Receive free KKR & Co LP updates

We’ll send you a myFT Daily Digest email rounding up the latest KKR & Co LP news every morning.

KKR is taking Germany’s OHB private in a deal that values the satellite manufacturer at about €1bn including debt, in a sign of growing interest from US private equity groups in the European space sector.

The founding Fuchs family will retain majority control as part of the deal, while KKR will end up with just over a third of the company as a result of the capital raise and take-private offer.

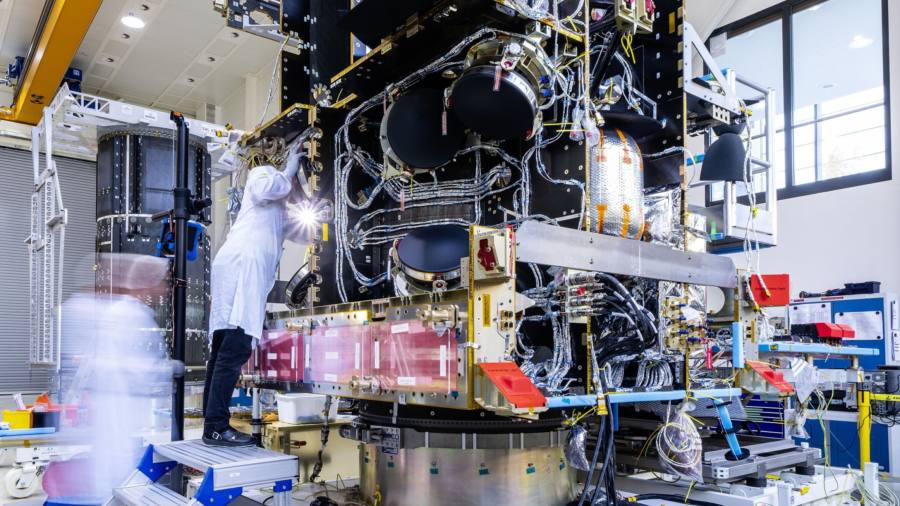

OHB is one of Europe’s most established space hardware companies, providing satellites to the EU’s Galileo navigation constellation, components to the Ariane rocket programme and to the Juice probe exploring Jupiter’s icy moons.

The group said it would receive €77mn in new capital to fund its growth strategy. In March it reported a 9 per cent rise in annual revenues and said 2022 had been its best-ever year.

KKR is offering to buy all shares not owned by the Fuchs family at €44 each, a premium of more than a third on their closing price on Friday. The Fuchs family will not sell any shares and will hold 63.4 per cent when the deal is complete.

The US private equity group will also invest €30mn through a convertible loan in Rocket Factory Augsburg, majority owned by OHB, which is racing to develop a micro-launcher to tap into a booming satellite launch market. However, with Elon Musk’s jumbo rocket Starship nearing completion, questions are emerging over whether too many rocket companies are chasing a limited market in the medium term.

The deal comes as the global space sector continues to struggle to attract investor interest after a dire 2022, when investment tumbled 58 per cent from a record high.

The sector was briefly buoyed by Advent International’s $6.4bn leveraged buyout of US satellite operator Maxar Technologies announced in December. But Space Capital’s quarterly investment index published last month showed that, excluding that deal, the second quarter of 2023 “was the lowest quarter for private market investment in the space economy since 2015 due to a lack of large late-stage rounds”.

However, many US companies are looking to Europe’s rapidly growing space sector for potential targets, according to space industry analysts at the Financial Times Investing in Space summit last June.

KKR’s interest could be a catalyst for further deals. KKR is investing in OHB through its latest European buyout fund that raised $8bn this year. The group has a long history backing German companies, having made its first investment in the country in 1999.

Other deals struck by KKR include the acquisition of German defence company Hensoldt, which it carved out of Airbus in 2017 before taking the business public again in 2020.

Read the full article here