Introduction

On the whole, all destinations are growing very slowly, but not too slowly. From a regional point of view, the Medtronic plc’s (NYSE:MDT) most stable growth dynamics are in the United States, but other regions are not far behind either. Overall, the possible approval of the MiniMed 780G product will not have a significant positive impact on revenue: first, it is part of the Diabetes segment, which itself generates only 7% of revenue. Second, within the Diabetes segment, it takes about 15-17%, which yields about $100 m$ of quarterly revenue at best. Raised the dividend for the 46th consecutive year, and that’s a good thing. The bad thing is that at $900 m$ of quarterly payouts, the annual FCF of $4 b$ is barely enough to cover them, and the payout ratio is higher than others. To be fair, this is about 2023, which brought in the smallest FCF in the last 5 years. Perhaps 2024 can do better, which will reduce payout ratios. Notably, the company was one of the first to express interest in implementing AI and has already signed a strategic partnership agreement with Nvidia. Right now, it won’t bring any financial return, but it’s positive that management is keeping its finger on the pulse and trying to keep up with current trends.

The company showed good results in a seasonally strong quarter, but everything was spoiled by the forecast, which did not give full effect to the positive dynamics of quotations. Macroeconomic factors such as inflation, exchange rates and tax rates will have a negative impact on the company’s performance in 2024, which makes its outlook weak. Growth requires improvement in financial performance, which is not happening right now. Falling below $80 is also unwarranted from both a valuation and financial perspective.

Product development

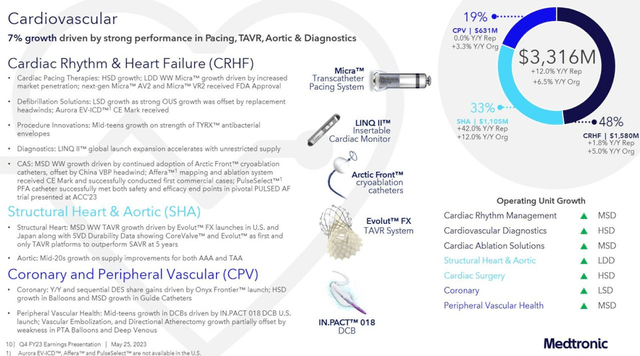

In terms of product development, the company is clearly a success here. For example: received FDA approval for the next-generation Micra AV 2 and VR 2 pacemakers, which extend battery life by 40% to an estimated 16 and 17 years, respectively. In March, the PULSE AF baseline study, which examined the PulseSelect PFA single catheter, showed excellent results. Have submitted a PMA application to the FDA and expect to be one of the first companies with a PFA catheter on the U.S. market. Obtained CE marking for the Affera mapping and ablation system, including the Sphere-9 catheter, and began a limited release to the market. Received FDA approval for the MiniMed 780G system with Guardian 4 transducer. These products have led to double-digit sales growth in Western Europe. Will begin shipping them to consumers in the U.S. next week. LINQ II artificial intelligence technology, called AccuRhythm AI, won the MedTech Breakthrough Award 2023 for Best New Technological Monitoring Solution. Announced a strategic collaboration with NVIDIA and Cosmo Pharmaceuticals to allow third-party developers to train and validate AI models that could eventually run as applications on the GI Genius platform. They’re planning significant cost reductions, including workforce reductions. It’s clear that everyone is trying to put AI anywhere right now to get attention, but how it will work and with what success is still unclear. But good results in research and product approvals are always a plus and a driver for long-term growth.

We can see strong growth in both ischemic and hemorrhagic stroke, with double-digit growth in several categories, including aspiration and flow diversion. Stroke is the number two cause of death worldwide, and combined with low penetration therapies see great opportunities for neurovascular changes in stroke treatment. Surgical robotics continues to gain momentum with the introduction of the Hugo differentiated robotic system in international markets. Made progress in the U.S. as they conduct a pivotal Expand URO trial. They continue to actively develop the diabetic field, seeing great benefit from the use of the EOPatch disposable patch in combination with the MiniMed 780G system with Guardian 4 sensor, for which they have just received FDA approval.

business (investor presentation)

Financials

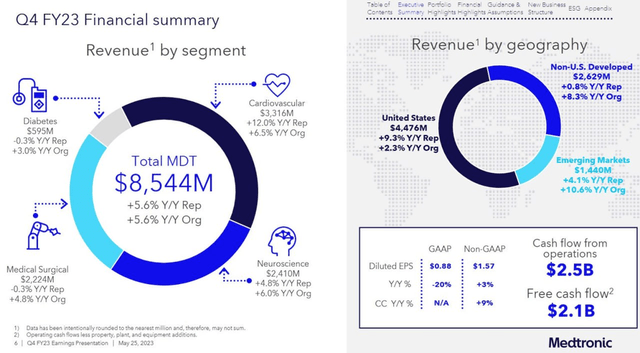

Overall stable report. Revenue rose 5.6% to $8.54 bn, ahead of expectations. The company gave a very weak forecast for the current year, and immediately warned about the lower boundary. Perhaps this is because they did not meet their forecast for fiscal year 2023 and are now knowingly giving a weaker forecast to be sure to beat it. At least now there is not even half of the problems that were in FY 2023, from supply chain to currency headwinds, so it is unclear why such a weak forecast, given that the drivers of revenue growth on the contrary are there. In response to direct questions about this at the conference call and the arguments of analysts, they could not say anything specific, limiting themselves to the standard excuses. Looking at revenue by geography, international markets remain strong – developed markets in Western Europe grew 8% in constant currency, and Japan returned to growth after the impact of COVID last quarter, +5% y/y. Emerging markets, which account for 17% of revenue, returned to double-digit growth, +11% y/y. China also posted 3% growth as procedures recovered from previous quarantines. Cash flow remains solidly strong, where FCF was $2.08 b/y, adding 25% y/y. The balance sheet is tricky, with decent net debt of $16.34 bn, Goodwill and intangibles at half of the company’s capitalization.

Overall, all lines of business are very slow but growing. From a regional perspective, the most stable-growth dynamics are in the U.S., but other regions are not far behind.

Q4 Financials (investor presentation)

Valuation and potential risks

The company showed good results in a seasonally strong quarter, but everything was spoiled by the forecast, which did not give full effect to the positive dynamics of quotations. The CEO reiterated that macroeconomic factors such as inflation, foreign exchange rates and, to a lesser extent, interest and tax rates, will have a negative impact on earnings in fiscal 2024. That said, continue to prioritize investment in research and development and expect R&D spending growth to exceed revenue growth. Actually, we can see this in the very weak annual EPS forecast.

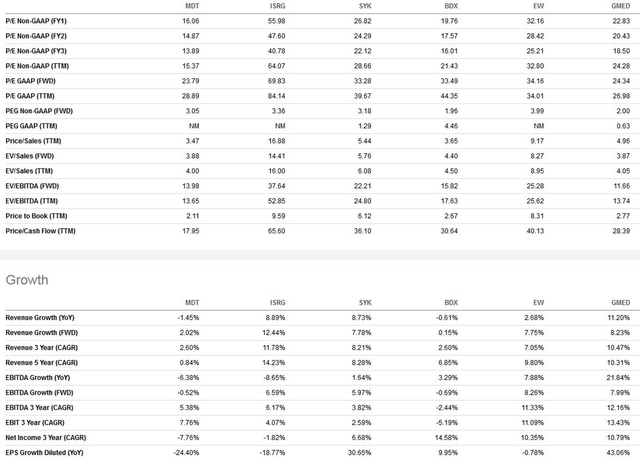

Compared to competitors (screen below), the company looks cheaper than the vast majority, while having some of the lowest growth rates, better dividends and comparable profitability. By historical mid-range, the 3-year revenue GAGR is 3%, and this year expect about 4%. Dividend yield of 3.4% p.a., with high payout ratios from both earnings (GAAP) and FCF over 80%.

Forward financial forecast (Seeking Alpha)

Bottom line

From an investment perspective, the company continues to be at 2015-2018 levels in both financials and quotes. Current levels above $80 can be considered a slight undervaluation. The obvious undervaluation lies at levels around $70, and if quotes get down there, that would be a good investment opportunity. Also, MDT can hardly worsen the situation from the point of view of financial indicators, but it can improve it. We recommend to HOLD this stock for the next 6 months.

Read the full article here