The second half of 2023 has officially begun, meaning it’s time for us to reflect on the commodities market so far this year. To view our interactive, updated Periodic Table of Commodities Returns, click here.

In the first half of the year, lithium increased by 10.81%, making it the best-performing commodity and one of only two that recorded a positive return, the other being gold. Every other commodity that we follow lost ground during the six-month period as global manufacturing activity receded and China’s economy, historically a major demand engine, delivered a disappointing rebound after ending three years of pandemic lock-downs.

So why was lithium up in the first six months of 2023? In a word: batteries. The lightweight metal, the top performer in 2021 and 2022, is a key component of the boom in electric vehicle (EV) sales.

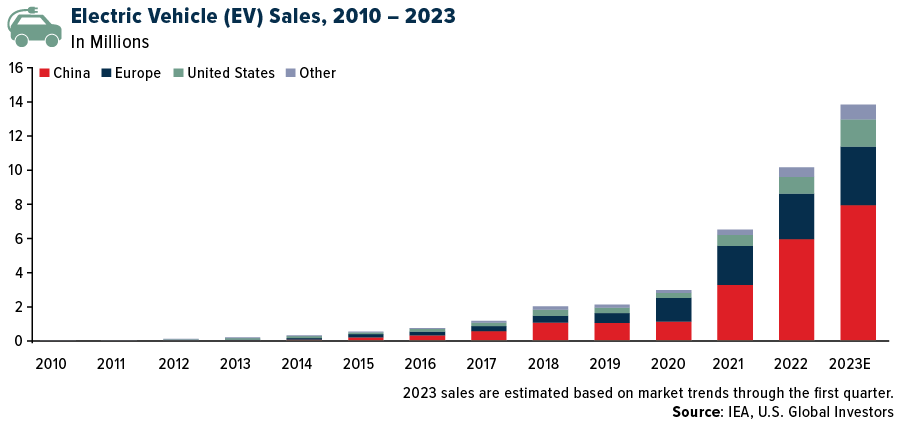

First-quarter EV sales suggested a promising year for the market, with a predicted global sales figure of approximately 14 million vehicles. This would mark a robust 35% increase from 2022, raising the global electric sales share to about 18%, according to the International Energy Agency (IEA).

U.S. Global Investors

China, the world’s number three supplier of lithium after Australia and Chile, remains the largest EV market. Tesla’s production in the country rose nearly 20% last month, aiding in the company’s record-breaking quarterly sales. The Elon Musk-led manufacturer, our favorite EV play, delivered 93,680 cars from its Shanghai factory in June, a significant increase from the 78,906 units in the same month last year and 77,695 vehicles in May.

Other car companies are rapidly shifting from combustion engine models to EVs or hybrids, boosting demand for lithium. Lamborghini, for instance, announced last year that it plans to invest at least 1.8 billion euros ($2 billion) to create a hybrid lineup by 2024 and to introduce its fully electric model by the end of the decade. The Volkswagen-owned company reported that its final gas-burning models are now sold out for the remainder of production.

Hedging With Gold

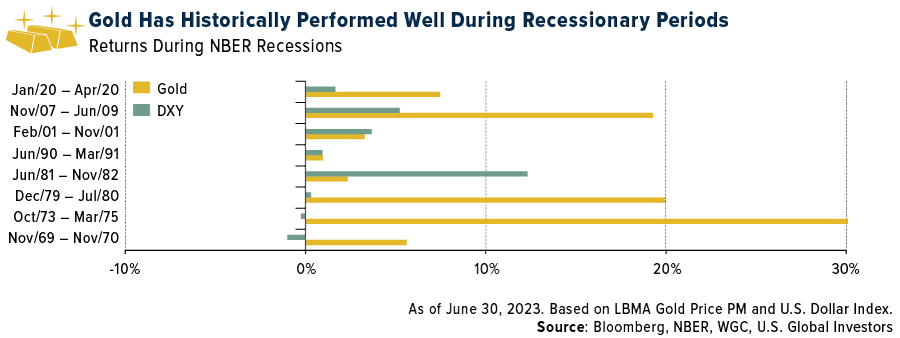

Gold was also positive in the first half, rising 4.93% and outperforming most other major assets. Its value was supported by a stable U.S. dollar and continued demand from central banks. The yellow metal was also sought by investors as a portfolio diversifier, particularly during the mini-banking crisis in March.

Central banks may be nearing the end of their interest rate tightening cycle, with the Federal Reserve expected to hike rates possibly one more time, especially after June’s strong jobs numbers. The market consensus suggests a mild economic contraction in the U.S. after the Fed pauses, along with slow growth in other developed markets.

Given its robust performance in the first half, gold is projected to remain supported in the second half of the year by factors such as India’s stronger economy, potential Chinese economic stimulus and continued hedging strategies. If the risk of recession persists, gold could see greater upside potential due to increased demand for high-quality, liquid assets, according to the latest report by the World Gold Council (WGC).

U.S. Global Investors

Monthly PMIs Could Be Pointing To An Economic Contraction

If the monthly PMIs (purchasing manager’s indices) are any indication, a recession could indeed be in the cards in the coming months. The Global Manufacturing PMI fell to 48.8 in June from 49.6 in May, extending a period of contraction for the 10th straight month. A reduction in factory output due to dwindling new orders and mounting pessimism drove this past month’s decline, impacting key regions such as the U.S., the eurozone, Canada, Japan and others.

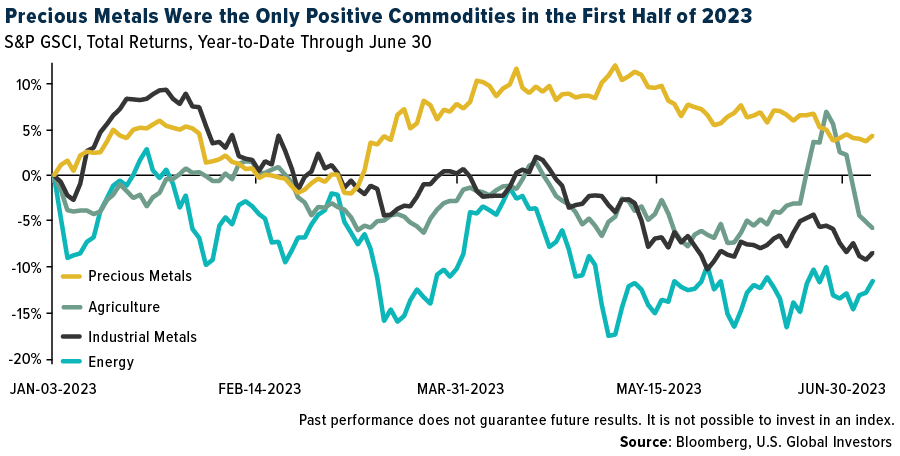

As I’ve said many times before, we believe the global PMI to be a forward-looking economic indicator. This is particularly true of commodity prices, which largely slumped in the first half. Year-to-date through the end of June, agriculture commodities fell 5.77%, industrial metals lost 9.55% and energy, including oil and natural gas, retreated 11.56%. Precious metals were the only positively performing group.

U.S. Global Investors

Notably hit were metals like iron ore and copper, significant indicators of cyclical portions of the global economy such as construction and manufacturing. These sectors are currently experiencing recessions in many regions.

A slowdown in China’s property market, which directly impacts demand for construction materials like steel, aluminum, copper and nickel, also contributed to the declines. Despite output cuts by the Organization of Petroleum Exporting Countries (OPEC), the downturn in oil prices is primarily due to weak energy consumption, especially in Europe, and China’s increased focus on coal production amid an energy crisis.

Global Oil Demand To Plateau?

Looking ahead, global oil demand is projected to plateau over the next decade before entering a period of decline, largely due to increasing vehicle efficiency and the use of alternative energy sources, according to a new report by BP. The British oil and gas company expects the decline to be more pronounced after 2035, with projections for 2050 ranging from 20 to 75 million barrels per day (Mb/d), depending on the extent of global commitment to net-zero emissions.

Emerging economies will maintain or slightly increase their oil consumption in the first half of the forecast period, contrasting with accelerating declines in the developed world. As a result, these economies will increase their share of global oil demand from 55% in 2021 to approximately 70% by 2050, BP writes.

The first half of 2023 saw lithium and gold rise as the only two commodities with positive returns, driven by the booming electric vehicle (EV) market and global economic uncertainties, respectively. However, most commodities struggled due to weakening global manufacturing and demand. Investors, therefore, may want to closely monitor lithium and gold, while adopting a cautious stance toward other energy commodities as the world moves toward a greener future.

Read the full article here