I have covered Kratos (NASDAQ:KTOS) in the past. The last time I covered the stock it was to discuss the cooperation with Boom to build the Symphony engine that should power the supersonic business-focused jet. For Kratos, I believe this gives the company some funded research opportunity that they could potentially leverage for other applications if it is not for the Boom supersonic jet because frankly the business concept for Boom is one that is continuously changing, and I believe it does not fit within the needs for the air travel industry for the years to come. In this report, I will be looking deeper at Kratos as a business to assess whether this is a company that is a buy, sell or hold.

Kratos Financial Results Improve

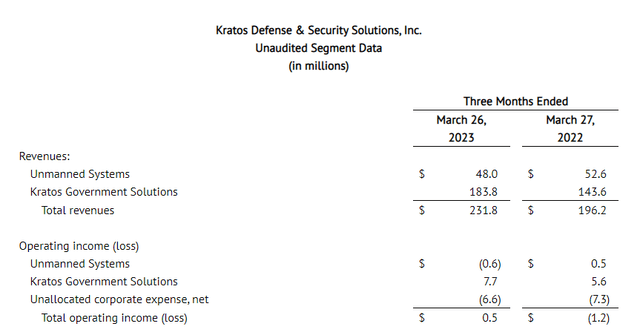

Kratos Defense & Security

The first quarter results improved by 18.1%. $12 million was driven by the acquisition of the Engineering Division of the Southern Research Institute. Unmanned systems revenues declined by nearly 9% reflecting lower tactical drone activities leading to a $0.6 million loss for the segment driven by lower volume and less favorable mix. Government Solutions revenues grew by around $40 million of which $12 million was inorganic growth. The remaining $28 million was driven by strength in Space, Satellite and Cyber, Turbine Technologies, C5ISR and Microwave Products while Training Solutions revenues declined by $2.2 million. Adjusted EBITDA improved from $13.8 million to $17 million.

Growth Drivers For Kratos

Mark

Kratos Defense & Security

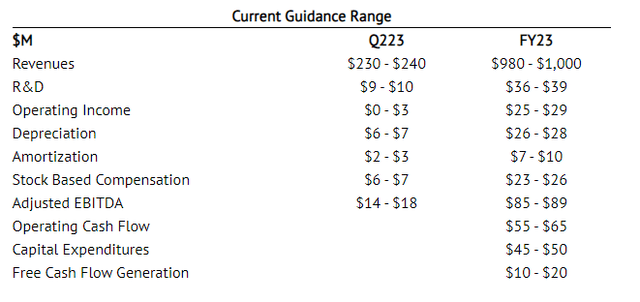

For the second quarter, Kratos expects revenues in line with the first quarter and operating income and adjusted EBITDA to be close to the first quarter figures as well, which points at results being backloaded. What I could appreciate about the Kratos presentation is the color they provided on growth drivers. This year the drivers will be the Ground Based Strategic Deterrent or Sentinel, aerial targets, the B-52 re-engine program and the Satellite Communication Augmentation Resource program.

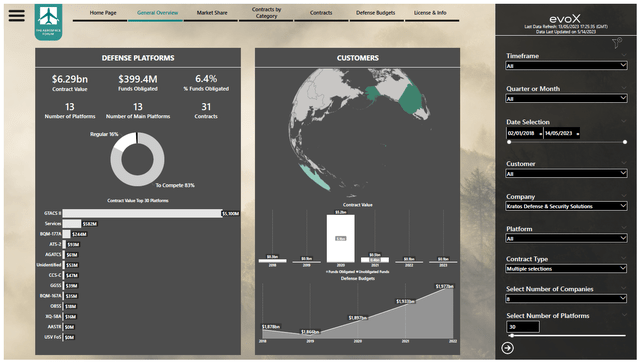

evoX Data Analytics

Into next year the growth drivers are expected to be the Integrated Air and Missile Defense Battle Command System or IBCS. That is a Northrop Grumman (NOC) program just like the Sentinel where Kratos is a subcontractor. Furthermore, in the fields of hypersonics with the MACH-TB hypersonic test capability and the Mayhem program.

Our evoX Defense Contracts Monitor shows $6.3 billion in contracts obtained by Kratos over the past years. Not included are multiple award contracts where multiple awardees can compete for orders but this is an area where Kratos, with history as an indicator, thinks it can be one of the beneficiaries out of multiple awardees.

Conclusion: A Buy Despite Stretched Valuations?

Looking at Kratos, I can see why analysts have a buy rating. Its hypersonics involvement as well as drones portfolio including aerial target drones are in demand. Further into the future, Kratos could benefit from pairing drones with the fighter jets such as the F-35 and at some point the next generation fighter. When looking at the company’s attractive business areas I was thinking this would be a no-brainer to buy. The opposite is true. I ran the numbers and even with the coming three years in mind Kratos is significantly overvalued compared to peers. Taking a 15x EV/EBITDA as acceptable, Kratos hits almost 50x and I am not certain whether those stretched multiples are justified. I am not trying to make a case against Kratos because if these multiples are indeed justified then upside to the stock could be >150% but I think the reality is that the company is valued richly. A bit too much for my taste, but perhaps I am missing something here and the rich valuation has a proper justification. I’ll leave it up to you to decide whether you consider the company a buy even on stretched valuations. If you do, you will love my model which shows 91% upside for 2023 based on the high multiple.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

Read the full article here