Invesco (NYSE:IVZ) is a Atlanta, Georgia-based global investment and asset management firm, handling retail and institutional clients through its Invesco, Trimark, WL Ross & Co, and PowerShares brands.

Invesco Q1’23 Presentation

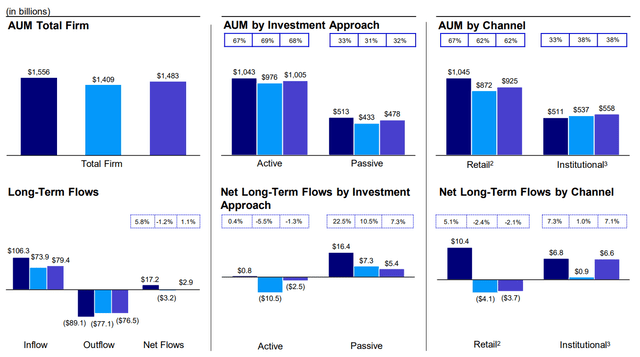

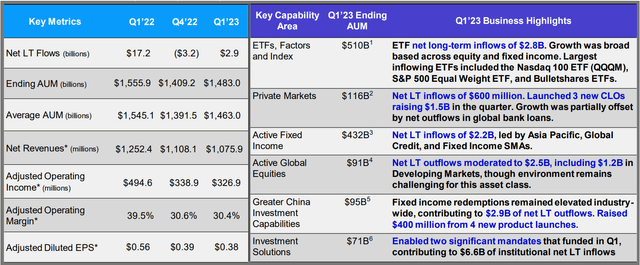

Over the past quarter, the firm has seen a reversion to long-term net AUM inflows as well as growth across all AUM channels and approaches. This has paired with small declines across revenues and operating incomes due to increased cost of capital and retail investor anxieties.

Invesco Q1’23 Presentation

Introduction

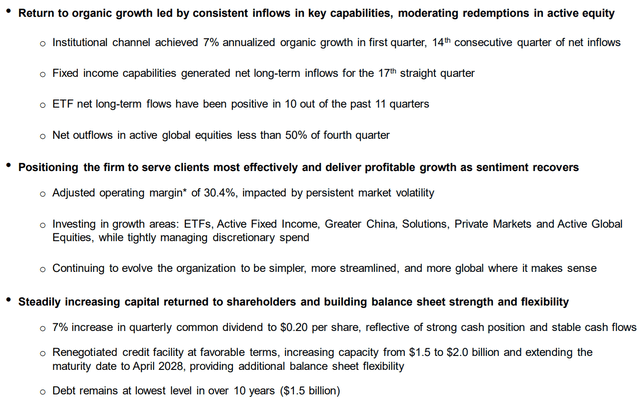

Invesco’s long-term objectives nonetheless remain the same; the company aims to drive organic scale growth by enhancing its core businesses, secondarily aiming for margin expansion through superior client services and optimally balancing reinvestment with shareholder returns.

Invesco Q1’23 Presentation

Although Invesco has seen an 8.12% cumulative return since my last article, the company’s continued commitment to scale expansion through AUM growth, its ability to return capital to shareholders, and a moderate undervaluation lead me to continue to rate the company a ‘buy’.

Valuation & Financials

General Overview

In the trailing 3M period, Invesco has seen 4.36% growth, trailing both the SPDR S&P Capital Markets Index (KCE)- up 8.00%- and the broad market, represented by the S&P 500 (SPY)- up 12.99%.

Invesco (Dark Blue) vs Industry & Market (TradingView)

The demonstrated underperformance mirrors the broader effect of continued interest rate hikes and poorer retail investor sentiment, leading to lower trading volumes across the firm’s ETF product mix.

Comparable Companies

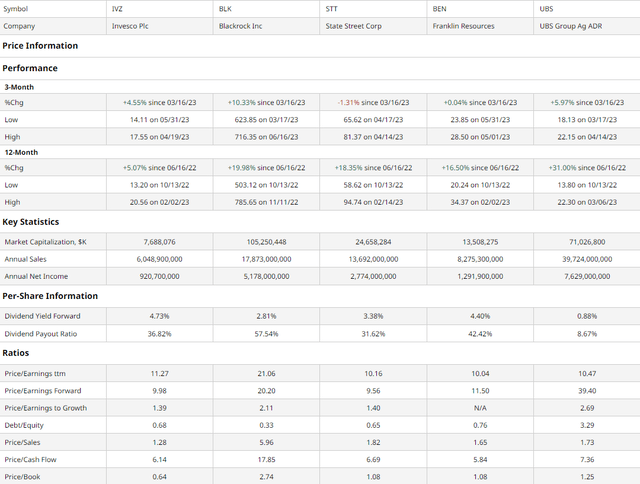

The asset management industry is inherently driven by scale and network effects, leading to a smaller number of larger, incumbent firms. These include >$10tn AUM asset manager BlackRock (BLK), the third largest asset manager State Street (STT), the more specialized Franklin Resources (BEN), and the Swiss megabank UBS (UBS).

barchart.com

As demonstrated above, though Invesco’s recent rally has reduced upside, the firm still has high levels of potential growth, both when looking at growth relative to peers, the firm’s superior multiples-based value, and Invesco’s ability to return capital to shareholders.

Exemplifying the firm’s value is its second-lowest forward P/E, the lowest PEG among peers, the lowest P/S, lowest P/B, and second-lowest P/CF.

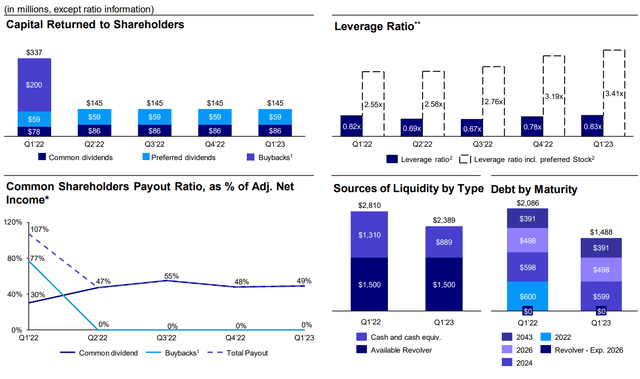

Moreover, alongside baked-in growth potential, Invesco has materially dedicated itself to investor returns, with the highest dividend amongst peers, with the lowest payout ratio adjusted for dividend size. More so than the dividend size, Invesco has committed to consistently raising its dividend, increasing it by 6.7% in Q1.

Valuation

According to my discounted cash flow analysis, at its base case, the fair value of Invesco is $17.84, meaning at its current price of $16.78, the stock is undervalued by 6%.

Calculated over a 5-year period without perpetuity, my DCF model assumes a discount rate of 9%, addressing an overall debt-average capital structure while incorporating recessionary risks and above-average implied volatility. Additionally, I assume a conservative revenue growth rate of 5%, lower than the 10Y average growth rate.

Alpha Spread

Alpha Spread’s multiples-based relative valuation tool more than corroborates my thesis on undervaluation, estimating an undervaluation of 49%, meaning the stock’s true value should be $32.68.

However, I believe Alpha Spread overestimates Invesco’s value due to its inability to account for beta and discount dividends in its evaluations.

Strong Inflows & Scaled Diversification Enable Shareholder Returns

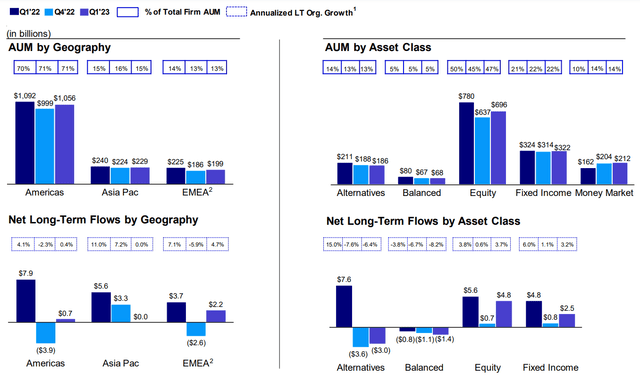

Through the headwinds and volatility of the past few years, Invesco has developed its resiliency strategy centered around prudent diversification, between geographies and asset classes alike. Through the said strategies, Invesco has seen considerable presence across the Americas, Asia Pacific, and EMEA regions as well as across asset classes. Moreover, in Q1, Invesco experienced the largest AUM inflows from the EMEA region, further promoting the firm’s diversification strategy.

Invesco Q1’23 Presentation

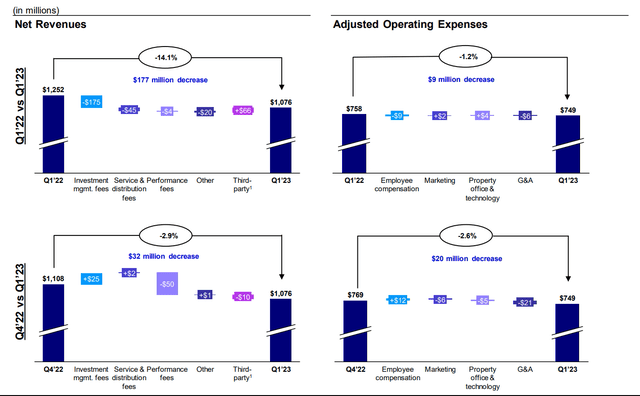

Invesco’s overall short-term strategy is best manifested by cash inflow and outflow locations. For instance, the company’s focus on scale-driven AUM growth has led to a significant windfall in management fees. Despite this, however, YoY and QoQ, Invesco has seen substantial declines in revenues alongside gradual increases in operating expenses, likely a product of the aforementioned pressures of higher interest rates and recessionary sentiments, though I believe the market approach is overly cautious.

Invesco Q1’23 Presentation

Despite these temporary pressures, though, Invesco remains committed to shareholder returns, principally through its best-in-class dividend, but also through opportunistic buybacks, all with capital discipline in mind.

Invesco Q1’23 Presentation

Wall Street Consensus

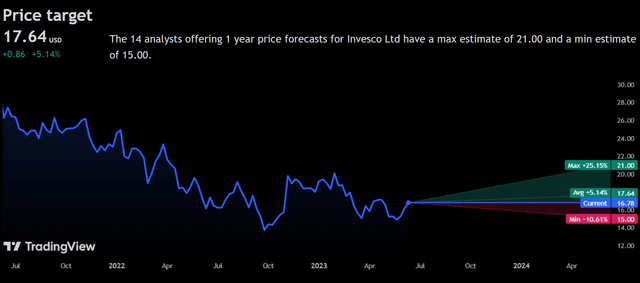

Analysts echo my positive- but less positive than last time- view on the stock, estimating an average 1Y price increase of 5.14% to a price of $17.64.

TradingView

Yet some investors estimate the minimum price target of $15.00, a 10.61% price decline. Though, when incorporating dividends and the overall volatility potential of the stock, Invesco remains in a healthy position in the worst case.

Risks & Challenges

Risks Remain Unchanged Since My Last Article

The principal risks I outlined in my last article were

- Poor Retail Sentiment – This came to be, with reduced trading volumes and fee generation from retail traders

- Third-Party Risk

- Accelerated Margin Compression – Was also realized, with QoQ reductions in operating margin

Conclusion

Although Invesco has rallied, they continue to maintain strong scale fundamentals and a disciplined capital allocation strategy, though sustained margin compression or appreciation may lead to a ‘hold’ rating next time.

Read the full article here