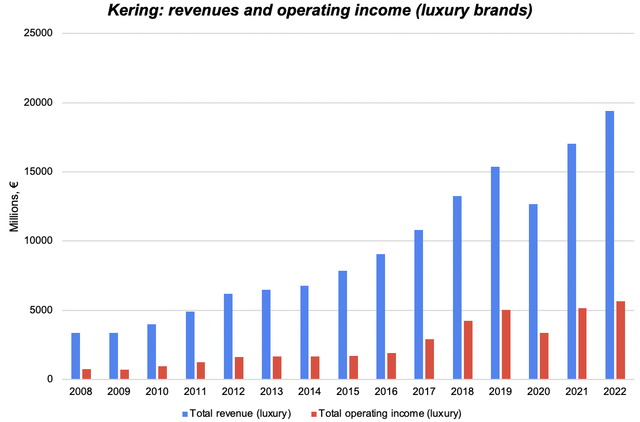

Kering (OTCPK:PPRUF) is a French luxury company known by being the owner of a distinguished group of brands such as Gucci, Yves Saint Laurent or Bottega Venetta, among others. The conglomerate operates in a very resilient sector with lots of tailwinds (growth of the middle class in China and Asia, premiumization of fashion market, luxury as a distinctive element…) that will boost growths in the years to come. The luxury division of the company has grown revenues at 13% annually since 2008, whilst operating income has grown at 15% due to margin expansion. The company has low leverage and is currently trading at a lower valuation than peers such as LVMH or Hermes.

The following article will briefly introduce the company, its main brands and segments and will also perform a simple valuation to help the reader understand whether the company is cheap compared to its terminal value risk and its future growth.

Some introduction

French luxury group Kering operates through 15 brands, although the bulk of the company’s sales and profits are generated mostly by three: Gucci, Saint Laurent and Bottega Veneta. In the 2000s, the group also had stakes in retail businesses such as Fnac or Conforama, from which they gradually divested to focus on the development of the luxury brands they operated. Kering’s long-term goal is to become a diversified luxury holding company that meets long-term customer demands as well as generating shareholder value.

To achieve these objectives, the company intends to optimize the existing brands in its portfolio (make them more efficient in terms of costs) as well as make strategic acquisitions in the orbit of the luxury sector aimed at the upper class and premium middle class.

Gucci

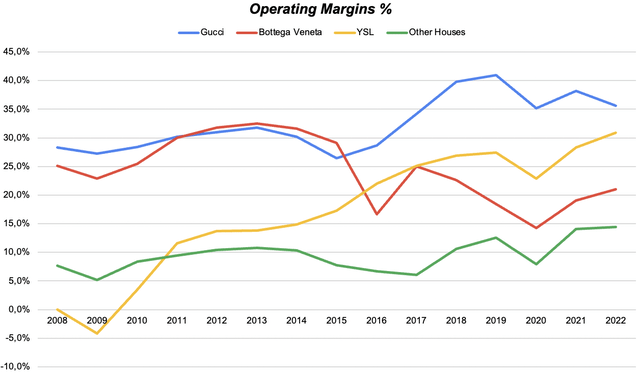

Gucci is the most important brand in terms of sales and operating profit of the group. The last few years have not been particularly good for the brand, with an excessive dependence on China, more than some rivals in the sector such as Louis Vuitton or Hermes. Traditionally the brand has been oriented towards the segment of women’s bags, although currently they also have a presence in other types of accessories which are not exclusive for women. The most premium subsegment (bags) has a high pricing power and less cyclicality than the fashion part. And the latter has less cyclicality than a typical retail business due to the premium audience it targets. The brand has operating margins of 35% in a context of increased investment and restructuring to achieve greater efficiency in the long term. It is somewhat far from the 40% margins of Hermes and LVMH (Leather and Fashion segment) although with the quality of the brand and the focus on customer satisfaction it can opt for these margins in the long term.

Saint Laurent

Yves Saint Laurent is the second most important brand in the group, also focused on premium clothing as well as accessories for men and women. The brand has outperformed Gucci in recent years, with leather and ready-to-wear accessories performing particularly well. YSL’s operating margins are 30%, somewhat lower than Gucci and other luxury brands operating in similar segments. The brand is now focused on continuing executing its elevation strategy with determination. Capex has been up in the last year in order to expand its penetration across key markets in order to ensure brand visibility, customer satisfaction and strong focus on the locals they operate. Part of the capex has also been destined to develop high quality store projects, really important to increase customer satisfaction and the shopping experience.

Bottega Veneta

Bottega is the third most important brand in the group and, like the previous ones, it is focused on developing fashion for a premium segment of the population. Bottega’s evolution in recent years has been far from extraordinary, not only in terms of sales but also in the generation of operating profits for the company. Operating margins are 21%, so there is still room to improve efficiency and long-term profitability metrics. The company has struggled over the past years and needs some adjustments to be made regarding the ultra-high quality positioning of the brand. They are now focusing on brand quality, excellence in distribution and prioritizing strong and lasting relationships with customers. It is important to stress out that the brand’s growth is now focused on a broader base of clients and limited store growth.

Other brands

Within Kering’s portfolio we can find iconic brands such as Balenciaga, Alexander McQueen, Stella McCartney… Even though Balenciaga has been surrounded by some scandals over the last months, this brand is focusing on regaining trust of clients and lost momentum in the market. In the words of the managers of the company:

Balenciaga clearly experienced a challenging quarter on the back of the controversies that impacted the U.S., the Middle East and to a lesser extent, Europe. However, in some of these markets, the brand showed signs of gradual recovery along the quarter, while it enjoyed double-digit growth in Asia.

This segment is really promising inside Kering and is well positioned for long term growth. Operating margins have improved to 15%, revenues have grown at rates of 18% and operating income has grown even faster due to margin expansion. This track record, combined with good execution and focus on customer satisfaction, will have a positive impact on margins and profitability in the years to come.

Long-term strategy

Over the last quarters, Kering has been reporting worse results than peers such as Hermes or LVMH. This has led to poor performance of the stock and has also increased investors’ concerns about the future performance of the French luxury company. The conglomerate is more dependent on key brands and is less diversified than other competitors. This is an undeniable truth. But the long term evolution of the company’s fundamentals is really appealing. The luxury division of Kering (before divestitures from Conforama and Fnac) has increased sales at an annual rate of 13%, whilst operating income has increased at rates close to 15% since the GFC. The company has low leverage and the strength of its cash flows backs the interest obligations that will come in the following years.

Kering’s management team has been focused on increasing profitability metrics of the brands within their portfolio. Over the last years, they have boosted the operating margins of brands such as YSL by improving the efficiency of the Maisons and making the cost structure more optimal. Brands such as Gucci continue to show strong resilience despite the short term headwinds that it has faced. The division of Other Brands, which includes Balenciaga, is also well positioned for long term growth.

I believe that their track record of operational excellence, combined with their focus in the long term, will show to investors that the company has a strong competitive advantage and that will be able to generate value in the years and decades to come.

Financials and valuation

Once we have understood the main brands that make up the group, as well as its long-term strategy, it is important to analyze the evolution of Kering’s financial data from 2008 to the current present. The following chart shows the evolution of sales of all luxury brands (excluding Fnac, Conforama, Puma and other assets, currently the company is only luxury brands) as well as their operating profits.

Kering’s revenues and profits (Own models)

During the GFC, the luxury segment remained stable, while profits slightly decreased due to fixed costs. The company was severely impacted during the pandemic, when sales dropped and operating profit also decreased. At first glance, this may seem negative, but I do believe that this proves the contrary. Namely, the company’s resilience in hard economic environments where profits are maintained even though your main source of revenue (physical stores) was partially closed.

Operating margins of the divisions (Own models)

In addition, I also studied the evolution of margins since 2008 and one can see how extraordinarily brands such as Gucci or YSL have behaved. The focus on operational excellence and customer satisfaction, as well as vertical control of the production and distribution process, achieves higher quality for customers and higher margins for shareholders. Bottega Venetta is the division that has suffered the most, in terms of margins, but it is well positioned for future growth, as we have previously mentioned. Other houses (which include Balenciaga, Alexander McQueen…) have also increased margins and profitability. This clearly proves that the management is focusing on developing all the potential of the brands within the company.

Once we have taken all of these data into consideration, we can make a simple but effective valuation in order to assess whether Kering can be seen as an interesting investment opportunity. The company is not heavily intensive in capital (capex is only used to fund new stores and maintain the existing Maisons), only around 20-25% of the operating cash flow is needed to maintain their existing operations. This, combined with the returns on capital they generate (currently around 20%) can produce annual organic growth rates between 6-8%. The optimization of their brands plus the tailwinds for the luxury sector in the years to come can increase that to 10% growth in profits per year. We see that the growth is there.

The company is currently generating an EPS of €30, whilst its price is in the range of €500. This implies an earnings yield of around 6% with growth rates which will be close to 10% ranges. At these valuation levels, I believe that the market is overreacting to the temporal problems experienced by the company. The resilience of its brands plus the oligopolistic nature of the market protect the terminal value of the company and constitute a moat that not many companies in the world can replicate.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here