I’ve been closely following the economic situation in China since 2021 when the country only started to recover from the COVID pandemic. However, the last several years turn out to be frustrating for the Chinese economy and stocks in particular.

Even despite an economic slowdown, I believe it’s a no-brainer that many of the Chinese stocks are grossly discounted relative to the rest of the world. Nonetheless, limited economic visibility severely constrains upside potential for the Chinese stock market, in my opinion. A questionable composition of the iShares MSCI China ETF (NASDAQ:MCHI) also makes it a not especially optimal way to invest in Chinese stocks.

The Endless Dip

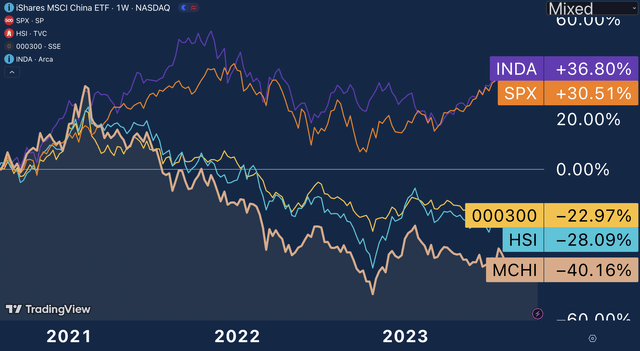

The performance of Chinese stocks has been disappointing in the last few years, to say the least. While the S&P500 continued to demonstrate pretty solid performance despite severe monetary tightening in the US, Chinese stocks significantly underperformed even with continuously easing monetary conditions.

Chinese indexes vs. S&P500 and Indian stocks (TradingView)

Not to mention that there’s been already a significant implied discount relative to the S&P500 and other developed (as well as developing!) markets. The INDA ETF, which tracks Indian stocks, has shown comparable returns with the American S&P500, so we can’t say that the underperformance of China is an “emerging markets” thing. Interestingly enough, the MCHI ETF has shown even worse results than two major Chinese indexes: CSI 300 and Hang Seng. This definitely has a lot to do with the holdings composition of the MCHI ETF.

Economic Matters

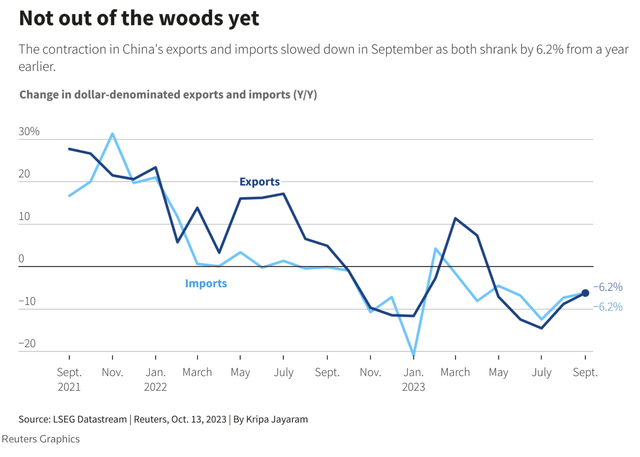

Fresh economic data on China gives us a mixed picture of what’s going on in the Chinese economy. Let’s take the latest imports and exports data for example.

Chinese exports and imports data (Reuters)

In September, Chinese exports fell by 6.2% year-over-year in US-dollar terms. That’s somewhat better than the -7.6% Reuters poll of analysts. Imports also fell by 6.2%, which is slightly worse than the 6% drop expected by the Reuters poll.

If we look at the month-over-month dynamic, then we can certainly notice an improving trend since July 2023. However, that’s a far cry from what we saw in the first months of the year when China only started to recover from harsh lockdowns in late 2022.

While exports keep contracting on a Y-o-Y basis, domestic demand also shows weakness. According to the most recent inflation data, China is balancing on the verge of deflation. This is an indirect sign that consumer demand stays low, and consumer confidence remains fragile. Given that the rest of the world is struggling with still-high inflation, many central banks could be envious of near-absent inflation in China, though deflation is no easier to beat than high inflation.

China’s CPI data (Bloomberg)

Therefore, the latest Chinese statistics indicate that the authorities would be required to stimulate the economy more aggressively by lowering interest rates and increasing lending. At the same time, more lending can be toxic for the country’s balance sheet, as China’s debt-to-GDP ratio has exceeded 280% (!), with a major portion of the debt held mostly by local governments of Chinese provinces.

A Real Estate Bubble

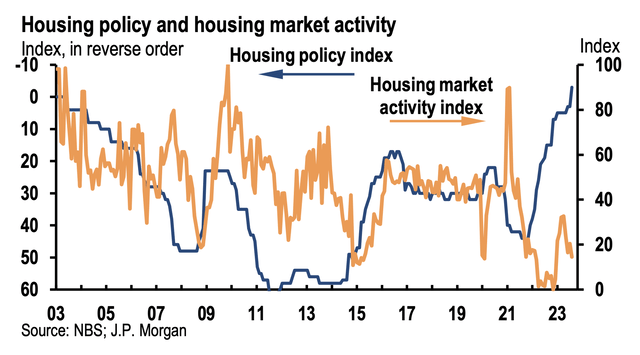

A huge elephant in the room is the situation in the real estate sector. Despite a dominating doom-and-gloom narrative about the collapse of the Chinese real estate market, I still tend to think the government has enough fiscal and monetary resources to limit the collateral damage from the bursting real estate bubble.

For reference, the real estate sector contributes about 30% of the country’s GDP, mostly because increasing infrastructure spending was an easy trick to artificially inflate the GDP growth for local governments. With a rapidly declining housing market activity in China in the last few years, the authorities have finally stepped up with more aggressive support measures for the sector, as reflected in the housing policy and activity indices tracked by JPMorgan (JPM).

Housing policy and market activity data (JPMorgan)

For example, the Chinese central bank lowered minimum down-payment ratios for both first-time and second-time home buyers and pushed commercial banks to cut interest rates for existing mortgages.

It remains unknown how effective the existing stimulus measures will be. My base scenario is that the government will manage to “defuse” the most financially volatile real estate companies like Evergrande (OTC:EGRNQ), and some private property companies will go bankrupt with limited damage to the rest of the economy.

On MCHI ETF

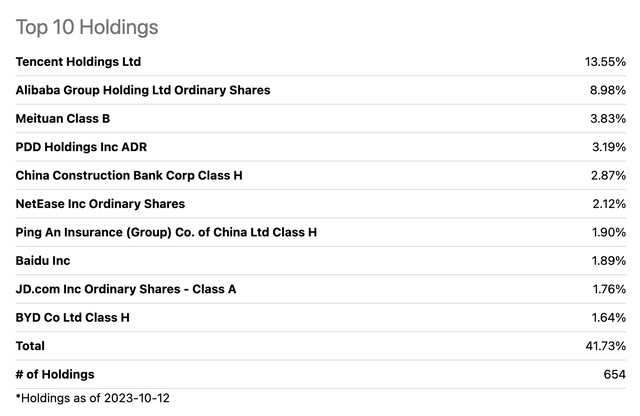

What I find particularly concerning about the MCHI ETF is the composition of the ETF. The ETF includes 654 Chinese companies, though two constituents, Tencent (OTCPK:TCEHY) and Alibaba (BABA) comprise a whopping 22.5% of the MCHI.

Top-10 Holdings of MCHI ETF (Seeking Alpha)

Out of the top-10 holdings (41% of the total ETF composition), 7 companies belong to either the tech or e-commerce sector. That makes MCHI a tough choice if you’d prefer a more balanced exposure to the Chinese stock market through an ETF.

The Bottom Line

The Chinese authorities are navigating through an extremely complicated domestic economic landscape, and there are no easy solutions to fix a plethora of imbalances (mostly in the real estate sector) accumulated by the Chinese economy over the last 30 years. A slow and underwhelming recovery of China from a period of hard COVID-related lockdowns, as well as anticipated global economic slowdown, add up challenges for the government of a historically export-oriented country.

For sure, the exhaustion of the Chinese economic model based on generous infrastructure spending and a strong focus on real estate will likely drag down the economic growth of China for years to come, though as I’ve mentioned above, I don’t expect a total meltdown of the Chinese economy given its economic capacity, scale, and still high importance for the global economy.

However, with a consistently weak consumer demand throughout this year amid a worsening economic outlook both for China and the world, I don’t think it’s a good time to get exposure to the Chinese stock market, especially in the form of MCHI ETF, which is heavy on domestically-focused companies.

Read the full article here