Thesis

Energy Drinks are one of the fastest-growing segments of the food and beverage industry in the United States and abroad. One company in particular, Monster Beverage Corporation (NASDAQ:MNST) has managed to capture a significant market share, using marketing and product innovation strategically. In this analysis, I will explore the industry’s prospects, the company’s growth progress, some key financial attributes and valuation metrics.

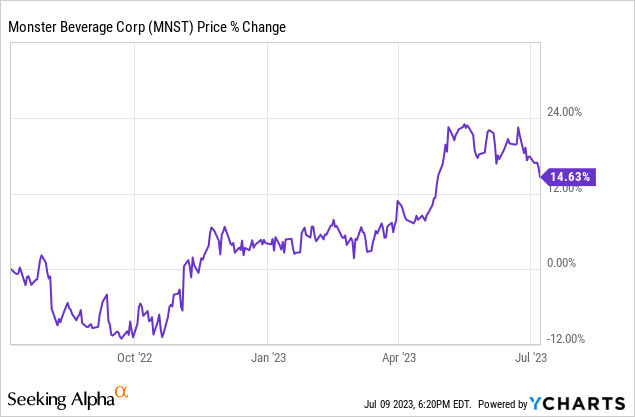

Stock Performance

Capitalizing on strong sales growth and market share increases, MNST has continued its positive stock performance over the past year. For the TTM, Monster has seen a 14.63% price appreciation. Currently, the stock trades at $55.87, approximately 8% lower than its 52-week-high levels and pays no dividends.

Business Characteristics

Contrary to popular belief, Monster’s brand portfolio is bigger than the Monster Energy Brand itself. The company markets a wide range of energy drink and alternative drink brands (Monster Energy, Reign, True North, NOS, Full Throttle and others) under its four reportable business segments. The company is establishing a massive global presence, with Monster Energy products now distributed to over 140 countries.

Monster Beverage uses a very effective marketing campaign that included both major sponsorships of sport/ extreme sports events (Motocross, NASCAR, UFC, MotoGP, X-Games, PBR, EA sports and other) as well as recruiting top-tier ambassadors like Tiger Woods, Valentino Rossi, Chloe Kim, Kurt Busch and many others. The company also establishes a marketing presence in music events and other festivals. Social media is the primary marketing tool for the business, as Monster records high engagement and following numbers across all top platforms (Facebook, Instagram, YouTube, TikTok and more).

Industry Tailwinds Will Persist

Caffeine is one of the most consumed substances around the world, with around 90% of adults in North America consuming it on a regular basis. Over the last years, consumption has increased with the rise of energy drinks, especially across younger generations, being a driving factor. Energy drinks now represent a sizable segment of total caffeine consumption, with over 30% of young adults consuming them. Caffeine consumption today is especially high among younger adults, according to recent studies. Millennials, and soon Gen-Z adults, are entering their prime economic year and will inevitably reshape the caffeine market. Trends in the industry include a shift towards low-sugar, low-calorie and even organic products.

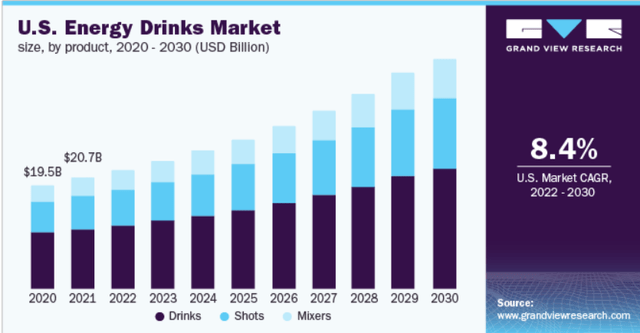

Growth in the global energy drink industry is driven by a much younger demographic than arguably any other consumer goods industry. The global energy drink market was estimated at $92BB in 2021 and is expected to grow at an 8.3% CAGR through 2030 (reaching over $170B). An identical trend also applies to the U.S. market, as shown in the chart below.

grandviewresearch.com

Competitive Forces

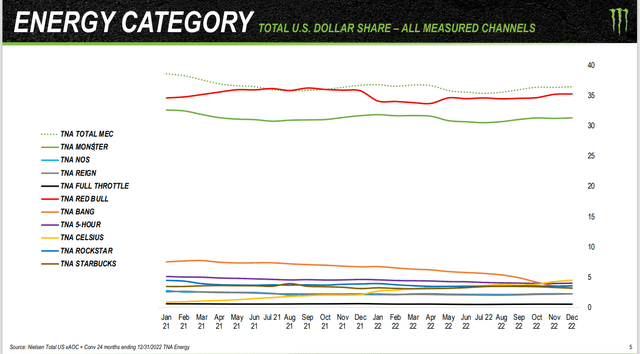

As expected with any growing segment of an industry, the energy drinks market is becoming increasingly competitive. Red Bull currently holds the leading brand name market share in the U.S. (around 35%), with Monster following at 31%. Factoring the other brand names that the company includes in its portfolio, Monster is actually the market leader, with a 36% market share. As shown in the chart below, the two market leaders remain widely separated from the competition, which is very fragmented and holds a combined market share of less than 29%. Key players that could be seen as threats to Monster Beverage include the rising Celsius brand, Rockstar, and others.

Investor Presentation

Sales Breakdown

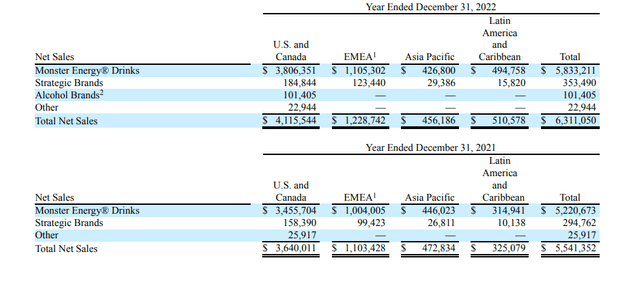

The Monster Energy brand accounts for the vast majority of sales, both in the United States and across the world (over 92% of sales). This percentage has, however, decreased from 94% in 2021, indicating that primarily through acquisitions, management looks to achieve greater diversification. North America accounts for approximately 65% of global sales, with Latin America gaining ground from 2021 to 2022.

10-K Report

Sales experience mild seasonality, with the second and third calendar quarters recording higher volumes. However, Energy Drink sales appear less seasonal than traditional beverage sales.

Sales Growth, But Margin Contraction

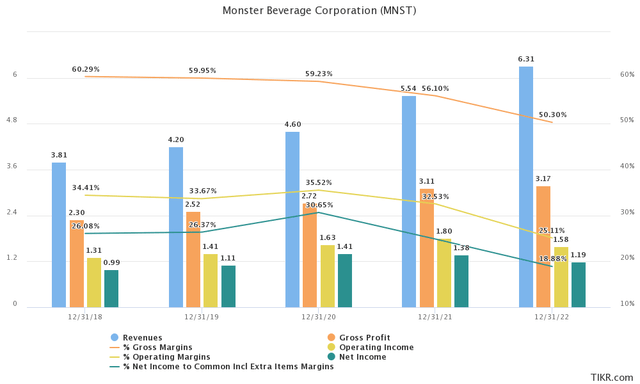

Since 2018, revenue has grown from $3.81B to 6.31B (13% CAGR), outpacing industry growth. The company has grown both organically and by acquiring smaller energy drink brands.

On the other hand, both operating and net income have seen smaller increases as margins have somewhat contracted across the board. Increased competition, supply chain disruptions and input cost inflation that cannot be passed down to consumers have contributed to this observed margin contraction.

In order to materialize its growth potential, Monster Beverage has spent large amounts on marketing and advertisement. MNST’s business model relies heavily on sponsoring events and ambassadors, and this comes at a cost (an increasing one when considering the competition intensifying). Marketing (sponsorship, endorsements, payroll and other marketing-related costs have increased by over $100M in 2022).

Despite the observed margin contraction, it is important to note that the company still exhibits very strong profitability, especially compared to sector and industry averages. A gross margin of 50.3%, an operating margin of 25.1% and a net margin of 18.9% are all very satisfying for investors.

Tikr.com

The biggest challenge for Monster Beverage going forward, in my view, is to maintain profitable growth. This will be achieved if the company defends successfully its market share and limit increases in operating costs. The industry provides enough mid-term growth for the company to grow, especially as one of the two market leaders. Cost-effectiveness strategies are now far more important, in order to reinforce the current wide profitability margins that make Monster stand out in the food and beverage sector.

Q1 2023 Results Outperformed

On May 4th, 2023 Monster Beverage released results for the first fiscal quarter of the year. The company surpassed expectations, marginally beating on revenue (+$10M) to record an impressive 11.9% YoY increase (15.3% adjusted sales growth for adverse foreign currency changes). EPS also delivered a beat of $0.04 and came in at $0.38. What is even more optimistic is the observed rise in profitability margins. More specifically, Gross margins stood at 52.8% (almost 200 basis points higher compared to 2022). Operating margins marginally improved.

Valuation

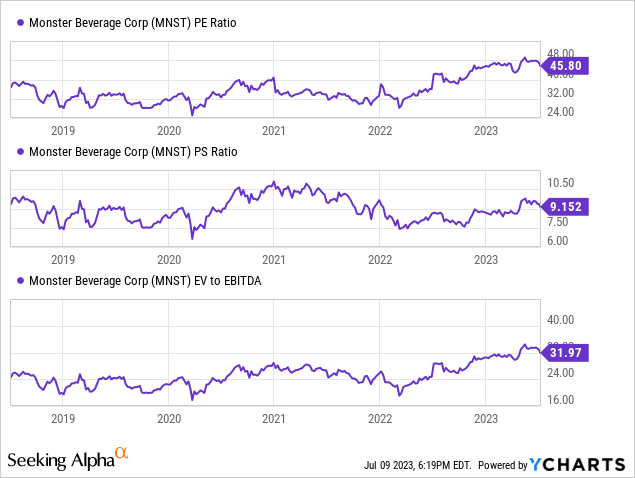

Along with the increases in Monster Beverages’ stock price and top-line growth, the company’s valuation metrics have overall expanded over the past couple of years. MNST trades at a very high 45.8x TTM P/E (36.3x FWD P/E), substantially higher than the company’s 5-year average. This is caused both by strong stock price performance and net margin contraction.

The company’s sales multiplier offers a more reasonable valuation outlook. The P/S ratio for the company stands at 9.15x, around historic 5-year averages. Price/Cash Flow and Price/Free Cash Flow multiples also indicate that the stock is overvalued. Overall, MNST gets a D- valuation grade from Seeking Alpha.

Considering the solid growth attributes of the company as well as its current strong market positioning, it would be reasonable to expect a valuation premium to be required for the stock. Considering an S&P 500 forward P/E around 19x and a similar average for the food & beverage industry, a forward P/E of 20x-25x can be considered reasonable for entering a long position in MNST with solid upside potential.

Final Thoughts

After all things are considered, Monster Beverage possesses several desirable business characteristics and ample growth potential. Profitability metrics are wide despite somewhat contracting over the past couple of years, and industry trends are likely to remain positive for the mid-term. The current valuation of the stock leads me to a hold rating, in anticipation of a pullback to convert into a buy.

Read the full article here