Investment Thesis

Lennar Corp (NYSE:LEN) is enjoying a stabilization in the housing market, evidenced by normalized cancellations, resilient financial performance, and a positive growth outlook, mirroring favorable economic conditions despite rising interest rates. Customers seem to adjust to higher mortgage rates, aided by record-low employment, rising wages, and GDP growth. Beyond macroeconomic indicators, the housing supply remains tight. Although the company’s margins declined off their 2022 peak, they remain above historical levels. Our bullish hypothesis is predicated on continued favorable macro and microeconomic trends. Housing supply often changes slowly, and market tightness has been going on for years, so we are unlikely to see a significant rebound in home supply in 2024. Potential interest rate cuts assuage the risk of macroeconomic slowdown. For these reasons, we see more upside potential than downside risk for LEN in the coming twelve months, underpinning our bullish outlook.

Resilient Performance Amid Disruptions

LEN maintains a strong position in the housing market, underpinned by robust demand for affordable housing and a limited supply. The market is expected to remain favorable for LEN, particularly with interest rates stabilizing and more moderate monetary adjustments as the Fed maintains its wait-and-see approach to monetary policy, as opposed to the rapid and arguably disruptive rate hikes in the past eighteen months. This renewed stability has allowed home buyers to adjust and adapt to higher mortgage costs, saving more and opting for smaller houses. Cancellation rates experienced a notable decline in the most recent quarter, declining to 13%, down from 21% last year. We expect these dynamics to offer accommodative tailwinds to LEN in 2024 and beyond. The company is the second-largest, entry-level home builder in the US, with a price sale range between $230,000 – $750,000 (Q3 23 Average Selling Price ~$450,000).

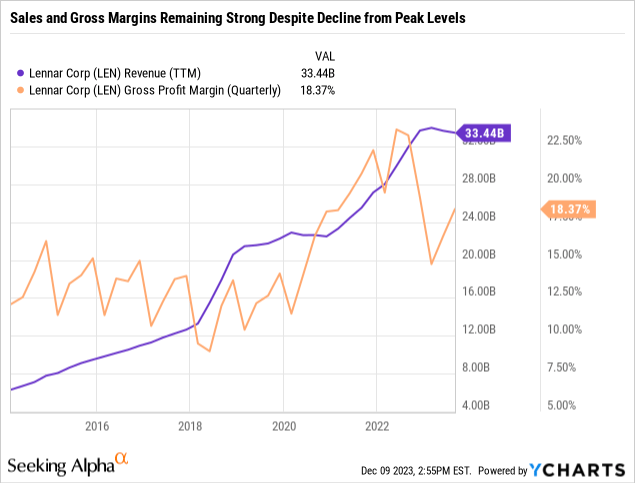

While LEN’s financial performance has moderated from its 2022 peaks, it remains solid. The company’s strategy focuses on adjusting prices to sustain sales volumes in response to the evolving market. The company’s 10% sales growth projections in 2024, which I describe as ‘Controlled Growth,’ are predicated on its approach to engineering prices to generate higher volumes, increased total revenue, cash flows, and EPS targets. The effects of margins are counterbalanced by revenue increase, economies of scale, and stable supplier and contractor relations that shorten the sales cycle.

The success achieved by LEN in 2023 through its dynamic pricing strategy provides a strong foundation for projecting its continued success into 2024. In the nine months ended August 2023, total revenue was $22.6 billion, up from $20.47 billion in the same period in 2022. While gross margins on home sales slightly decreased from 26% to 24%, they remain at healthy levels.

The increase in community count in areas with high growth potential is promising for future growth. As of August 2023, LEN had 1,253 active communities, up from 1,189 in the previous year. In Q3, the company witnessed a significant number of new home orders and closed on more homes compared to the previous quarter of last year, aided by an 8.7% decline in sales price, as the company enhanced its incentive programs to brokers and clients.

We believe that the worst is behind us now in terms of the impact of rising interest rates that previously alienated home buyers and many investors from the sector. Despite a challenging macroeconomic environment and softening margins and backlog, we see opportunity as the company continues its focus on maintaining volumes, cash flows, and economies of scale going forward into next year. Given the recent performance, it is likely that LEN will continue to see robust and resilient operating performance despite a higher-for-longer interest rate regime.

Strengthening Financial Position

LEN has strengthened its balance sheet position through a reduction in its debt-to-capital ratio, a robust cash position, and a focus on maintaining scale to meet EPS targets. The company’s adoption of a capital-light approach, favoring land purchase options over outright ownership, has minimized risk and increased flexibility, particularly in the face of economic downturns. This strategic shift also led to an improved inventory turnover by reducing the time land is held before home development and delivery sales.

The company’s strong balance sheet paves the way for growth and supports the continuation of its share repurchase and dividend programs. In the nine months ending August 2023, operating cash flow rose to $2.6 billion, up from $550 million in the same period of last year.

Operationally, the biggest challenge is balancing growth with dividends and share repurchases. LEN’s achievements in this area are evident in its financial results during the nine months ending August 2023, lending confidence in our bullish hypothesis. During this period, LEN redeemed $575 million in senior notes, repaid $238 million under warehouse facilities, repurchased $919 million of its common stock, and paid $330 million in dividends. This was accomplished while ending Q3 with $3.9 billion in cash, zero net debt, and no borrowing on its $2.6 billion credit facility. These significant achievements eclipse the slight softness in margins, backlog, and Average Selling Price often noted by industry skeptics.

Attractive Valuation

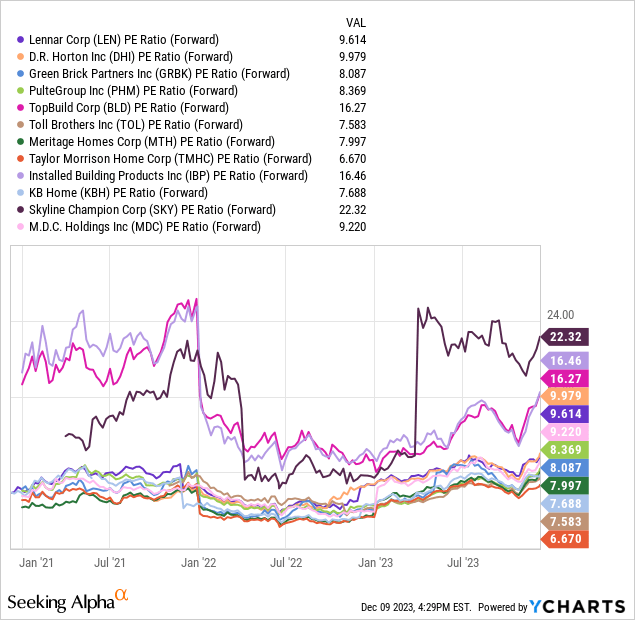

At a forward P/E ratio of 10x, LEN presents a compelling valuation on a standalone basis. Although this valuation aligns with industry averages, it appears particularly attractive considering the current industry slowdown. While some peers might be trading at a steeper discount, LEN is one of the handful of homebuilders included in the S&P 500 index (SP500), offering a distinct advantage in terms of liquidity. Additionally, LEN’s substantial size and robust balance sheet further reinforce the attractiveness of its current valuation for a buy strategy.

The company’s stature as the second-largest homebuilder, combined with its diversified operations, significantly mitigates risks associated with regional economic fluctuations, unlike its smaller peers. For example, KB Home (KBH), which trades at 7.7x P/E, operates in 9 states, compared to LEN’s operations spanning 27 states. This diversification, along with LEN’s substantial market presence, underscores its resilience and potential for growth, making it an appealing investment option.

What to Expect This Thursday

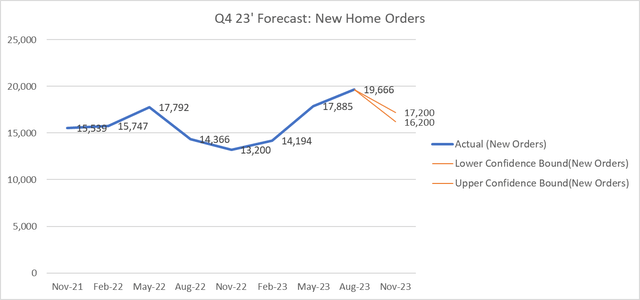

Management plans to release Q4 23′ results on Thursday, December 14, 2023, for the 12 months ended November 30. Regarding new orders, management expects between 16,200 – 17,200, down 12.5% – 17.5% sequentially but up 23% – 30% on a YoY basis. The November quarter is usually a soft period, as weather patterns impact consumer home purchasing trends. Temperature this fall was warmer than average, potentially offering a tailwind for the Q4 23′ order book.

LEN, Author’s Estimates

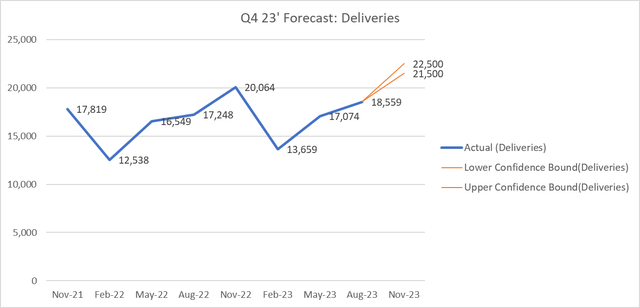

Regarding deliveries, investors should be expecting a strong Q4 23′, supported by an exceptionally strong order book during the prior quarter, as shown above (the highest in two years). The company has been making progress in its sale cycle. On average, it takes large homebuilder around LEN 4-6 months to complete a single-family home.

LEN, Author’s Estimates

Regarding Average Sale Prices and margins, we don’t see significant change compared to Q3. Housing supply remains tight, and despite LEN’s focus on driving volumes, we don’t see it necessary for LEN to implement additional home price cuts to meet its delivery and order projections. Thus, we expect home sales margins will remain stable, mirroring the levels observed in Q3 23′, which were around 24% on an ASP of $448,000.

Risk

Despite the strong performance of LEN in the face of high interest rates, one can’t ignore the cyclical nature of the sector. The company’s tactics, namely the provision of discounts, might not be enough to sustain demand during a severe economic downturn. The company is also sensitive to commodity prices, namely lumber, which have recently provided margin tailwinds after recent price declines. However, a rise in commodity prices will impact margins. Finally, with rising land prices, the need to proactively manage land inventory is more important than ever. LEN ended Q3 with nearly 400,000 land sites, enough for 1.5 years of supply, offering confidence in our 2024 bullish outlook. However, if the trend in land prices accelerates, we could see pressure on working capital needs, which would ultimately impact LEN’s share repurchase and dividend programs.

Summary

LEN stands as a resilient player in the housing market, with a proven track record and a solid strategy, positioning it for success in 2024, especially as risks of a hard landing are largely behind us now. Despite economic uncertainties in the past nine months and the sector’s cyclical nature, LEN’s financial performance lends us confidence in its 2024 prospects. The company’s low valuation is augmented by a shareholder-friendly share repurchase and dividend programs, increasing LEN’s appeal in the housing market.

Read the full article here