Marsh & McLennan (NYSE:MMC) released their Q3 FY23 results on October 19th, demonstrating significant achievements. They delivered a remarkable 10% growth in organic revenue, accompanied by a 24% increase in adjusted operating income and an impressive 33% surge in adjusted EPS. These figures showcase their robust performance and ability to thrive across economic cycles. Furthermore, their exceptional management of operating expenses further strengthens their position in the market.

Given their strong performance and strategic management, I recommend investors seize the recent market pullback opportunity to consider investing in Marsh & McLennan. I reaffirm my “Buy” rating for MMC, setting a new target price of $210.

Q3 FY23 Review

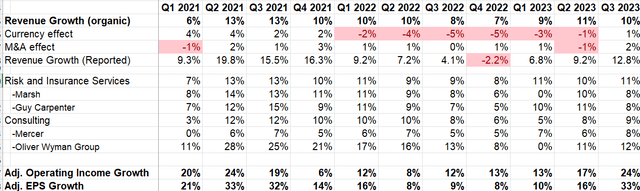

It is quite a strong quarterly result for Marsh & McLennan. They achieved 10% organic revenue growth in Q3 FY23, on top of the 8% growth in Q3 FY22. Their adjusted operating margin expanded by 170 basis points compared to Q3 FY22.

MMC Quarterly Results

For the FY23 guidance, they expect 9-10% organic revenue growth and strong growth in operating income and EPS for the full year.

Regarding capital allocation, they utilized approximately $1 billion in cash during the quarter, including $353 million for dividends, $368 million for acquisitions, and $300 million for share buybacks. Their capital allocation has remained consistent in the past, as they continue to deploy cash from operations toward dividends, buybacks, and acquisitions. For the full fiscal year of FY23, they anticipate deploying $4 billion in total capital, encompassing dividends, share repurchases, and M&A activities.

It is worth noting that in the first three quarters, their free cash flow increased by 36% year over year, reaching $2.18 billion in YTD FY23. This robust cash flow generation stems from strong underlying revenue growth as well as prudent expense control. I will discuss their expense management later.

Growing Portfolio Across Economic Cycles

In their Q3 earnings call, the management mentioned several times that their portfolio is well-positioned across economic cycles. They indicated that they have invested in talent, sales operations, and client engagement models to better position themselves to perform across different economic cycles. They provided an example of a significant acquisition they made in the Aerospace and Defense end-market last year, which they saw as more robust throughout the cycle. The acquisition they referred to is the Avascent acquisition made in November 2022. Avascent is an Aerospace and Defense management consulting firm focused on the corporate and private equity sectors.

I believe their Avascent acquisition makes total sense in the current macro environment. On one hand, the Aerospace and Defense management consulting business operates on a different cycle compared to traditional insurance industries. For Marsh & McLennan, a less correlated portfolio could reduce their sensitivity to macroeconomic fluctuations. On the other hand, current geopolitical risks are increasing, and there might be a growing demand for Aerospace and Defense services globally. Thus, the acquisition aligns with their long-term strategy to shift more toward high-growth areas. I discussed this high-growth focus in my initiation article titled “Marsh & McLennan Companies: Mix Shift Towards Higher Growth Areas.”

Superior Expense Management

Marsh & McLennan is aiming to grow their top line faster than their operating expenses. In Q3 FY23, they continued their restructuring actions and indicated that they had identified additional opportunities to rationalize technology, reduce their real estate footprint, and realign their workforce. They have increased their target to achieve total savings of $400 million by FY24, with approximately $225 million expected to be realized in FY23.

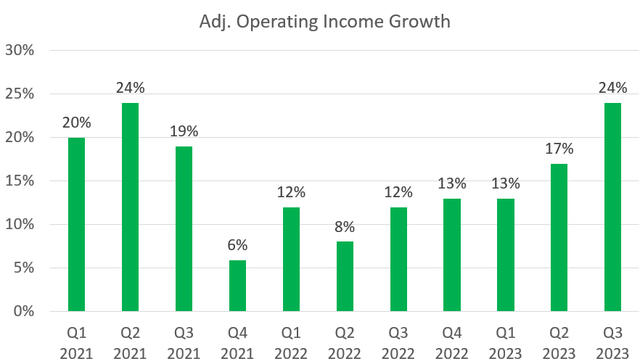

I appreciate their expense management approach, and these restructuring initiatives have already been reflected in their adjusted operating income growth over the past few years. They have experienced strong earnings growth as a result.

MMC Quarterly Earnings

Their restructuring initiatives span various areas, including IT, operations, and back offices. I believe these actions are vital for their future growth and margin expansion. Firstly, as Marsh & McLennan gradually shifts its business portfolio towards higher-growth areas such as cybersecurity, sustainable investing, affordable healthcare, and digital services, they require a different set of talents. Consequently, some legacy functions need to be eliminated. Secondly, their Consulting business relies heavily on human capital. It is crucial to enhance productivity, which necessitates the modernization of their IT platform and more efficient supporting teams. This improvement mandates continuous restructuring of their operations. Lastly, to generate operating leverage, the management team must ensure that expense growth remains lower than the top-line growth.

Key Risks

I mentioned in my initiation report that their Consulting business could be volatile in a weak macro environment. However, this quarter, their Consulting business showed a robust 9% organic growth, which is quite impressive. For the first nine months of FY23, consulting revenue increased by 7%. The management expressed that Mercer (a main unit of their Consulting business) had its best quarter of growth in the past 15 years.

I believe the robust growth in their Consulting business is a result of their strategy to shift towards higher-growth areas. They have been investing in Mercer’s Investment business over the past few years, and these Mercer investment solutions now offer services beyond consulting advice. They cover investment management, operations, implementations, as well as efficiency management. These additional service offerings can help generate extra revenue and offset any weaknesses in the traditional consulting advice business.

Valuation

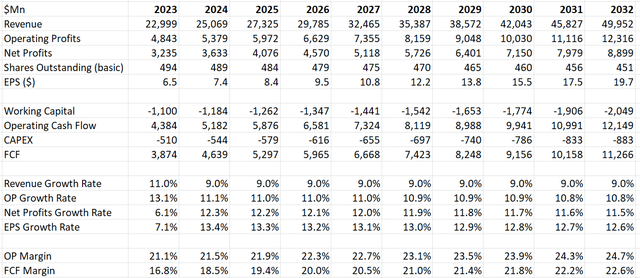

Considering their strong Q3 FY23 results and the management’s confidence in the full-year growth, I have increased the revenue growth assumption for FY23 to 11%, comprising 9% organic revenue growth and 2% from acquisitions. I have kept the rest of the assumptions intact.

MMC DCF Model

The revised fair value is $210 per share, calculated after discounting all the free cash flow and adjusting the net cash and debt balances. Considering the recent market pullback, the stock price is undervalued.

Conclusion

I remain confident that Marsh & McLennan can grow their business across economic cycles, and the stock price is undervalued. I reiterate my ‘Buy’ rating with a target price of $210.

Read the full article here