At a Glance

Kymera Therapeutics (NASDAQ:KYMR), in its latest phase, navigates a landscape rife with both clinical promise and financial uncertainties. The company’s flagship asset, KT-474, shows remarkable potential in treating inflammatory diseases like Hidradenitis Suppurativa [HS] and Atopic Dermatitis [AD], courtesy of its novel mechanism of action involving targeted protein degradation. This scientific merit, demonstrated in Phase I trials, places Kymera at a potentially transformative juncture in the treatment of these conditions. However, this clinical optimism is counterbalanced by financial challenges highlighted in their latest earnings report, showing a dip in collaboration revenue and an uptick in operating expenses. The juxtaposition of a robust cash position and a high short interest rate paints a complex picture for investors. As Kymera progresses towards Phase II trials, the focus on its ability to maintain financial stability while capitalizing on its clinical advancements becomes paramount. This introduction sets the stage for a deeper dive into Kymera’s clinical and financial health, suggesting a cautious yet hopeful outlook.

Q3 Earnings

To begin my analysis, looking at Kymera Therapeutics most recent earnings report, the company exhibited a YOY decrease in collaboration revenue, down from $9.55M in Q3 2022 to $4.73M in Q3 2023. This decline is notable, especially given the relatively steady nine-month revenue ($30.71M in 2023 vs. $30.69M in 2022). Operating expenses rose significantly, with research and development costs increasing from $43.88M to $48.12M and general/administrative expenses jumping from $10.56M to $14.12M. This escalation in expenses led to a larger operating loss of $57.51M in Q3 2023 compared to $44.88M in Q3 2022. The net loss also widened, from $43M to $52.87M YOY. Share dilution is evident, with an increase in weighted average common stock outstanding from approximately 54.54M shares in 2022 to 58.42M shares in 2023.

Financial Health

Turning to Kymera Therapeutics’ balance sheet, the aggregation of ‘cash and cash equivalents’, ‘marketable securities’, and ‘investments’ reveals a total liquid asset position of approximately $434.8M ($81.1M in cash and equivalents and $353.7M in marketable securities). Comparing this to the total current liabilities of $63.2M, the current ratio is approximately 6.88, indicating a strong short-term financial health. When assessing total assets ($552.4M) against total liabilities ($156.8M), the asset-to-liability ratio is roughly 3.52, suggesting a solid overall financial position.

The company’s net cash used in operating activities over the past nine months is $110.9M. This translates to an average monthly cash burn of about $12.3M. Given this burn rate, Kymera’s cash runway, calculated by dividing its liquid assets ($434.8M) by its monthly burn rate, is approximately 35 months. However, it’s crucial to note that these values and estimates are based on past data and may not reflect future performance.

Considering Kymera’s substantial cash reserves and current burn rate, the likelihood of requiring additional financing in the next twelve months appears low. This is under the assumption that there are no significant changes in their operational expenses or unforeseen financial commitments.

Market Sentiment

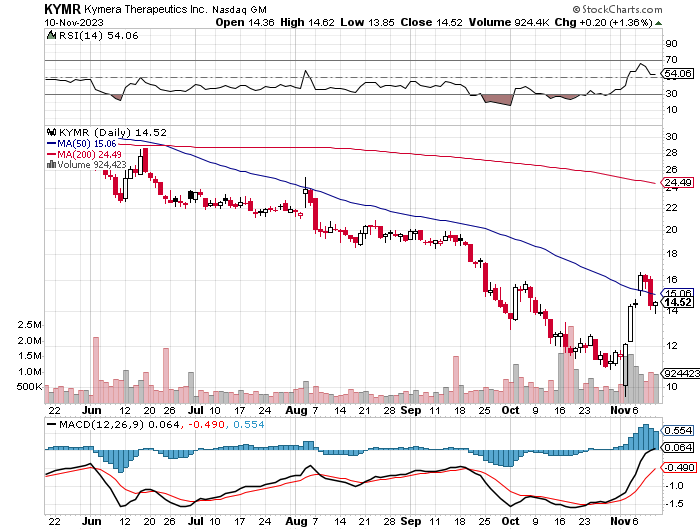

According to Seeking Alpha data, Kymera Therapeutics has a market capitalization of approximately $898.16 million. This valuation, in my view, reflects investor caution, considering the company’s cash reserves and innovative drug pipeline. The growth prospects seem mixed; a projected revenue increase in 2023 is followed by a forecasted drop in 2024, typical of early-stage biotechs dependent on collaboration revenue. In terms of stock momentum, KYMR has underperformed compared to the SP500, with a significant decline over various timeframes, which may signal investor skepticism about the company’s near-term prospects.

StockCharts.com

Short interest in KYMR is notably high at 21.02% with 7.32 million shares short, suggesting a significant bearish sentiment among investors. This could indicate skepticism about the company’s future performance or a reaction to its financial metrics.

Institutional ownership dynamics show an interesting picture: 69 holders have increased their positions, totaling 5,101,712 shares, while 51 holders decreased positions, shedding 2,937,507 shares. Notable institutional holders include Atlas Venture Life Science Advisors, Price T Rowe Associates, and Wellington Management Group, with Atlas and Price T Rowe showing stability in their holdings, while Wellington increased its stake.

Insider trading activity over the past 12 months reveals a net selling trend, with 1,020,818 shares sold against 579,002 bought. However, the recent 3 months have seen a reversal, with 414,105 shares acquired and none sold, possibly indicating growing insider confidence in the company’s future.

Kymera Therapeutics’ KT-474: A Paradigm Shift in Inflammatory Disease Management

Kymera Therapeutics’ lead drug, KT-474, is an orally administered molecule designed to target and degrade IRAK4 (Interleukin-1 Receptor-Associated Kinase 4). The drug’s mechanism of action (MOA) rationale is grounded in the role of IRAK4 in the immune response pathway.

Mechanism of Action (MOA) Rationale

-

IRAK4 as a Key Signaling Node: IRAK4 is a key signaling kinase in the Toll-like receptor [TLR] and interleukin-1 receptor (IL-1R) signaling pathways. These pathways are essential for innate immunity and inflammation. Upon activation, IRAK4 phosphorylates downstream IRAK1, leading to the activation of transcription factors such as NF-κB and the production of pro-inflammatory cytokines.

-

Role in Inflammatory Diseases: Given its central role in inflammation, IRAK4 is implicated in the pathogenesis of various inflammatory diseases, including HS. HS is characterized by the recurrent formation of painful abscesses and nodules in skin folds. Excessive activation of the TLR and IL-1R pathways can lead to the hyperproduction of inflammatory cytokines, which are thought to play a pivotal role in HS.

- Advantages Over Inhibitors: Traditional kinase inhibitors, exemplified by Pfizer’s (PFE) now-halted IRAK4 asset, often struggle with partial blocking of the kinase’s active site, leading to demands for high doses. Kymera’s KT-474 diverges from this path. By degrading IRAK4, it may offer more complete and enduring inflammatory pathway suppression. This distinction becomes critical in light of Pfizer’s decision, underscoring the potential relevance and superiority of Kymera’s degrading approach over traditional inhibition.

-

Potential for Oral Administration: The oral bioavailability of KT-474 is a significant advantage, potentially offering a convenient route of administration for patients with HS, which is important for chronic conditions requiring long-term treatment.

-

Commercial Partnership and Confidence: The milestone payments and partnership with Sanofi (SNY) reflect confidence in the drug’s potential and the commercial strategy in place for the development and future marketing of KT-474.

Phase I Insights: Groundwork for Phase II

The Phase I study’s design was robust, involving a 28-day dosing regimen followed by a two-week observation period. The selected 75 mg daily dose in the fed state was informed by pharmacokinetic [PK] parallels to healthy volunteers from the multiple ascending dose cohort, ensuring comparable systemic exposure. The study enrolled a diverse group of 21 patients, aged between 31-40 years, straddling a spectrum of disease severity, from moderate to very severe for HS, and mild to severe for atopic dermatitis (AD).

The pharmacodynamics data was particularly telling, showing a substantial knockdown of IRAK4 in both blood and skin, with the extent of degradation surpassing 90%. This effect was consistent across HS and AD patients, pointing to the drug’s broad applicability. Furthermore, KT-474 displayed potent inhibition of several disease-relevant cytokines, with up to 84% reduction in HS cases. Notably, reductions in circulating cytokines and acute phase reactants like IL-6 and CRP underscored the drug’s potential to quell systemic inflammation.

Clinical Efficacy: A Beacon for HS and AD Patients

Clinically, KT-474 showcased a noteworthy response in AD, with up to 71% of patients experiencing relief from pruritus, and a mean reduction in the Eczema Area and Severity Index [EASI] score of 37%. The HS patient group also saw significant clinical improvements, with 50% of moderate to severe cases achieving a 50% or greater Hidradenitis Suppurativa Clinical Response (HiSCR), and a 60% responder rate for pain reduction.

Safety: A Cornerstone of KT-474’s Profile

KT-474 exhibited a favorable tolerance profile, a key consideration for long-term therapies. The absence of serious adverse events is noteworthy, with only minor events like headaches and fatigue, which resolved independently. Notably, the transient QTcF prolongation, which resolved spontaneously, alleviates some cardiac safety concerns. Nonetheless, given the chronic nature of conditions like HS, the long-term safety of KT-474 warrants further evaluation.

The Path Forward Amidst Risks

As KT-474 enters Phase II trials, Kymera’s scientific acumen is on full display. Yet, the path to commercialization is strewn with potential obstacles. The competition in the biopharmaceutical sector is fierce, with numerous companies vying to innovate in the inflammatory disease space. The unique challenges of drug development—from patient enrollment to regulatory navigation—persist. Moreover, the reliance on partnerships and funding milestones adds a layer of financial complexity and vulnerability.

Despite these challenges, KT-474’s Phase I data lays a foundation of optimism. The drug’s efficacy in reducing key biomarkers and improving clinical outcomes for both HS and AD patients positions it as a potentially transformative therapy. As Kymera continues to harness the power of protein degradation, KT-474 stands as a testament to the company’s potential to redefine treatment paradigms in inflammatory diseases.

My Analysis & Recommendation

In assessing Kymera Therapeutics’ investment outlook, the company stands at a pivotal crossroad, marked by promising clinical developments and financial uncertainties. Kymera’s flagship asset, KT-474, displays significant potential in the inflammatory disease arena. Its Phase I successes in treating HS and AD, coupled with its innovative mechanism via targeted protein degradation, distinguish it within a competitive biopharmaceutical landscape. This scientific promise, however, is tempered by fiscal challenges, as evidenced by Kymera’s varied revenues, increased operating expenses, and a high short interest.

Financially, Kymera maintains a robust position with a strong current ratio and ample cash reserves, offering a cushion against immediate liquidity risks. The company’s 35-month cash runway, assuming stable burn rates, grants it a degree of operational flexibility. However, investors should remain vigilant about Kymera’s future financing needs, especially as it gears up for costly Phase II trials.

Market dynamics paint a mixed sentiment. Institutional ownership trends and recent insider buying signal cautious optimism, but the high short interest reflects prevailing investor skepticism. This skepticism is likely fueled by the inherent risks associated with early-stage biotechs, including clinical trial uncertainties and regulatory hurdles.

Investors should closely monitor Kymera’s progress in Phase II trials, keeping an eye on patient enrollment, trial outcomes, and regulatory developments. Additionally, staying attuned to the company’s financial health and market dynamics is crucial. An effective investment strategy would involve a balanced approach, leveraging Kymera’s potential upside while hedging against the risks intrinsic to early-stage biotech ventures.

In evaluating Kymera, I assign a cautious confidence score of 40/100, recommending a “Hold” stance. My analysis tilts bearish, considering the intensely competitive anti-inflammatory market and the challenges inherent in developing drugs for conditions such as HS and AD. While Pfizer’s unsuccessful attempt with their IRAK4 asset in HS is not directly comparable, it does inject a note of caution. Investors are advised to maintain a vigilant, data-driven approach, especially in light of forthcoming clinical trial results.

Read the full article here