Investment thesis

Our current investment thesis is:

- KDP is attractive due to its strong margins, which, despite slipping, are market-leading.

- Growth is good and its investment in growth areas, such as with Nutrabolt, should support outperformance.

- Our concern is that its current valuation does not provide upside for risks around how margins change in the coming 12-24 months.

Company description

Keurig Dr Pepper Inc. (NASDAQ:KDP) is a beverage company that operates globally. The company has four segments: Coffee Systems, Packaged Beverages, Beverage Concentrates, and Latin America Beverages.

Brands include the following (Keurig Dr Pepper)

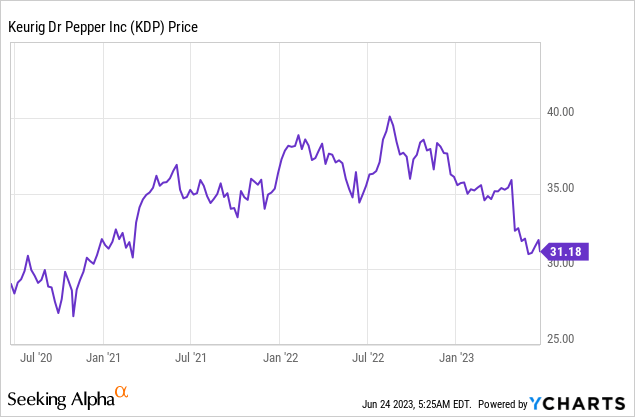

Share price

Since the Keurig Dr Pepper merger, the combined company has returned over 30% to shareholders, alongside consistent shareholder distributions.

Financial analysis

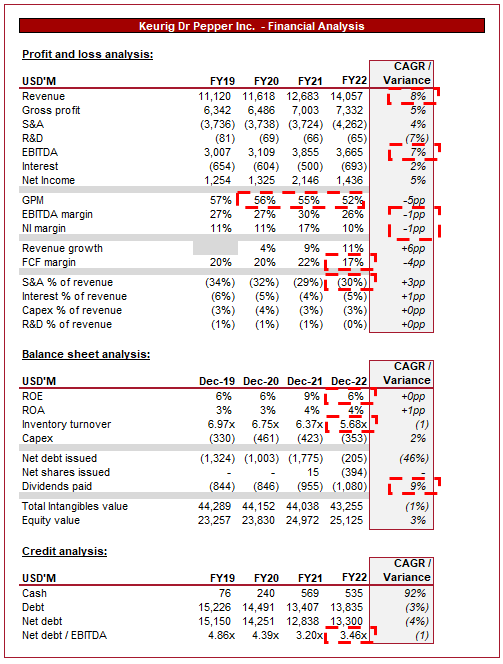

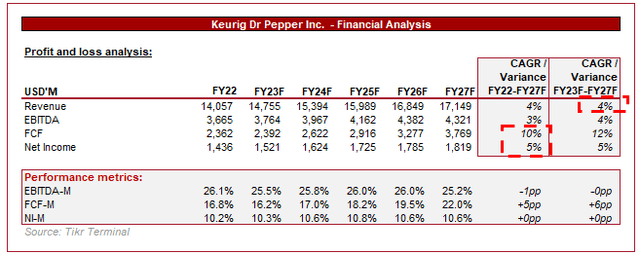

KDP Financials (TIkr Terminal)

Presented above is KDP’s financial performance for the last 4 years.

Revenue

Revenue has grown at an impressive 8% CAGR, a rate in excess of many of its FMCGs peers.

The primary reason for this is the strength of its brands, which are leading in the beverage market. This is best illustrated in the current year, where inflationary pressures are forcing FMCGs to increase their prices in response to supply-chain issues. KDP has been active with the pricing of its products, relying on the brand to keep volume changes to a minimum. This is illustrated below.

Price/vol impact (KDP)

In 3 of its 4 segments, KDP has seen a double-digit increase in net price realization, with a net increase in volume despite this. This reflects what is inherently strong demand in the market, with consumers willing to accept the additional prices without an impact on demand.

Consumers are increasingly interested in healthier beverage options. This trend is driving demand for low-sugar, low-calorie, and natural beverages. To capitalize on this trend, KDP has been launching new products that cater to health-conscious consumers, such as Bai, a line of antioxidant-infused beverages. Further, KDP has recently announced a strategic partnership with Nutrabolt, a health and wellness company. This gives KDP an accelerated expansion in the market, reducing the pressure to build a brand. This looks to be a shrewd decision, as our view is that this is more of a change in consumers’ habits rather than a short-lived trend.

Premiumization is also a trend in the beverage industry, although more so in alcohol, that involves offering high-quality, premium products to consumers who are willing to pay a premium. KDP has been launching premium products, such as its Peet’s Coffee line, to tap into this trend and boost revenue.

Further, consumers are increasingly looking for convenient beverage options at home, likely driven by increased working from home. KDP has been launching new products, such as its K-Mini coffee maker, that are designed to be convenient and easy to use. The K-Mini is currently rated 4.4 on Amazon, with over 15k reviews.

Finally, we really like the diversified nature of its beverage exposure. The business is not reliant on any one segment, such as coffee, which allows for protection against any change in consumer behaviors. When partnered with strategic investments in growth areas, KDP’s long term looks set to be more of the same.

Economic considerations

Economic uncertainty, particularly in the wake of the COVID-19 pandemic, has the potential to impact consumer behavior and spending. With elevated inflation, consumers are seeing their finances squeezed. This encourages cutting back discretionary spending and finding cost-saving measures. A classic example of this is unbranded/generic equivalents, such as supermarket-branded cola. Therefore, we see a risk that consumers are more incentivized to switch, and those who do may not necessarily return.

Margin

KDP’s historical profitability profile is fantastic, although we have seen it slip quite considerably in the most recent year. Given the degree to which prices have increased, the margin deterioration is disappointing. Management has stated that they are unlikely to return to FY19 levels, although some improvement is targeted.

The good news is that the impact is diluted on an EBITDA and NI level, but this usually means an offsetting expense is foregone.

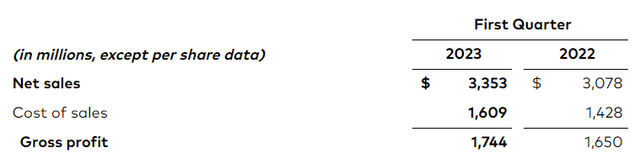

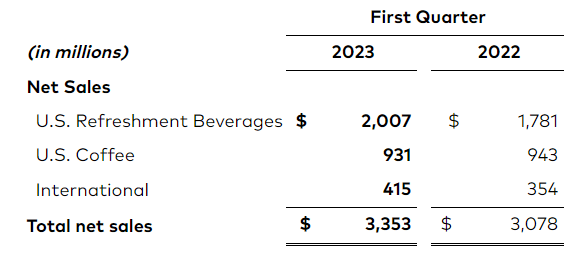

Q1 results

Q1 results (Dr Pepper)

Despite the weakening economic conditions, top-line performance remains strong for KDP. This has been driven by growth across the board, with every segment continuing to benefit from positive pricing action. This being said, the company has noticeably slowed compared to Q4. Further, margins continue to slip, with GPM down for successive quarters.

By segment (Keurig Dr Pepper)

The only concern is that volume performance for the quarter is worse than the LTM. This suggests the elasticity benefits are beginning to diminish.

Balance sheet

Inventory turnover has declined in the most recent year, suggesting demand is slowing relative to Management’s expectations. This is not a serious concern but an unneeded cash drag.

As part of the merger, KDP took on a large amount of debt, with the focus on recent years being a rapid deleveraging process. Currently, KDP’s ND/EBITDA ratio is 3.5x, which in our view is slightly high. 3x is a good level, and anything below this provides flexibility to conduct M&A. Given the level of cash generation, we do not see a concern with debt. It is a matter of time before KDP falls below 3x, at which point Management may switch toward greater distributions to shareholders, triggering positive price action.

Dividends have grown well at a 9% rate, although the absolute payment looks mild relative to the current valuation. With a yield of 2.2%, dividend-seeking investors are likely to find better options among the FMCGs cohort.

Outlook

Wall Street outlook (Tikr Terminal)

Presented above is Wall Street’s consensus forecast for the coming 5 years.

Revenue is expected to grow at a CAGR of 4%, which looks reasonable for a mature FMCGs business. Scope for outperformance stems from exploiting trends and changes in consumer behaviors, which KDP is looking to do.

Interestingly, margin improvement, to any degree, is not forecast. Analysts are skeptical as to Management’s ability to deliver results. This is concerning as we do not see how this can be achieved, especially if pricing power begins to wane.

Peer analysis

In order to assess KDP’s relative attractiveness, we have utilized Seeking Alpha’s factor grades, which compares the company to other Consumer Staples businesses.

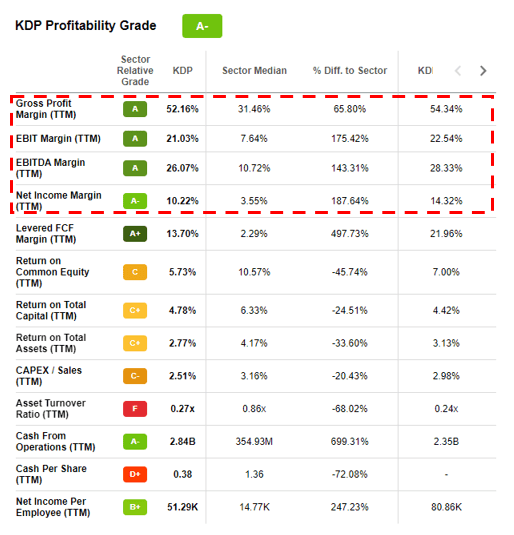

Profitability (Seeking Alpha)

Although the business is struggling with profitability, the company remains a leader in margins. The degree of outperformance is substantial.

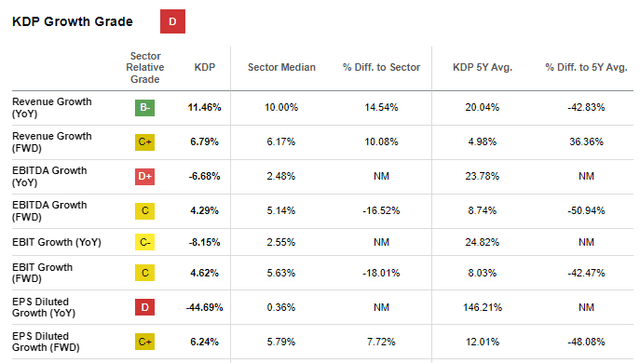

Growth (Seeking Alpha)

KDP has achieved strong growth Y/Y but when compared to others, the achievement looks average. Further, this perfectly reflects that KDP’s growth has come at the expense of margins, whereas this is not the case on average.

Valuation

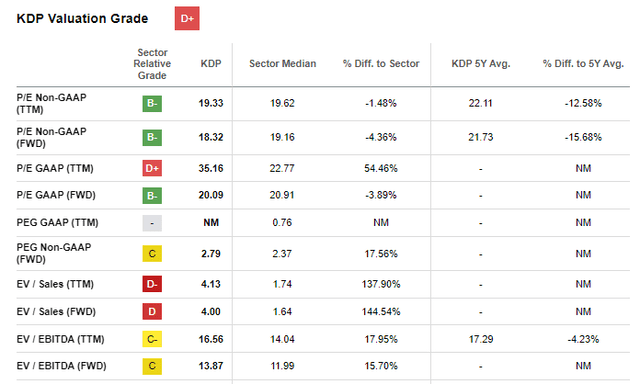

Valuation (Seeking Alpha)

KDP is trading at a premium to the cohort, which is expected given the degree to which margins outperform. In this industry, margins are king.

The question then becomes the degree to which a premium is appropriate. Since Jan20, KDP’s valuation has been relatively steady on an EBITDA basis, giving us a trading range to assess. KDP is currently trading in line with its historical average, which suggests the margin contraction is not being appropriately valued.

Key risks with our thesis

The risks to our current thesis are:

- Upside would quickly materialize if KDP shows the ability to continue pricing action without impacting volume to material degree. This would instill confidence that margin improvement is possible.

- The bear case with KDP is that it is unable to recover margins, which based on the historical trading range would suggest a decline in valuation is warranted.

The key risks to the business are how margins change over the coming 12–24 months. Given the uncertainty and lack of clear outlook from Management, markets will be quick to react based on communications/earnings.

Final thoughts

KDP is a strong FMCGs business which is attractive for its margins. The business is highly profitable when compared to its peers, and growth is not bad either. Continued deleveraging is required, but the end is near, which should trigger consistent buybacks or greater dividends.

The key risk is around margins, which have slipped to a degree not seen in the market. The company’s valuation is at a crossroads based on this. If margins can improve, we see upside. Equally, if margins cannot recover, KDP is slightly overvalued.

Read the full article here