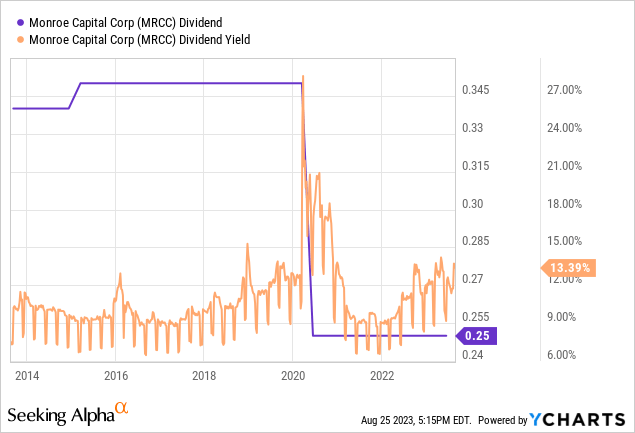

Monroe Capital (NASDAQ:MRCC) last declared a quarterly cash dividend of $0.25 per share, in line with its prior payment and for a 13.5% annualized forward yield. Income is the prize and Monroe’s double-digit yield has moved to pandemic-era highs on the back of what’s been a 17% dip in its common shares over the last 1-year in response to a rising Fed funds rate that now sits at a 22-year high of 5.25% to 5.50%. The externally managed business development company did cut its quarterly distributions by 28.5% during the outbreak of the pandemic with the payouts yet to recover to this level despite their stability over the last 3 years. The BDC is currently swapping hands for $7.42 per share, a roughly 25% discount to its net asset value per share of $9.84 at the end of its fiscal 2023 second quarter.

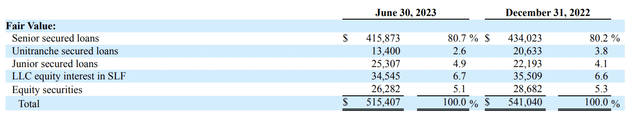

Hence, the upside here is built around the closing of this discount to NAV in aggregate with the double-digit yield. Monroe focuses on first-lien loans, which formed 83.3% of the portfolio, and held debt and equity investments in 99 portfolio companies with a total fair value of $515.4 million as of the end of the second quarter. This was a $16.7 million dip sequentially from a portfolio fair value of $532.1 million in the first quarter. Critically, the BDC’s weighted average contractual and effective yield on its debt investments was 12.2% as of the end of the second quarter, a 70 basis points expansion from 11.5% in the first quarter on the back of the continued hawkish interest rate path from the Fed.

Follow The NAV

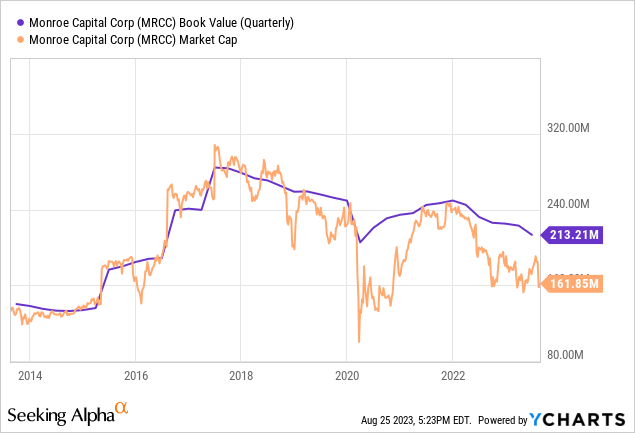

The direction of Monroe’s NAV, as defined by book value, has not been great. The trendline has pointed down since 2017 with the commons of the BDC moving in tow. Critically, NAV dictates price returns and Monroe’s NAV has formed an intense headwind for total returns that have lagged behind. Indeed, a NAV of $213.2 million as of the second quarter fell 8.15% from $232.1 million in the year-ago comp. It was also down from $244.8 million in the second quarter of fiscal 2021. This constant pressure on NAV should have been somewhat alleviated by a macroeconomic environment that has seen the average yield of BDC credit investments move up.

Monroe Capital Fiscal 2023 Second Quarter Form 10-Q

Debt to equity of 1.54x as of the end of the second quarter was broadly in line with its peers but increased from 1.49x in the first quarter and was set against second-quarter total investment income of $16.35 million. This was up from total investment income of $13 million in the year-ago period. Net investment income for the recent second quarter came in at $5.9 million, $0.27 per share, and up from net investment income of $5 million, or $0.23 per share in the year-ago period. The quarter-over-quarter NAV decline stood at $0.45, around 4.4%, and was primarily driven by what management flagged were unfavorable market conditions stemming from negative realizations on its equity investments in two brick-and-mortar outlets Forman Mills and California Pizza Kitchen. The BDC realized a $10.3 million loss on investments during the second quarter, a marked deterioration from a $3.3 million realized loss in the prior first quarter, and held a 5.1% allocation to equity securities.

Loans On Non-accrual Spike But Dividend Covered As Economy Set To Remain Strong

1.3% of Monroe’s total investments at fair value were on non-accrual status as of the end of the second quarter, up sequentially from 0.4% in the first quarter. This bump in loans on non-accruals status also formed part of the headwinds faced by NAV during the second quarter. NII per share of $0.27 meant the BDC’s payout ratio stood at 92.6% for the second quarter. This payout ratio has improved significantly from a year ago when Monroe was paying out 108.7% of its NII as a dividend.

Critically, greater coverage should help rebuild NAV and form a hedge for Monroe in the event of a hard landing that sees loans on non-accrual status experience upward pressure. However, recession forecasts have been dialed back with no US recession expected in 2023 and Goldman Sachs writing down its probability of a recession next year to 20% from 25%. The higher for longer mantra is also set to continue to provide a boost for Monroe’s first lien credit heavy portfolio even with the market expecting the Fed to keep rates unchanged at its next FOMC meeting on the 20th of September. Hence, whilst Monroe is not a buy due to its NAV challenges, higher NII is driving better coverage and a safer distribution that renders it a hold.

Read the full article here