Introduction

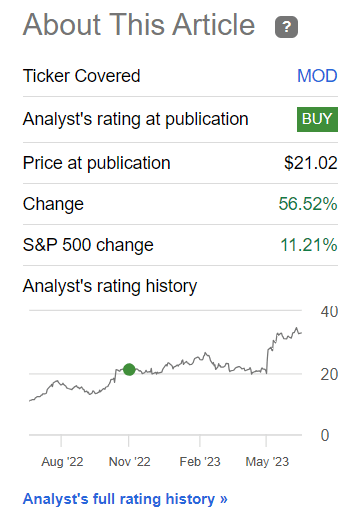

I have written about Modine Manufacturing Company (NYSE:MOD) before – the first and last time I covered the company was in November 2022, and since then my bullish thesis has stood the test of time very well:

Seeking Alpha, my coverage of MOD

Today, while screening, this company popped back up on my radar and I decided to rethink my thesis – does it make sense to buy MOD stock after such a strong rally? Let’s figure it out together.

The Company

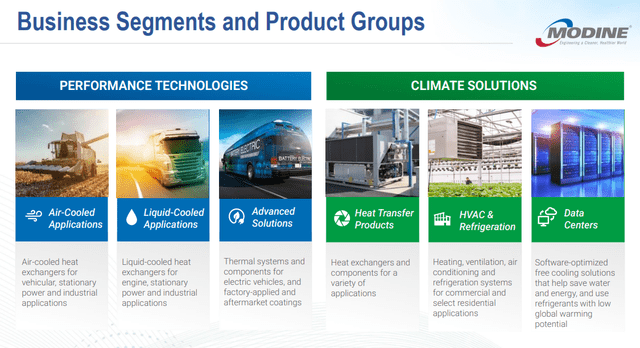

Modine Manufacturing Company is a $1.71 billion market cap company that specializes in thermal management solutions. They offer a broad range of innovative and environmentally responsible products and technologies that improve indoor air quality, conserve natural resources, reduce emissions, and enable cleaner vehicles.

Their customer base is diverse and includes HVAC&R OEMs, construction architects and contractors, heating equipment wholesalers, agricultural and industrial equipment OEMs, commercial and industrial equipment OEMs, and automobile, truck, bus, and specialty vehicle OEMs.

Modine Manufacturing stays proactive in anticipating and adapting to changes, including new regulations and the demand for sustainable technologies driven by stricter emissions, fuel economy, and energy efficiency standards.

MOD’s IR materials

In fiscal year 2023, Modine Manufacturing reported record-breaking results, including the highest sales and adjusted EBITDA in the company’s history. Sales were $618 million, up 8% (11% on a constant currency basis), and adjusted EBITDA was $66 million, up 16% from the previous year. The company also generated $24 million of FCF and reported adjusted EPS of $0.67.

MOD’s IR materials [Q4 FY23]![MOD's IR materials [Q4 FY23]](https://indebta.com/wp-content/uploads/2023/07/49513514-16890520392502513.png)

As I mentioned last year, MOD has been in the process of a transformation over the past few quarters. And we see from the recent results, that was the main reason for the success we see today. The company adopted an 80/20 mindset, focusing on reducing complexity and prioritizing the best opportunities. The Climate Solutions segment implemented the 80/20 approach, resulting in improved results. The Performance Technologies segment also showed sequential margin improvement as a result of the 80/20 initiatives, according to the CEO’s words during the Q4 FY23 earnings call.

Both the Climate Solutions and Performance Technologies segments achieved margin expansion. The Climate Solutions segment reported an adjusted EBITDA margin of 14.6%, meeting the target margins for fiscal 2024 one year earlier than planned. The Performance Technologies segment reported an adjusted EBITDA margin of 7.6% for FY2023, a 140 b.p. improvement. Sequential margin improvement was observed throughout the fiscal year in the Performance Technologies segment.

The Climate Solutions segment had a fantastic year, with revenue increasing 11% YoY. Data center sales were a significant contributor to the growth, up 60% YoY. The Performance Technologies segment also delivered a strong performance, with revenue up 12% YoY. Sales increased across all product groups, with notable gains in air-cooled products for the genset market and advanced solutions for electric vehicles.

MOD’s IR materials [Q4 FY23]![MOD's IR materials [Q4 FY23]](https://indebta.com/wp-content/uploads/2023/07/49513514-1689052291956665.png)

MOD’s IR materials [Q4 FY23]![MOD's IR materials [Q4 FY23]](https://indebta.com/wp-content/uploads/2023/07/49513514-16890528128150437.png)

Modine Manufacturing’s management expects continued growth and improvement in the fiscal year 2024 [calendar 2023 and calendar Q1 FY2024]. The company anticipates stable markets with strong backlogs in the Climate Solutions segment, particularly in data centers. Growth is expected in targeted markets such as data centers, indoor air quality for schools, and electric vehicles. Modine expects total company revenue to grow in the range of 4% to 10% in FY2024, and Wall Street analysts agree with this guidance:

Seeking Alpha Premium

In terms of prospect earnings, Modine anticipates another year of EPS growth and margin expansion in FY2024. Adjusted EBITDA is expected to be in the range of $240 million to $260 million, representing a 13% to 23% increase [18% in the mid-range]. They also expect further improvement in FCF, with CAPEX projected to be ~$70 million [only by 38% higher YoY].

MOD successfully reduced its net debt by $47 million YTD as of May 2023, with a decrease of $22 million during the Q4 FY23. The company ended the quarter with a cash balance of $67 million [+44% YoY]. Also important to note is that Modine continued its anti-dilutive share repurchase plan, repurchasing 100,000 shares during the quarter and a total of 400,000 shares for the full fiscal year.

MOD’s 10-K [author’s notes]![MOD's 10-K [author's notes]](https://indebta.com/wp-content/uploads/2023/07/49513514-1689053084579246.png)

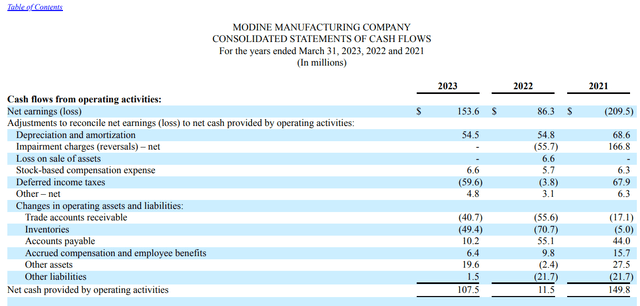

The way I see it, Modine appears to be a cash machine – in FY2023, the company generated $107.5 million in CFO [operating cash flow], and most importantly, they achieved this in an almost organic fashion with no significant one-time positives:

MOD’s 10-K

Modine Manufacturing’s balance sheet looks strong, providing a solid foundation to support future growth and acquisition initiatives. The firm is well-positioned to pursue opportunities for expansion and strategic acquisitions, in my view.

But how cheap is it?

The Valuation

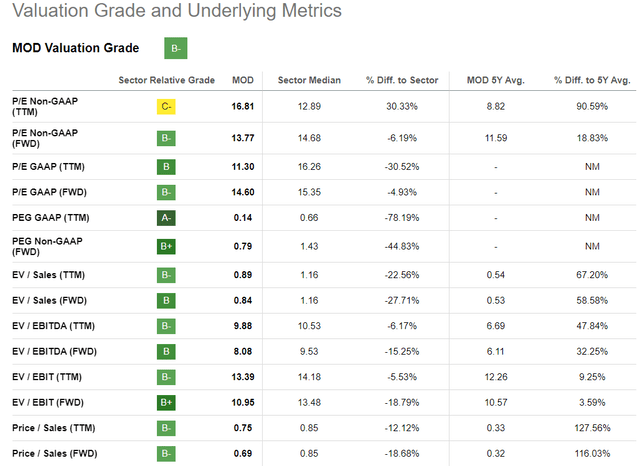

Modine Manufacturing’s key valuation metrics are much higher today compared to the 5-year averages. However, compared to the median of the consumer goods sector, MOD lags significantly on almost all valuation metrics – hence MOD’s strong “B-” rating, based on Seeking Alpha’s Quant system:

Seeking Alpha Premium

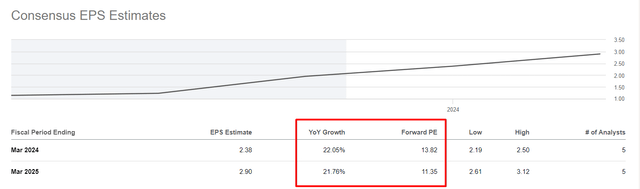

The market expects from MOD an average EPS growth of ~21.9% year-over-year over the next 2 years, implying a sharper decline in the P/E multiple [from 13.82x in FY24 to 11.35x in FY25]:

Seeking Alpha Premium, author’s notes

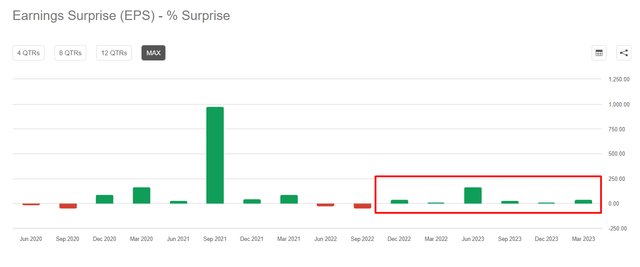

Over the last 5 quarters, MOD has consistently beaten EPS forecasts by at least a double-digit percentage, demonstrating once again how the obscurity of this company has a positive impact on the final return on such an investment.

Seeking Alpha Premium, author’s notes

What I mean by this is that the market continues to underestimate the company’s growth prospects as it expands its margins and improves its operations by growing its revenue and EBITDA in the way we see in Modine’s example because its market capitalization does not allow it to get on the radar of large institutional investors. But EPS surprises ultimately help attract new audiences and at least partially correct unfair valuations – which is why MOD’s current and forwarding P/Es, EV/EBITDAs, P/Bs, etc. are much higher compared to the firm’s long-term multiples.

Let us assess the fairness of MOD’s multiples by looking at them through the lens of the firm’s direct peers:

- Lennox International (LII)

- Gentherm (THRM)

- BorgWarner Inc. (BWA)

YCharts [author’s notes]![YCharts [author's notes]](https://indebta.com/wp-content/uploads/2023/07/49513514-16890549754585092.png)

As you can see, MOD’s EV/EBITDA forwarding multiple is quite average – this can be explained by the still lagging margins of the company. But this very margin is growing much faster than average – as we can see, the room for growth is still there, which may indicate that MOD should eventually see a multiple expansion. I think an EV/EBITDA ratio of 10-12x in 2-3 years from today is quite fair.

Management has set the following targets for FY2024:

MOD’s IR materials [Q4 FY23]![MOD's IR materials [Q4 FY23]](https://indebta.com/wp-content/uploads/2023/07/49513514-16890551365739005.png)

At the low end of my “fair range” EV/EBITDA, Modine Manufacturing should be valued at ~$2.416 billion after adjusting for net debt of $342.8 million. This output offers an upside potential of ~41% from the last closing price.

The Bottom Line

Modine carries a number of risks that each investor must weigh for himself before making a final investment decision. With a capitalization as small as Modine’s, liquidity risk could drag the stock down sharply in the event of a sharp sell-off in the broad market. Also, my valuation output, assuming an EV/EBITDA of 10-12x, may seem overly optimistic.

But despite the risks, I still believe MOD is a relatively cheap and reliable way to bet on the development of the electric vehicle market in the U.S. and globally. The company has proven in recent quarters that it can make a quality business transition without losing customers in its legacy end markets. In my opinion, Modine’s potential goes beyond the EV hype, as the company’s products are in high demand in other areas that continue to grow, even in the “lagging” sub-segments. This shows that Modine Manufacturing offers multiple opportunities for growth and potential returns on investment.

So I reaffirm my Buy rating and see an upside potential of 41% over the next 1-2 years.

Thanks for reading!

Read the full article here