Back in December 2023, I modified my stock classification for MidCap Financial Investment Corporation (NASDAQ:MFIC) to a ‘Hold’ because I had anticipated a fast decline in short-term interest rates.

The BDC’s 100% floating-rate exposure strongly hinted at softening net investment income prospects in a lower-rate environment, which so far has not materialized.

A reluctant central bank obviously benefited MidCap Financial Investment, and the stock has enjoyed an almost 20% rise in the first couple of months in 2024.

While I don’t think passive income investors should chase the BDC’s stock price at this time, the 9.4% yield MidCap Financial Investment pays should prove to be sustainable. Thus, I reaffirm my ‘Hold’ stock classification for MFIC.

Portfolio Review, Non-Accruals, NII Performance

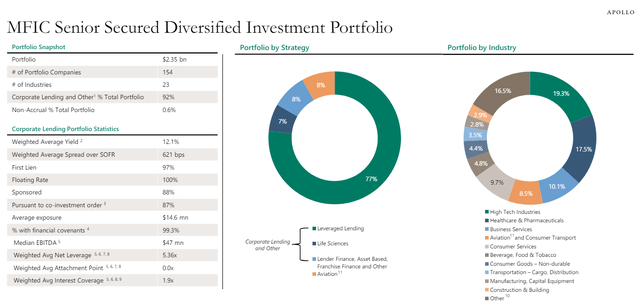

MidCap Financial Investment is a diversified business development company with a large focus on Senior Secured loans. The BDC owned a $2.35 billion portfolio, as of March 2024, with First Liens accounting for a whopping 97% of investments in the corporate lending portfolio.

MidCap Financial Investment is also, as I alluded to in my last review of the business development company in December 2023, heavily geared towards floating-rate loans (100% of the corporate lending portfolio).

In addition to traditional loan investments to middle-market companies, MidCap Financial Investment’s portfolio also included an investment in Merx Aviation (8% of portfolio value), a global aircraft leasing, management & finance company which gives MFIC a bit of a unique positioning in the BDC market.

Portfolio Overview (MidCap Financial Investment Corp)

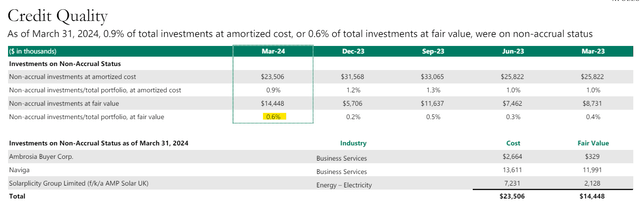

Though MidCap Financial Investment has suffered a deterioration in the non-accrual ratio in the first quarter, the business development company’s credit quality overall is very robust: MidCap Financial Investment’s non-accrual ratio was 0.6% based on fair value, up 0.4 percentage points QoQ.

The BDC’s portfolio quality is quite good, in my view, as some of the BDCs that I reviewed lately, like this one, have non-accrual ratios of 1%, also based on fair value. In terms of credit quality, MidCap Financial Investment is on-par with Ares Capital Corp. (ARCC) which reported a fair value-based non-accrual ratio of 0.7% in 1Q24.

Credit Quality (MidCap Financial Investment Corp)

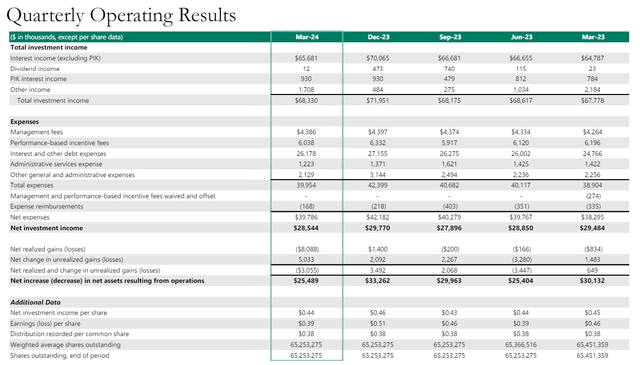

MidCap Financial Investment produces the majority of its total investment income from charging its customers interest, though the BDC also had other income sources such as dividend income and payment-in-kind interest.

In 1Q24, MidCap Financial Investment earned $68.3 million in total investment income, up 1% YoY thanks to new originations. The BDC’s net investment income fell 3%, however, primarily due to higher interest and other debt expenses.

Taking into account MFIC’s robust dividend coverage, I am not worried about the small decline in net investment income.

Quarterly Operating Results (MidCap Financial Investment Corp)

Dividend Metrics Still Looks Quite Good

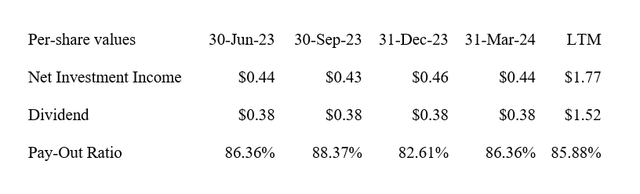

Because the central bank has so far refused to move short-term interest rates, MidCap Financial Investment’s net investment income is still looking very healthy, and so is the BDC’s dividend pay-out ratio.

MidCap Financial Investment earned $0.44 per share in net investment income in 1Q24, down $0.01 per share YoY, and the BDC paid out a steady $0.38 per share per quarter in the last year. The dividend pay-out ratio in the most recent quarter was 86% while the BDC also paid out 86% of its net investment income in the last twelve months.

I note that MidCap Financial Investment’s pay-out ratio has not been very volatile at all in the last year (with the pay-out ratio moving only between 83-88%) indicating a high degree of earnings and cash flow stability. With a present dividend pay rate of $0.38 per share, an investment in MFIC throws off a 9.4% annualized yield.

Dividend (Author Created Table Using BDC Information)

Now Selling For A Premium

When I first recommended MidCap Financial Investment to passive income, the stock was selling at a 9% discount to book value. These days, the business development company’s stock is selling at a 5% premium to book value and though MidCap Financial Investment’s dividend pay-out ratio appears healthy for now, I wouldn’t want to chase the stock price at a premium valuation.

A higher-for-longer rate environment is probably the main reason for the stock’s 19% rise this year, but the central bank is, sooner or later, going to cut interest rates and full floating-rate BDCs may see growing headwinds to their net investment incomes.

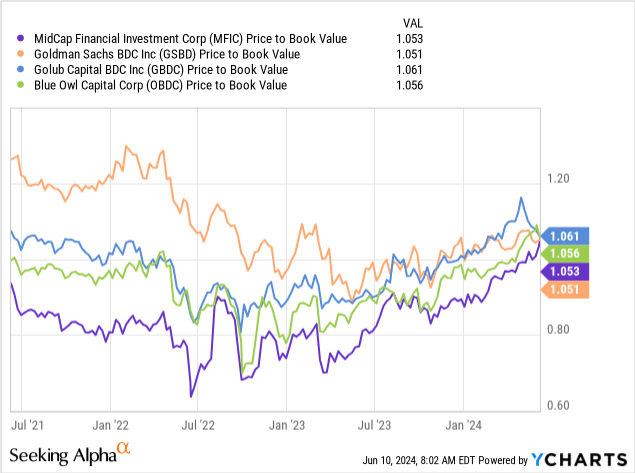

Other floating-rate BDCs like Goldman Sachs BDC Inc. (GSBD), Blue Owl Capital Inc. (OBDC) and Golub Capital BDC Inc. (GBDC) also all sell at small premiums to net asset value. Though I maintain my ‘Hold’ stock classification for MFIC, I think the valuation will eventually return to a more sensible NAV multiple of 1.0x (implied intrinsic value of $15.42).

Why The Investment Thesis Might Not Work Out At All

As I referenced in other articles about business development companies that have heavily invested into floating-rate loans, 100% floating-rate BDCs are poised to suffer from slowing net investment income growth once the Fed completes its policy shift.

The market anticipates this to be the case in the latter half of the year, though there is a chance that the central bank might push rate cuts into 2025 if inflation holds up for longer than expected.

My Conclusion

I don’t regret my ‘Hold’ stock classification from December 2023 even though MFIC has appreciated by 19% in 2024. I operated under the condition that the central bank would soon slash short-term interest rates, which would have obviously been a headwind to aggressively floating-rate positioned BDCs like MidCap Financial Investment. That the central bank didn’t cut rates until now is probably the main reason for the stock’s excellent performance.

MidCap Financial Investment’s performance in 1Q24 looked quite good, though I wouldn’t want to chase the stock here.

The BDC’s pay-out ratio in the mid-80s percentage range indicates a high-quality dividend and though investors should anticipate a dividend hike, I don’t see the dividend at imminent risk.

I don’t like the valuation too much, though, as I think the premium will be harder to sustain in a lower-rate environment. Hold.

Read the full article here