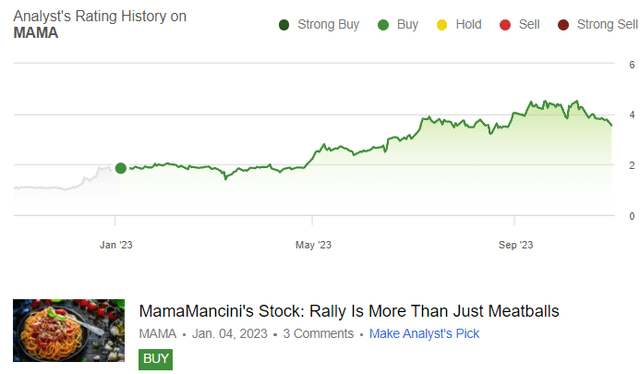

Mama’s Creations, Inc. (NASDAQ:MAMA) has drawn attention on Wall Street as a spectacular growth story with shares more than doubling over the past year. The food manufacturer specializing in fresh deli-prepared meal options has benefited from an expanding distribution network counting on major grocery store chains and big box retailers as key customers propelling sales.

This is a stock we covered at the start of the year when it was still known as “MamaMancini’s” before a corporate name change in August. We were bullish then but it’s fair to say the rally this year surpassed our expectations.

Fast forward, we’re eyeing a round of ongoing volatility with MAMA currently down about 25% from its recent high. Other than some weakness in consumer staples as a market segment and broader macro headwinds, we sense that this selloff is unjustified. We reiterate a bullish view on MAMA and see the current level as a buy-the-dip opportunity.

Seeking Alpha

MAMA Financials Recap

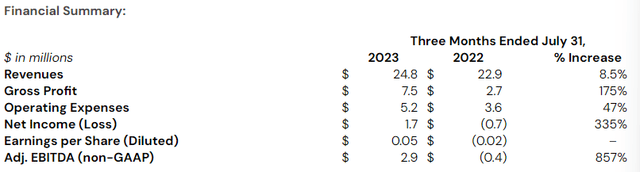

MAMA last reported its fiscal 2024 Q2 earnings back in September with EPS of $0.05, reversing a loss of $0.02 in the period last year. While revenue at $24.8 million was up by a relatively modest 8.5% year over year, that upside comes against an 89% increase in the comparable period, lapping the boost of new nationwide customer contracts last year.

The bigger shift is in underlying profitability as the gross profit increased 175% in Q3 with the company leveraging the benefits of its larger scale including the ramp-up of a new manufacturing facility. The gross profit margin at 30.2% was up from 11.7% in Q2 2022, flowing into an adjusted EBITDA of $2.9 million, turning positive this past year.

source: company IR

Other key developments has been the accretive impact of the company’s “Chef Inspirational Foods” acquisition which is expected to support higher margins into more premium segments going forward.

We mentioned the name change by MAMA with the reasoning being to reflect this expanded national profile into more deli categories beyond the original pasta bowls and meatball specialty.

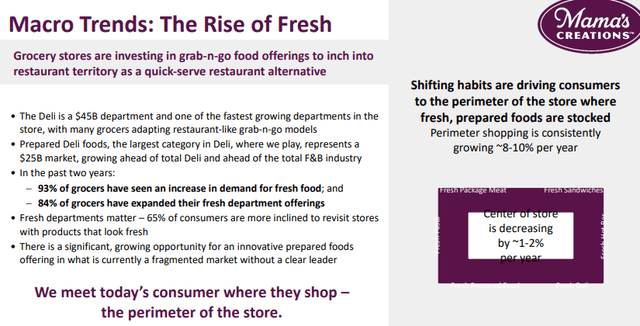

source: company IR

For reference, a large part of the company’s success has been the climbing demand for hot foods/ salad bars where customers at supermarkets are purchasing healthier ready-to-eat meals as an alternative to processed or frozen foods.

Mama Creations management explains that retailers are devoting more floor space to this category because it continues to outperform and drive store traffic.

Finally, we can mention that the longer-term strategy here is supported by a solid balance sheet. MAMA ended the quarter with $5.6 million in cash against $10.8 million in debt. Considering the annualized run rate for EBITDA approaching $12 million, the expectation is that there is further room for strategic acquisitions down the line.

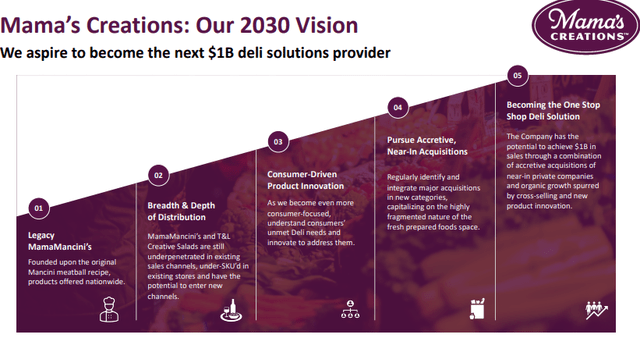

source: company IR

What’s Next For MAMA?

With a market value of just around $125 million, we’re looking at MAMA as something of a unicorn among “micro-cap” stocks in terms of this combination of strong growth, and earnings momentum, with a clean balance sheet.

Within the consumer staples sector, and sub-packaged foods industry, Mama Creations stands out as unique given its early leadership position in this emerging category of “fresh” or prepared deli foods, gaining the market against other grocery departments. The attraction here is its established relationships with the major sales channels representing core customers.

Overall, the setup is for a positive long-term tailwind where there is still room to add more customers as distribution partners as well as expand the offerings into more types of prepared foods.

According to management, the goal is to potentially reach $1 billion in annual sales by 2023, representing a compound annual growth rate of nearly 40% over the next 7 years including both acquisitions and organically.

source: Company IR

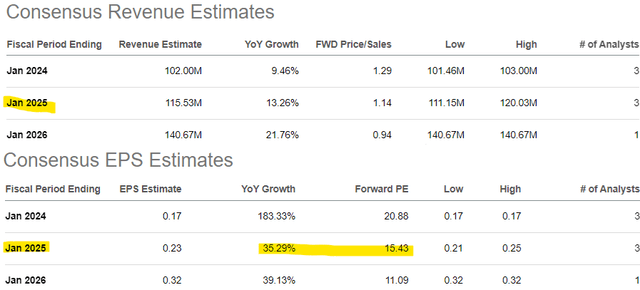

While that target can still be considered an aspiration, indications are that the company is moving in the right direction. In the near term, the earnings strength is the main driver of the stock as far as we’re concerned. From the forecasted 183% increase to current year EPS toward $0.17, the consensus is for that momentum to continue with a 35% earnings increase into fiscal 2025. The upside here is room for firming margins including through pricing initiatives.

Seeking Alpha

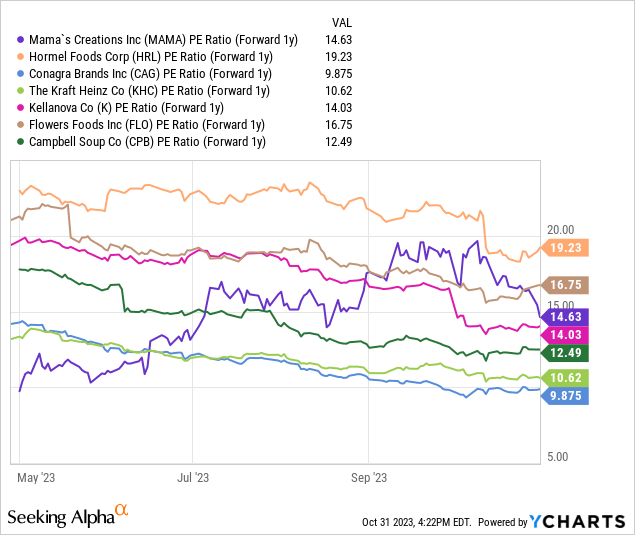

As it relates to valuation, we believe MAMA is trading at a 1-year forward P/E of 15x against the current 2025 consensus sizes up well next to larger packaged food stocks. The argument we make is that the company’s growth potential and near-term earnings trends justify a larger premium compared to names like Campbell Soup Co (CPB), Flower Foods Inc (FLO), Hormel Foods Corp (HRL), Conagra Brands Inc (CAG), and The Kraft Heinz Co (KHC) recognized as grocery store staples.

From the stock price chart, we can identify that the latest selloff in MAMA has driven shares to an area of technical support going back to a breakout in late June.

One reason for the weakness could be attributed to news of the cashing out on 5.6 million shares. The stock sold off by more than 5% on the report despite the sales having already been executed.

Our understanding is that the company’s former CEO Carl Wolf is exiting a portion of his stake consistent with his career retirement following more than a decade with the company. In our opinion, the move does not reflect a change in the company’s long-term outlook or the intrinsic value of the stock.

In other words, the volatility surrounding this transaction given the relatively small size of the outstanding float offers investors the opportunity to buy what may once again be an undervalued stock in our opinion.

Seeking Alpha

Final Thoughts

We rate MAMA as a buy with a price target for the year ahead at $5.00, effectively reclaiming the recent high. At this level, the stock would be trading at a 22x P/E multiple on the consensus 2025 EPS which we believe is a reasonable premium for the company relative to the sector.

In terms of risks, keep in mind that given the micro-cam profile of MAMA, wider swings of volatility including the potential for a deeper selloff are possible. The next few quarters will be important for the company to continue executing with metrics like the operating margin and number of stores where the products are sold as key monitoring points.

Read the full article here