2023 has so far been very good for Legend Biotech (NASDAQ:LEGN). Carvykti’s uptake has improved in the second quarter and the company continues to generate positive clinical data in multiple myeloma patients that I covered in the previous article when the ASCO abstract leaked and showed very strong CARTITUDE-4 results in second line+ multiple myeloma patients.

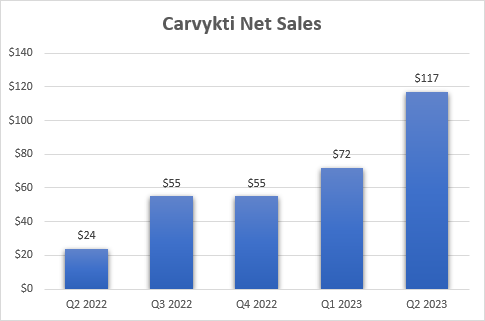

Carvykti showed modest progress until the second quarter, but the problem was and still is supply, not demand. The sequential surge in net sales, from $72 million in Q1 to $117 million in Q2, was driven by an earlier-than-anticipated manufacturing ramp. Legend and partner Johnson & Johnson (JNJ) also made continued improvements in manufacturing processes and the out-of-spec rate was reduced as well (this refers to manufactured doses that do not meet the requirements under the FDA label).

Johnson & Johnson earnings reports

Limited capacity is anticipated to be an ongoing problem, but the two companies say they are on track to reach an annualized capacity of 10,000 doses or more by the end of 2025. This provides a guesstimate of Carvykti’s potential net sales run rate at the end of 2025 or at the start of 2026. The wording specifies the run rate and annual capacity, not that 10,000 doses will be produced in 2025. If we take $400,000 per patient as a net price per dose compared to nearly half a million gross price, this means Carvykti will generate close to $1 billion in net sales in Q4 2025 or Q1 2026.

The consensus revenue estimate for Legend for 2025 is $1.28 billion and since the split with J&J is 50:50, we could calculate nearly $2.6 billion in Carvykti net sales. Of course, the situation is not as simple since Carvykti will likely receive approval in China, and the price there is likely to be lower and is still unknown. Legend’s share in China is 70% as opposed to 50% in other territories. But this sounds like a reasonable, if not somewhat conservative estimate.

The two companies have recently added Novartis (NVS) as a manufacturing partner and this along with the ongoing efforts should ensure they reach the goal of an annualized rate of 10,000 doses of Carvykti by late 2025.

But that is the supply side. Will there be demand?

Based on the demand and uptake to date with a very limited label that includes only late-line patients, my answer is a resounding yes. Management did say on the earnings call that backlog has decreased recently, but only due to the recent availability of bispecific antibodies that are meant to serve as a bridging therapy until patients can receive Carvykti.

The backlog should increase substantially in 2024 when Legend and J&J expect to receive FDA approval to treat second-line+ patients. If and when Carvykti is approved in other major geographies, the total addressable market should nearly triple from 22,000 to 57,000 multiple myeloma patients. And given that Carvykti is by far the best treatment option for these patients, I believe Legend and J&J will not have problems selling a single of the 2,500 doses they could potentially produce in the fourth quarter of 2025.

As such, I believe the second line+ label in multiple myeloma patients will be sufficient to exceed J&J’s peak sales estimate of $5 billion. And the two additional opportunities should considerably contribute toward the end of the decade – first-line treatment in patients who are not candidates for autologous stem cell transplant (‘ASCT’) and all first-line patients. To get there, we would need to see resoundingly positive data in the CARTITUDE-5 trial in transplant-ineligible patients and the data from the CARTITUDE-6 trial where Carvykti will be compared directly against ASCT.

The key risks for Carvykti in the medium and long term are the ability of Legend and J&J to produce enough doses to meet demand and competition.

Regarding manufacturing, there are no guarantees, but it seems a matter of time and investment rather than an inability to manufacture the product.

And on the competition side, Bristol Myers Squibb’s (BMY) ABECMA is the key competitor in the CAR-T space in the next few years, but to date, it has not generated data that are comparable to Carvykti.

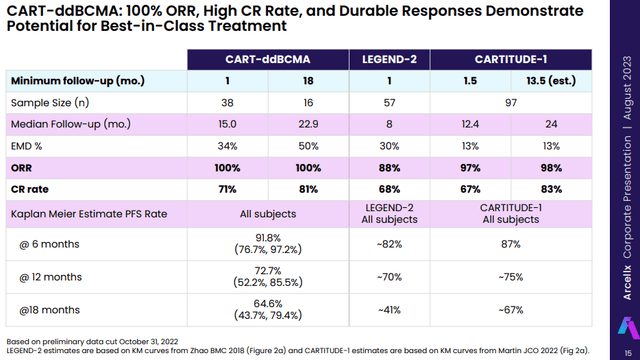

Arcellx (ACLX) looks like the most potent potential competitor with data that show its candidate CART-ddBCMA could be a match to Carvykti and, like Legend, it will have big pharma backing by partner Gilead (GILD) with a similar deal structure to what Legend has with J&J. The data CART-ddBCMA generated to date in late-line multiple myeloma patients looks to be largely in line with Carvykti’s CARTITUDE-1 data and better than the data ABECMA generated.

Arcellx investor presentation

Arcellx anticipates a commercial launch of CART-ddBCMA in late-line multiple myeloma patients (Carvykti’s current indication) in 2026. In addition to a head start of 4 to 5 years, we will probably see similar manufacturing ramp-up problems, and both the efficacy and safety data of CART-ddBCMA would need to look at least as good to be a viable competitor to Carvykti. But so far, so good for CART-ddBCMA. I believe there is room for more than two strong products in this very large market and the more likely problem will be producing enough doses rather than one company taking patients from the other.

Conclusion

Some of the progress Legend Biotech has made in the last few years is already reflected in the current relatively high market cap, but there should be plenty of upside left considering the opportunity Carvykti has in the very large multiple myeloma market. The manufacturing step-up and improvements in the manufacturing processes have led to a significant sequential increase in net sales, and we should see steady growth in the following quarters followed by a stronger ramp to end 2025 with a capacity to generate nearly $1 billion in quarterly net sales.

Importantly, Legend is in good financial shape to achieve its long-term goals after it raised $785 million in gross proceeds in Q2 through a direct offering, private placements, and the exercise of warrants. This brought the cash and equivalents position to $1.5 billion which the company expects to last at least through 2025, and possibly longer. This could also be sufficient to fund the company to profitability depending on how fast manufacturing and net sales of Carvykti ramp in the following quarters and years.

There is also a pipeline behind Carvykti that could expand Legend’s reach into non-Hodgkin lymphoma, acute myeloid leukemia, and also solid tumors, but it is still unproven and with a long road ahead, and I continue to expect Carvykti to be the primary asset of interest to investors in the next two to three years.

Read the full article here