Thesis

Most consumer discretionary stocks performed well relative to the broader market over the past couple of years, capitalizing on their defensive attributes during a turbulent time for the market. McCormick & Company (NYSE:MKC) is a well-known spice, herb and condiment manufacturer within the food industry and in this analysis, I will dig into the company’s financial performance and its valuation.

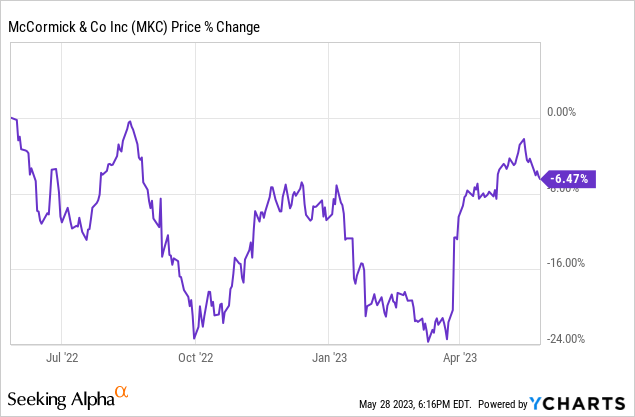

Over the past year, MKC has seen elevated levels of volatility, recording drawdowns over -20% a couple of times. Despite recently showing signs of recovery, still, the stock has returned a negative, -6.47% price change, underperforming the broader market. Currently, MKC trades at $86.93 per share ($23.32B market cap) and pays a 1.79% dividend yield.

The Business

McCormick & Company is a global manufacturer and distributor of spices, seasoning mixes, condiments and other food products, with operations based in North America. The company operates in two business segments; Consumer and Flavor Solutions. The Consumer segment includes all of McCormick’s brands that cater to the retail consumer (McCormick, French’s , Frank’s RedHot, Lawry’s Cholula Hot Sauce and others) across the world. Two-thirds of the consumer segment sales are spices and seasonings and condiments and sauces. On the other hand, the Flavor Solution segments provided food manufacturers with a wide range of seasoning blends, spices, herbs, condiments and others.

2020 Acquisitions

During a turbulent 2020 market, filled with uncertainty for the future of many companies, McCormick not only saw revenue continuing to increase, but the company also completed two significant acquisitions.

On December 30, 2020x, McCormick completed the acquisition of FONA International for approximately $708M net of cash acquired. FONA is a leading manufacturer of clean and natural flavors across different applications for the food, beverage and nutritional markets, targeting a wide range of consumers. The second major acquisition of 2020 was finalized on November 30, when McCormick completed the purchase of Cholula Hot Sauce for approximately $800M. While the second transaction is aimed more toward widening the company’s product portfolio, the FONA acquisition looks to bring more value-added to MKC by adding manufacturing capacity and increasing the scale of operations.

Sales Growth and Profitability Concerns

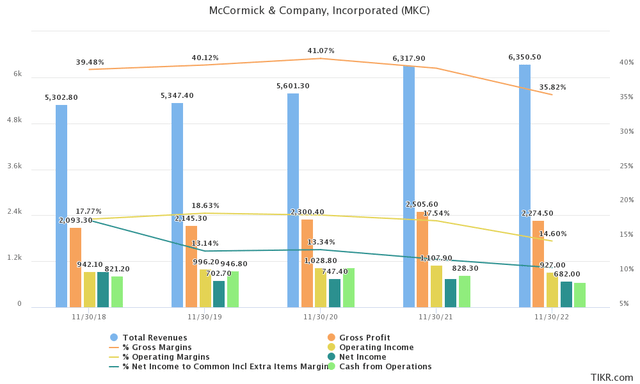

Despite broader economic disruption by the Covid-19 pandemic and global inflationary pressures, over the past 5 years, McCormick has managed to carve an uninterrupted moderate growth path for the company’s sales. Revenue has grown at a 5.02% CAGR since 2018, increasing from $5.3B to $6.4B. Operating income has seen lower growth, increasing from $2.1B in 2018 to $2.3B in 2022. Net income has actually decreased over the same period.

A main concern that becomes immediately clear has to do with MKC’s profitability. Margins have decreased across the board over the past 5 years, with gross margins falling from 39.5% to 35.8% and operating margins decreasing from 17.8% to 14.6%. On the flip side, MKC still maintains relatively strong profitability compared to sector averages.

Tikr.com

A more optimistic image was painted as the company delivered strong Q1 results, beating on non-GAAP EPS and revenue. The outlook for 2023 (looking for 5-7% top-line growth) was also reaffirmed.

For the next years, McCormick’s management maintains an optimistic forecast, looking for sales growth in the 4-6% range and EPS growth between 9-11%. Analysts seem to also share the optimism looking for $2.63 in EPS for 2023 and $6.75B in sales. A couple of years down the road, for the fiscal year 2024, they expect MKC to generate $3.18 in EPS and $7.19B in revenue, practically adopting management’s expectation.

Cash Production & Balance Sheet

Cash flow generation has been consistently good for the business as it has generated cash from operations of over $600M annually for the past seven years in a row. Despite that, 2022 marked one of the company’s lowest-performing years in CFO generation in the last decade. Management expects strong Cash Flow generation performance in 2023.

Over the past few years, MKC has increased cash spent on capital expenditure ($270M 3-year average) as it attempts to grow both organically and through acquisitions. Currently, the company maintains a $357M cash stockpile and an $3.6B long-term debt balance.

Inventory Management

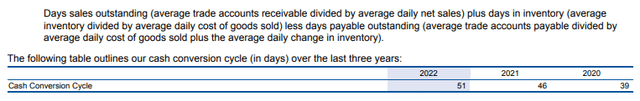

Another metric useful to gauge operational efficiency (especially with regard to inventory management) is the company’s cash conversion cycle (i.e. the number of days it takes the business to convert inventory purchases to cash through sales). A short and gradually decreasing cycle is ideal for companies, yet MKC has seen annual increases for both 2021 and 2022.

The apparent increase in the company’s cash conversion cycle was primarily due to an increase in days of inventory that management blames on rising cost inflation and lower-than-forecasted sales. The increase in the cycle is also somewhat attributable to the effects of precautionary inventory stock increase in order to combat persisting supply chain disruptions from Covid-19.

2022 10-K

Deteriorating effectiveness in the company’s inventory management leads to increased related costs that further hurt operational profitability. It could also be an indication that management struggles more than usual to forecast sales even in the short term.

Dividend Performance

McCormick pays a respectable 1.79% dividend yield, slightly higher than the market average, yet significantly lower than the sector median of 2.56%. The company also maintains a moderately high 60% payout ratio. In terms of dividend growth MKC is performing well; dividends have grown at a 10-year 8.9% CAGR and a 5-year 9.0% CAGR. Dividends remain a priority for MKC’s management as they look for a balanced use of excess cash, towards portfolio expansion, paying down debt and distributions to shareholders.

Peer Comparison & Valuation

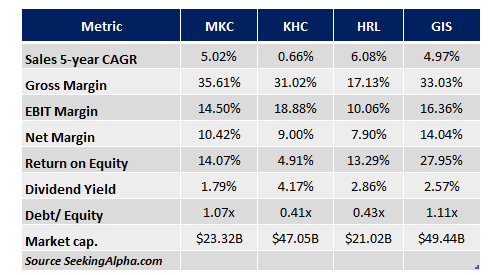

The food industry in the United States is led by a few key players many of whom present similar business characteristics. Before a deeper look into the company’s comparative valuation is given, it is proper to examine some key metrics of MKC in comparison to a few key peers. The peer group presented in this segment includes Kraft Heinz (KHC), Hormel Foods (HRL) and General Mills (GIS).

While McCormick is well positioned in terms of both revenue growth and profitability, compared to its peers, it lacks in dividend yield and it also exhibits relatively high leverage. General Mills appears to be the overall winner among the metrics presented in the table as it offers superior return on equity, bottom-line profitability and a decent 5-year sales CACG of 4.97%.

SA

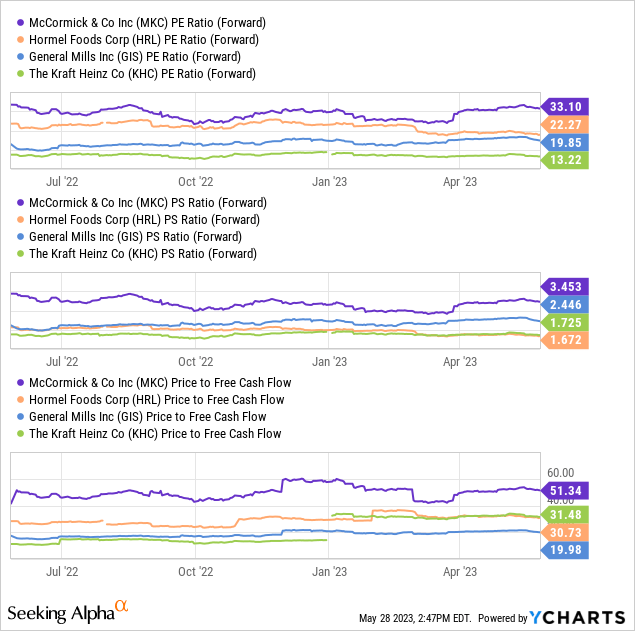

Even though MKC does not seem to particularly stand out in terms of performance, it maintains significantly higher valuation multiples compared to its peers. McCormick trades at a 33.1x forward P/E, a 3.5x P/S and an extraordinary 51.3x P/FCF. All three valuation multiples indicate a very expensive valuation, especially for the food industry.

Despite the fact that both management and analysts alike see some moderate growth ahead (mid-single-digit sales growth and low-double-digit EPS growth), this is hardly sufficient to justify such aggressive valuation multiples for a company that if anything should have a value appeal to potential investors.

Final Thoughts

McCormick’s financial performance offers mixed signals for the overall attractiveness of the company, as despite moderate sales, growth profitability and cash flow generation have somewhat declined over the past few years. The biggest sticking point for MKC however, is without a doubt, its valuation. The over-aggressive multiples that the stock trades at are likely to provide poor market performance for the stock over the mid-term. For this reason, I would rate MKC as a sell.

Read the full article here