Heading into the second half, now might be an opportune time to look at price action in risk-on cyclical sectors and industries. While the Magnificent Seven captured the awe of the financial media for much of the first two quarters of 2023, June featured a remarkable catch-up in some less-loved areas. One such niche is the metals and mining industry.

I have a buy rating on the SPDR S&P Metals and Mining ETF (NYSEARCA:XME). The fund features a low expense ratio, favorable valuation, and decent technical trends despite relative weakness for the better part of the last four months.

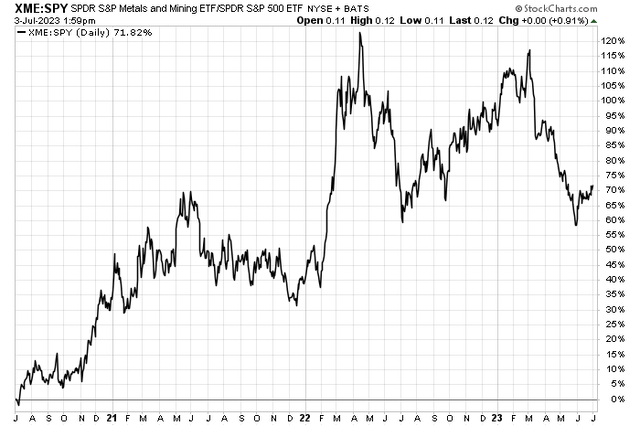

XME vs SPY: A Poor Relative Stretch Last 4 Months, Near Key Relative Support

Stockcharts.com

According to the issuer, XME offers investors exposure to the metals & mining segment of the S&P TMI, which comprises the following sub-industries: Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Precious Metals & Minerals, Silver, and Steel.

With a somewhat low annual expense ratio of 0.35%, XME offers an efficient way for investors to get exposure to global firms that should benefit from heavy investment into manufacturing activity.

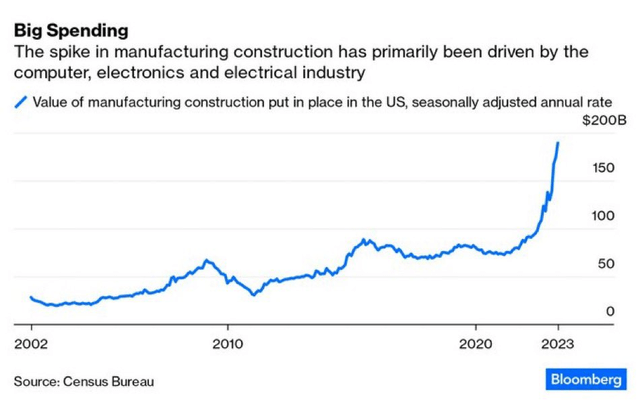

Does High Manufacturing Spending Bode Well for Metals & Mining Firms?

Bloomberg

Key mining products go into various manufacturing construction processes, and XME’s diversified sub-industry exposure is a positive attribute. With $1.8 billion in assets under management, the fund’s weighted average price-to-earnings ratio on a forward basis is low at just 8.3, though that is up modestly from when I last reviewed the ETF. Holding 33 total stocks, the weighted average market cap is $10.4 billion and XME’s trailing 12-month dividend yield is about on par with the S&P 500’s average at 1.7% and average volume is often near two million shares daily. Tradeability is indeed high as the ETF’s 30-day median bid/ask spread is a modest two basis points while the portfolio sells right near its NAV. It’s key for investors to recognize that XME is a modified equal-weight portfolio with most positions in the 3% to 5% weight range.

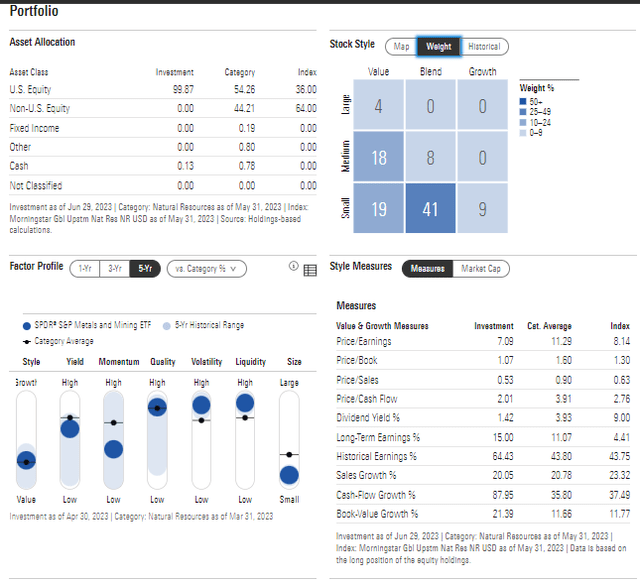

Digging into the portfolio, data from Morningstar reveal that XME is very much a SMID cap portfolio with a high emphasis on the value style (over growth). Factor-wise, XME also ranks high on quality and in volatility, though Seeking Alpha quant data show XME to be an A+ high momentum fund. Lastly, long-term earnings growth is robust, so the PEG ratio (once we get past this earnings soft patch) is less than one, using Morningstar’s figures.

XME: Heavily Small Cap, Value-Oriented

Morningstar

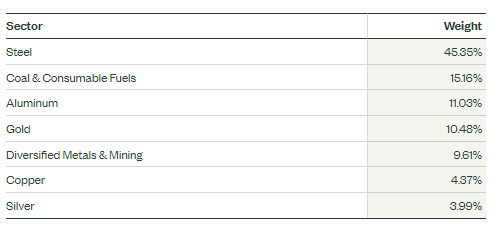

A key risk I find is that there is a remarkably high allocation to the cyclical and niche steel industry. So, should we see a round of poor earnings reports from major global steel companies later this month and in August, the fund could see volatility and downside price action.

XME: Steely Exposure

SSGA Funds

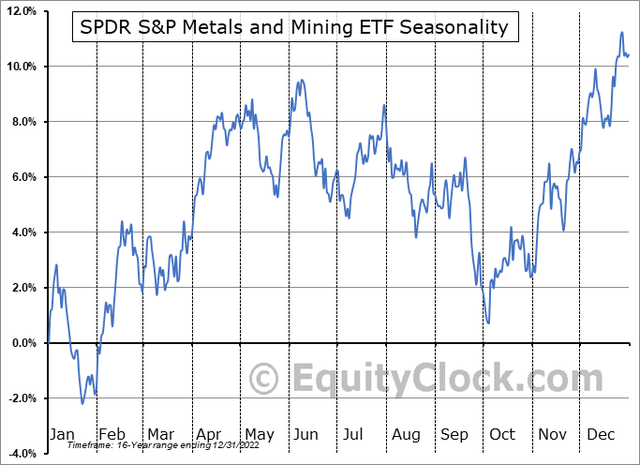

Seasonally, XME tends to do well in July, but the danger lies in the August and September months of Q3. More broadly and on average, according to data from Equity Clock, loading up in advance of Q4 is the better play. So, I assert the seasonal factor is neutral right now.

XME: Tough Seasonal Stretch Ahead (August – September)

EquityClock.com

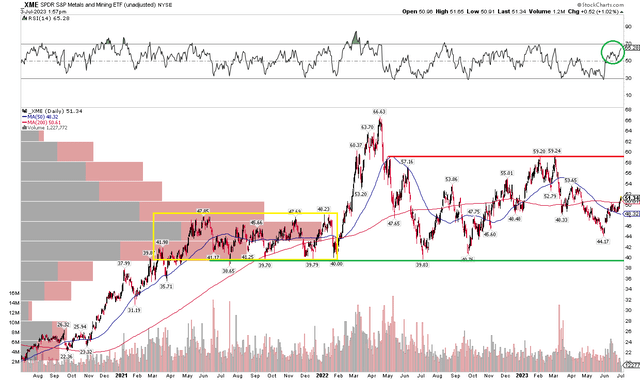

The Technical Take

There have been some interesting technical developments since I last looked at XME in Q4 2022. A trading range with a supportive base in the $38 to $40 range is countered by a resistance zone from $57 to $60. What I like, though, is that the old sideway price range in the $40s from 2021 proved to be key support on pullbacks over the last year-plus.

I must concede that the long-term 200-day moving average is simply flat, proving that there is no trend at the moment. What’s bullish is that the RSI momentum indicator at the top of the chart is solidly in bullish territory (between 40 and 90), so this momentum turn higher could portend future positive price action.

For now, the support and resistance levels mentioned previously are what we should monitor.

XME: Persistent Trading Range, But Strengthening RSI Momentum

Stockcharts.com

The Bottom Line

While there has been negative alpha owning XME (versus the S&P 500) over the last many months, I continue to like its long-run valuation. Recent positive momentum trends are encouraging ahead of the Q2 earnings season.

Read the full article here