A Quick Take On Mission Produce

Mission Produce, Inc. (NASDAQ:AVO) reported its FQ2 2023 financial results on June 8, 2023, missing revenue and EPS estimates.

The firm grows and distributes fresh avocados in more than 25 countries.

I previously wrote about Mission Produce with a Neutral opinion due to continued inflationary pressures and a soft pricing environment.

With inflationary pressures easing and a stable pricing environment on higher volumes ahead, my outlook on AVO stock is a buy at around $12.70.

Mission Produce Overview

Oxnard, California-based Mission Produce, Inc. was founded to develop an integrated avocado supply chain, from sourcing to production and distribution.

The firm produces avocados on its own land as well as sources avocados from third-party growers to provide customers with a year-round supply.

Management is headed by Founder, President and CEO, Mr. Stephen Barnard, who was previously in the lettuce and avocado divisions of Santa Clara Produce and has served in senior leadership roles in various industry trade association trade groups.

The company’s primary offerings include:

-

Ripening

-

Bagging

-

Custom packing

-

Logistical management

-

Merchandising & promotional support

-

Training

The firm sells its produce through distributors via a global distribution network.

The U.S. is the company’s largest single market, and the Hass avocado accounts for approximately 95% of avocados consumed in the U.S. and 80% of avocados consumed on a global basis.

Market & Competition

According to a 2020 market research report, the global market for avocados is expected to grow from an estimated $14 billion in 2020 to $19 billion by 2027.

This represents a forecast CAGR of 4.8% from 2020 to 2027.

The main driver for this expected growth is increased consumption of avocados in China, which is expected to grow at a much higher CAGR of 7.4% from 2020 to 2027.

Also, the markets of Canada, Japan, and Germany are expected to grow at 4.3%, 2.6%, and 3%, respectively, growing at a slower rate than the overall growth rate.

Major competitive or other industry participants include:

-

Calavo Growers (CVGW)

-

Fresh Del Monte Produce (FDP)

-

Westfalia

-

Del Rey Avocado Company

-

Henry Avocado

-

Olivado USA

-

Superior Foods Companies

-

The Horton Fruit Co.

-

Salud Foodgroup Europe B.V.

AVO’s Recent Financial Trends

-

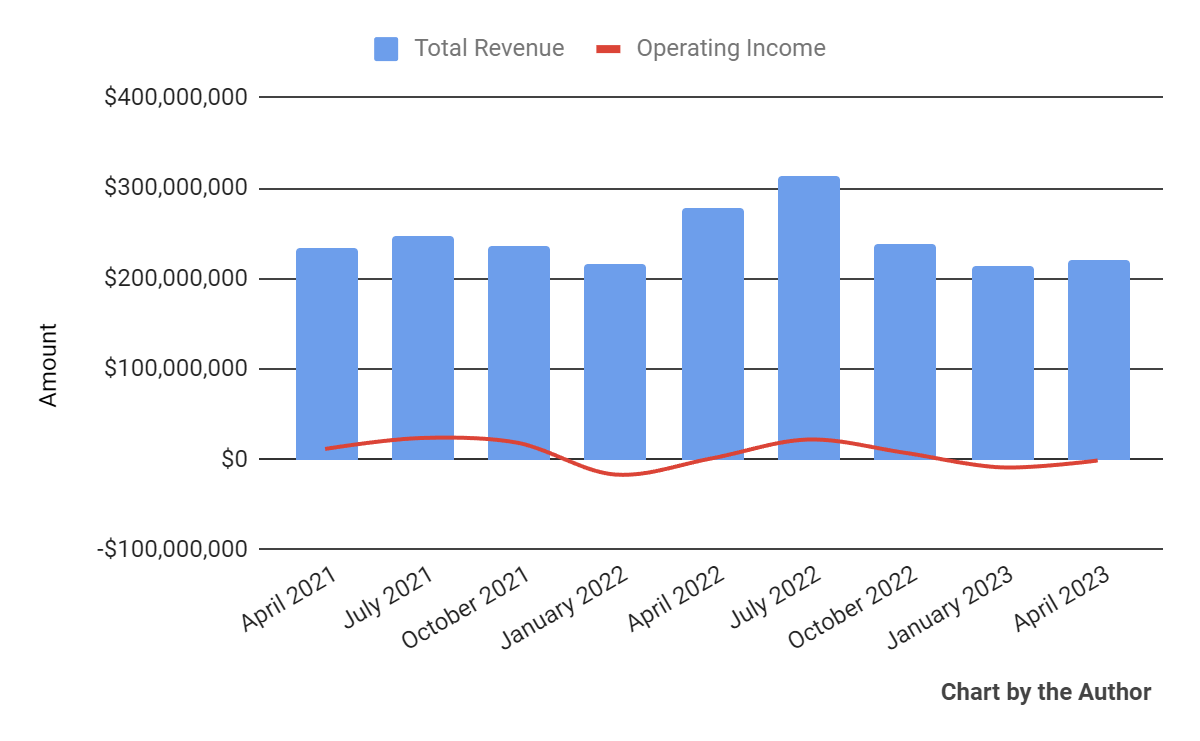

Total revenue by quarter has fallen in recent quarters; Operating income by quarter has dropped year-over-year:

Total Revenue and Operating Income (Seeking Alpha)

-

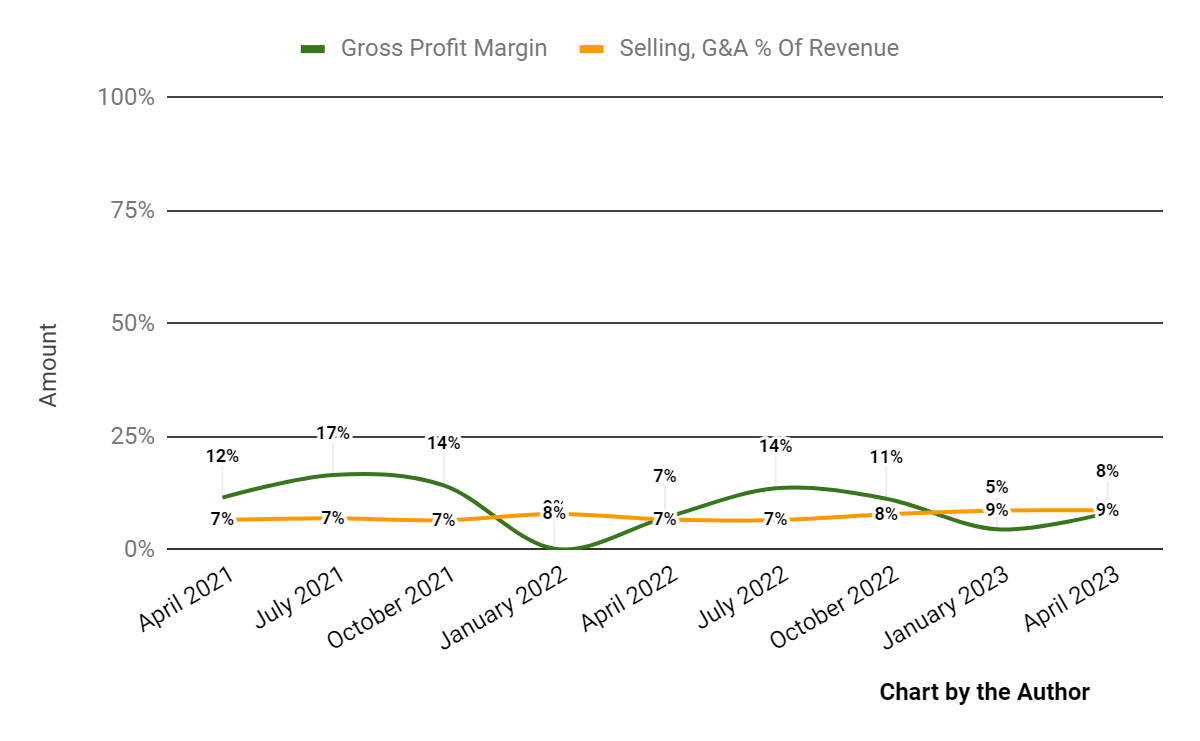

Gross profit margin by quarter has varied within a narrow range; Selling, G&A expenses as a percentage of total revenue by quarter have trended higher more recently:

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

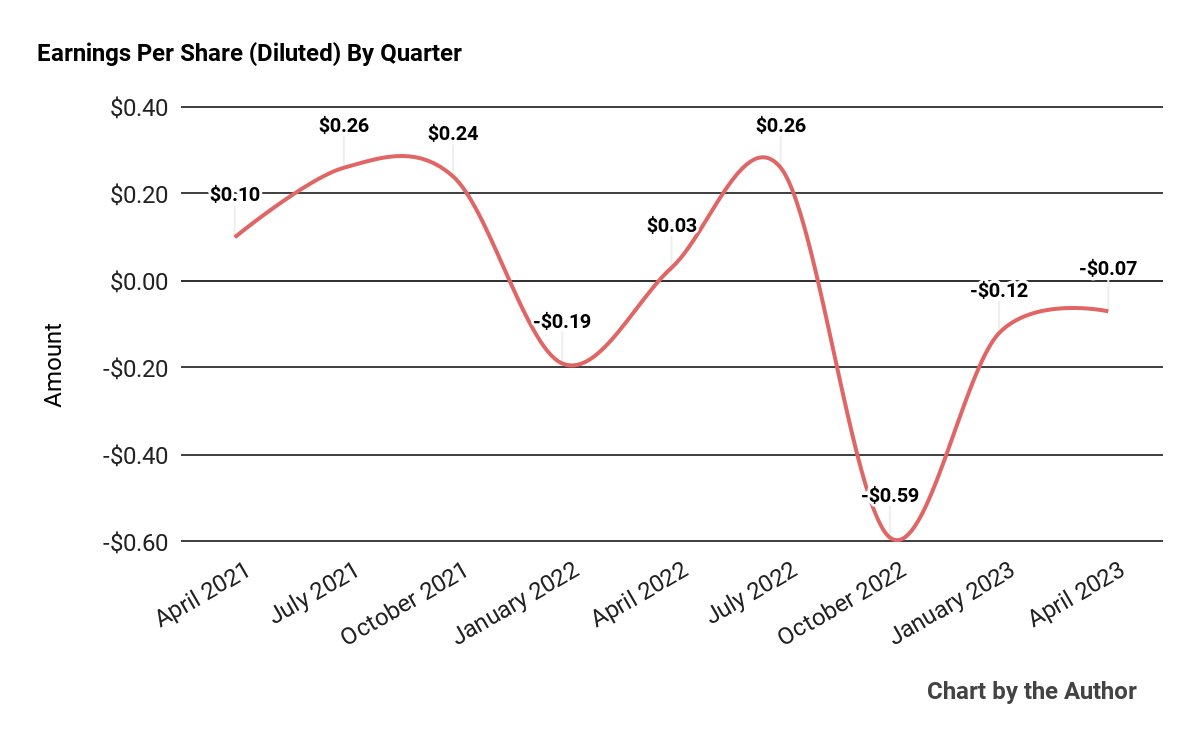

Earnings per share (Diluted) have fluctuated significantly, trending lower into negative territory in recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

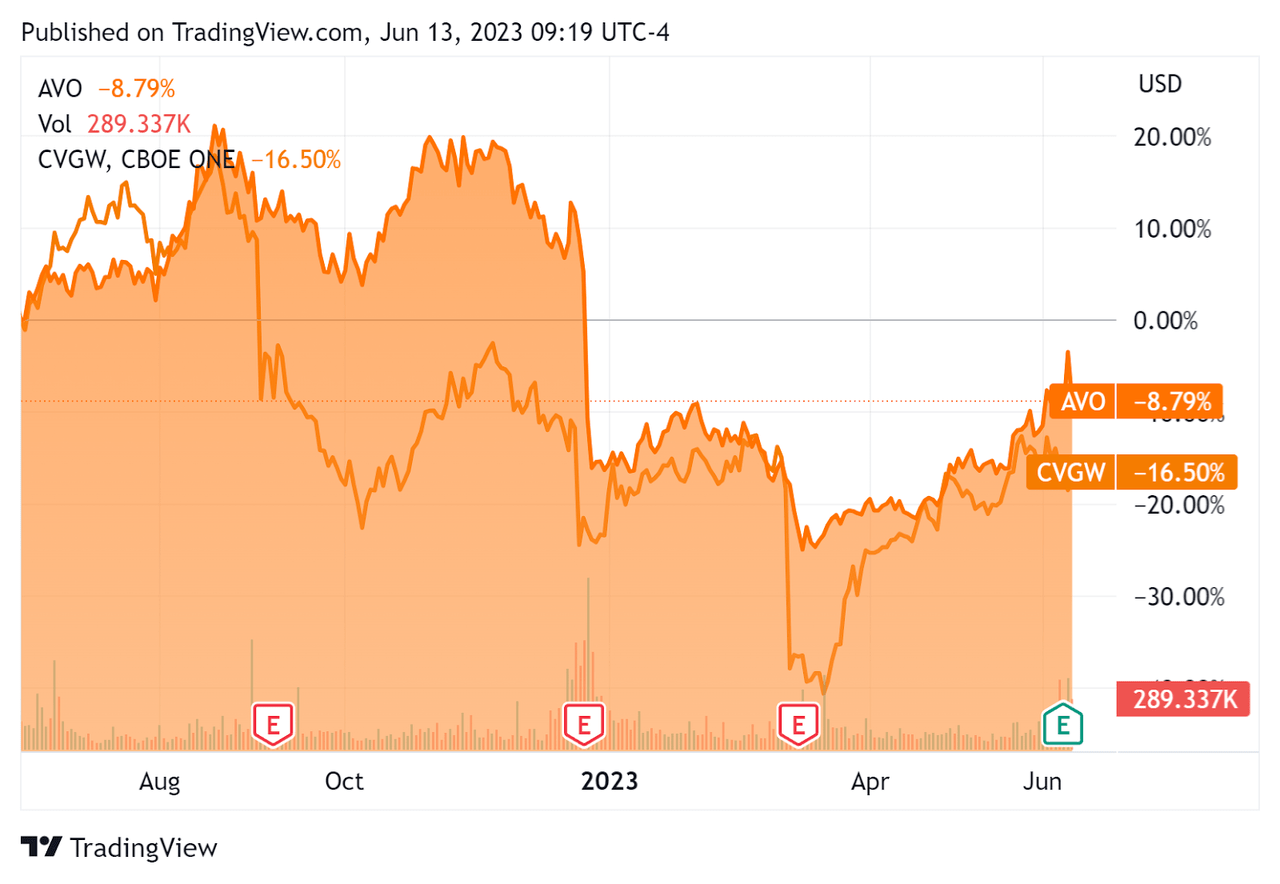

In the past 12 months, AVO’s stock price has fallen 8.79% vs. that of Calavo Growers’ drop of 16.5%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $20.9 million in cash and equivalents and $177.2 million in total debt, of which only $3.6 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash used was ($20.9 million), during which capital expenditures were a sizable $67.0 million. The company paid only $3.9 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Mission Produce

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.2 |

|

Enterprise Value/EBITDA |

25.4 |

|

Price/Sales |

1.0 |

|

Revenue Growth Rate |

75.0% |

|

Net Income Margin |

-3.8% |

|

EBITDA % |

4.9% |

|

Net Debt To Annual EBITDA |

3.3 |

|

Market Capitalization |

$948,530,000 |

|

Enterprise Value |

$1,220,000,000 |

|

Operating Cash Flow |

$46,100,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.52 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Calavo Growers; shown below is a comparison of their primary valuation metrics:

|

Metric (TTM) |

Calavo Growers |

Mission Produce |

Variance |

|

Enterprise Value/Sales |

0.6 |

1.2 |

100.0% |

|

Enterprise Value/EBITDA |

31.9 |

25.4 |

-20.3% |

|

Revenue Growth Rate |

-9.2% |

75.0% |

–% |

|

Net Income Margin |

-0.9% |

-3.8% |

336.0% |

|

Operating Cash Flow |

$25,120,000 |

$46,100,000 |

83.5% |

(Source – Seeking Alpha)

Commentary On Mission Produce

In its last earnings call (Source – Seeking Alpha), covering FQ2 2023’s results, management highlighted:

increasing market stability…[with] fairly consistent pricing through the Mexican season, and those conditions have continued into our current fiscal third quarter as well.

The previous year’s volatility increased the company’s gross margins in 2022 but is not continuing into the current year.

However, management says the more stable market conditions will foster long-term consumption growth by consumers who are less whipsawed by price volatility.

Management also highlighted the company’s growing distribution volumes amid lower inflationary pressures as the basis for:

improving our per unit margins on a sequential basis and support[ing] the seasonal step-up in adjusted EBITDA in the second half of the fiscal year.

Total revenue for FQ2 2023 fell 20.5% year-over-year and gross profit margin rose 1.1 percentage points.

Selling, G&A expenses as a percentage of revenue grew by two percentage points while operating income turned to negative $1.2 million from positive $1.1 million in FQ2 2022.

Looking ahead, management did not provide any financial guidance but did say that they expect higher volumes due to lower YoY prices and inflationary pressures.

The company’s financial position is moderate, with material debt against limited liquidity and significant cash used in the last twelve months; its net debt-to-EBITDA multiple is 3.3x.

Regarding valuation, the market is valuing the company at a lower EV/EBITDA than competitor Calavo, although both stocks have been volatile in the last twelve months.

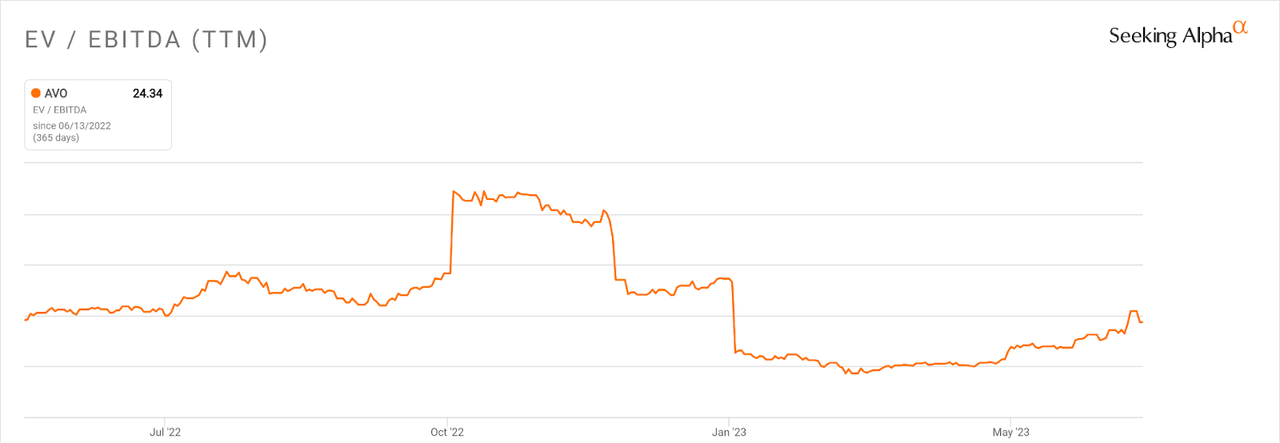

In the past twelve months, the firm’s EV/EBITDA valuation multiple has risen, then fallen and ended the period at virtually the same level as the beginning of the period, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

With a return to more normal inflation levels and pricing that will draw consumers to purchase avocados in high volumes, Mission Produce stock may exhibit reduced volatility ahead.

Additional production capacity will be of some help to revenue growth as the company continues to pursue new market opportunities.

With inflationary pressures easing and a stable pricing environment on higher volumes ahead, my outlook on Mission Produce, Inc. stock is a Buy at around $12.70.

Read the full article here