Investment Thesis

Beneath the surface of Luckin Coffee Inc. (OTCPK:LKNCY) a high-growth coffee business in China lies various challenges. It operates in a market where competition is high and is especially exemplified for itself as it uses convenience and price to differentiate. The extent of differentiation is limited with very similar products from competitors such as Cotti. Its stock seems to be undervalued with a 0.2 PEG ratio. However, such a ratio is artificially low and not a useful indicator. A PEG ratio based on forwarded earnings will be much higher and indicates reasonable valuation relative to peers. As of now for Luckin, due to low operating margins and its aggressive expansion strategies pursued, earnings are volatile and pressured downwards with unfavourable unit economics in the short term. In the longer term, growth potential is fairly robust but at a slower pace. Such expectation is reflected in its valuation. I will give Luckin a “hold” rating until further information.

The Luckin Story

Luckin Coffee was founded in 2017, in Beijing. The business model focuses on leveraging technology by having a fully mobile-based order system and a majority of stores being pick-up stores with each employing 1-2 baristas. The digitally-driven approach is what allowed Luckin to maximize efficiency and minimize cost. Luckin’s proposition encompasses its product being high-quality, low-cost, and convenient. For reference, a cup of coffee or any beverage costs around 10-20 RMB at Luckin vs. the 30-40 range for Starbucks and many other stores that are more “premiumized”.

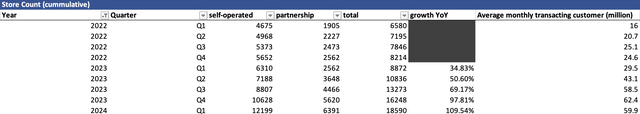

As of FY23, Luckin had nearly 16,000 total stores (self-operated + partnerships) and $3.5 billion in revenue. The expansion pace has been consistent for every quarter in the past 4 years as it started to be profitable back in FY21 with 8 billion RMB in revenue and 600 million in net income. In a similar period, Luckin was charged with $180 million for widespread fraud relating to inflated revenue figures in excess of 40% amongst other issues.

Luckin stock price

After the crisis, the company was able to pick itself back up by continuously expanding, reaching the revenue figure of 24 billion RMB in FY23 vs. 8 billion in FY 21. The high revenue growth rate has coincided with Luckin’s aggressive pace of adding new stores, which is becoming more and more unsustainable.

Luckin Coffee store count (Luckin Coffee, author)

Discussion Recent Performance and Valuation

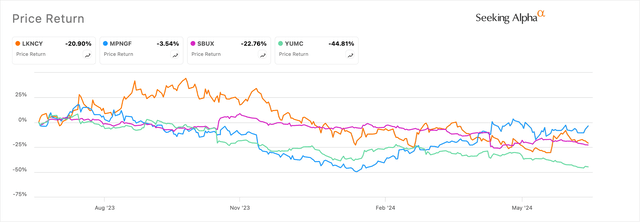

Seeking Alpha

Lately, consumer discretionary stocks focused on the China market performed poorly. Luckin Coffee’s share price is down 21% in the recent one-year period, in line with some of its peers. This is partially due to the overall uncertain sentiment of China’s macro-environment. In this environment, caution is advised, looking beyond stock fundamentals (see “risks” section), although the fundamentals are what this analysis will focus on.

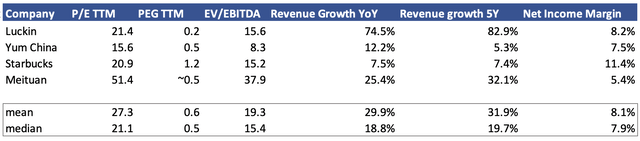

Comps and Multiples

Seeking Alpha, Author’s calculation

tickers: Luckin Coffee Inc. (LKNCY), Yum China Holdings, Inc. (YUMC), Starbucks Corporation (SBUX), Meituan (OTCPK:MPNGF).

As previously mentioned, Luckin’s stock seems cheap with its PEG ratio of 0.2 vs. the comp median of 0.5. Aside from the validity of such a ratio, the question is: can the growth trajectory continue? Recent performance in Q1 24′ would highlight considerable skepticism. The quarterly revenue was 6.3 billion RMB, a 41.5% YoY increase vs. a 102% YoY increase in total store counts. However, Its operating loss stood at 65 million RMB vs. 678 million RMB of operating income in Q1 23′. The reality is that the growth in demand for Luckin’s product lags the aggressive pace of store count expansions, and profitability suffered.

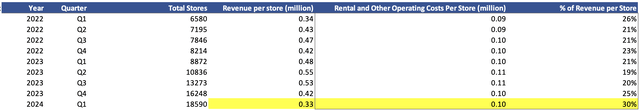

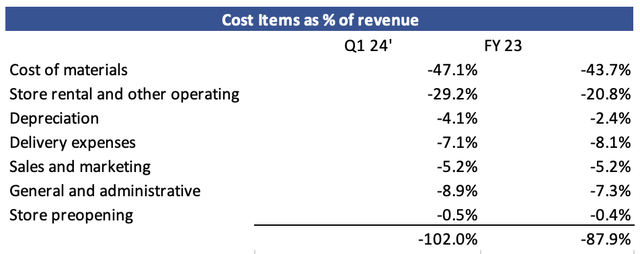

Store Profitability Challenged by High Rental Costs and Weaker Demand Growth

Luckin Coffee, author’s calculation

As we can see, revenue per store peaked at around Q2 23′. It has been declining consistently ever since, fuelling the recent quarterly operating loss where rental expense alone accounted for 30% of revenue. The increase in proportion is primarily driven by the decrease in revenue per store, raising the question of whether Luckin has been expanding at a pace to which demand can’t catch up. An unfavourable outcome is not unexpected in the competitive market that Luckin is in.

Challenging Market Dynamics and Opportunities in China

Competition for freshly brewed coffee is fierce in China considering dimensions of experience, product quality, and price. Barriers to entry are also low. Cotti Coffee, a major competitor of Luckin, has increased its store count by 6,000 in 2023 alone and has over 7,000 stores as of today. The brand is really quite similar to Luckin in regards to price range and product diversity, which is not surprising given that it was founded by two ex-Luckin executives. The fierce stand-off between the two brands is also highlighted by the proximity of store locations. But that is not it, there are also numerous other competitors such as Starbucks, Manner Coffee, localized cafes, or even restaurant cafes such as KFC and McDonalds.

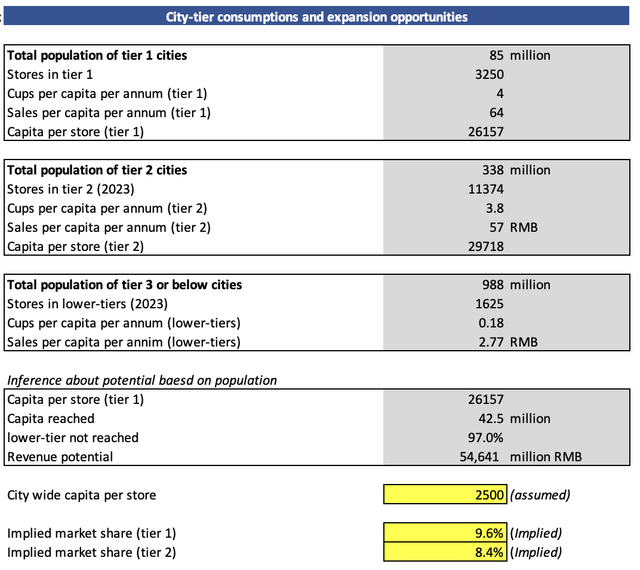

Based on the survey in 2022, Luckin’s market share in the China market is around 9%. Based on my rough estimate using recent store count data, the figure is in a similar range although the methodology is far from perfect.

Luckin Coffee, National Bureau of Statistics, author’s calculation

The majority of coffee consumption as well as Luckin’s store count are in higher-tier cities where 70% of stores are in tier-2 cities and 20% in tier-1. These are cities where coffee consumption is high in comparison to the weak average coffee consumption for China as a whole. However, based on the trend of recent financials, these are also cities where it seemed like Luckin’s expansion potential is hitting a limit as profitability fades.

To mitigate the risks from larger cities’ cut-throat competition, there are also lower-tier cities that inhabit around 70% of China’s 1.4 billion population and where the coffee penetration rate is low. Competitors such as Starbucks and Cotti are on their way to capture such opportunity. This news coverage provides a sample study of one of China’s lower-tier cities. Although per-store sales (~300 cups/day) are not as high, the growth potential in consumption is certainly there. If Luckin leverages these opportunities, it can continue to operate as a high-growth business for a while but at a level that is considerably lower than the massive growth figure in 2023. The revenue growth rate for the next few years will be around 25-45% in my opinion. This is based on the assumption that sales per store for lower-tier cities are similar to 2nd-tier cities, that it will capture most of the revenue opportunities within 10 years, and that revenue from higher-tier cities will continue to grow at a more moderate pace.

Valuation

Luckin’s current situation is not favourable as profitability is sacrificed for sales growth. Its short-term earnings are subject to extreme volatility due to its poor margins, the need for operations adjustments to heal profitability, and non-operating items that add to uncertainty. Looking back at the 0.2 PEG ratio, it is subject to significant external influences such as COVID-19 in the previous year, ultimately inflating the growth rate in FY23′. In such a context, using current or trailing earnings growth for PEG ratio comparison is generally not suitable for peers due to the same reasons. In the longer term, the growth opportunity is still fairly attractive and that is a much more important determining factor of Luckin’s share price.

Short-term Margin Deviates Against its Potential

Luckin Coffee, author’s calculation

Looking at consensus earnings, the CAGR for the next 3 years expected earnings growth is around 15%, yielding a forward PEG ratio of 1.2. In my opinion, this is quite reasonable given Luckin’s sales growth trajectory and expansion opportunities. Although its operating margin is weak in the short term, its gross margin is very high relative to its peers. There is certainly room for margin improvement as it adjusts its growth pace to a more sustainable level and gradually optimizes costs.

Risks

1) Methodology: I’ve presented my side of view, looking primarily at the fundamentals and multiples. The heuristic nature of looking at the selected metrics offers a conclusion that is uncertain. Further analysis and research are needed beyond this point in order to get a more precise range of intrinsic value.

2) Earnings volatility: Given low margins, earnings are highly sensitivity against operating margin, which may vary meaningfully depending on management’s decision and outside cost factors that are exogenous.

3) Economic and market catalysts: China is a market with persistent downward momentum and uncertain macro-factors. Sentiment is fairly correlated with policy measures that are difficult to predict.

4) Dependency on market narrative: Luckin Coffee’s current narrative is fairly positive in my opinion, namely how it is increasing its market share by leveraging its cost advantage. Before major catalysts such as earnings surprise, the stock price will likely continue to be supported by the positive narrative. On the contrary, that may change due to earnings shock. Although I believe long-term term growth expectation is what drives Luckin’s valuation. Short-term surprises vs. expectations should not be neglected.

Conclusion

We have looked at some of the facts regarding Luckin Coffee’s expansion outlook as well as my interpretations that are speculative. In Q1 24′, Luckin had around 19,000 stores combining self-operated and partnerships. The total store count grew more than 100% YoY whereas revenue grew at around 42% YoY. Sales have trouble keeping up with the pace of store count expansion given the competitive nature of the coffee market. This situation adds significant pressure and uncertainty for short-term performance.

Luckin currently has a PEG ratio of 0.2. However, that is not a meaningful metric given the excessive volatility in short-term earnings. In the short term, the company is facing major challenges in its unit economics, although the capacity to reverse that is sufficient given its innate cost advantage. Looking ahead, using a 3-year forward EPS CAGR (~15%) would yield a PEG ratio of 1.2. That is a fair consensus as we should expect a lower-growth regime for Luckin as the opportunity set for expansion has changed. For the time being, its valuation seems fair, and I rate the stock “hold”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here