Another sign the economy is flying at cruising altitude and refuses to land, even with short-term interest rates over 5%.

Seasonally, May is one of the best month for construction starts of single-family houses and multi-family buildings. Typically, residential construction starts hit their annual peaks between April and July.

Today, the Census Bureau released the May construction starts, and they were a blowout, with even single-family construction starts further bouncing off their January lows, and multifamily spiking to the highest level since the mania of the mid-1980s. Both are far above any kind of recessionary scenario.

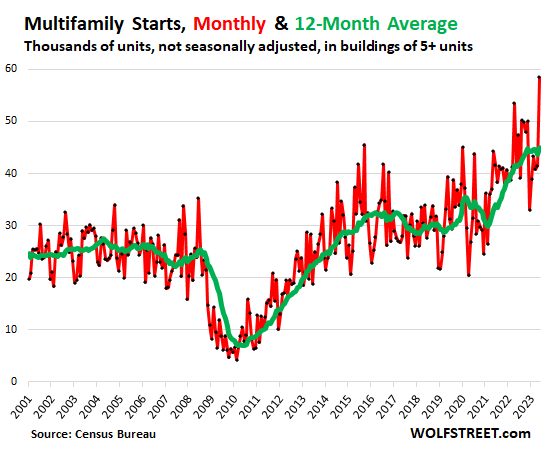

Construction starts of multifamily housing units in buildings with five or more units (such as in large condo and apartment buildings) spiked in May to 58,500 units (not seasonally adjusted), the highest since 1986, up by 42% from May last year, and up by 49% from May 2019.

More importantly, the 12-month average, which irons out the huge seasonal and month-to-month fluctuations and shows the longer-term trends, rose to 45,100 units, also the highest since 1986 (green line).

Big multifamily projects have long lead times, and planning for these buildings whose units show up in the May data started quite a while ago – with big projects, years ago.

In big, densely populated urban cores, higher-end multifamily buildings with lots of amenities have been just about the only type of housing that is getting built – a trend going back many years – while the bulk of single-family construction takes place further away from urban cores.

For buyers and renters alike, the decision whether to live in a new multifamily building in an urban core or in a new house further out comes down to lifestyle choice – not necessarily price, because both are now expensive.

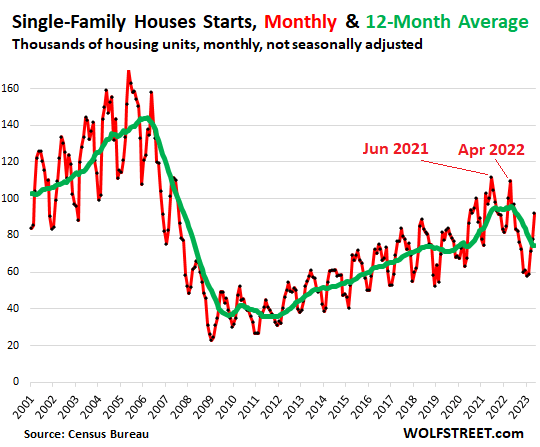

Construction starts of single-family houses, after a big drop that started last summer as unsold inventory was piling up, jumped by 18% in May from April, to 91,900 houses (not seasonally adjusted), the fourth month in a row of seasonal increases from the January low. Not included are manufactured homes (mobile homes).

- Compared to May 2022, starts were down 5%.

- Compared to the blowout boom months of April 2022 and June 2021, starts were down 16% and 18% respectively.

- But compared to the more normal times of May 2019, starts were up by 18%.

For the longer trend, the 12-month average dipped further in May to 74,200, just above the high end of pre-pandemic levels, and up by 4% from 2019. Starts have essentially unwound the pandemic boom – and based on monthly starts, are now accelerating again (green line).

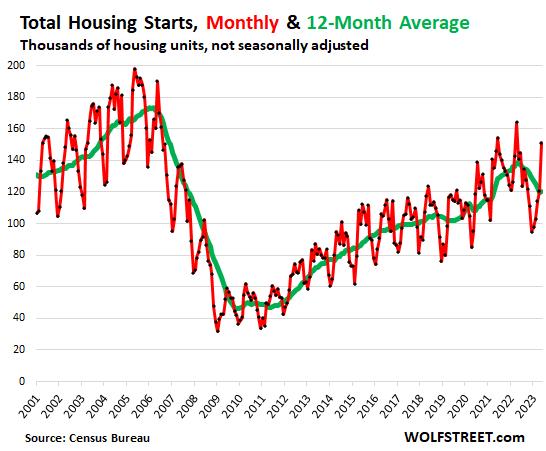

Total residential construction starts – single-family houses and multifamily buildings combined – jumped to 128,600 housing units in May (not seasonally adjusted), up by 7.5% from a year ago, and by 28% from May 2019.

For the longer trend, the 12-month moving average edged up to 120,400 starts, which was down from the pandemic boom, but was still up by 18% from May 2019.

Shares, Booms, and Busts

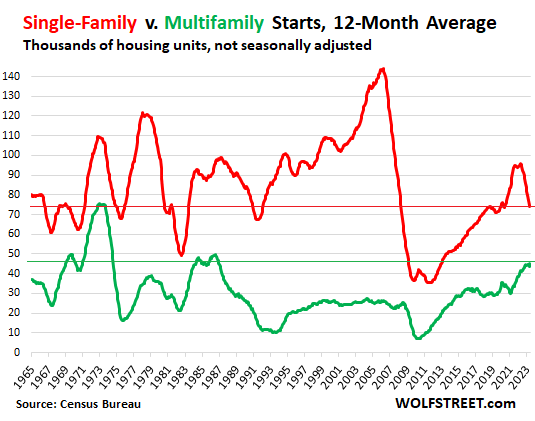

The share of single-family housing starts dropped to 61.5% of total housing starts over the past 12 months through May, the lowest share since 1986.

The share of multifamily starts in buildings of 5+ units rose to 38.7%, the highest share since 1974.

The share of multifamily starts of buildings with 2 to 4 units has declined over the years to less than 1%.

And this trend makes sense longer term as urban sprawl in big cities makes for ever more hellish commutes. Working from home cut down on commute hell for office workers, but now many employers are trying to get their people back to the office at least a few times a week. And non-office workers can’t work at home anyway.

Over the long term, housing starts come and go in huge waves of booms and busts. Housing Bubble 1 was an epic creature for single-family starts; the 12-month average peaked in 2005 at around 142,000 houses per month, nearly double today’s rate.

Multifamily had its moment in the bubble sun in 1973 when the 12-month average peaked at 75,000 units per month, and then again in the mid-1980s, when starts peaked at 50,000 per month. But those were years with far higher population growth. Population growth has dwindled in recent years. And the recent multifamily starts are getting close to the mid-1980s high.

The long-term view, 12-month average – on a month-to-month basis, last year’s decline in single-family starts reversed this year and this reversal will show up in the 12-month average over the summer).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here