***This report is a recommendation to purchase the 2031 (04686JAC5) or 2033 ( 04686JAF8) Athene bonds or the preferreds (ATH-E/ATH-C).***

We believe individual bonds are situated today as one of the best risk/rewards in the market. We can achieve 6%+ returns for investment-grade rated company debt. Two years ago, those issues yielded 2.5% or less.

We think this is a generational opportunity in individual bonds given the aggressive hiking campaign to kill the inflation bug. Investment grade bonds are boring but will provide you the best returns for the risk over the medium term.

- Individual Investment Grade Bonds: A Generational Opportunity To Lock In 6%+ Yields.

- Why A Lower Yield May Be A Better Long-Term Investment.

The opportunity today should not and cannot be underscored. Investment grade bonds offer up yields of 6.0% to 7.5% or more in some cases. Investors can lock these in as they are likely to be a fleeting figment of history.

We are encouraging readers to lock in these yields for as long as you can to cement these ~6.5% yields for many years. Individual bonds are the best (and really only way) to lock these in, as open-end bond funds will be subject to cash flows that will correlate with current yields. Thus, as interest rates come down in the coming years, the yield on the bond fund will decline as well.

In the first part of this series, we looked at Main Street Capital (MAIN) 2026 bonds that yield upwards of 7.0% (at the time 7.5%).

- Let’s Build A Bond Portfolio Together: Main Street Capital 2026 Bonds, 56035LAE4, YTW: 7.5%

Who Is Athene Ltd.?

Athene Holding Ltd., the insurance company you’ve never heard of. It is part of the Apollo Global Management (APO) company, one of the largest asset managers. They are one of the largest fixed and indexed annuity insurers in the world. They issue, reinsure, and acquire retirement savings products through their strongly developed distribution channels.

Some basic facts:

- $248B of gross invested assets as of March 31, 2023

- #1 leading market shares in fixed annuities

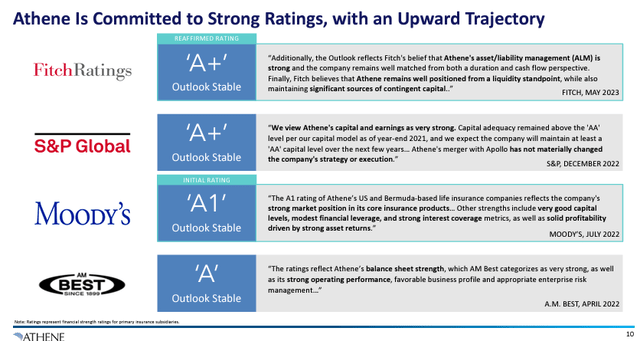

- Top rated by the credit agencies – S&P: A+, Fitch: A+, A.M. Best: A, and Moody’s: A12 — and our U.S. operating subsidiaries are licensed to distribute products in all 50 state

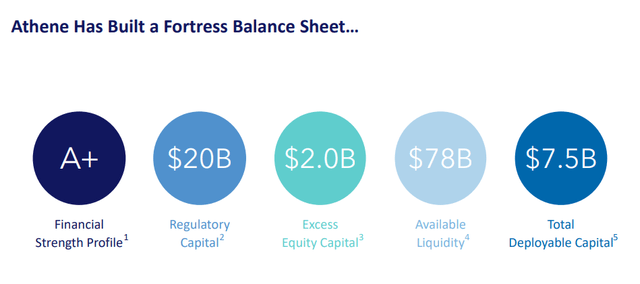

The balance sheet is very strong, as indicated by the strong credit ratings, which, as bond investor, is our main concern. We want to make sure the cash flow and financial ratios are there so that we, as the senior bondholders, continue to get paid and don’t have to go through a default process.

athene

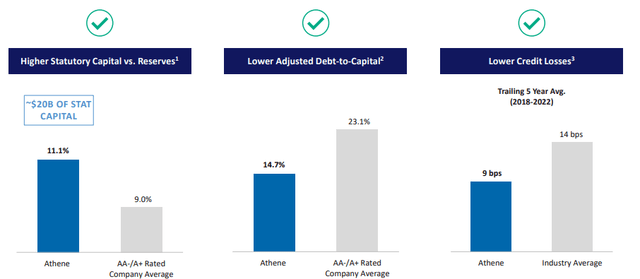

These numbers are meaningless unless you compare them to their top peers in the same industry. As you can see below, Athene has higher statutory capital and lower losses.

athene

Of course, does it matter to you, the bondholder, that these ratios are that strong? Not really. The company has almost no shot of bankruptcy outside of a massive fraud being uncovered, so the upside case or relative figures just confirm that lower risk.

The company gets high marks for their credit position and financial strength earning that A- rating from S&P and Baa1 rating from Moody’s. Here’s the Moody’s summary opinion:

…reflects the company’s strong market position in its core insurance products, which include retail and pension group annuities, as well as flow reinsurance. Strengths also include very good capital levels, modest financial leverage, and strong interest coverage metrics, as well as solid profitability driven by strong asset returns and higher interest margins on spread-based products. Athene also benefits from Apollo Global Management’s combined complementary strategic capabilities.

These strengths are offset by an above average concentration in specific structured asset classes, such as CLOs and ABS investments, particularly its high-grade alpha investments, which are largely underwritten by Athene and AGM using their own acquired underwriting platforms. While these asset classes provide unique and higher yielding investment opportunities for Athene, they can be larger, concentrated investments with less transparency to outside parties than publicly traded investments

All in all, Athene is ranked near the top of all insurers for credit quality. Add in the fact that they were recently acquired by Apollo Group and you get additional levels of safety. Also from the Moody’s report:

Athene also benefits from Apollo Global Management’s ((AGM, issuer rating A2 stable)) ownership, which supports the company’s business profile and provides access to investment expertise through AGM’s ownership of Apollo Asset Management, Inc. ((AAM, issuer rating A2 stable)), as well as increased financial flexibility.

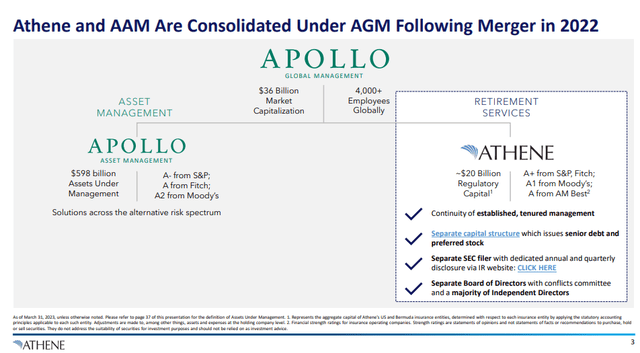

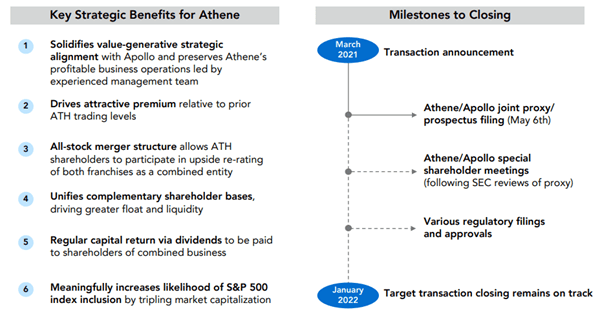

Here is the relevant slide from their investor day presentation last year. The slide shows the entity structure of the organization. It also helps detail the strategic benefits of the merger.

athene athene

The pairing of insurers with asset managers gives the combined entity greater diversification and the ability to originate assets. This is now common in the public insurance business. For instance, Guardian/HPS, Assured Guaranty/Blue Mountain, Sun Life/Green Oak, Prudential/Deerpath, etc.

The problem is that most insurers have used commercial real estate as a means to enhance their return on invested capital above the required capital base. Most have done so by entering the commercial real estate sector. Athene has not. As a percentage of total General Account assets, Athene has just 0.1% in real estate equity. The industry average is about 1.0%. Doesn’t sound like a lot but margins here are slim.

Athene’s strong credit ratings and what the ratings agencies say about them:

athene

How To Invest | What’s Right For You?

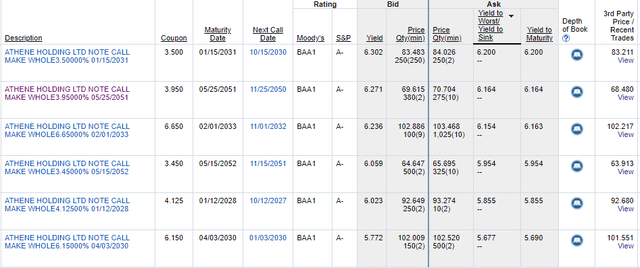

The company is rated A- by S&P as we noted above. Today, the best options for investment (since they company was absorbed by Apollo Global) is either the preferred shares or the bonds.

The two bonds I would consider are:

- Athene Holding 3.5% 2031 (04686JAC5), YTW: 6.20%

- Athene Holding 6.65% 2033 (04686JAF8), YTW: 6.15%

The difference between the two bonds in terms of yield-to-worst is negligible (5 basis points). However, there is a big difference in coupons. One is a low-coupon discount bond and the other a high coupon premium bond.

Buying a bond at a discount or premium creates a variety of tax issues. Make sure you consult with your CPA about the tax treatment to your personal return and select the appropriate bond. This is a good article on the complexities of taxation of bond discounts and premiums HERE.

You can see the bond discount typically generates a small premium or excess yield relative to the high coupon alternative. That is because, all else equal, investors prefer the current income to a lower income amount plus price appreciation.

The 3.5% bond is priced around $83 while the 6.65% is priced at $102, hence the reason the YTWs are virtually identical.

Fidelity

There are also a handful of preferred stocks to choose from as well. Remember, with preferred stocks, you are lower on the capital structure relative to the senior secured debt- the bonds.

- Athene Holding (ATH.PC) – 6.76%

- Fixed rate reset – 6.375% until 2025 than the coupon shifts to 5-year treasury rate plus 5.97% spread

- Athene Holding (ATH.PA)- 7.62%

- Fixed-to-Floating. Fixed coupon until 2029 at 6.35% after which it resets to 3-month Libor plus 4.253% spread, quarterly reset.

- Athene Holding (NYSE:ATH.PD)- 7.19%

- Fixed rate 4.875% coupon, non-cumulative

- Athene Holding (ATH.PB)- 7.09%

- Fixed rate 5.625% coupon, non-cumulative

- Athene Holding (ATH.PE)- 7.83%

- Fixed-rate reset 7.75% coupon until 2027 after which it resets to the 5-year treasury plus a 3.962% spread.

You can see that the preferreds have a clear yield advantage. In the case of the series E (ATH-E) you are netting an additional 1.6% in yield per annum. However, that is NOT free.

The two big differences are that you are taking more risk by being lower on the capital structure and, of course, the lack of a terminal date (maturity date) which helps pull up the price.

ATH-E trades right near par of $25, so the upside in price is minimal at this point. This brings up another key risk with the E-series; call risk. Since the coupon is 7.75% for an A- rated company, if rates fall and new issuance is lower, than the company can call the shares. That means price will unlikely ever go above $25.

If we switch over to the A series, which are fixed-to-floating, these are essentially fixed for the next 6 years. The likelihood that they float is fairly low since they will likely be called prior to the float date.

Landlord Investor adds:

ATH- E and ATH-C are the best options but I prefer ATH-C when it is at least $1 cheaper than ATH-E. ATH-E will provide about 70 cents of extra divs until ATH-C floats at which point ATH-C should be trading at par+accrued if not called (slightly above $25).

Concluding Thoughts

Constructing a bond portfolio is no different than a stock one- we want to buy value with exposure to strong, stable businesses that provide us a long-term income stream. We want to avoid fads and other flash-in-the-pan type business models that have no moat, profitability, or staying power.

In this economic regime, it makes sense to take the 6%+ and run but also lock it in for many years. I own both the 2031 and 2033 bonds but have much more in 2033 since it locks me into these yields for an extra two years.

Our goal with these individual bond portfolios is to hold until maturity, reaping the benefit of these high yields in high-quality bonds for as long as possible.

Read the full article here