Despite the AI hype, Microsoft (NASDAQ:MSFT) has fallen about $50 from the all-time highs just back in July. The September market sell-off has made a lot of tech stocks far more appealing now. My investment thesis is slightly Bullish on the stock with the coming AI boost apparently not factored into financial targets.

Source: Finviz

Big AI Ambitions

Outside of NVIDIA (NVDA), most tech stocks haven’t seen any real boost from AI, especially in the enterprise AI software sector. Microsoft has big AI ambitions, but investors need to be patient for the numbers to materialize.

The company will launch Microsoft 365 Copilot for enterprise customers on November 1 charging users $30 per month. The J.P. Morgan analyst forecast the adoption ramp period could take 12 to 36 months as enterprises take time to run tests before adoption and implementation.

The average E3 user spends ~$36 per month for Office 365, so AI Copilot would be a substantial increase at $30 per month. A corporation with thousands of users would suddenly need to spend millions in additional expenses for every employee to have the AI functionality of Copilot. An employee costing $432 annually for Office 365 would suddenly cost $782 to include Copilot.

The tech giant is also working on generative AI functions within Bing Search. For the July quarter, Search revenues only increased by 8% suggesting Google, owned by Alphabet (GOOG, GOOGL), has effectively blocked any shift from Google search despite the initial excitement on the OpenAI and ChatGPT investment back in February.

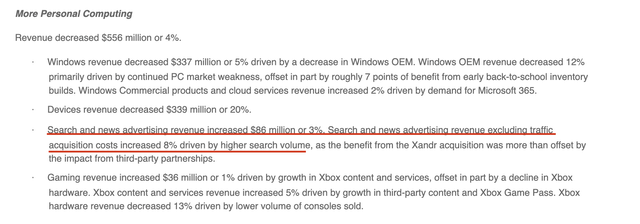

The Search business only grew revenues by $86 million in FQ4. Revenues were up 8% when excluding TAC while business units like Azure and Office 365 grew at far higher rates.

Source: Microsoft FQ4’23 earnings release

Microsoft reported FQ4 revenues of $56.2 billion for an 8% increase. The AI Copilot product will need to produce billions in annual revenues in order to move the needle.

Macquarie analysts estimate AI could boost sales by $14 billion with just 10% of Office customers utilizing the new feature. Evercore ISI assigned a $100 billion potential of incremental revenue by 2027.

Analyst Kirk Materne sees revenues coming primarily from the upside in the Azure cloud business combined with the upside from Copilot software additions in Office and Productivity businesses. The analyst has the least conviction on Bing Search and the July quarter results affirm this forecast.

Consensus analyst estimates have Microsoft generating $236 billion in revenues for the just-started FY24. The tech giant produced $212 billion in revenues in the just completed FY23, suggesting AI could help boost revenues by nearly 50% alone in 4 years.

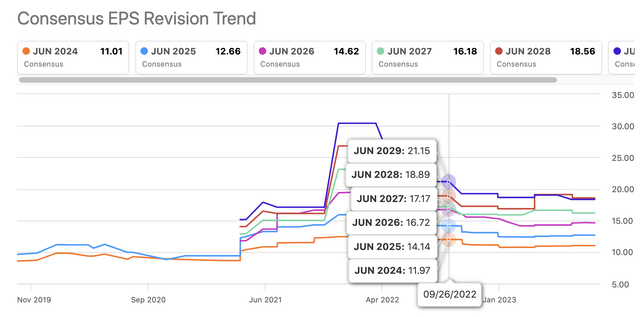

Naturally, the numbers aren’t clear on how much of the growth is assigned to uplifts from AI. The analyst estimates have revenues included for FY27, but the estimate sat higher back in mid-2022 than the current $341 billion estimate.

The FY27 EPS target of $16.18 is actually lower than the level last September before the generative AI craze started. The AI excitement has boosted some analyst targets for out years, but most of these estimates don’t appear to actually capture the upside from Copilot, Azure, or Bing sales boosts from AI.

Source: Seeking Alpha

The EPS estimates were actually $16.72 last year suggesting nearly all of the earnings and revenue growth through FY27 isn’t due to the AI products.

Better Value Now

As most followers know, Stone Fox Capital has been very bearish on Apple (AAPL) for a long time due to the valuation disconnect with the limited growth projections. While Apple is struggling to grow due to a product-heavy business model boosted during Covid, Microsoft remains a far more consistent grower due to a software focus and now the opportunity in AI.

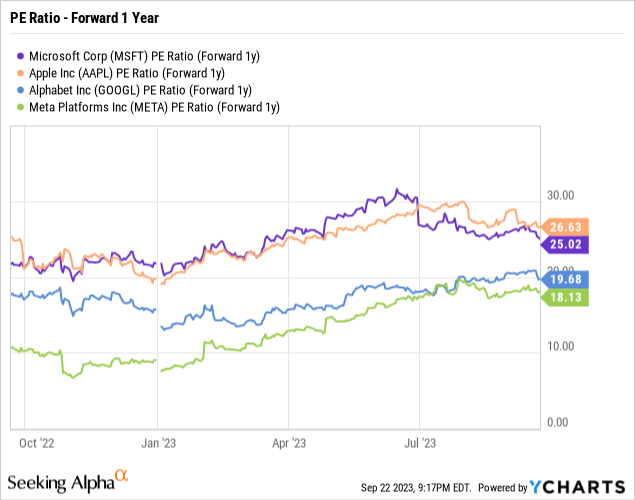

Even better, the stock valuations for mega tech stocks have compressed over the Summer months. Microsoft and Apple are both down trading around 26x forward EPS estimates.

Microsoft has earnings growth rates targeted at 15% with a 25x forward PE multiple while Apple trades at a higher multiple of 27x forward EPS estimates with lower growth. The company just released the iPhone 15, but the company forecast a revenue decline in the current quarter.

Microsoft trades at a sub 2 PEG ratio while Apple now tops 3x the growth rate with analysts forecasting EPS growth rates of only 8% in the next 2 years. Even better for Microsoft is the analysts estimates appear conservative due to the AI upside potential while Apple continues struggling to release new products with the Vision Pro delayed until sometime in 2024.

Takeaway

The key investor takeaway is that Microsoft is actually a reasonable value now based on the assigned growth rates and the potential upside from AI products. If the tech giant actually generates $100 billion in additional revenues from AI by FY27, the company will achieve revenue growth rates far above the 10% annual rate and EPS will grow at rates in excess of 15%.

Investors should look to buy Microsoft on the ongoing September weakness and the best source of funds would be selling an investment in Apple.

Read the full article here