Magic Software (NASDAQ:MGIC) looks appealing on the surface because of its low valuation compared to recent multiple expansions. However, I think that the company’s long-term growth is not as strong as one would hope for in a long-term investment. That being said, in the near term, I do think it is quite likely for the investment to rise in price significantly. My prediction for Magic Software is that there is considerable near-term alpha to be had, helped by its high dividend yield, but likely no alpha following this from holding the shares as a long-term investment for 5-10 years.

Operational Analysis

Magic Software is a global enterprise software company with a market cap of $495.41M. It was founded in Israel in 1983, and its core products and services are a low-code application development called Magic xpa, an enterprise integration solution called Magic xpi, a development environment for large-scale enterprise applications called AppBuilder, and an Industry 4.0 solution for manufacturers, called FactoryEye. The company serves thousands of enterprises and partners worldwide and has a presence in over 50 countries. It partners with major tech companies like IBM (IBM), Microsoft (MSFT), Oracle (ORCL), Salesforce (CRM), and SAP (SAP).

In my opinion, the company is positioned well to continue to capitalize on growth trends in digitalization. As more businesses seek digital transformation, I expect Magic’s low-code development platforms and integration solutions to grow. As an example of how the company is staying relevant, management is investing in Industry 4.0 and IoT solutions, particularly through FactoryEye. This will position the company to profit from the growing trends in smart manufacturing and IoT in the industrial sector.

Despite the positives, I do think there are long-term risks with this investment, which include a rapidly changing software and tech industry. It may be difficult for a smaller competitor like Magic to stay relevant amid high levels of consolidation from major players like Microsoft. In addition, the company is dependent on a small number of key customers, meaning that a loss of its major clients to other companies, which may begin to offer services at a reduced cost due to economies of scale, could result in big long-term losses and earnings misses for Magic moving forward.

In my opinion, the company is operating well and providing useful services for now, but the threat of stagnation and decline is also prevalent. It is one of the reasons, along with my financial and valuation analysis, that I consider Magic a Buy in the near term, but a Hold over the next 5-10 years. I do not expect it to beat the market once it is trading closer to a fairer valuation.

Financial & Valuation Analysis

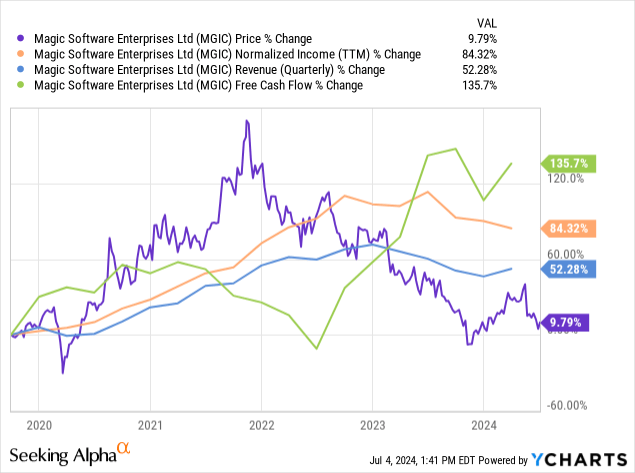

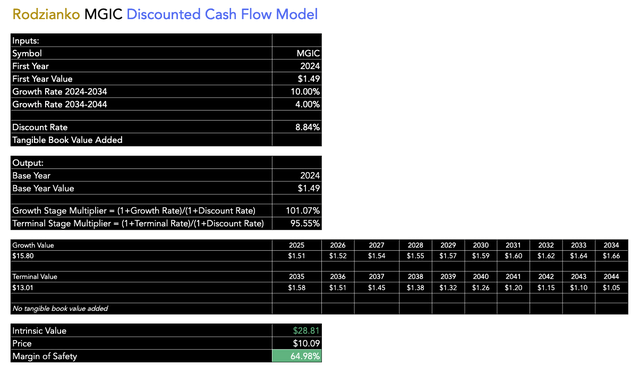

There is arguably an opportunity here in the company’s valuation because its net income and revenue have decreased much less than its stock price over the past two years. In addition, its free cash flow has remained notably resilient, even increasing for most of the period. This significantly impacts my favorable outcome in the DCF analysis I will present below. The growth in FCF has largely been supported by the change in accounts receivable, meaning accrued earnings had become due during this time.

Magic benefits from a stable balance sheet, with an equity-to-asset ratio of 0.51 and a debt-to-equity ratio, including lease obligations, of 0.38. However, it has taken on more debt long-term recently, with $41.6M in total long-term debt as of the last report, compared to $13.4M in 2020. While management likely does not want to extend the liabilities on the balance sheet any further, in my opinion, the current amount of leverage is sustainable without inhibiting future growth opportunities due to caution around introducing too much risk to the capital structure.

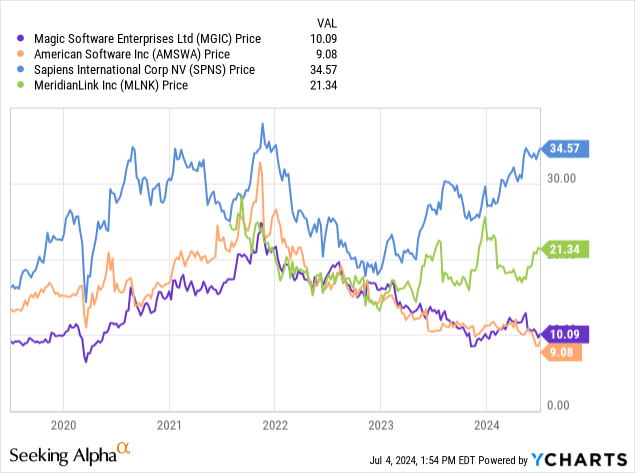

Magic faces significant competition from major big tech companies like Microsoft, IBM and Oracle, but there are also smaller competitors with a more akin market cap that are threats to its market share. These include American Software (AMSWA), Sapiens International (SPNS) and MeridianLink (MLNK).

Magic has been underperforming both Sapiens and MeridianLink in price growth, but I think this opens up a significant value opportunity for Magic.

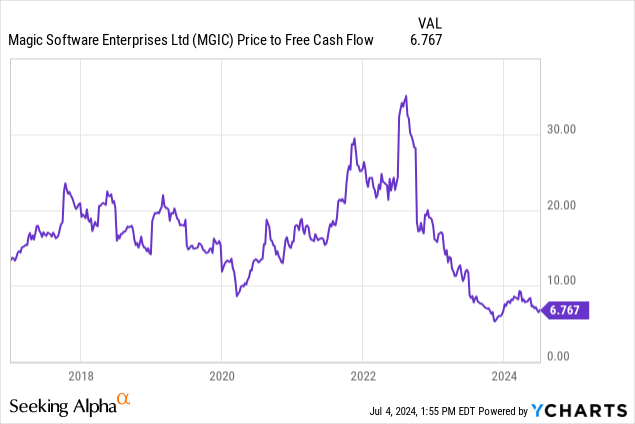

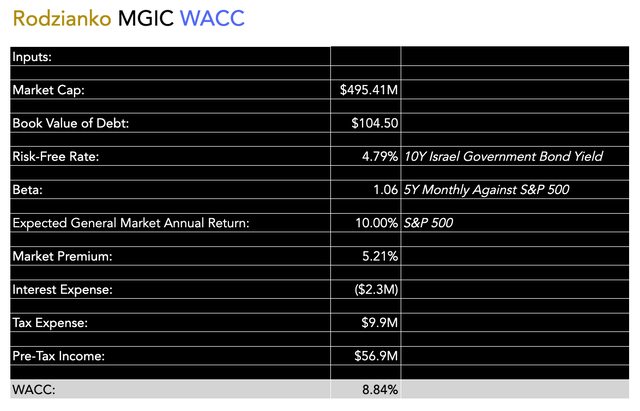

As a result of the depression in the price-to-free cash flow ratio, Magic is incredibly cheap on paper. I do not think it is trading anywhere near fair value right now, which is made even more evident by my DCF analysis of the company. Magic has delivered free cash flow growth of around 14% as a 10Y average and 19% as a 5Y average. Moving forward, I think a 10Y average 10% FCF annual growth rate is conservative to forecast. Following this, a more moderate 4% annual FCF growth rate seems reasonable to me for 2034-2044. For my DCF analysis, I used the company’s WACC for the discount rate.

Author’s Calculation Author’s Model

Evidently, the upside and margin of safety here are large, even by my conservative model. In my opinion, the stock is unlikely to reach this intrinsic value soon. Instead, I expect the price-to-free-cash-flow ratio to expand toward its 10Y median of 15.74 from its current 6.77. I think that as the company’s net income growth begins to normalize again, the price-to-free-cash-flow ratio is likely to expand. My reasonable estimate, although somewhat speculative, is that the company achieves a price-to-free-cash-flow ratio of 9 by December 2025 and that it achieves free cash flow growth of around 20%, making full-year FCF per share for December 2025 $1.79, as the current FCF is $1.49. That would make the stock price in December 2025 $16.11, implying a CAGR of 35%, as the current stock price is $10.09.

Further Risk Analysis

Despite the near-term upside here, which is leading me to potentially take a 12-month stake in the company while I assess its long-term potential in more depth, at this time, I do think that there is a considerable likelihood of the stock underperforming the market over 5-10 years. Despite a strong dividend yield of 5.3%, the stock has only gained 34.71% over the last 10 years. In my opinion, this makes the investment a poor choice for long-term investors, and this is made especially evident by the fact that the company’s earnings growth is unlikely to sustain above 10% annually over 10 years. This places the investment in a position where it is unlikely to develop significant long-term high sentiment in the market. Partly, I attribute this to the fact that its operational offerings are not geared toward high traction, and I think that the threat of consolidation from major big tech companies in application development through AI and cloud services should not be underestimated. Rivals like ChatGPT and Google (GOOG) (GOOGL) are likely to grow in proficiency in low-code and even no-code development interfaces, and I think it will become harder for Magic to compete over time.

Conclusion

In my opinion, Magic Software is significantly undervalued in the near term. I think it is probable that the stock will achieve a 30%+ return in a year or 16 months. However, over the long term, I see it highly unlikely that Magic will beat the market. Therefore, I think this is a great investment for value investors who are willing to watch the stock as it reaches fair value and then assess if the company has made any strategic pivots that may position it to develop higher price returns moving forward. Investors should not forget that the high dividend yield, especially if bought at this time, raising the yield on cost, could be a significant long-term benefit to multi-year and decade-long holders of Magic stock. The company is undervalued by FCF DCF measures, and it is not a business that is in decline. For that reason, Magic is a Buy.

Read the full article here