Markforged (NYSE:MKFG) is an additive manufacturing solution provider differentiated by its use of binder jetting technology and focus on distributed manufacturing and composites. Growth has been fairly modest over the past five years and Markforged is yet to demonstrate that its business is financially viable. From a fundamental perspective, there is little to explain the stock’s recent move higher, but M&A activity involving 3D Systems (DDD), Stratasys (SSYS), Nano Dimension (NNDM) and Desktop Metal (DM) may be fueling speculation regarding a potential offer for Markforged.

Market

Additive manufacturing is a type of manufacturing where products are made by progressively depositing layers of a printing material. This process enables:

- Design flexibility.

- Mass customization.

- Greater complexity.

- Economical production of parts in low volumes.

- Faster product cycles.

Because of these properties, additive manufacturing has primarily been used for prototyping, but manufacturers are now beginning to utilize additive manufacturing at scale to create more complex products and customized products.

Some of the factors contributing to the growth of additive manufacturing include:

- Limited design flexibility of traditional manufacturing approaches.

- Shortage of skilled manufacturing workers.

- Supply chain disruptions.

- Increased focus on digital transformation and industrial automation.

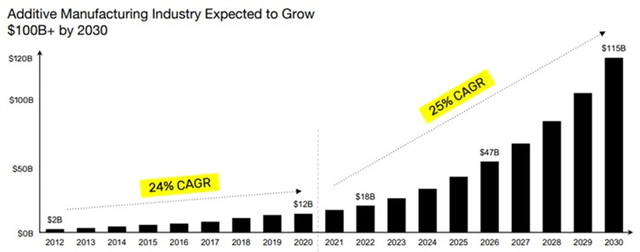

Markforged’s current market opportunity is 40 billion USD and is expected to grow to 115 billion USD by 2030. While the opportunity is large, Markforged’s revenue is still fairly small and growth modest.

Figure 1: Additive Manufacturing Addressable Market Opportunity (Source: Markforged)

Markforged

Markforged is an additive manufacturing solution provider which is differentiated by its focus on distributed manufacturing and composite materials. Markforged also offers metal binder jetting technology, which came through the acquisition of Digital Media in 2022.

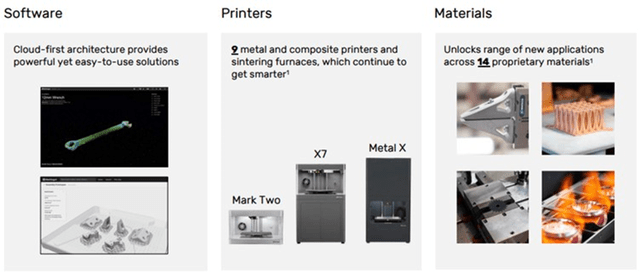

In the past, companies have had limited options between expensive industrial printers and hobby printers. Markforged aims at addressing this with the Digital Forge, a mini factory that delivers production parts at the point of need. In support of this, Markforged offers a range of software, materials, and printers (including desktop printers).

Figure 2: Markforged Solutions (Source: Markforged)

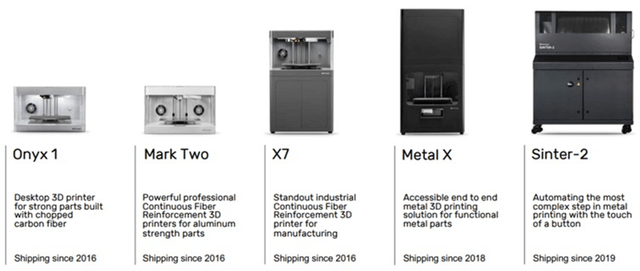

Markforged offers a range of printers (polymer and metal) that are targeted at different use cases, including:

- PX100 – Metal binder jetting solution for high-volume production.

- X3 – Fused Filament Fabrication 3D printer for micro carbon fiber filled nylon parts.

- FX20 – printer focused on the scale production of large, strong, high temp parts. The aerospace market is a key target for the FX20 and Markforged is pleased with early interest in this area. Customers are already using the FX20 for maintenance and repairs and there is growing interest in producing end use parts for new aircraft.

Figure 3: Markforged Printers (Source: Markforged)

Markforged’s software helps customers to prep designs for printing, manage the printing process, and scale operations. Markforged also offers simulation software to validate part performance and optimize print settings to ensure parts meet performance requirements while maximizing manufacturing efficiency. During metal binder jet printing, the post-print sintering process can cause distortions, making simulation software that can calculate this and adjust for it during printing a necessity.

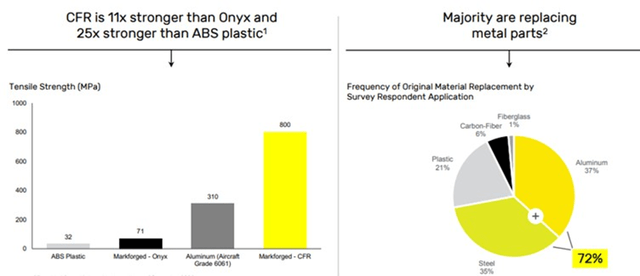

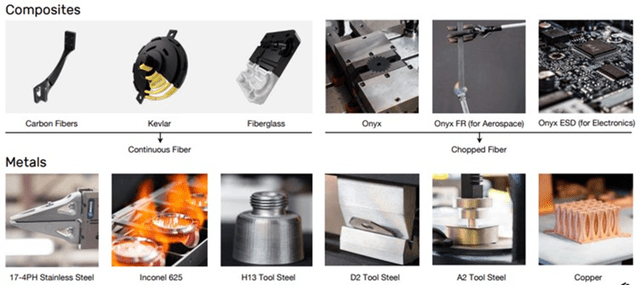

Material selection is an important part of the value proposition for binder jet printing companies, as extensive R&D is often required to determine optimal print parameters for a particular material. Markforged offers a wide range of proprietary composite and metal materials, and its composite material technology is a potential source of advantage. Composites can be stronger and lighter, leading to the replacement of traditionally manufactured steel and aluminum parts.

Figure 4: Illustrative Uses of Composite Materials (Source: Markforged)

Markforged offers the Continuous Fiber Reinforcement process for the production of composites. This process uses continuous strands of composite fibers to improve the properties of parts. A CFR-capable machine uses two extrusion systems, one for conventional FFF polymer filament and a second for long-strand continuous fibers. CFR parts are significantly stronger (up to 25 times stronger than ABS plastics) and can replace machined aluminum parts.

Figure 5: Markforged’s CFR (Source: Markforged) Figure 6: Markforged Materials (Source: Markforged)

Markforged’s product portfolio places it in competition with a range of companies. Competition in the binder jet printing space is primarily between Markforged, Desktop Metal, HP and GE Additive. Desktop Metal offers faster print speeds due to its single-pass jetting approach, but Markforged appears to offer greater resolution/tighter tolerances.

Additive manufacturing is still a fairly fragmented market, with a broad range of competing technologies and vendors. As a result, many companies have struggled to create profits or sustainable growth. While Markforged has achieved a reasonable level of traction in the market, ongoing losses and modest growth mean its long-term future remains unclear.

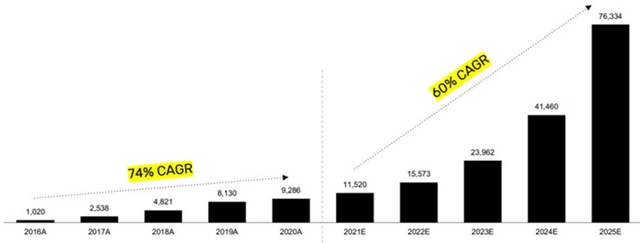

Figure 7: Markforged Installed Base of Active Online Printers (Source: Markforged)

Financial Analysis

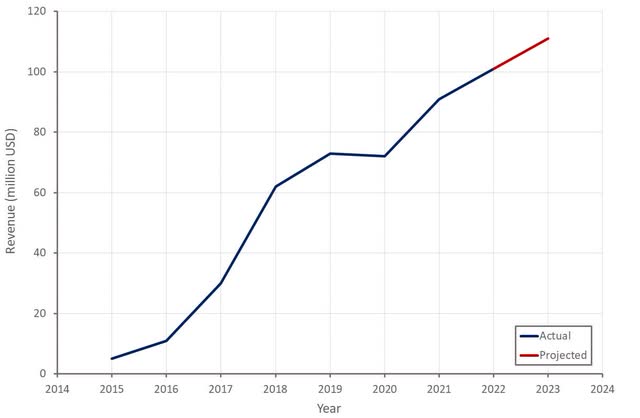

Revenue increased by 10.2% YoY in the first quarter of 2023 with growth being driven by manufacturers adopting Markforged’s metal and composite solutions. Demand is coming from the automotive, luxury goods, consumer electronics and telecom industries. The company’s pipeline is particularly strong in North America, which is also Markforged’s largest region. While the company’s pipeline is strong, some customers are delaying purchase decisions and access to capital is an issue for smaller businesses. Markforged is currently expecting 2023 revenue to be in the range of 101-110 million USD, which would represent roughly 4% YoY growth.

Figure 8: Markforged Revenue (Source: Created by author using data from Markforged)

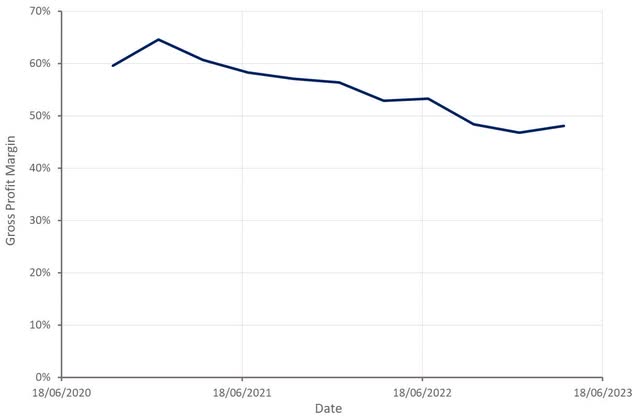

While Markforged’s gross profit margins are still quite high, they have declined significantly over the past two years. Margins have been negatively impacted by freight and logistics costs, as well as material and labor costs. Markforged expects that gross profit margins will return to historical levels over the long term though, and it appears likely that margins have already bottomed with cost pressures beginning to ease.

Figure 9: Markforged Gross Profit Margin (Source: Created by author using data from Markforged)

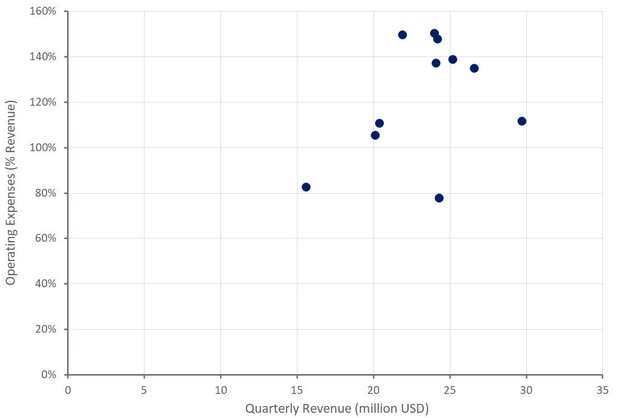

Operating expenses have also been elevated in recent periods, but a combination of revenue growth, higher gross profit margins and better operating expense control should begin moving Markforged towards profitability going forward. Operating profit breakeven may take several years to achieve at the current growth rate though. The company’s cash balance is large relative to the current cash burn rate though, which gives the company a substantial runway in which to resolve issues.

Figure 10: Markforged Operating Expenses (Source: Created by author using data from Markforged)

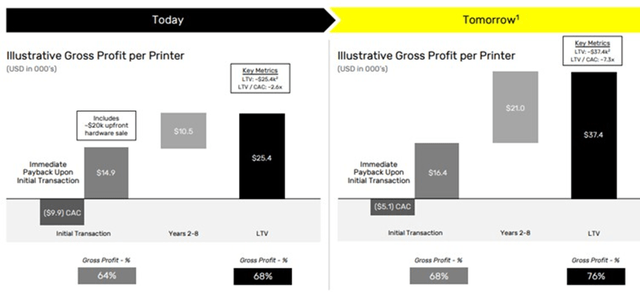

Markforged expects its unit economics to be highly attractive in the future, which should eventually lead to reasonable profit margins. Whether this actually ends up happening will depend on market structure and Markforged’s competitive positioning.

In the metal binder jetting space companies are likely to try and use tight integration between printing materials, binder materials and printer hardware to drive high margins on consumables. A similar dynamic could also play out with composites. The adoption of additive manufacturing in higher volume applications should increase consumable revenue and contribute to improved margins in the future.

Figure 11: Illustrative Unit Economics (Source: Markforged)

Conclusion

At the time of listing, Markforged was projecting in excess of 700 million USD revenue in 2025. Based on recent performance Markforged will struggle to reach even half of this amount. This reflects current manufacturing headwinds and the continued failure of additive manufacturing to live up to hype as much as anything Markforged specific though.

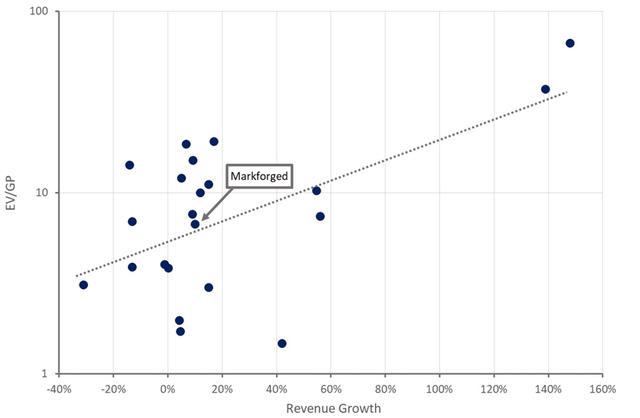

Despite weak fundamentals, Markforged’s stock is up nearly 200% over the past three months. This could be due to growing optimism regarding the economic outlook, a low starting valuation, or speculation regarding a potential acquisition offering.

Enthusiasm should probably be tempered at this point though. While Markforged’s margins should improve going forward, growth is likely to remain soft. It is also not clear who would want to acquire Markforged. Most additive manufacturing companies are in search of scale to try and improve profitability, and Markforged doesn’t really offer this. Even if an offer does eventuate, it is unlikely to be at a substantial premium to the current share price.

Figure 12: Markforged Relative Valuation (Source: Created by author using data from Seeking Alpha)

Read the full article here