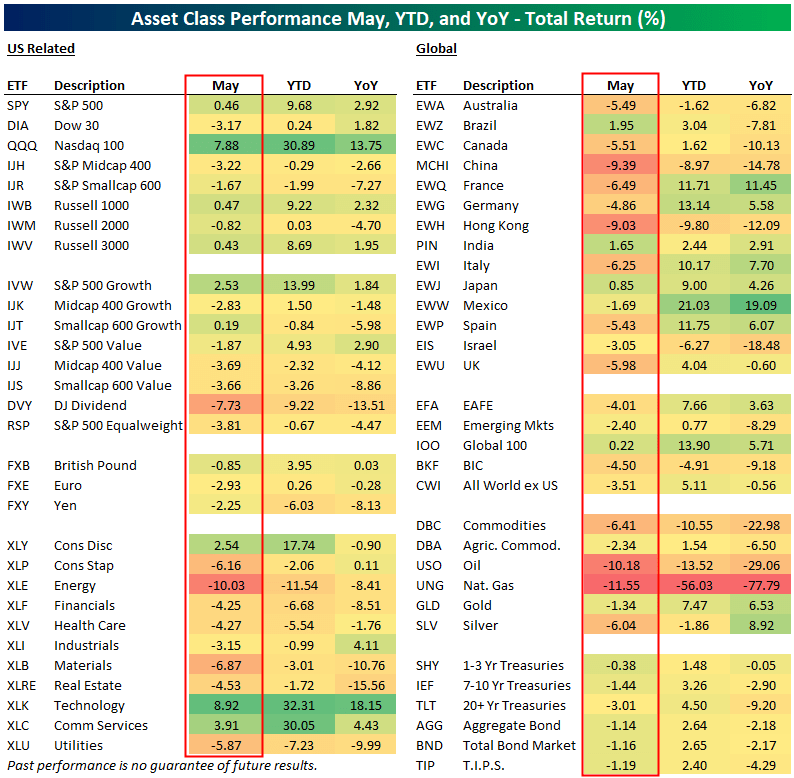

May 2023 is now behind us, and below is a look at how various asset classes performed during the month using US-listed exchange-traded products as proxies. We also include YTD and YoY total returns.

May was a month of divergence where Tech/AI soared, and the rest of the market fell. Notably, the Nasdaq 100 ETF (QQQ) gained 7.88% in May while the Dow Jones Dividend ETF (DVY) fell 7.7%. That’s a 15 percentage-point spread!

At the sector level, it was a similar story. While the Tech sector (XLK) rose 8.9%, sectors like Energy (XLE), Consumer Staples (XLP), Materials (XLB), and Utilities (XLU) fell more than 5%. In total, 8 of 11 sectors were in the red for the month.

Outside the US, we saw pullbacks in most areas of the world other than Brazil, India, and Japan. China, Hong Kong, France, Canada, Italy, Spain, and the UK all fell more than 5%.

All of the commodity-related ETFs/ETNs were in the red for May, with oil (USO) and natural gas (UNG) falling the most at more than 10% each.

Finally, fixed-income ETFs also fell in May as interest rates bounced back. The aggregate bond market ETF (AGG) was down 1.14% in May, leaving it up just 2.6% YTD and down 2.2% year-over-year.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here