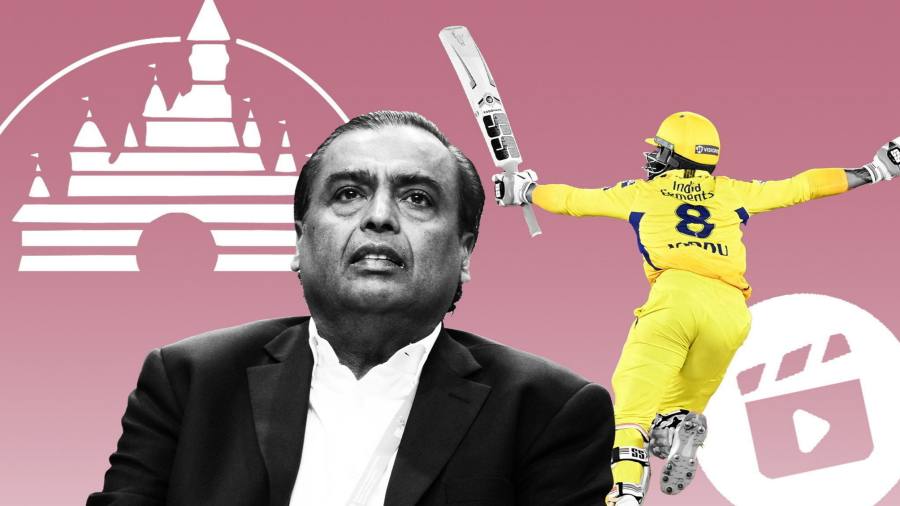

India’s richest man Mukesh Ambani has in a matter of months turned his streaming platform from a marginal provider of soap operas and old Bollywood films into the most formidable competitor to global heavyweight Disney.

JioCinema attracted more than 400mn viewers to its streams of the Indian Premier League cricket tournament in April and May. It has bought the rights to shows and films made by global networks NBC, HBO and Warner Bros.

Ambani is making most of it available for free, sparking a price war in India’s fast-growing streaming market. “It’s just the beginning of the disruptions,” one person familiar with JioCinema’s strategy said.

For Ambani, the foray into streaming is the latest step in a plan to transform his industrial conglomerate Reliance Industries into the country’s leading digital group.

The plan centres on Jio, Ambani’s telecom network that is now India’s largest. Since the 2016 launch of Jio, Ambani has used aggressive discounting and freebies to undercut rivals and gain market share in everything from ecommerce to home broadband service.

Uday Shankar, an investor and director at JioCinema’s parent company Viacom18, said the goal was to build a platform with audience volumes to rival television in scale.

Other streaming platforms in India, such as Netflix and Amazon Prime, “are not our competition”, said Shankar, who used to run Walt Disney’s India business Star. “We see television as our competition. Until you’re able to get a large number of people to not watch TV and watch all their content on JioCinema, that mission is not complete.”

For that, there is no greater prize in India than the IPL, the lucrative, two-month cricket tournament whose format is a hit with viewers and advertisers. Disney Star, the country’s largest TV network, which held the rights from 2018 to 2022, used the IPL to win more than 60mn subscribers to its streaming service as of last year.

JioCinema’s ascent out of relative obscurity began last June when Viacom18 — a joint venture among Reliance, Paramount, James Murdoch and Shankar — beat Disney Star for the digital rights to stream the IPL until 2028. Disney Star retained the broadcast rights at a record-breaking $6bn auction, making the IPL the world’s second-most valuable sports tournament on a per game basis after the US’s National Football League.

JioCinema has since taken the fight to its rival, poaching a wave of senior executives from Disney Star, including incoming chief executive Kevin Vaz and sports head Anil Jayaraj. “Most of [Disney’s] talent had offers from competition,” one person familiar with the situation said, adding many of those came from JioCinema.

Crucially, JioCinema undercut Disney Star’s pay-TV business by making the IPL free to watch online. It became the most downloaded video streaming app last month, up from 13th the same time a year earlier, according to mobile analytics company Data.ai.

For Shankar, offering free, advertiser-supported content for mobile phones is vital to building a large enough audience in a country where western-style subscription packages are too expensive for much of the population. “In mass media, the only way to create value is if you open the doors to a much broader base,” he said.

JioCinema plans to supplement its free tier with subscription packages targeting more affluent consumers, along with English-speaking audiences who will pay to watch HBO and other global networks. Its “Best of Hollywood” package is currently available for about Rs80 ($1) a month, almost half the cost of Netflix’s cheapest, mobile-only subscription tier. The IPL will also be free to watch next year, a person close to the company said.

One Bollywood producer expressed surprise at JioCinema’s rapid rise. “A lot of the larger production companies were a little unsure about whether they were serious enough about the business or not . . . We’re really looking at them as a serious player now,” the producer said.

Jio’s gambit to provide free content is proving costly as advertiser appetite for the tournament wanes. Advertising revenues for the season fell an estimated 15 per cent compared with a year earlier, according to brokerage Kotak Institutional Equities, as previously big-spending tech start-ups cut costs due to a funding crunch.

This has led to potentially heavy losses for both companies. Kotak estimated that Jio lost as much as Rs33bn on the 2023 IPL, compared with Rs20bn at Disney Star. Disney Star said these estimates typically did not include money it made from its TV subscriptions.

Disney Star argued that predictions of television’s decline had been overblown, saying it added more than 11mn TV subscribers during the IPL. “Our hypothesis around television offering a more communal, lean-back and immersive experience for sports fan has also been proven true,” said Sanjog Gupta, head of sports at Disney Star.

However, Disney Star’s streaming platform has haemorrhaged subscribers since losing the IPL digital rights. Subscribers to Disney Plus Hotstar, the India platform, fell to 53mn in March from 61mn in October.

The company announced in June that Disney Plus Hotstar would start streaming high-profile cricket tournaments, the Asia Cup in September and World Cup in October, for free in an effort to drive traffic.

“It’s a little bit of a myth that has been created that we are not invested in digital,” Gupta said. Disney Star also holds the rights for other sports such as English Premier League football.

The price war comes at an inopportune time for Disney, which like other entertainment groups is under investor pressure to control losses from streaming.

JioCinema’s parent company Reliance is also not immune to that pressure. Reliance pumped more than $1bn into Viacom18 after most of the money from a $1.8bn fundraising round announced last year did not materialise, which analysts attributed to a weak fundraising environment.

Analysts said any streaming losses were manageable for a conglomerate buttressed by vast oil refining and petrochemicals revenues.

But Reliance’s debt levels have been rising as it finances its transition into everything from green energy to consumer businesses, with outstanding debts at Rs3.1tn for the financial year ending in March, compared with Rs2.6tn a year earlier.

“Reliance is on a multi-decade transition to consumer businesses,” said Vivekanand Subbaraman, an analyst at brokerage Ambit Capital, adding that JioCinema had become a “breakout success for them”. “The question is, what’s life after the IPL?”

Read the full article here