The AR/VR Battle Has Only Started

We have previously covered Meta (NASDAQ:META) in May 2023, discussing its exemplary FQ1’23 double beats and excellent FY2023 guidance. Combined with the return of advertising dollars once the macroeconomic outlook normalizes, its projected NTM EV/ EBIT of 9.42x does not seem expensive then.

For now, META has finally met its match in the AR/VR competition, in our opinion, with the long-awaited Apple (AAPL) Vision Pro spatial headset finally introduced by early June 2023. In just the span of a week, the internet and market analysts are already abuzz with the new computing platform, a hype that has unfortunately skipped the Quest series.

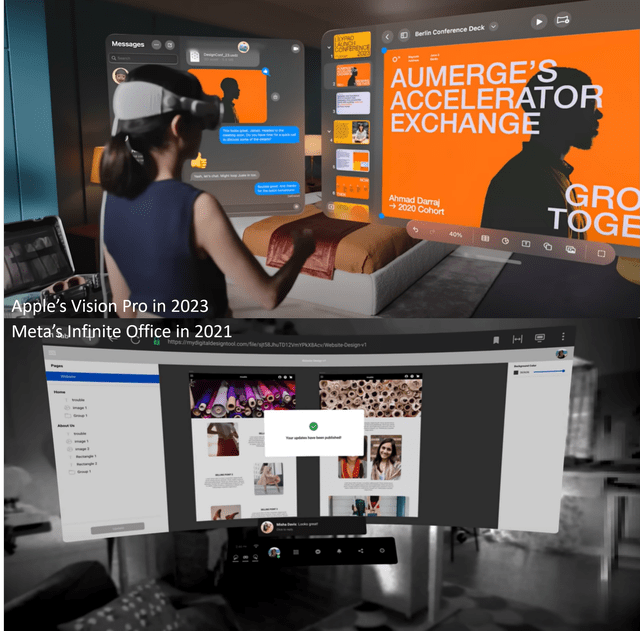

AAPL & META’s Similar Offerings, But Different Marketing Strategy

AAPL & META

Most importantly, we believe Mark Zuckerberg has failed to effectively convey Quest Pro’s capabilities, which supposedly already offer a comparative computing platform since 2021.

Meta 2022 & 2023 Super Bowl Commercial

Youtube

As similarly highlighted by other retail commentators and reviewers, many had been confused about Quest Pro’s full offerings, with Meta preferring to go with ambiguous commercials, leaving the audience with minimal takeaways on its hardware/ software Metaverse strategy.

META’s Quest Marketing Videos

Youtube, Meta

Even now, the more commonly highlighted use cases for the Meta Quest VR headset are game-centric and, very occasionally, e-sports on the YouTube page. With this strategy, it appears that the target audience is mostly retail-based instead of the next-generational computing and/or professional approach that AAPL has opted for.

This is likely attributed to Mark Zuckerberg’s decision to focus on the mass market through improved affordability and the “supposed” social interaction from the Metaverse, as recently highlighted in Meta’s company-wide meeting after the release of AAPL’s Vision Pro spatial headset:

We innovate to make sure that our products are as accessible and affordable to everyone as possible, and that is a core part of what we do. And we have sold tens of millions of Quests.

More importantly, our vision for the metaverse and presence is fundamentally social. It’s about people interacting in new ways and feeling closer in new ways. Our device is also about being active and doing things. By contrast, every demo that they (AAPL) showed was a person sitting on a couch by themself. I mean, that could be the vision of the future of computing, but like, it’s not the one that I want. (The Verge)

While some may have expressed interest to make do with Meta’s lower-priced options, the Quest Pro offers a relatively poorer display quality of 1,800 x 1,920 pixels per eye, compared to AAPL Vision Pro’s 2,160 x 3,840 pixels per eye, or “23 million pixels-nearly three times as many as in a 4K display.” This is on top of the former’s 22 Pixels Per Degree [PPD], compared to the latter at “around 50 to 70 PPD.”

Long story short, you will get the quality that you pay for.

Furthermore, Mark Zuckerberg opted to take the Quest hardware segment as a loss leader, offering significant discounts by March 2023 to supposedly boost demand.

However, it remains to be seen how Meta’s Quest Store may eventually make up for the shortfall, with Reality Labs only reporting FQ1’23 revenues of $339M (-53.3% QoQ/ -51.2% YoY), with the deceleration mostly attributed to slowing Quest sales. While the Quest Store has recorded $1.5B in total revenue by October 2022, the Reality Labs remains unprofitable, with FQ1’23 operating losses of $4B (-6.9% QoQ/ +33.3% YoY).

While the bulls may point to Quest Store’s robust library offerings, it is no secret that AAPL users also recorded higher global in-app spending at $86.8B in 2022 (+1.9% YoY). Therefore, we believe the gap in their catalogs may eventually narrow, with the latter likely to command improved in-app revenues in the long term.

Furthermore, with the release of AAPL’s Vision Pro by 2024 and, likely, Alphabet’s (GOOG) (GOOGL) AR headset at the same time, it is uncertain how Meta may retain its edge in the AR/VR market moving forward. This is on top of the market projection of 500K units in Vision Pro sales by 2024, potentially triggering demand headwinds to the incumbent.

In addition, the sales for AR/VR devices are expected to only hit 10.35M units in 2023, minimally improved from the 8.58M reported in 2022 (-5.3% YoY). With Meta only recording cumulative sales of 20M devices across Quest 1, 2, and Pro models since 2019, likely attributed to repeat customers, we suppose the actual use cases have been less than impressive, compared to the global installed base of AR/VR headsets at 34.7M in 2022 (+21.7% YoY).

We suppose this is a chicken-and-egg problem, since Meta’s quest for affordability has triggered a less-than-impressive display resolution, triggering the more game-centric use cases, compared to AAPL’s well-rounded features, professional target audience, and premium/ compelling experience.

Then again, things may change for good from Quest 3 onwards, given the management’s claim about “Better displays and resolution – Next-gen Qualcomm chipset with 2x the graphics performance,” and “High-fidelity color Passthrough, innovative machine learning, and spatial understanding let you interact with virtual content and the physical world simultaneously, creating limitless possibilities to explore.”

Assuming a drastically improved performance compared to the previous models and effective demonstration in Meta’s upcoming Connect conference on September 27, 2023, we may see Quest put up a note-worthy fight in the AR/ VR battle ahead. Only time may tell.

So, Is META Stock A Buy, Sell, or Hold?

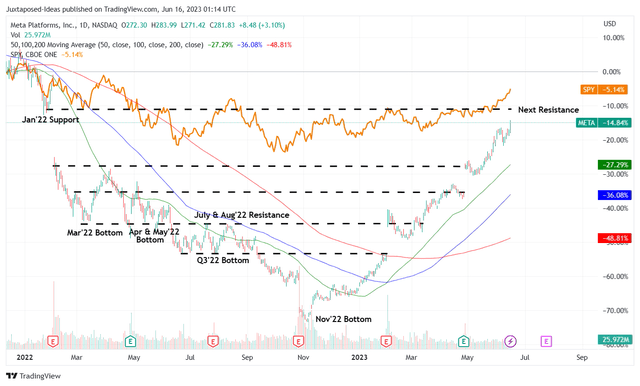

META 2Y Stock Price

Trading View

For now, META has only retreated minimally post-AAPL-launch, implying that Mr. Market may be convinced about the two companies’ different approaches and, likely, distinct end markets.

While we remain optimistic about the advertising/ social media company’s execution, the rally has been optimistic indeed, giving us minimal upside potential to the price target of $301.74. This is based on its NTM P/E valuations of 21.31x and market analysts’ FY2024 adj. EPS of $14.16.

As a result, we prefer to rate the META stock as a Hold here. We will also be awaiting more clarity from the upcoming event in September. Meanwhile, Mark Zuckerberg may be learning a few useful tips from Vision Pro’s marketing material.

Read the full article here