Introduction

By now, it’s no hidden secret that I have been bullish on defense stocks for a long time. 23% of my dividend growth portfolio consists of aerospace & defense stocks, which underlines my confidence in my strategy.

That said, recently, defense stocks have, once again, started to gain downside momentum, as debt ceiling talks in Washington are scaring investors out of investments that rely on government funding.

One of the stocks that suffered from this is L3Harris Technologies (NYSE:LHX), one of my all-time favorite defense stocks. This stock has been struggling for a while, which is why I wrote an article titled L3Harris Dividends – The Perfect Mix Between Growth And Value in early April.

Now, the stock is back to where it was back then. Only this time, it has reported 1Q23 earnings, which confirm my expectations and show the market that the company is, indeed, significantly undervalued.

In this article, we’ll discuss all of this and much more.

So, let’s get to it!

What Makes LHX A Powerful Dividend Stock

With a market cap of $37.6 billion, L3Harris is one of the world’s largest defense contractors. Founded in 2019 as a result of the merger between L3 and Harris, the company is one of four defense holdings in my portfolio.

While there is no reason why anyone absolutely needs to own four defense stocks, I believe that LHX is in a somewhat unique position. One of the reasons why I wanted to own LHX so badly is its place in the defense supply chain. While it does produce its own end-products, it is a key supplier to all major defense contractors in the West.

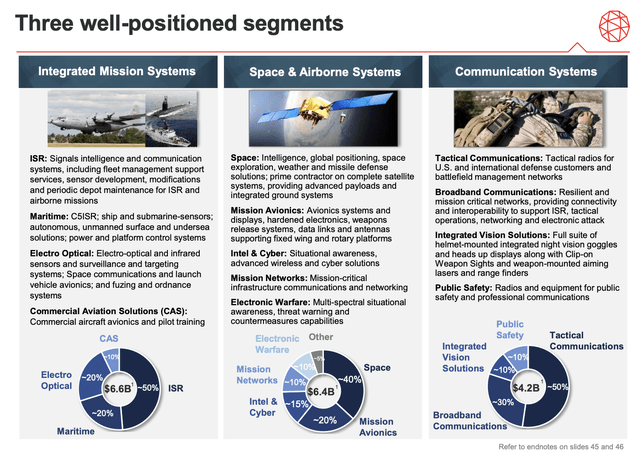

Unlike Lockheed Martin (LMT), which is highly dependent on the F-35 program, LHX is extremely well diversified, as it essentially covers countless end-markets in the three business segments that are shown below.

L3Harris Technologies

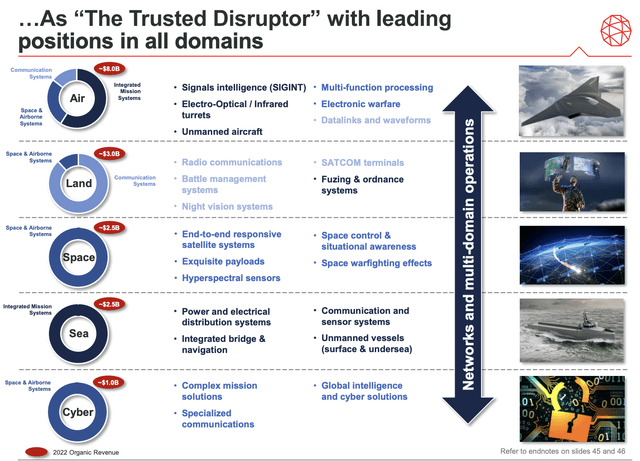

The company has products and services in all domains, including air, land, space, sea, and cyber. This also puts the company in a terrific position to exploit multi-domain services and operations, which combine all of these domains.

L3Harris Technologies

Not only that but according to the company, it is the most efficient player when it comes to turning earnings into free cash flow. This year, the company is expected to have an FCF conversion rate (adjusted for R&D-related taxes) of 105%, which beats the average of its four biggest peers by 12.5 points.

Furthermore, the company has 99% of its pensions funded.

Speaking of cash, the company has clear priorities. Roughly 55% of its cash is expected to be spent on dividends and share repurchases through 2025. The remaining part is expected to go toward debt-financed acquisitions.

One major pending acquisition is Aerojet Rocketdyne (AJRD), the producer of rocket engines, which would expand LHX’s exposure to long-cycle programs, enhancing L3Harris earnings visibility and diversifying its program portfolio. Additionally, the acquisition would contribute to the company’s reputation as a long-standing merchant supplier.

The deal, which was valued at just 12x 2024E EBITDA, should not come with major issues, as LHX and AJRD are not competitors. Both supply the same contractors, which does not indicate a shift in strategic advantages for any of AJRD’s major customers.

According to LHX:

On March 15, L3Harris received a request for additional information from the Federal Trade Commission as part of the regulatory review process. The request extends the waiting period until after L3Harris and AJRD have substantially complied with the request. L3Harris does not compete with AJRD, and therefore the pending acquisition does not change the competitive landscape for missiles and space.

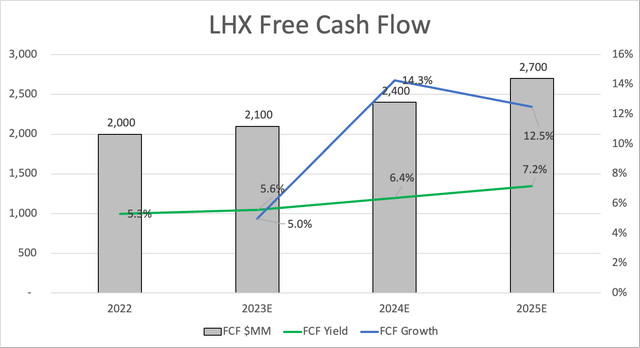

With that in mind, LHX is a cash cow. A fast-growing cash cow, to be precise. The company is expected to generate close to $2.1 billion in free cash flow this year, which indicates a 5% growth rate versus 2022. In the next two years, free cash flow growth is expected to grow by double digits, resulting in a free cash flow yield exceeding 7% in 2025.

Leo Nelissen

While I am writing this, LHX has a dividend yield of 2.3%. This means that using 2023 numbers, the company has a cash payout ratio of 41%.

Despite its free cash flow outlook, the company is not expected to significantly boost its dividend. In February, it hiked its dividend by just 1.8%. In February 2022, the company hiked by 9.8%.

Essentially, the company has refrained from aggressively hiking its dividend to allow for faster post-acquisition debt reduction if it gets approval to buy AJRD.

While it’s hard to estimate when dividend growth will accelerate again, the company is currently sitting on a very healthy balance sheet with a net debt ratio of just 2.4x EBITDA. Moreover, it intends to retire its 5-year $800 million bond maturing in June 2023 with cash on hand and some commercial paper issuance. The company has a BBB+ credit rating.

L3Harris aims to maintain a net-debt-to-adjusted EBITDA ratio of under 3.0x in the long run. If this target is exceeded, the company intends to prioritize debt repayment to ensure it maintains a solid investment-grade credit rating. This can be achieved through a reduction in share repurchases and by potentially selling non-core assets to generate proceeds for debt repayment.

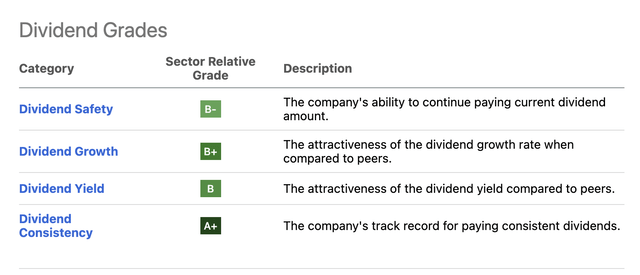

With that in mind, the company’s 5-year average annual dividend growth rate is still 15.0%. It also has one of the best dividend scorecards in the industrial sector.

Seeking Alpha

Hence, while dividend growth may be slow in 2023 and 2024, I expect it to accelerate in the years after that, boosted by buybacks.

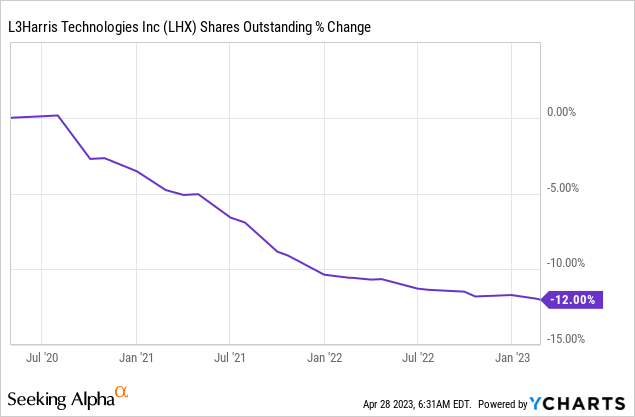

Note that LHX bought back 1.1% of its outstanding shares in 1Q23, which isn’t half bad for a company looking to close a major acquisition soon.

Over the past three years, LHX has bought back 12% of its shares.

Now, let’s take a look at its 1Q23 earnings, which confirm my bull case.

1Q23 Confirms That L3Harris Is Too Cheap

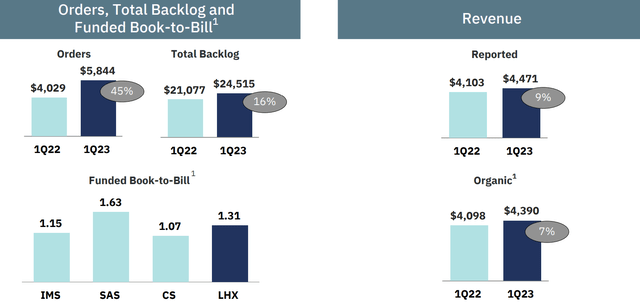

The first quarter earnings were good. The company generated $4.47 billion in revenue, beating estimates by $190 million. Revenue growth was 9.0%. Adjusted EPS was $2.86, which missed estimates by $0.04.

Given what I’m about to show you next, we can ignore the EPS miss of just 4 pennies.

For example, the company generated $5.8 billion in orders in 1Q23, which translates to a growth rate of 45%. Total backlog grew from $21.1 billion to $24.5 billion, which implies 16% growth.

L3Harris Technologies

The funded book-to-bill ratio is 1.31, which indicates that order growth is stronger than the company’s ability to turn backlog into sales. This is indicative of higher growth in the future. Also, all of its segments have a book-to-bill ratio of more than 1.0, with Space and Airborne Systems reporting a ratio of 1.63.

According to the company:

The increased demand and focus on global defense spending has continued into the first quarter of 2023, supporting strong orders for L3Harris capabilities. Geopolitical tensions remain elevated with near-peer threats such as China and the conflict between Russia and Ukraine entering its fourteenth month. International governments continue to revisit spending levels to address threats across all domains.

Domestically, the Government Fiscal Year (“GFY”) 2024 President’s Budget Request (“PBR”) seeks a 3% increase to Department of Defense (DoD) spending over GFY23, reflecting a persistent threat environment.

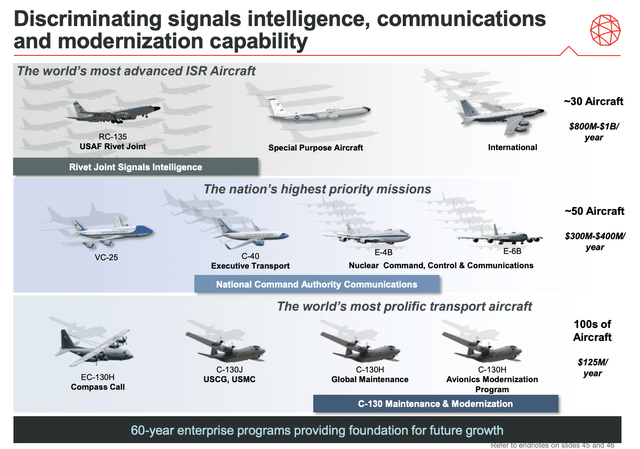

In this case, it’s important to mention that LHX is very well positioned to benefit from higher spending, thanks to its exposure in areas that require accelerated investments. This includes space, ISR (surveillance) aircraft, tactical communications, and maritime solutions.

L3Harris Technologies

Awards included $750 million for the next-generation high-resolution imager for NOAA’s GeoXO satellites, $400 million to build an earth observation constellation for a European buyer, $550 million to missionize four modern business jets with the Compass Call EW system, and $80 million for critical components for the Columbia-class and Virginia-class submarines.

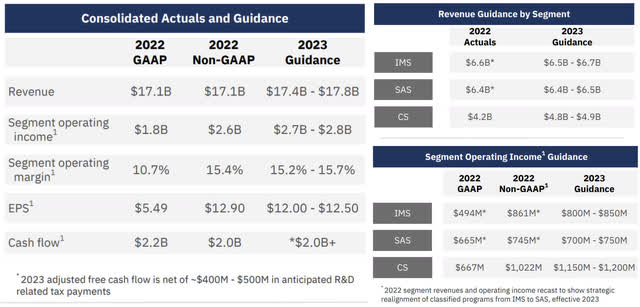

Based on this context, the company confirmed its full-year guidance. It sees between $17.4 and $17.8 billion in revenue, which is up from $17.1 billion in 2022. The operating margin is expected to rise from 10.7% (GAAP) in 2022 to at least 15.2%.

L3Harris 2023 guidance continues to reflect expected improvements in electronic component availability and supplier performance with plateauing input costs and labor mobility.

L3Harris Technologies

The company predicts that its non-GAAP EPS and adjusted free cash flow will be more heavily weighted in the second half of the year. They anticipate that the availability of materials will improve, resulting in increased product deliveries and that suppliers will perform better, which will reduce input costs.

The benefits of operational improvements, cost controls, and other mitigation efforts are expected to have a greater impact in the second half of the year as projects ramp up. The company also expects that its adjusted free cash flow will be more heavily weighted in the second half of the year due to the timing of R&D-related cash tax payments and anticipated improvements to working capital.

These comments are in line with what I’ve heard from other defense contractors. It’s also confirmed by the free cash flow chart I showed in this article. While 2023 will be somewhat flat-ish, we can expect a steep recovery in 2024 and beyond, boosted by strong orders.

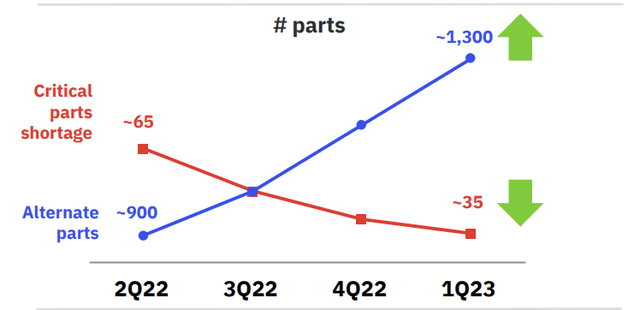

Furthermore, the company visualized the uptrend in alternate parts and a decline in critical part shortages.

L3Harris Technologies

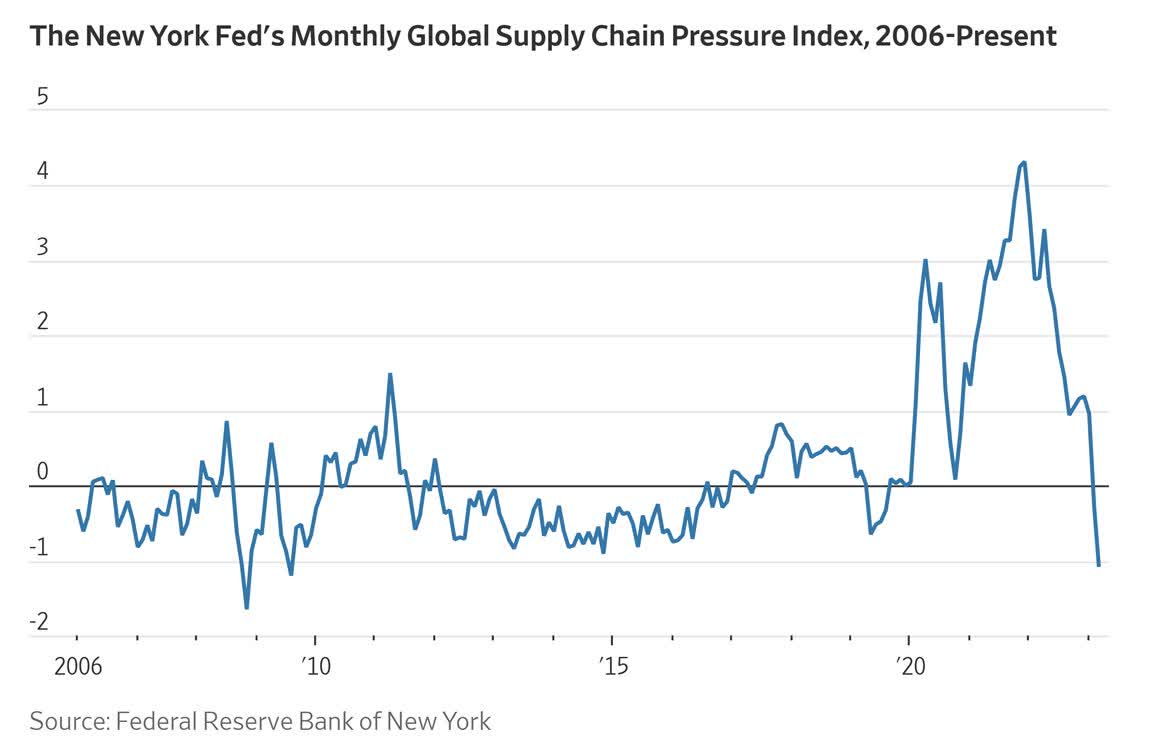

This is partially due to the company’s own supply chain improvements, which include working closer with suppliers. However, we’re witnessing a steep decline in the global supply chain pressure index. This is partially caused by weakening global demand. As I have said in the past, a recession would be bullish for the defense supply chain. Companies like LHX with minimal commercial exposure will benefit when cyclical companies reduce orders. They will have less competition when it comes to high-tech supplies.

Wall Street Journal

Unfortunately, inflation remains an issue, which is what I expected, given my sticky inflation thesis. According to the company (emphasis added):

Material and labor input costs continue to stabilize, but remain high on a relative historical basis. These higher-than-assumed costs continue to pressure certain fixed-price contracts, impacting the company’s ability to leverage positive EAC opportunities across a diverse portfolio and therefore impacting margins. We continue to proactively deploy operational improvement strategies combined with pricing opportunities to mitigate cost growth.

So, what about the valuation?

Valuation

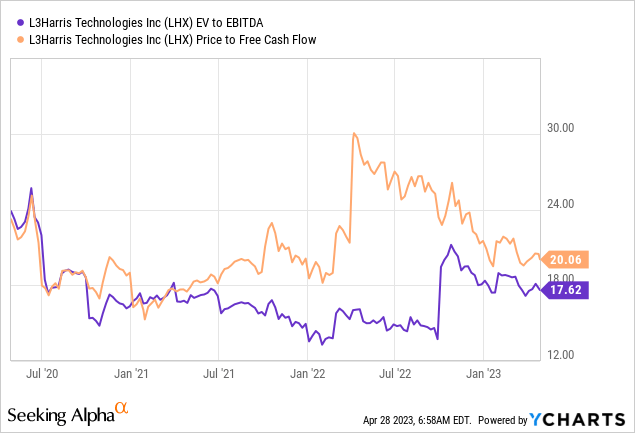

I believe that LHX is way too cheap. The company is trading at 11.9x 2024 EBITDA. In this case, I’m using 2024 numbers, as I am (very) confident in its ability to reach these targets. Also, it’s fair to price in easing supply chain issues. If anything, I think the company could beat its 2024 numbers by a considerable margin.

Moreover, the company is trading at just 17.9x 2023E free cash flow and 15.7x 2024E free cash flow.

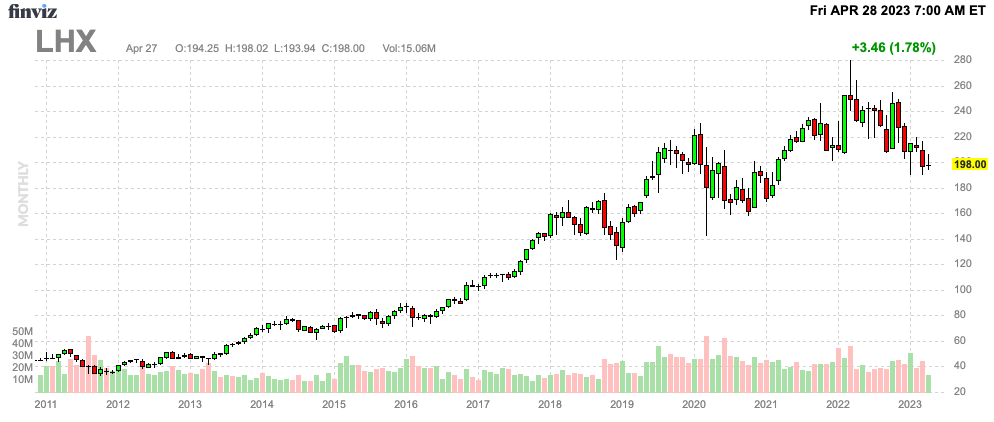

As I said in my prior article, I do not believe that LHX should trade below 15x EBITDA, especially not given its strong free cash flow. The company is currently trading 28% below its all-time high.

I believe that LHX is at least 30% to 40% undervalued.

At that point, LHX would trade at what I consider to be fair value. Hence, my price target range is $260 to $280.

FINVIZ

The only reason why I am not buying more LHX is because I already have so much defense exposure.

If that were not the case, I would be an aggressive buyer at these levels.

Takeaway

I went with a very bullish title. However, I stand by everything said in this article. L3Harris isn’t just one of my all-time favorite dividend and defense stocks, but it is also trading at an extremely attractive price.

Ongoing supply chain and inflation problems coupled with funding and M&A uncertainty have kept LHX (and its peers) subdued.

However, that is now changing. The company enjoys a very strong flow of news orders, backed by an advanced product portfolio and the fact that supply chain issues are quickly fading.

While inflation is expected to remain a headwind, LHX confirmed its full-year guidance and is in a good spot to report accelerating organic growth in the next few years.

With regard to its dividend, we’re dealing with a company committed to distributing most of its free cash flow to shareholders. However, in both 2023 and 2024, it is likely that dividend growth will remain subdued if the company is allowed to buy AJRD.

In the years after that, I expect aggressive double-digit dividend growth with support from opportunistic buybacks.

Long story short, if I didn’t own so much defense already, I would be a buyer at these levels, as I expect that LHX is trading between 30% to 40% below its fair value.

Read the full article here