospects have been fruitful. This is significant because it suggests JOY may meet its long-term goal (FY26 goal) much earlier than expected.

Finally, JOBY has maintained a strong balance sheet up to this point. JOBY has $1.1 billion in cash as of 2Q23 after spending $77 million in cash during the quarter and $164 million during the first half of the year. High cash reserves give JOBY confidence it can spend between $360 million and $380 million in fiscal year 23 (note that the guidance implies a spending increase for the second half of the year). Given the magnitude of the opportunity, it’s encouraging to see that JOBY has received strategic funding that could boost production for an expansion of its DOD contract.

Valuation

Own calculation

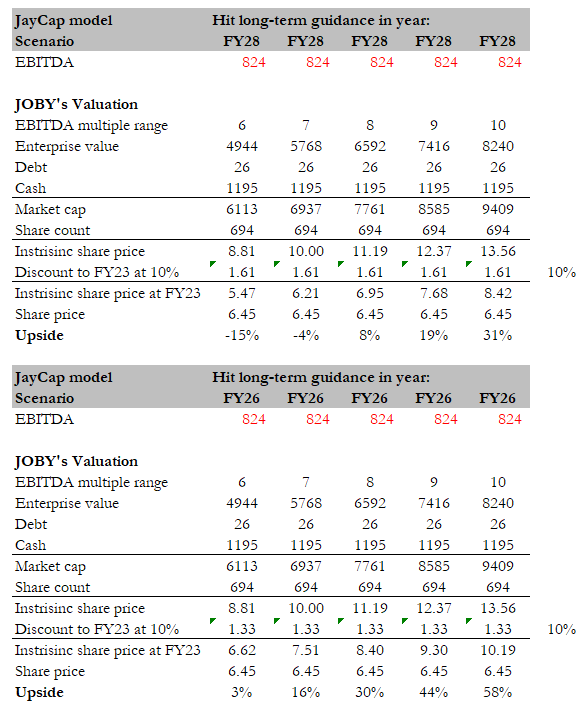

To reiterate my previous model, the primary goal is to demonstrate the range of upside if JOBY can hit management’s guidance in its SPAC presentation. The key assumption I made is that JOBY will only hit its guidance in FY28 (2 years later than the original target of FY26) due to the current macroenvironment.

I assumed JOBY would trade in the range of 6x to 10x EBITDA, based on where Lyft (LYFT) used to trade. The reason for choosing LYFT is because it operates in a similar industry serving similar functions.

However, with the recent updates, I believe there is a good change for JOBY to actually hit the FY26 targets. With this assumption, my price target range has increased from $5.47 to $8.42 initially to $6.62 to $10.19, indicating a new upside range of 3% to 58% (after a discount rate of 10%).

Risk

Travelers’ openness to trying new modes of transportation and the government’s willingness to approve of eVTOL technology are crucial to Joby’s success. They may not be able to progress as quickly as planned if commuters do not view UAM as beneficial or choose not to use it out of safety concerns.

Conclusion

I maintain my buy rating for JOBY as the company continues to execute its compliance and commercialization plans effectively, with improved visibility into its revenue generation timeline. JOBY’s progress in type certification, extensive flight testing, and its successful delivery of aircraft to the Edwards Air Force Base ahead of schedule are promising signs of its capabilities. The early delivery demonstrates JOBY’s commitment to fulfilling its contracts with the United States Air Force and other government agencies, which bodes well for its future revenue prospects. JOBY’s strong balance sheet and strategic funding also provide a solid foundation for expansion and production growth.

Read the full article here