MSCI Inc. (NYSE:MSCI) reported Q2-23 results that exceeded expectations, as revenues increased by 12.6% to $621M, and GAAP EPS came in at $3.1, a 0.1$ beat. The company’s subscription run rate grew by 10.7%, amounting to $2.45B as of the end of the quarter. Management sees lower pressure from the economic environment, specifically in the Index segment, which saw linked AUM grow by 15.3% YoY.

While MSCI should continue to see growth accelerate as the market rebounds, I find the company’s non-index businesses to be inferior in terms of a competitive moat. With its peers trading at much lower valuations, I reiterate a Hold rating and increase my fair value estimate to $497 per share.

Background

I initiated coverage on MSCI in April with a Hold rating, claiming ‘This Index Provider Is A Great, But Expensive Stock’. I followed up in May after the Q1 report, which reaffirmed my thesis that the company’s growing non-index businesses are not as strong in terms of a competitive moat.

I urge you to read my previous articles, in which I explained my investment thesis in detail, as well as the company’s operating segments, revenue streams, risks, and competitors. Moreover, I focused on the strength of its index business, which I find to be the most attractive business of the company.

In short, my investment thesis in MSCI is based on its Index business, which I find extremely attractive. Being the second-largest player in the industry behind S&P Global (SPGI), made me interested. Furthermore, the company’s products and services are sold to large enterprises through recurring fee arrangements that provide clarity regarding MSCI’s revenues, and its ability to reliably grow over time. Overall, I see MSCI as one of the best ways to capitalize on the global long-term wealth accumulation trend.

So far, we were pretty much correct with our Hold ratings, as MSCI continued to lag behind the market and underperform compared to its peers. Now, let’s focus on the company’s results and provide an updated analysis after a much better second quarter.

Q2-23 Highlights

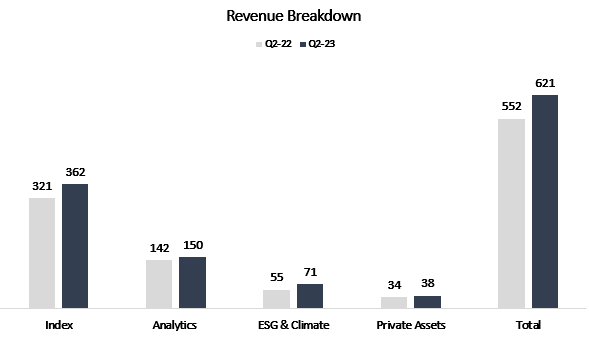

MSCI reported consolidated revenues of $621M, a 10.7% increase from the prior year period. Based on its historical seasonality, the group is on pace to deliver nearly $2,480 in sales for the year (10.7% growth). I’m disappointed to see the company is on track to miss my already downgraded estimate of $2,535, which means it’s on pace to come just in line with consensus expectations.

Created by the author based on data from MSCI financial reports

As we can see, growth was led by ESG & Climate, which increased by 29.2% YoY. Index capitalized on the market bull run and saw growth accelerate to 12.9% YoY. All Other – Private Assets grew by 10.9%, and Analytics was the worst performer with an underwhelming 5.8% growth.

In the previous quarter, management discussed longer sale cycles, a changing regulatory environment, and a lagging effect from market performance and its indexes. In the second quarter, we saw continued pushback in the Analytics segment but increased clarity in ESG regulation and timing in Index more than offset those, resulting in a return to double-digit growth on a consolidated basis.

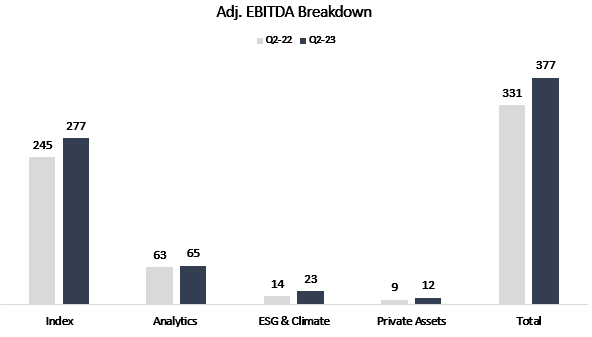

Created by the author based on data from MSCI financial reports

Looking at Adj. EBITDA per segment, we see similar trends. Index Adj. EBITDA increased by 13.0%, in line with revenue growth. Analytics Adj. EBITDA grew by 3.5%, reflecting a 90 bps margin contraction, as the company is forced to adjust prices to current demand trends. ESG & Climate Adj. EBITDA grew by 59.1%, reflecting a 6.0 percentage point expansion, and All Other – Private Assets grew Adj. EBITDA by 41.6%, with a 7.1 percentage point expansion. On a consolidated basis, Adj. EBITDA grew by 13.9%, and Adj. EBITDA margin increased by 70 bps.

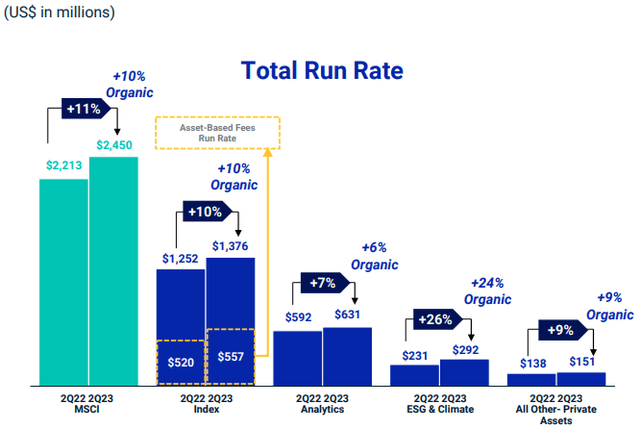

MSCI Q2-23 Investor Presentation

Despite the aforementioned headwinds, the company’s run rate continues to expand, with 10.7% growth on a consolidated level. As we can see, ESG & Climate is clearly the fastest-growing segment and is projected to become a significant portion of the group in the mid-term. Another double-digit grower was Index, which capitalized on increased demand for passive investments and continued to gain market share, primarily in non-U.S. indexes.

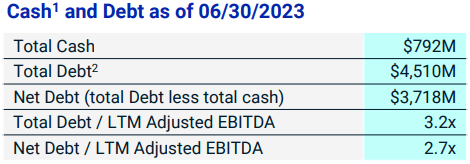

MSCI Q2-23 Investor Presentation

Looking at the balance sheet, MSCI is very reasonably leveraged, with a BBB- rating from S&P Global, and most of its debt maturing not before 2029.

Important Notes From The Call

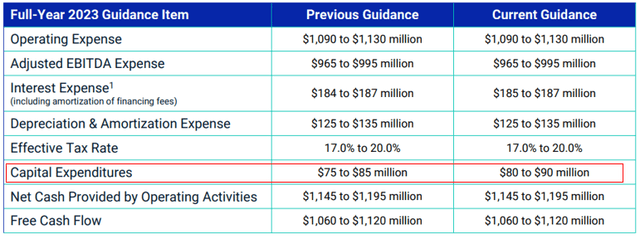

Let’s begin with the company’s updated guidance:

MSCI Q2-23 Investor Presentation

If you’re asking yourself what changed, the answer is not much. Management increased its Capex outlook by $5M while maintaining every other item. At the midpoint, the guidance still forecasts $1,090M of Free Cash Flow, which reflects a 2.7% FCF yield based on the company’s current market cap. On the call, the CFO suggested they’ll probably end towards the higher end of their expenses range.

Regarding the longer sale cycles, management has stated they are still very existent, as evidenced by the lower growth in Analytics, which is the most sales-dependent. However, demand for ESG & Climate products improved as the regulatory framework became more clear, especially in North America.

Updated Financial Model

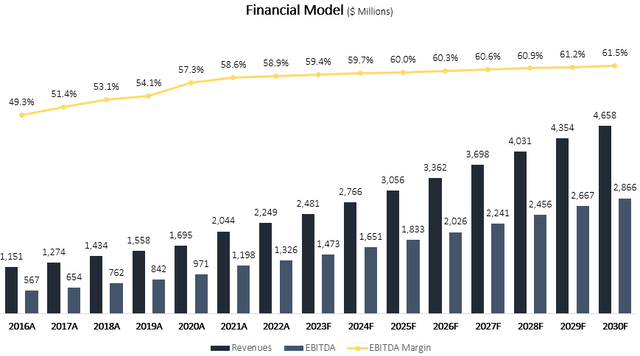

I used a discounted cash flow methodology to evaluate MSCI’s fair value. I assume the company will grow revenues at a CAGR of 9.4% between 2023-2030, which is according to the company’s long-term growth targets. I believe revenues will grow at that pace due to high growth in AUM linked to existing indexes, as well as the continued introduction of new offerings. Additionally, I expect exponential growth in ESG and Climate, as regulatory pressures recover. Lastly, I project Analytics and All Other to continue to grow according to the management’s long-term guidance.

I project MSCI’s EBITDA margins to increase incrementally up to 61.5%, slightly above the management’s long-term target of the high 50s. I find management’s guidance to be overly conservative, as most of its products leverage economies of scale and the company is already above the 60.0% threshold.

Created and calculated by the author based on MSCI’s financial reports and the author’s projections

Taking a WACC of 7.2%, I estimate MSCI’s fair value at $39.8B or $497 per share. My valuation represents a 34.3x multiple on 2024 earnings, which is below the company’s 5-year average, as I estimate the company’s multiple will contract over time.

Despite being a very high-quality company, MSCI remains too expensive for me at current levels, especially after the post-earnings surge. The company will remain on my watchlist, but I still prefer S&P Global.

Conclusion

More often than not, we see high-quality companies like MSCI trading for rich valuations, with immense optimism baked in the price. For me, I don’t mind buying at what is an objectively high multiple, as exceptional quality doesn’t come cheap, and I seek to invest in companies for the very long term. However, I believe the market is missing the fact that the company’s growth prospects aren’t as high quality as its index businesses. The stickiness and moat are much lower in ESG & Climate, and in my view, that will result in a steady multiple contraction over time.

While I expected the market will react positively to near-term triggers like Index recovery, I think that at current prices, there’s a minimal upside (if any), and a very low margin of safety. Therefore, I reiterate MSCI stock a Hold.

Read the full article here