Introduction

Since ChatGPT’s appearance, artificial intelligence (AI) is on the mouth of every investor. As a matter of fact, we might be facing one of the most important revolutions since the inception of the Internet. Jensen Huang, Nvidia Corporation (NASDAQ:NVDA) CEO, has been talking about the “iPhone moment of AI,” while NVDA’s biggest competitor, Lisa SU, CEO of Advanced Micro Devices, Inc. (AMD), talked about an “Inflection point.” Salesforce’s (CRM) CEO, Marc Benioff, also stated recently, “This AI wave will be the biggest that anyone has ever seen.”

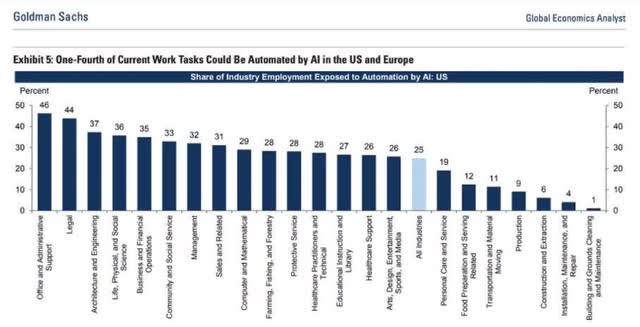

It appears that AI and its potential implications on our way of living and our way of working will be massive. Supporting this idea, a recent study made by Goldman Sachs highlights this disruption potential and estimates that ¼ of current work tasks could be automated by AI in the U.S. and Europe.

Goldman Sachs

Since the launch of ChatGPT on the 30th of November 2022, NVDA has printed an impressive performance (+152%), adding within this time lapse close to $700 billion in market cap. To give you an order of magnitude, even if it doesn’t make sense as such, this represents slightly more than the GDP of Switzerland, the world’s 20th-largest economy. After this strong rally, many are concerned about Nvidia’s valuation, which in my opinion is understandable.

In this article, we will first have a look at NVDA’s positioning and the market potential for AI. Then, we will mainly focus on valuation and try to understand if there is a reason to call this phenomenon a “bubble” or not.

From Gaming To AI

Since its inception in 1993, Nvidia has impressively evolved from a gaming-focused company to a leader in artificial intelligence. This evolution is the reflection of wise strategic decisions supported by the visionary leadership of its CEO, Jensen Huang. Initially, NVDA gained prominence for its high-performance graphics cards. Already in the early 2010s, Huang recognized the potential of AI and made critical decisions to steer the company in that direction.

An interesting anecdote reported by Bloomberg highlighted that in 2016, to test his products and the need/quality of its chips, Huang “Instructed his team to build a server designed for AI and hand-delivered the first one in 2016 to Elon Musk and Sam Altman, the founders of OpenAI.” Furthermore, Huang is said to have personally brought it to the startup’s office as a gift.

Huang seems to be the kind of person who gives gifts and expects something in return… but this might be one of the most worth-it gifts he has ever made. Indeed, since then, NVDA now works with both Tesla (TSLA) – notably on Tesla V100, which became the industry standard for AI computing – and OpenAI / Microsoft (MSFT). Without NVDA and its 20 000 graphic processors sold to OpenAI, ChatGPT might have never been able to see the light of day.

This anecdote is not insignificant. It shows that under Huang’s guidance, NVDA leveraged its expertise in graphics processing units (GPUs) and parallel computing to create hardware and software solutions optimized for AI workloads. Since its inception, the firm has never ceased to evolve, I would even state that this evolution is particularly visible when having a look at NVDA revenues segmentation a few years back.

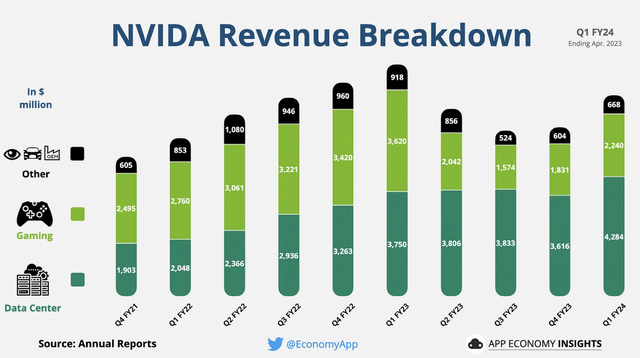

EconomyApp

By embracing AI as a core focus, NVDA positioned itself at the forefront of the AI revolution and established a dominant presence in the market, with now close to 90% of the market share according to HSBC.

Accelerated Computing And Generative AI Opportunities

The growth of artificial intelligence-related applications and revenues is fueling both excitement and skepticism. This convergence is driving data center operators to invest billions of dollars in accelerated computing hardware over the next decade. Huang envisions a 10-year transition towards accelerated computing, where data centers will be revamped and optimized for generative AI workloads. Traditional computing with Central Processing Units (CPU) and dumb Network Interface Controllers (NIC) will be replaced by smart NICs, smart switches, and Graphics Processing Units (GPU). The demand for accelerated computing arises from the need to process large amounts of data and reduce latency. As a result, data center operators are installing graphics processing units, tensor processing units, and adaptive computing hardware to complement CPUs.

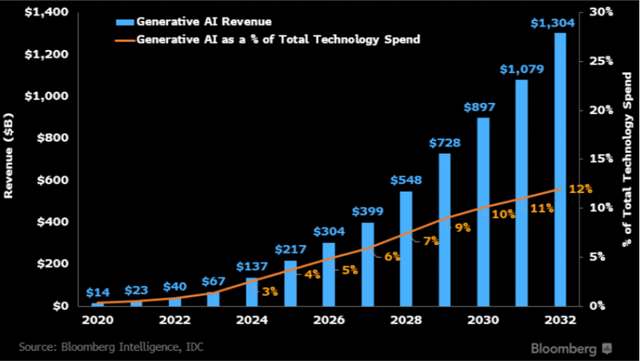

Infrastructure investors have been drawn to the data center industry due to its contractual cash flows and barriers to entry, but now they face the risk of tech obsolescence and seek to raise funds for computing power that can keep up with data demands. According to a study made by Bloomberg Intelligence, AI is expected to represent a $1.3 trillion opportunity, with Generative AI representing 12% of total Technology Spending, with significant investments in servers, accelerated computing, and edge computing.

Bloomberg

AI is expected to drive capex for the entire communications infrastructure ecosystem, and the network infrastructure must be positioned at the edge to support low-latency AI deployments. While the overall data center capex will grow, the adoption of accelerated computing will make data centers more energy-efficient. In my opinion, NVDA’s DGX system has the potential to replace tens of thousands of CPU servers, significantly reducing power consumption and costs.

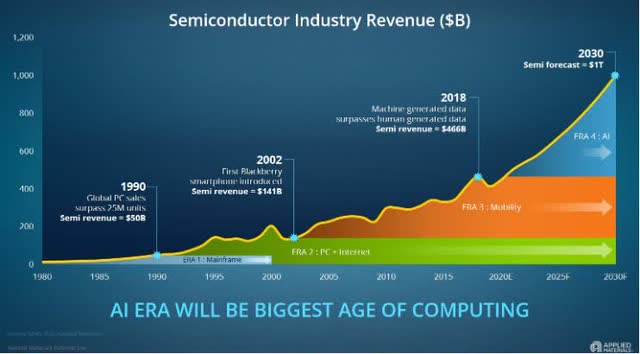

The strong growth of AI and the revenue opportunities it might imply are also mentioned by Applied Materials (AMAT), a leading semi manufacturer. On the graph below you can see that AI is expected to represent close to a $650 billion opportunity until 2030.

AMAT company presentation

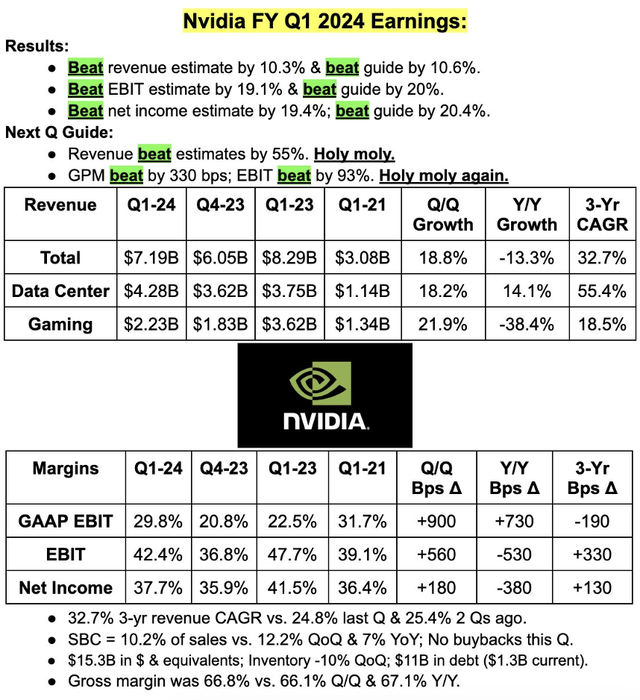

All these very supportive elements led NVDA to print an astonishing Q1 FY2024, as you can see below:

@StockMarketNerd on Twitter

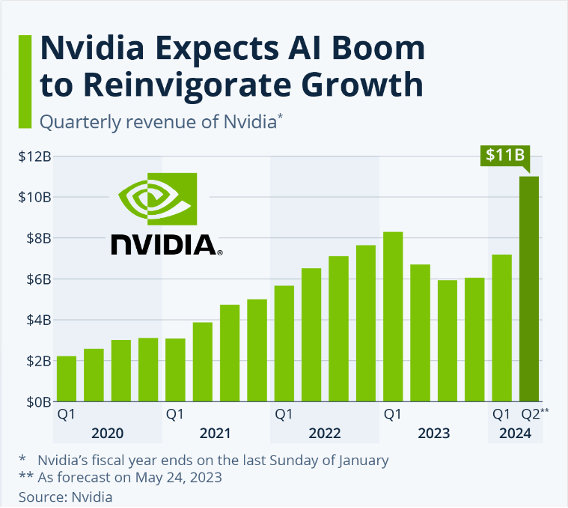

Demand for NVDA products is incredibly strong, as highlighted by their strong Q1 print and their guidance massively revised to the upside. Indeed, the guidance for Q2 FY2024 indicates that there is a significant increase in projected revenue for Data Center, primarily due to the strong demand for generative AI. The expected revenue for July is $11.0 billion, which is a 53% increase compared to the previous quarter and a 64% increase compared to the same period last year. This guidance exceeded the consensus estimate of $7.18 billion.

Statista

Supported by all these elements, I expect a strong and accelerated growth in demand for NVDA data center products for the upcoming years.

Fundamentals and Valuations

Bloomberg

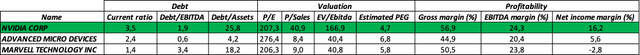

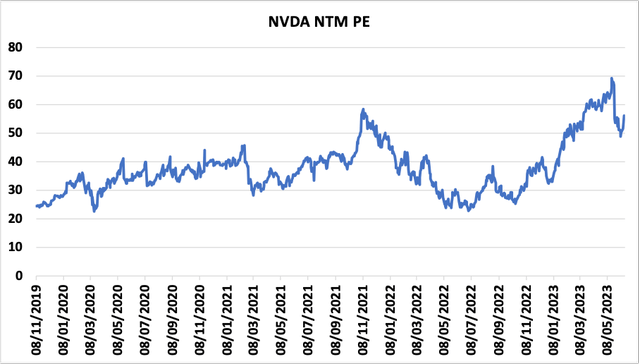

Despite undeniable growth prospects, NVDA has become controversial due mainly to its valuation. With a balance sheet characterized by a strong ST liquidity position and a relatively high level of LT debt due to major investments that should continue to pay off in the near future, some concerns remain. Indeed, concerns are mainly about the firm valuation due to high metrics such as P/E, P/S, and EV/EBITDA. Only by looking at these ratios, many are believing that the stock is in a “bubble territory.” However, using forward valuation metrics, NVDA is cheaper today than it was in early 2023 or at the end of 2022. I expect growth to accelerate and this trend to continue.

Bloomberg

Furthermore, when looking at high-growth companies, it would be wiser in my view to look at the PEG ratio instead of the P/E. According to Wallstreetprep, “The PEG ratio, or Price/Earnings to Growth ratio, is a valuation metric that takes into account a company’s PE ratio concerning its earnings growth rate.” It is used to assess the relative value of a company’s stock by considering its earnings growth potential. I prefer it to the P/E as it helps investors determine whether a company’s stock price is justifiably priced based on its growth prospects.

Thus, when looking at NVDA’s PEG, you can see that it is expensive. That’s a fact, but still less expensive than Advanced Micro Devices or Marvell Technology (MRVL), which can be considered as the best peers for a comparison.

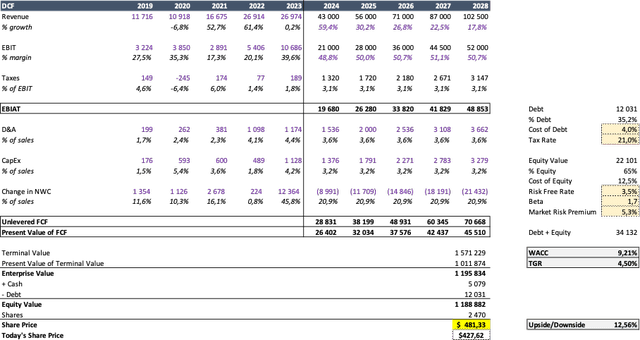

Let’s now have a look at my valuation forecast:

Author forecast

My forecast is based on the following assumptions:

NVDA will remain the leader in the AI segment thanks to early investments made. Although my forecast is considering the possibility that a competitor, in my view AMD might be able to enter the market with a competitive product starting in Q3-Q4 2023. In this sense, I expect growth to decline progressively by 10, 15, and 20%, starting from 2025.

I expect gross margins to stand close to 70% following NVDA’s outlook for the second quarter of fiscal 2024. In terms of EBIT margins, I expect substantial improvements thanks to the quality of NVDA products and high demand leading the firm to have strong pricing power. My forecast also expects economies of scale due to better control of costs and a better mastering of the technologies developed. These elements lead me to an EBIT margin close to 50% on average for the 5 upcoming years.

The tax rate is the average tax rate of the last 3 years, I used methodology to estimate the tax rate, the D&A, and the Change in NWC.

Using a WACC of 9,21% and a TGR of 4,5% I arrive at a target price, or TP, of $481 leaving a 12.5% upside potential.

Note that my forecast is slightly more conservative than the consensus, especially for the years after 2024. As explained above, I expect competition to intensify as some competitors like AMD should be able to enter the market with some new interesting products like the long-awaited MI300X that could erode a bit of NVDA’s market shares with its H100 AI chip product.

There’s a possibility that I might be too conservative, as historically, NVDA has consistently surpassed Wall Street’s earnings predictions, indicating once more that it may not be as overvalued as many seem to think. In general, I rather am more conservative rather than too optimistic, but considering the company’s track record and growth expectations, there is still some Nvidia stock upside, in my view.

Risks

While I believe in the growth potential of NVDA, there are certain risks that could impact my forecast.

These risks include:

- Global economic conditions: NVDA’s growth is dependent on the overall health of the global economy. Economic downturns or recessions could lead to reduced spending on AI infrastructure and technology, affecting the demand for NVIDIA’s products.

- Dependence on AI adoption: NVDA’s growth is heavily reliant on the widespread adoption of AI technologies. If the adoption of AI is slower than anticipated or faces significant barriers, it could affect the demand for NVIDIA’s products and limit its revenue growth.

- Intensifying competition: As the AI market continues to grow, competition from other companies, particularly AMD, could increase. If competitors introduce new and competitive products or technologies that gain market share, it could impact NVDA’s revenue and growth projections.

- Technological advancements: The field of AI is rapidly evolving, and new technologies or breakthroughs could disrupt the market. If NVDA fails to keep up with these advancements or faces challenges in adapting its products to changing technologies, it could affect its position and growth prospects.

- Supply chain disruptions: Any disruptions in the global supply chain, such as component shortages or logistics issues, could impact NVDA’s ability to meet demand and fulfill orders, leading to potential revenue loss and customer dissatisfaction.

- Regulatory challenges: The AI industry is subject to evolving regulations and policies, particularly concerning data privacy and ethical considerations. Changes in regulations or increased scrutiny of AI applications could impact the adoption and growth of NVDA’s products.

Conclusion

The rise of artificial intelligence has become a prominent topic among investors, with industry leaders and experts recognizing its potential for significant disruption. NVDA, under the visionary leadership of Jensen Huang, has successfully transitioned from a gaming-focused company to a leader in AI, positioning itself at the forefront of this revolutionary wave. The strategic decisions made to embrace AI early on and leverage its expertise in graphics processing have paid off handsomely.

The market potential for AI is immense and its benefits in terms of productivity are undeniable. Data center operators are investing heavily in accelerated computing hardware, and NVDA’s dominance in this space, with close to 90% market share, positions it well to capitalize on the growing demand for generative AI.

While NVDA’s recent financial performance has been exceptional, with a strong Q1 and revised upward guidance, driven by robust demand for its data center products concerns about valuation exist. However, when having a closer look, growth prospects and the firm profitability and dominant position justify in my view the current price.

In my opinion, the transformative potential of AI, coupled with NVDA’s strategic positioning, strong financial performance, and relentless pursuit of innovation, makes it an appealing investment opportunity. Despite concerns about valuation, the company’s growth trajectory and industry leadership indicate in my view upside potential. Therefore, considering the compelling market dynamics and NVDA’s track record, investors may find a compelling case for investing in this AI powerhouse. For all these reasons, I initiate on Nvidia Corporation stock with a Buy Rating and a target price of $481, implying a 12.5% upside potential.

Read the full article here