By Min Joo Kang

Nominal labour cash earnings grew slower than expected in August

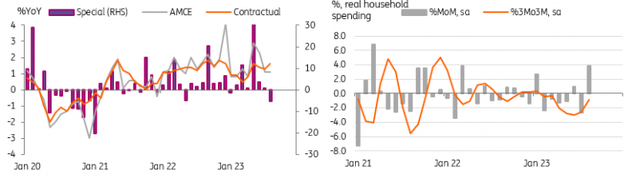

We had expected to see some acceleration in earnings given the reasonably strong wage negotiation results from the last quarter, but disappointingly, headline growth rose 1.1% year-on-year in August (versus the revised 1.1% in July and the 1.5% market consensus). However, we still found some positive signs in the details. The most important contracted earnings continued to grow (1.6%) faster than the previous month (1.3%), while downside surprises came mainly from monthly volatile bonus payments (-5.4%).

Spending rebounded despite high inflation and mediocre wage growth

Separately, real household spending rebounded 3.9% month-on-month in August, more than offsetting the previous month’s decline of 2.7%. In year-on-year terms, it fell 2.5% versus 5.0% in July and the market consensus of 3.9%. We believe that household spending held up relatively well despite high inflation and lacklustre earnings growth. The influx of foreign tourists and their spending has also boosted service activity and retail sales. The number of Chinese tourists increased during the summer vacation season and this is expected to continue over the coming months, so it’s likely that we’ll see tourism grow even further. Solid consumption boosted by strong tourism will likely drive recovery in the second half of the year and will also keep demand-side inflation up to some extent.

Spending rebounded despite lacklustre wage growth in August

CEIC

Inconvenient truth for the BoJ

The Bank of Japan will meet for its upcoming policy decision meeting at the end of this month. The BoJ’s policy choices are fairly limited, which puts the central bank in a difficult situation. Inflation has been above target for more than a year with no clear signs of slowing down, especially in core inflation. Meanwhile, both supply and demand inflationary pressures will likely add up even more in the coming months.

The weak JPY is likely to pile more pressure on import product prices alongside the recent rise in global commodity prices, while strong tourism should also push up private service prices. Surveys and other activity data showed quite a solid recovery in services, which should remain the case in the second half of the year despite global headwinds.

However, long-awaited wage growth remains quite lacklustre so far. As a result, the possibility of the BoJ hiking rates will be off the table for quite some time. Yet, the higher-for-longer narrative seen in the US pushed up JGB 10Y yields to the 0.8% level, which immediately raised concerns for the BoJ. We think it needs to respond to the recent market move with another yield curve control (YCC) policy change – and perhaps even consider the option of scrapping the policy. We believe that changes in forward guidance could be a good way to communicate with the market on its future policy move.

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Read the full article here