MoneyLion (NYSE:ML) continues to report banner numbers, yet the stock trades at all-time lows, not representative of the results. The fintech produces strong growth despite the tough economic times while also now generating adjusted profits, though still reporting small GAAP losses. My investment thesis remains ultra Bullish on the stock, especially after the dip due to a reverse split hasn’t seen a rebound hold yet.

Finviz

More Banner Numbers

MoneyLion has seen growth pull back as 3rd-party partners reduced spending. When the economy improves and interest rates stabilize, we believe the company will see this business return to strong growth.

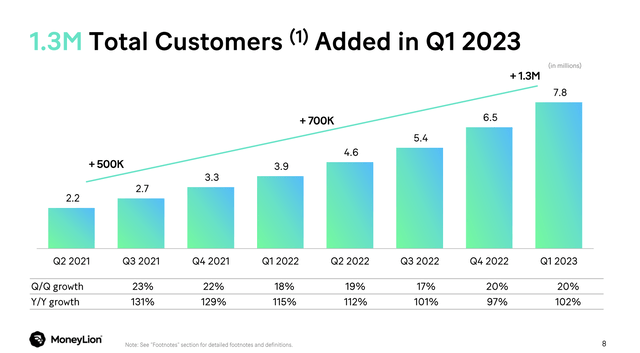

Regardless of this issue, MoneyLion continues to ramp up total customers, with another 20% sequential growth in customers during Q1’23 to 7.8 million. The fintech has seen non-stop growth since starting the SPAC deal, but the market hasn’t liked the stock.

MoneyLion Q1’23 presentation

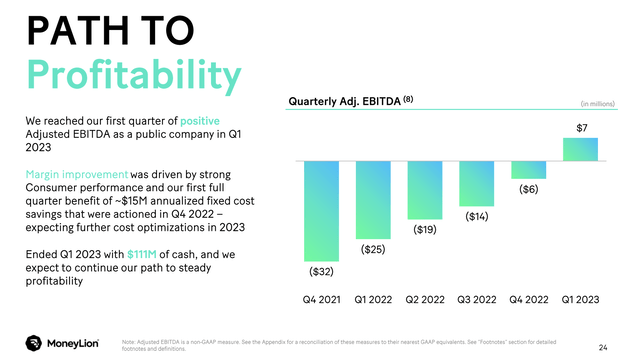

The biggest market issue was supposedly the large adjusted EBITDA losses, and MoneyLion has now wiped those out in a few quarters due to very low CAC costs. The company spends less than $15 on new customers now and saw adjusted EBITDA jump $13 million sequentially to $7 million. The metric improved by $32 million over the prior Q1 on adjusted revenue growth of only $23 million.

MoneyLion Q1’23 presentation

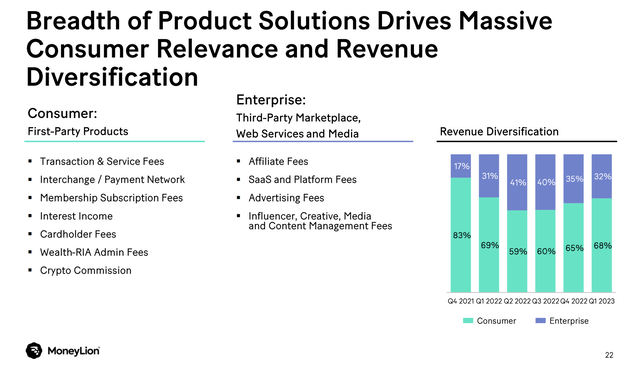

MoneyLion has targeted enterprise sales at 50% of revenues, and the recent weakness in partner advertising and platform fees has reduced enterprise growth due to the current weak macro environment. The fintech is different from other financials in this aspect of focusing on generating revenues from partners versus internal financial products.

MoneyLion Q1’23 presentation

MoneyLion is very focused on driving customers toward partners based on the financial needs of the people signing up for services with the platform. As an example, enterprise revenue hit $40 million last Q2 and the company has added 3.2 million accounts during this period, while enterprise sales have fallen due to this tough economic climate.

The company only produced Q1’23 enterprise revenue in the $30 million range, despite all of these additional customers added in the period. At a similar revenue per customer level as back in Q2’22, MoneyLion would generate up to $70 million in quarterly enterprise sales now versus the dip to only $30 million in the last quarter.

Even with the higher interest rates, MoneyLion has continued to push loan originations higher. In Q1’23, loan originations were up 24% to $506 million, but the good news is that provision expense was actually down below 4%. Some of the forecasted dip in adjusted EBITDA from Q1 to Q2 is a return to more normal credit costs.

Reverse Split Impact

The fintech completed a reverse split effective April 24 and the stock slumped right into the 1-for-30 split. Right after, MoneyLion rallied all the way past $20, but the rally somehow didn’t hold after the company reported a strong Q1’23 on May 9.

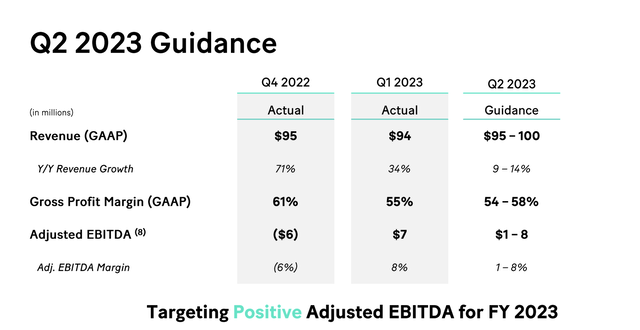

The stock is crazy cheap here, with a share count reduced to only 8.7 million. The market cap has fallen all the way to only $100 million, despite the guidance for Q2’23 revenue of up to $100 million alone.

MoneyLion Q1’23 presentation

The company is guiding for adjusted EBITDA generally at the level of the $7 million reported in Q1. These numbers are close to adjusted profits, with the only real exclusion impacting profits being the $3+ million assigned for interest expenses. The other costs excluded are one-time or non-cash charges such as stock-based compensation of $6 million and another $6 million for amortization expenses.

Regardless of the positives, the stock remains risky. MoneyLion wouldn’t have completed a reverse split if the market felt the prospects for the business warranted a higher price.

The company has turned adjusted EBITDA profitable, but the fintech could quickly revert back to losses in future quarters. Due to the struggles in the enterprise business, the company has failed to achieve revenue targets and is only guiding to around 10% growth now, in a huge disappointment.

MoneyLion has a cash balance of $111 million with secured loans at $89 million and plans to repay $25 million worth of these loans in order to reduce interest expenses. With the business shifting to adjusted profits, the fintech should be able to repay debt and isn’t in any position of needing to raise additional funding like a lot of former SPACs.

On top of normal risks in a small fintech stock, MoneyLion only averages trading 63,000 shares a day. Any investor looking to purchase a large position in the stock could easily run into liquidity issues trying to exit and could drive the stock price higher just by attempting to buy 10K shares. A position is only ideal for an investor willing to lose their investment in a very diversified portfolio.

Takeaway

The key investor takeaway is that MoneyLion remains a cheap stock now trading at a fraction of sales. The fintech has even quickly transitioned to generally solid adjusted EBITDA profits, yet the stock still trades around all-time lows.

Investors should use the weakness to continue investing in the financial platform at a fraction of sales, while a rebound in enterprise demand could provide a solid catalyst for growth.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here