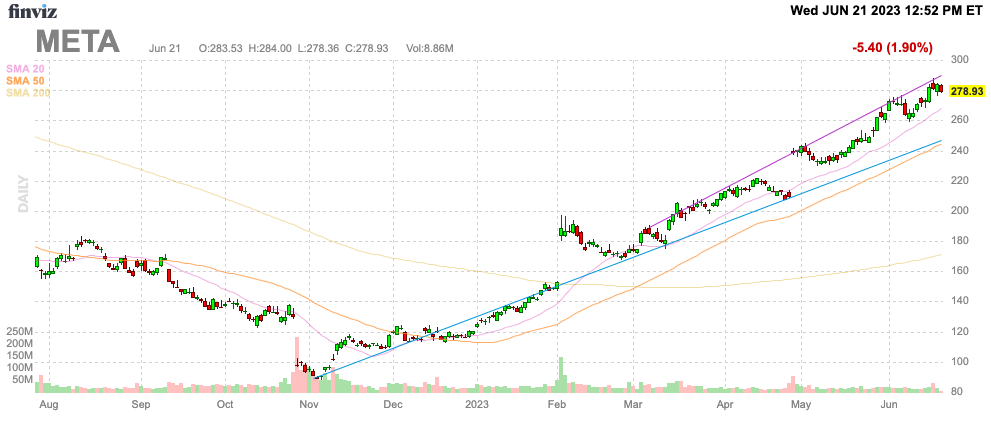

After a massive rally, Meta Platforms (NASDAQ:META) shareholders have made the easy money now. The Quest 3 launch continues to offer a promising product to lead the mixed reality landscape, especially after Apple (AAPL) launched a $3,500 device. My investment thesis remains bullish on the stock, even after the massive run over the last year.

Finviz

Surprise Quest 3 Launch

In early June, Meta had a surprise launch event for the Quest 3 VR headset. The market already knew the device would be released by October, but the company apparently wanted to jump in front of the MR device released by Apple on June 5.

Meta

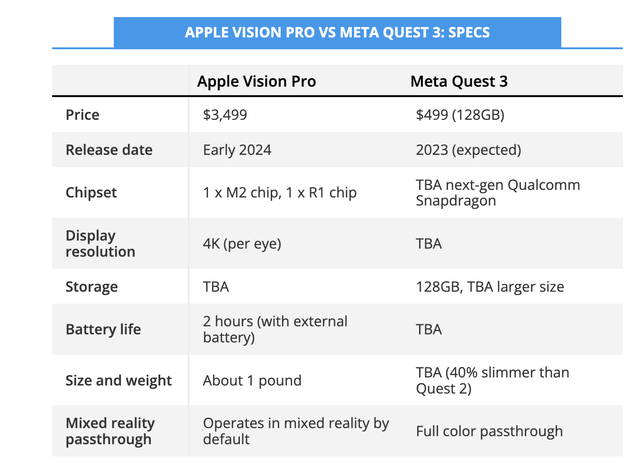

The reviews for the Quest 3 appear rather solid, with the device offering far better video pass-through technology and the speed of navigating the device improved substantially compared to the Quest 2. In addition, the Quest 3 is noticeably slimmer and starts at only $499 for the 128 GB model.

The Vision Pro from Apple isn’t really comparable due to the $3,499 price point, allowing the tech giant to include far more costly technology. Also, Apple doesn’t even have a release date yet other than early 2024 while the Quest 3 should be launched on Sept. 27 at the Meta Connect event in order to hit the holiday shopping season.

Tom’s Guide

While the Vision Pro is an impressive device, consumers aren’t likely to fork over $3,000 more in order to pay for impressive technology like EyeSight. In addition, Apple has failed to provide any path on future devices, probably due to the lack of being able to release the first AR/VR device with likely seven-plus months before one still hits the market.

Apple likely won’t have another device out in 2024 leaving Meta with the only real roadmap. The company has huge plans following the Quest 4 next year with an expected third-generation smart glasses related device in 2025 followed by AR glasses in 2027. In fact, the Financial Times has Meta working with AR firm Magic Leap on a licensing deal to bring AR glasses to market utilizing their waveguide technology.

Easy Money Over

Meta has rallied more than $190 off the lows back in just last October when the Meta Quest Pro was released. The device has been a major failure, but the social media company continues to execute on the product path unlike Apple.

Just since the lows, Meta has again launched another AR/VR device, while Apple still promotes officially releasing a product sometime next year. The amazing part is that Meta already has sold 20 million devices, while Apple is struggling to just release a product with demand next year of only around 100K devices.

Regardless, the easy money is over with the stock rallying from the ridiculous lows below $90. The company will have to continue executing in order to reward shareholders here, but the base case appears for Meta to continue down that path.

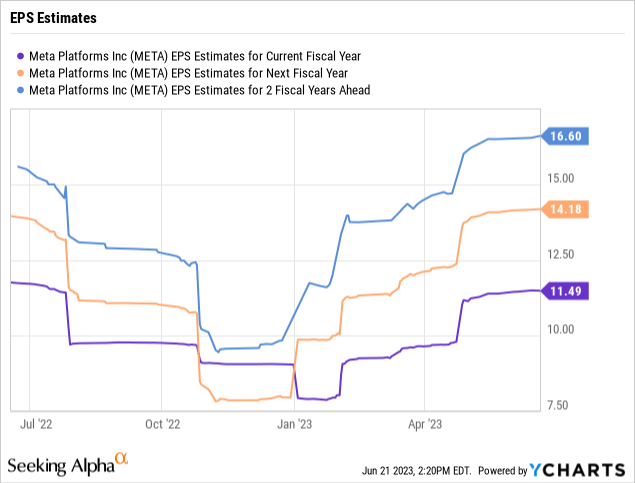

Based on analyst EPS estimates, Meta now trades at 20x 2024 EPS targets of $14.18. Analysts forecast another big EPS boost to $16.60 EPS in 2025 after original estimates had collapsed below $10 just back last October.

The unknown is really how much progress Meta will make in reducing or eliminating the massive losses of the Reality Labs division. The social media company losses up to $5 per share on the Metaverse division now with Q1 losses of $4 billion.

While a lot of the forecasted earnings boosts are primarily related to cutting 25% of the workforce via a massive 21,000 employee reduction and improving the effectiveness of Reels and related ads, some analysts could forecast the Reality Labs division to cut losses. A successful AR/VR device could help cut the losses, considering the division only produced $339 million in Q1’23 revenues, down 50% from last Q1.

Ultimately, though, the Reality Labs division will still contribute a large tailwind to the $14+ EPS target for 2024. At some point, this division will become a profit contributor or the costs will be eliminated. One might assume Meta has the pathway to a 2025 EPS of $20 making the stock still cheap at only $280 here.

Takeaway

The key investor takeaway is that Meta could easily pause after the long rally during the last nine months. Regardless, the stock is still cheap compared to the opportunity ahead in the Metaverse and AR/VR devices. Meta continues to execute in the category while Apple is struggling to actually release a device, making the bull case on the stock much stronger, with the stock trading at just 14x normalized 2025 earnings.

Read the full article here