September 8th proved to be a rather interesting day for shareholders of both Albertsons Companies (NYSE:ACI) and The Kroger Co (NYSE:KR). Both companies made known that they have elected to divest of over 400 stores, as well as other related assets, in an attempt to appease regulators and get their merger approved. In addition to this bullish development, the management team at Kroger announced financial results covering the second quarter of the company’s 2023 fiscal year. Even though revenue and earnings failed to meet expectations, adjusted earnings exceeded forecasts and revenue, excluding fuel, managed to rise year over year. Management also reaffirmed guidance for 2023. On the whole, I view these as positive developments and investors should take both companies very seriously moving forward.

A look at Kroger’s earnings

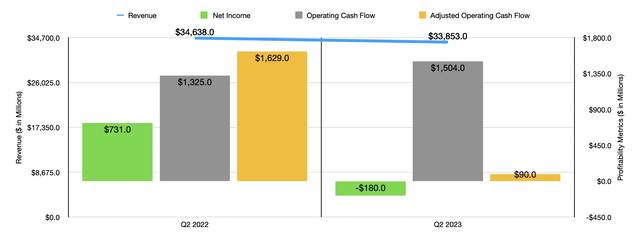

Before we get into the more exciting news regarding the merger between the two companies, I would like to touch on the financial results that Kroger reported for the second quarter of its 2023 fiscal year. Overall sales for the quarter came in at $33.85 billion. At first glance, this looks rather bad. I say this because, in addition to coming in 2.3% lower than the $34.64 billion management reported for the second quarter of 2022, sales also were $266.3 million lower than what analysts forecasted.

Author – SEC EDGAR Data

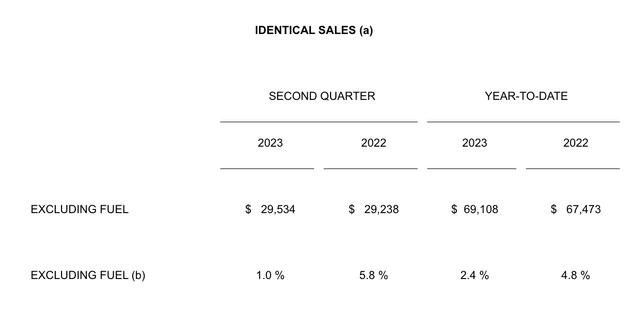

This drop in sales is not as bad as it appears, however. I say this because, if we use management’s definition of ‘identical sales’, which excludes fuel costs and utilizes identical supermarket locations and other operations from one year to the next, revenue would have risen by 1% from $29.24 billion to $29.53 billion. This would have been even better had it not been for a reduction in pharmacy sales that the business experienced because of management’s decision to terminate an agreement with Express Scripts. If not for that, identical sales would have risen 2.6% year over year.

The Kroger Co

On the bottom line, earnings were somewhat mixed. Earnings per share technically came in at negative $0.25. That is significantly worse than the $1 per share generated at the same time last year. In addition, it also means that management missed forecasts to the tune of $1.15. The earnings per share reported by the company translated to a net loss of $180 million. That compares to the $731 million profit reported at the same time last year. There were a couple of items that were responsible for this shortcoming.

The most significant, by far, was a massive charge the company booked, totaling $1.4 billion, or $1.54, related to an opioid settlement. This settlement, which is in principle only and has yet to be finalized, was also announced on September 8th and it will involve Kroger paying, over the next 11 years, $1.2 billion to various States and subdivisions, as well as $36 million to Native American tribes. In addition to this, over the next six years, the company will be paying $177 million to cover attorney’s fees and expenses. The good news is that, on a post-tax basis, the net present value of this charge is a more modest $870 million. On an adjusted basis, the company actually reported $0.96 per share in profits. That’s up from the $0.90 per share reported one year earlier and it exceeded analysts’ forecasts by $0.05 per share. While net earnings were down year over year, operating cash flow managed to rise, climbing from $1.33 billion to $1.50 billion. But if we were to adjust for changes in working capital, we would get a decline from $1.63 billion to only $90 million.

The Kroger Co

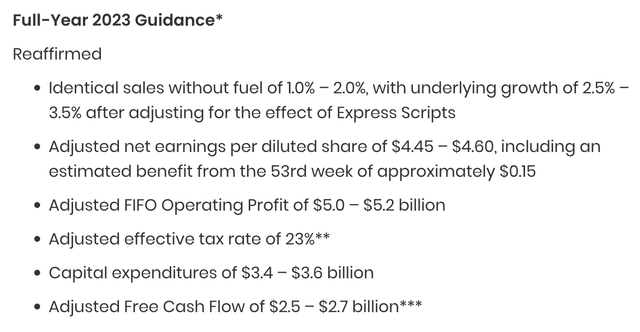

Despite some of these troubles, management did reaffirm guidance for the 2023 fiscal year. They currently anticipate identical sales climbing by between 1% and 2% if we exclude fuel costs. Underlying growth should be between 2.5% and 3.5%. That is a scenario where we exclude the aforementioned Express Scripts issue. Adjusted earnings per share should come in somewhere between $4.45 and $4.60. And adjusted operating cash flow should be between $5.9 billion and $6.3 billion.

Big merger news and a great opportunity

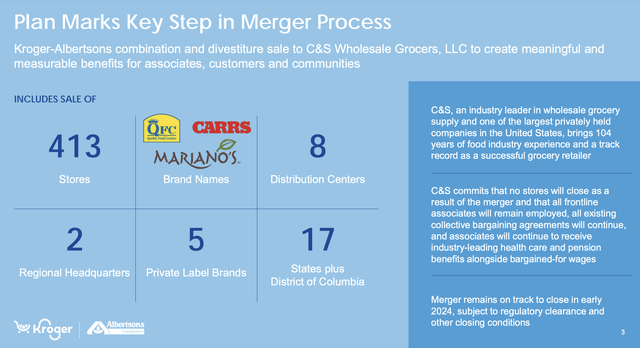

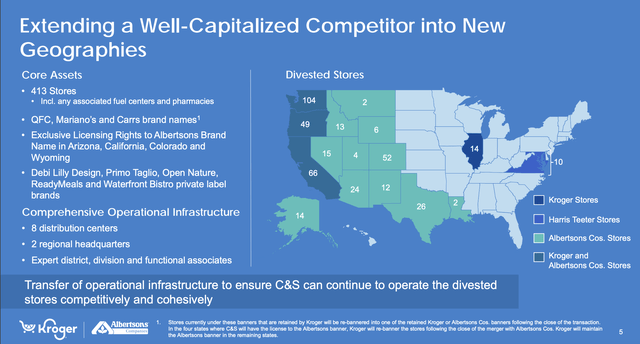

In addition to announcing financial results for the most recent quarter and revealing the opioid settlement, the management teams at both companies revealed that they had reached an agreement to sell off a significant amount of assets in order to get the merger approved. The buyer in question is C&S Wholesale Grocers and the purchase price is $1.9 billion. In exchange for this sum, C&S Wholesale Grocers will be acquiring 413 stores, eight distribution centers, and two regional headquarters, all spread across 17 States and Washington, DC.

The Kroger Co

Most of the stores in question are on the West Coast. But significant numbers are located in Texas, Arizona, and Nevada. The purchase will also include five private label brands and, in the event that additional sales are required by regulators in order for the deal between Kroger and Albertsons to go through, C&S Wholesale Grocers has agreed to purchase up to another 237 stores at some undisclosed sum. Very likely, however, it would be a number at or above $1 billion based on the current agreement for the 413 stores.

The Kroger Co

Even though this is a rather significant asset sale, Kroger remains adamant that the benefits of the merger between it and Albertsons are still there. For instance, they are still forecasting at least $1 billion in annual run rate synergies, net of the aforementioned divestiture, to occur within four years after the close of the merger. An estimated 50% of these synergies should be captured within the first two years after the merger takes place. And thanks in part to the aforementioned divestiture, the combined company remains on track to achieve a net leverage ratio of 2.5 or lower within the first 18 to 24 months following the completion of the deal.

Truthfully, I believe that all of these developments make very likely the probability that the merger will go through. Management seems optimistic as well because, in the presentation announcing the asset sale, the companies said that a previously contemplated spinoff of assets into a separate entity is now no longer being pursued, likely because there is no need for it thanks to this sale.

Takeaway

All things considered, I view the pending merger between these two companies as incredibly attractive. The original buyout price for Albertsons was $34.10 per share. In January of this year, shareholders of the company were granted a special dividend of $6.85. That reduced the effect of buyout price to $27.25 per share. As of this writing, shares of the company are at $23.63. This implies a fantastic spread of 15.3%. Had anybody gotten into the deal when I last wrote about the merger of prospects in April of this year, upside would have been greater. At that time, I rated Kroger a ‘buy’ and Albertsons a ‘strong buy’. Shares of the latter are up 14.7% at a time when the S&P 500 is up only 8.8%. But there is no use crying over spilled milk. Given how attractive this existing spread is and the fact that Kroger still sees the merger being completed by early next year, I’m reiterating these ratings and I am also considering putting a chunk of my capital into Albertsons stock.

Read the full article here